Service Analytics Market Size, Share & Trends Analysis Report By Component, By Business Application, By Deployment, By Enterprise Size, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-443-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Service Analytics Market Size & Trends

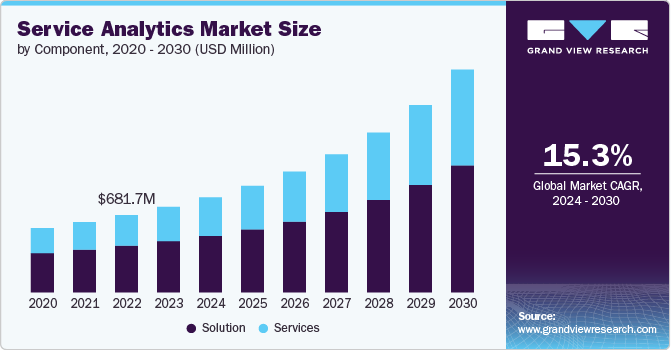

The global service analytics market size was estimated at USD 753.2 million in 2023 and is projected to grow at a CAGR of 15.3% from 2024 to 2030. The market growth is driven by the increasing demand for enhanced customer experiences and the growing use of AI and machine learning technologies. As businesses strive to improve customer satisfaction and loyalty, they are turning to service analytics to gain deeper insights into customer interactions, preferences, and pain points, allowing them to personalize services and resolve issues more efficiently.

The integration of AI and machine learning in service analytics enables companies to automate data analysis, predict customer behavior, and optimize service operations, leading to more informed decision-making and a competitive edge in delivering superior service.

Component Insights

Based on component, the solution segment led the market with the largest revenue share of 59.9% in 2023, owing to the increasing demand for personalized customer experiences. As consumers expect more tailored services and faster response times, companies are turning to service analytics solutions to better understand customer behavior, preferences, and service history. By leveraging these insights, businesses can offer more personalized solutions, which can lead to higher customer satisfaction and loyalty.

The services segment is anticipated to grow at the fastest CAGR over the forecast period. The surge in cloud-based solutions and big data analytics is significantly contributing to the expansion of the global market. Cloud computing allows service providers to access and analyze vast amounts of data in real-time, facilitating faster decision-making and improved agility. This is particularly beneficial for industries such as IT services, retail, and telecommunications, where efficient service delivery and quick resolution of customer issues are crucial.

Business Application Insights

Based on business application, the customer service analytics segment led the market with the largest revenue share of 45.8% in 2023.Advancements in artificial intelligence (AI) and machine learning (ML) are transforming customer service analytics. AI-powered analytics tools can process large datasets quickly and provide predictive insights, such as forecasting customer complaints or identifying at-risk customers who may churn. These technologies also enable sentiment analysis, allowing companies to gauge customer emotions and adjust their responses in real-time. For instance, in March 2024 Accenture, an Irishprofessional services company acquired GemSeek, a Bulgaria-based customer experience analytics provider that supports businesses by delivering insights through analytics and AI-driven predictive models. This strategic move highlights Accenture’s continued investment in enhancing data and AI capabilities, enabling clients to drive business growth and maintain customer relevance.

The IT service analytics segment is anticipated to grow at the fastest CAGR over the forecast period, due to the increasing focus on proactive problem resolution and predictive analytics. Organizations are moving away from reactive IT management toward proactive strategies that predict potential service disruptions before they occur. By leveraging advanced analytics, machine learning, and artificial intelligence (AI), IT service analytics solutions can detect patterns, anticipate issues, and recommend actions to prevent system outages or performance degradation.

Deployment Insights

Based on deployment, the cloud segment led the market with the largest revenue share of 66.3% in 2023, due to the increasing adoption of cloud computing across industries, which allows organizations to store and analyze vast amounts of data without the need for significant investments in on premise infrastructure. Cloud-based service analytics solutions provide flexibility, scalability, and cost-efficiency, making them an attractive choice for companies of all sizes.

The on premise segment is anticipated to grow at the fastest CAGR over the forecast period.Many organizations, particularly in industries such as finance, healthcare, and government, prioritize having full control over their data due to regulatory requirements and security concerns. On-premise service analytics solutions allow companies to store and manage their sensitive data locally, providing them with greater oversight and reducing the risk of data breaches that could occur with cloud-based alternatives.

