Service Integration And Management In Healthcare Market Size, Share & Trends Analysis Report By Service Type, By End-use, By Delivery Mode, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-372-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

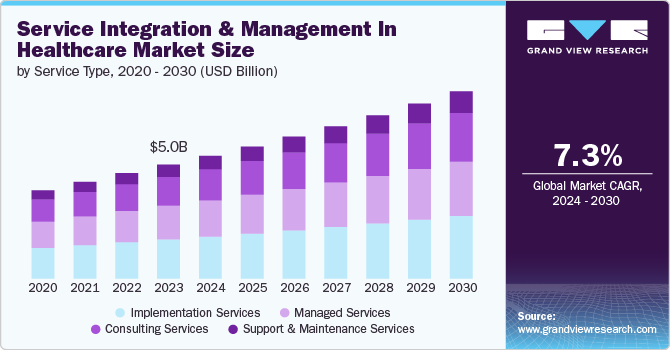

The global service integration and management in healthcare market size was estimated at USD 5.04 billion in 2023 and it is anticipated to grow at a CAGR of 7.3% from 2024 to 2030. The increasing technological advancements, increasing focus on patient outcomes, rising government initiatives, and increasing diversification of healthcare services are some of the major factors driving the market growth. The government bodies globally are emphasizing the digitization of their healthcare systems to increase the efficiency and reach of their system. These initiatives are expected to increase the demand for integration and management services, thereby driving the market growth. For instance, in June 2024, the U.S. Trade and Development Agency signed a grant agreement to offer technical assistance to Jordan’s national digital health transformation program “Hakeem.”

The increasing outsourcing trend in the pharmaceutical and biotechnology industry is also one of the major factors driving market growth. As pharmaceutical and biotech companies outsource tasks such as clinical trials, drug development, and manufacturing, the overall IT landscape for this industry becomes more complex. Integrating the management solutions can help manage this complexity by allowing easy data exchange across internal and external organizations, thereby ensuring seamless information flow and efficient collaboration among different stakeholders.

The COVID-19 pandemic has accelerated the adoption of telehealth and remote patient monitoring technologies as healthcare providers seek ways to deliver care while minimizing in-person contact. This trend has continued owing to the advantages offered by telehealth, such as easy access, better efficiency, and increased reach. As the industry increases the adoption of digital solutions, it is further anticipated that the demand for integration and management services will increase over the forecast period.

Furthermore, there is an increasing demand in different healthcare organizations to optimize their operational efficiency, which leads to partnerships among integration and management service providers. The market players are leveraging this growth opportunity offered by the increasing digital transformation of the healthcare industry by taking various initiatives, thereby increasing their market presence and fueling the market growth. For instance, in August 2023, Globant and Medocity entered a strategic partnership to enhance clinical research's digitization. The partnership aims to leverage Globant's digital IQ, digital strategy, data & system integration, and software engineering expertise to implement comprehensive digital solutions to support clinical research operations.

Service Type Insights

Implementation services segment led the market and accounted for a 34.4% share of the global revenue in 2023. This can be attributed to the increasing adoption of digital solutions in the healthcare industry and the complexities in implementing advanced technologies owing to several steps involved, such as planning, designing, building, testing, integrating, and launching. In May 2024, Nordic Consulting partnered with Clinical Healthcare Analytics to offer consulting on and implement CHA's enterprise suite of diagnostic & treatment analytic solutions for EHR platforms to allow professionals to perform real-time analysis at the point of care. Such initiatives by companies operating in the market are anticipated to drive segment growth.

Support and maintenance services segment is anticipated to grow at the fastest CAGR over the forecast period. Healthcare organizations are rapidly adopting new technologies such as electronic health records (EHRs), telehealth platforms, and data analytics solutions. These technologies require regular technical support, system upgrades, and user training to ensure optimal performance and security, which drives the segment’s growth. Moreover, these services allow organizations to stay updated with the latest developments, implement enhancements, and regularly improve their digital solutions to deliver better patient outcomes.

