Serverless Security Market Size, Share & Trends Analysis Report By Service Model (FAAS, BAAS), By Security Type (Data Security, Network Security), By Deployment, By Enterprise Size, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-374-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Serverless Security Market Size & Trends

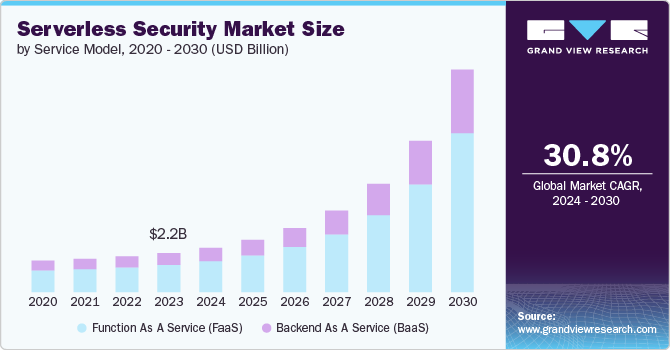

The global serverless security market size was estimated at USD 2.19 billion in 2023 and is expected to grow at a CAGR of 30.8% from 2024 to 2030. The rapid adoption of serverless computing by organizations seeking to reduce operational costs and improve scalability, the increasing complexity and frequency of cyber threats targeting serverless environments, and the rising need for robust security solutions that can address the unique challenges of serverless architectures are driving the growth of the market.

The growing use of cloud computing is a significant growth driver for the serverless security market. As businesses increasingly migrate to cloud environments to leverage their scalability, flexibility, and cost-efficiency, they are also adopting serverless architectures to streamline operations and accelerate application development. However, this shift to cloud-based, serverless infrastructures introduces new security challenges, such as securing transient functions, managing access controls, and ensuring data protection across distributed environments. Therefore, the demand for specialized serverless security solutions has surged, as organizations seek to safeguard their serverless applications and data from evolving cyber threats while maintaining compliance with industry regulations.

This heightened need for robust security measures tailored to serverless environments is propelling the expansion of the serverless security market. According to the European Commission, in 2023, 45.2% of EU enterprises utilized cloud computing services, primarily for hosting email systems, storing electronic files, and office software. 75.3% of these enterprises chose advanced cloud services, which included hosting databases, security software applications, and platforms for application development, testing, or deployment. This represents a 4.2% point increase in the adoption of cloud computing services compared to 2021.

As organizations increasingly adopt DevOps methodologies to accelerate development cycles, improve collaboration, and enhance deployment efficiencies, the reliance on serverless architectures has also grown. Serverless computing allows DevOps teams to focus on code development and deployment without the need to manage the underlying infrastructure, leading to faster innovation and reduced operational complexity. However, this shift also introduces new security challenges, such as managing identity and access controls, monitoring for potential vulnerabilities, and ensuring compliance with industry standards. Therefore, the demand for robust serverless security solutions has surged, enabling organizations to address these challenges while maintaining the agility and scalability that serverless architectures provide.

Organizations increasingly use serverless computing to enhance operational efficiency, scalability, and cost-effectiveness. Serverless architectures allow businesses to focus on developing and deploying applications without the burden of managing the underlying infrastructure. As serverless adoption grows, there is a need for specialized security solutions to address the unique challenges associated with this model, such as securing transitory functions, managing access controls, and ensuring compliance.

Serverless computing eliminates the need for businesses to manage and maintain underlying infrastructure, allowing them to focus on core development and innovation. This reduction in operational complexity lowers costs and streamlines resource allocation and management. As organizations leverage serverless architectures to minimize overhead, they recognize the necessity of robust security solutions to protect their serverless applications and data. This drives the demand for specialized serverless security offerings that can provide comprehensive protection without adding to the operational burden. The cost efficiencies and operational simplicity of serverless computing, combined with the critical need for effective security, significantly contribute to the growth of the serverless security market.

Service Model Insights

The Function as a Service (FaaS) segment dominated the market and accounted for a 69.8% share of the global revenue in 2023. The proliferation of DevOps and microservices architectures is fueling the segment’s growth. FaaS is well-suited for microservices, where applications are composed of small, independent services that communicate with each other. This architectural approach requires robust security practices to protect each microservice and the data flows between them. As DevOps practices emphasize continuous integration and continuous delivery (CI/CD), integrating security into the development pipeline (DevSecOps) becomes crucial.