Enterprise Size Insights

Based on enterprise size, the large enterprises segment led the market with the largest revenue share of 57.9% in 2023.The demand of operational efficiency is fueling the demand for service analytics in large enterprises. These organizations are continually seeking ways to streamline their operations, reduce costs, and enhance productivity. Service analytics provides insights into service workflows, process bottlenecks, and resource allocation, enabling enterprises to identify inefficiencies and implement process improvements. The ability to monitor and measure performance in real-time allows for proactive management and optimization of service operations, contributing to overall operational excellence.

The SMEs segment is anticipated to grow at the fastest CAGR over the forecast period.Cloud technology is playing a significant role in making advanced service analytics solutions available to SMEs. With cloud-based platforms, SMEs access analytics tools without the need for heavy investments in on-premise infrastructure. This scalability and cost-effectiveness allow businesses to leverage real-time data analysis and improve decision-making processes, fostering wider adoption among smaller companies.According to Eurostat, 42.5% of enterprises in the European Union utilized cloud computing services in 2023, with the majority using them for tasks such as email, file storage, and office software.

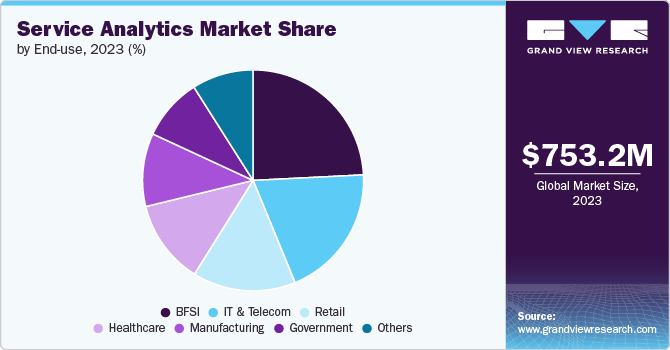

End Use Insights

Based on end use, the BFSI segment led the market with the largest revenue share of 24.2% in 2023. The BFSI sector increasingly adopting service analytics to enhance operational efficiency, customer experience, and decision-making processes. Service analytics in BFSI helps organizations harness vast amounts of data from customer interactions, transactions, and financial processes, allowing them to gain real-time insights and predictive capabilities. By leveraging analytics, BFSI institutions can better understand customer needs, identify trends, and optimize services to deliver personalized and seamless experiences. This use of analytics also assists in identifying and mitigating risks, ensuring regulatory compliance, and driving financial performance.

The government segment is anticipated to grow at the fastest CAGR over the forecast period.The rise of smart cities and digital transformation initiatives has also led to an increased focus on leveraging analytics to optimize infrastructure and services. Moreover, the growing availability of cloud-based solutions enables more flexible and cost-effective deployment of service analytics, making it easier for governments to adopt these technologies without significant upfront investment.

Regional Insights

North America dominated the service analytics market with the revenue share of 38.6% in 2023, owing tothe integration of artificial intelligence (AI) and machine learning (ML) within service analytics platforms. AI-driven analytics solutions are gaining traction as they enable predictive insights and automated decision-making, allowing organizations to identify potential service issues before they arise. This is particularly valuable in customer service, where advanced analytics tools can help predict customer needs, improve response times, and enhance overall service quality.

U.S. Service Analytics Market Trends

The service analytics market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030.In the U.S., the market is seeing significant adoption within the government sector, particularly in areas related to national security. Government agencies are increasingly turning to service analytics tools to optimize the management of public services, improve operational efficiency, and enhance decision-making processes. For instance, in August 2024, Palantir Technologies Inc., a U.S.-based software company, and Microsoft Corporation expanded their collaboration to provide advanced cloud, AI, and analytics solutions to the U.S. Defense and Intelligence Community. The partnership aims to accelerate the secure and effective deployment of advanced AI capabilities for the government.

Europe Service Analytics Market Trends

The service analytics market in Europe is expected to grow at a significant CAGR of 14.9% from 2024 to 2030, owing to the increasing focus on data privacy and regulatory compliance. With the General Data Protection Regulation (GDPR) in full effect, organizations across Europe are prioritizing analytics solutions that ensure data protection and transparency. This has led to a growing demand for service analytics platforms that provide secure data processing while ensuring compliance with strict privacy regulations.