End-use Insights

Hospitals and clinics segment held the largest market share of 48.5% in 2023. This can be attributed to the increasing adoption of digital solutions and the increasing patient pool of hospitals globally. Hospitals are increasingly emphasizing coordinated care across various departments and specialties to improve patient outcomes. Adopting advanced service integration and management solutions facilitates this by enabling seamless data sharing and communication between various stakeholders involved in a patient's care journey. For instance, in November 2023, NYU Langone Health announced an 8-year strategic partnership with Royal Philips to adopt its IntelliSite Pathology solution, AI-enabled diagnostic imaging technologies, and enterprise informatics for improving patient care quality, safety, and outcomes.

Healthcare payers segment is anticipated to witness the highest growth rate during the projected period. Healthcare payers, such as insurance companies and government agencies, are witnessing complexity in operations due to the implementation of new regulations such as the Affordable Care Act in the U.S. Moreover, the increasing partnerships among various service providers and payers is further expected to fuel the segment growth. For instance, in January 2024, Tata Consultancy Services (TCS) and Aviva, a leading insurance, wealth, and retirement provider in the UK, announced the 15-year expansion of their partnership to transform Aviva’s business and enhance customer experience by leveraging the TCS BaNCS-based platform.

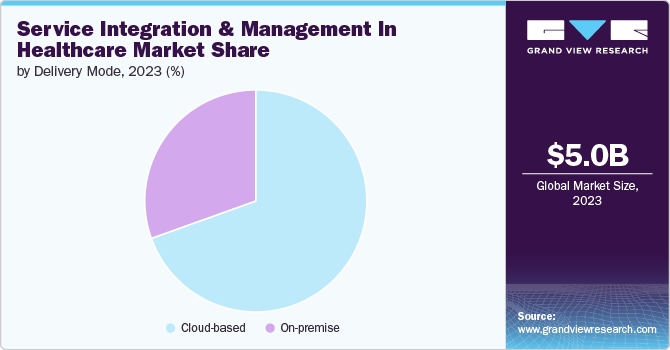

Delivery Mode Insights

Cloud-based segment held the largest market share in 2023 and is expected to witness the fastest growth over the forecast period. This can be attributed to the various advantages of cloud-based software solutions, such as improved cost-effectiveness, better data security, data recovery, backup, and enhanced data insights. These advantages drive the demand for web and cloud-based solutions in the country, thereby driving the segment growth. Moreover, cloud-based solutions offer on-demand scalability, allowing organizations to easily adapt their IT infrastructure to meet changing needs, which is significantly beneficial for hospitals and payers experiencing surge in patient volume or data requirements.

On-premises segment is expected to witness a lucrative growth rate over the forecast period owing to the increasing preference of healthcare organizations to have complete control of their service integration and management solutions. Moreover, on-premises solutions allow the organization to restrict the access of its data from unauthorized users offering better data privacy.

Regional Insights

North America service integration and management in healthcare market dominated global market and accounted for a 46.3% share in 2023. This growth is driven by factors such as increasing EHR adoption and the rise of telehealth technologies. This surge increases the demand for service integration and management solutions to handle the expanding IT landscape in the region’s healthcare industry. Furthermore, the increasing adoption of cloud-based services, such as Software-as-a-Service (SaaS) and Infrastructure-as-a-Service (IaaS), owing to their advantages, such as flexibility, scalability, and cost-efficiency, is driving the SIAM market in North America.

U.S. Service Integration And Management In Healthcare Market Trends

Service integration and management solutions market in the U.S. is expected to witness significant growth over the forecast period. This can be attributed to the presence of leading market players, the country’s developed healthcare infrastructure, and acceptability towards technologically advanced digital solutions. Moreover, the country is witnessing a significant rise in adopting digital solutions, such as e-prescribing, telehealth, and remote patient monitoring. This trend is expected to continue, driving demand for healthcare IT integration platforms that can seamlessly connect these technologies.

Furthermore, the market players in the country are developing advanced solutions, leading to market growth. For instance, in March 2024, Trinity Hunt Partners announced the launch of two life science and healthcare consulting platforms, Supreme Group and Coker Group, which focus on commercialization services and businesses of these industries.

Europe Service Integration And Management In Healthcare Market Trends

Service integration and management in the healthcare market in Europe is expected to witness significant growth over the forecast period. This can be attributed to the stringent regulatory framework, increasing adoption of cloud-based services, and growing outsourcing trend in the region’s healthcare industry. Moreover, Europe has stringent data privacy regulations such as GDPR. SIAM solutions can help organizations comply with these regulations by ensuring secure data storage, access control, and robust data governance practices.