Asia Pacific Service Analytics Market Trends

The service analytics market in Asia Pacific is anticipated to grow at a significant CAGR of 17.2% from 2024 to 2030.The growing focus on customer experience (CX) is also shaping the service analytics landscape in Asia Pacific. Businesses are increasingly using analytics to gain deeper insights into customer preferences, behaviors, and pain points, allowing them to deliver more personalized and efficient services. Industries such as e-commerce, telecommunications, and financial services are leading the way in using service analytics to improve customer satisfaction, foster loyalty, and gain a competitive edge.

Key Service Analytics Company Insights

Key players operating in the global market includeMicrosoft, Numerify, Oracle,Salesforce, ServiceNow, and SAP SE. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Service Analytics Companies:

The following are the leading companies in the service analytics market. These companies collectively hold the largest market share and dictate industry trends.

- Centina Systems

- Cloudera, Inc.

- Field Squared

- Microsoft

- Numerify

- Oracle

- Paskon

- Salesforce

- SAP SE

- ServiceNow

Recent Developments

-

In March 2024, Salesforce introduced new innovations in Service Cloud aimed at enhancing customer experiences and creating revenue opportunities through data and AI. These updates equip agents and supervisors with AI-driven insights, content generation, and automation tools to boost customer satisfaction and loyalty while transforming contact centers into revenue-generating hubs. Leveraging the Einstein 1 Platform, service leaders can now utilize Data Cloud and Einstein to identify common issues, recommend actions based on customer feedback, and monitor conversations to suggest faster case resolutions

-

In November 2023, Accenture, Avanade, and Microsoft collaborating to enhance data accessibility, management, and actionability within Microsoft's product organization. By utilizing Microsoft Fabric, the collaboration aims to deliver self-service analytics that unlock the potential of Microsoft's data, enabling faster innovation. The integrated platform provides a streamlined data foundation to support and accelerate AI adoption

-

In October 2023, ServiceNow and Deloitte, a UK-based professional services network, collaborated to incorporate Now Assist's generative AI features into next-generation managed services. This collaboration, known as Operate services, combines Deloitte's industry expertise with ServiceNow's AI-powered enterprise platform to offer comprehensive managed services. Deloitte’s Operate services are designed to support clients in managing their ongoing operational and technology requirements, improving technology applications, cloud infrastructure, and providing continuous advisory, data, and analytics services to help drive business transformation goals

Service Analytics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 838.0 million |

|

Revenue forecast in 2030 |

USD 1,963.9 million |

|

Growth rate |

CAGR of 15.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component,business application, deployment, enterprise size, end use region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa |

|

Key companies profiled |

Centina Systems; Cloudera; Inc.; Field Squared; Microsoft; Numerify; Oracle; Paskon; Salesforce; SAP SE; ServiceNow |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Service Analytics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the service analytics market report based on component,business application, deployment enterprise size, end use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Services

-

-

Business Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Field Service Analytics

-

Customer Service Analytics

-

IT Service Analytics

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Retail

-

Government

-

IT & Telecom

-

Healthcare

-

Manufacturing

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global service analytics market size was estimated at USD 753.2 million in 2023 and is expected to reach USD 838.0 million in 2024.

b. The global service analytics market is expected to grow at a compound annual growth rate of 15.3% from 2024 to 2030 to reach USD 1,963.9 million by 2030.

b. The service analytics market in North America held the share of 38.6% in 2023 owing to the integration of artificial intelligence (AI) and machine learning (ML) within service analytics platforms. AI-driven analytics solutions are gaining traction as they enable predictive insights and automated decision-making, allowing organizations to identify potential service issues before they arise.

b. Some key players operating in the service analytics market include Centina Systems; Cloudera, Inc.; Field Squared; Microsoft; Numerify; Oracle; Paskon; Salesforce; SAP SE; and ServiceNow

b. The growth of the market driven by the increasing demand for enhanced customer experiences and the growing use of AI and machine learning technologies. As businesses strive to improve customer satisfaction and loyalty, they are turning to service analytics to gain deeper insights into customer interactions, preferences, and pain points, allowing them to personalize services and resolve issues more efficiently.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."