Asia Pacific Service Integration And Management In Healthcare Market Trends

Asia Pacific region is anticipated to witness fastest growth at a CAGR of 9.3% during the forecast period. This can be attributed to the developing healthcare infrastructure, increasing IT integration in the region's healthcare sector, and increasing government initiatives to increase the adoption of advanced digital solutions in the region’s healthcare sector are driving the market growth in the region. For instance, in September 2021, the Government of India (GOI) announced the launch of the Ayushman Bharat Digital Mission (ABDM). This scheme aims to leverage digital technologies to enable universal health coverage in the country, enhance the effectiveness and efficiency of healthcare services, and allow citizens to manage their wellness and health.

Key Service Integration And Management In Healthcare Market Company Insights

Some of the key players operating in the market include IBM Corporation, Capgemini, Atos, DXC Technology, HCL Technologies, NTT DATA, Cognizant and others. These players are using various strategies, such as partnerships, expansion, acquisitions, and collaborations, to increase their presence and gain a competitive edge over other market players.

Key Service Integration And Management In Healthcare Market Companies:

The following are the leading companies in the service integration and management in healthcare market. These companies collectively hold the largest market share and dictate industry trends.

- IBM Corporation

- Capgemini

- Atos

- DXC Technology

- HCL Technologies

- NTT DATA

- Cognizant

- Tata Consultancy Services (TCS)

- Infosys

- Wipro

Recent Developments

-

In June 2024, Oracle NetSuite launched NetSuite SuiteSuccess Healthcare Edition, a solution designed to improve patient care and enhance the efficiency of healthcare organizations by streamlining their business process, enhancing decision making, and expanding insights.

-

In March 2022, Icertis announced the launch of Icertis Contract Intelligence (ICI) Contract Lifecycle Management Solution. This solution assists healthcare providers accelerate their digital transformation journey by modernizing complex agreements such as supplier, payer, and contract services.

Service Integration And Management In Healthcare Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 5.43 billion |

|

Revenue forecast in 2030 |

USD 8.28 billion |

|

Growth rate |

CAGR of 7.3% from 2024 to 2030 |

|

Historical Data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Service type, end-use, delivery mode, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

IBM Corporation; Capgemini; Atos; DXC Technology; HCL Technologies; NTT DATA; Cognizant; Tata Consultancy Services (TCS); Infosys; Wipro |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Service Integration And Management In Healthcare Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global service integration and management in healthcare market report based on service type, end-use, delivery mode, and region.

-

Service Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Consulting Services

-

Strategy And Planning

-

Process Improvement

-

Technology Consulting

-

-

Implementation Services

-

System Integration

-

Application Development

-

Cloud Implementation

-

-

Managed Services

-

IT Infrastructure Management

-

Application Management

-

Security Management

-

-

Support And Maintenance Services

-

Technical Support

-

System Upgrades

-

User Training

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals And Clinics

-

Healthcare Payors

-

Life Sciences Companies (Pharmaceutical, Biotechnology, etc.)

-

Other Healthcare Providers (Long-term Care Facilities, Ambulatory Service, etc.)

-

-

Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premises

-

Cloud-based

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global service integration and management in healthcare market size was estimated at USD 5.04 billion in 2023 and is expected to reach USD 5.43 billion in 2024.

b. The global service integration and management in healthcare market is expected to grow at a compound annual growth rate of 7.3% from 2024 to 2030 to reach USD 8.28 billion by 2030.

b. North America dominated the service integration and management in healthcare market with a share of 48.3% in 2023. This is attributable to the rising need for efficient IT management, increasing adoption of digital health solutions, regulatory compliance requirements, and the integration of advanced technologies like AI and IoT to streamline healthcare operations.

b. Some key players operating in the service integration and management in healthcare market include Smart Communications; Newgen Software Technologies Limited.; Oracle; Cincom; DataOceans LLC.; Flexsin Inc.; Doxim; CAL-SIERRA TECHNOLOGIES, INC.; Hyland Software, Inc.; Conduent, Inc.; Avaali Solutions Pvt Ltd.

b. Key factors that are driving the market growth include the increasing adoption of digital health technologies, rising demand for coordinated care, regulatory compliance needs, enhanced patient data management, cost reduction imperatives, and the shift towards value-based care models fostering integrated service delivery.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."