The Backend as a Service (BaaS) segment is projected to witness significant growth from 2024 to 2030. The surge in mobile and web application development has fueled the demand for BaaS solutions, which offer developers a comprehensive platform to manage backend services such as databases, authentication, and cloud storage. By offloading these tasks to a BaaS provider, developers can focus on frontend development and user experience, accelerating time-to-market. However, this reliance on third-party backend services necessitates robust security measures to protect sensitive data and ensure application integrity, driving the demand for advanced serverless security solutions tailored for BaaS environments.

Security Type Insights

The application security segment dominated the market and accounted for a 31.4% share of the global revenue in 2023. Innovations in security technologies, such as artificial intelligence (AI) and machine learning (ML), have significantly enhanced the capabilities of application security solutions. AI and ML can provide proactive threat detection, behavioral analysis, and anomaly detection, offering more effective protection for serverless applications. The adoption of these advanced technologies in application security tools enables organizations to stay ahead of emerging threats and ensures robust protection for their serverless applications. The continuous development and integration of these technologies contribute to the growth of the application security segment.

The data security segment is projected to witness significant growth from 2024 to 2030. The increasing sophistication of cyber threats targeting cloud infrastructures highlights the importance of robust data security in serverless environments. Threat actors exploit vulnerabilities in serverless applications and APIs to gain unauthorized access to sensitive data or execute malicious activities. Advanced serverless security solutions leverage technologies such as machine learning for anomaly detection, real-time monitoring, and automated incident response to detect and mitigate these threats proactively. By enhancing data visibility and control across serverless deployments, these solutions enable organizations to strengthen their overall security posture and mitigate the risks associated with data breaches and compliance violations.

Deployment Insights

The cloud segment dominated the market and accounted for an 84.3% share of the global revenue in 2023. Enterprises are increasingly adopting multi-cloud and hybrid cloud strategies to avoid vendor lock-in and enhance flexibility. This trend necessitates robust security solutions that can seamlessly integrate and provide security across diverse cloud environments. For instance, in June 2024, SentinelOne, a U.S.-based autonomous AI-powered cybersecurity provider, unveiled Singularity Cloud Workload Security for Serverless Containers. This offering delivers real-time, AI-enhanced protection for containerized workloads on AWS Fargate, supporting both Amazon ECS and Amazon EKS. Utilizing five autonomous detection engines, this solution identifies and mitigates runtime threats such as ransomware, zero-days, and fileless exploits instantly, enabling swift, automated response actions.

The on-premise segment is projected to witness significant growth from 2024 to 2030. Many enterprises have substantial investments in their existing on-premise infrastructure and are not ready to fully transition to the cloud. On-premise serverless security solutions provide a bridge, allowing these organizations to leverage the benefits of serverless architectures while maintaining compatibility with their current systems. This approach helps in minimizing disruption and ensures a smoother transition towards modernizing their IT environments.

Enterprise Size Insights

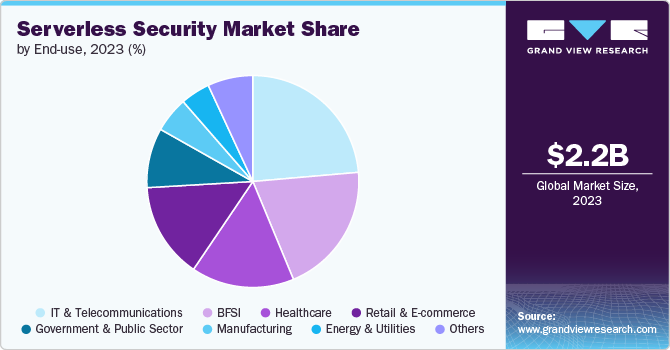

The large enterprises segment dominated the market and accounted for a 63.9% share of the global revenue in 2023. Compliance and risk management are vital concerns for large enterprises. Serverless security frameworks come with comprehensive compliance certifications and built-in security controls that help enterprises adhere to industry regulations and mitigate potential risks. This aspect is particularly crucial for industries such as finance, healthcare, and government, where data privacy and regulatory compliance are non-negotiable.

The SMEs segment is projected to witness significant growth from 2024 to 2030. Serverless architectures enable faster development and deployment of applications, which is crucial for SMEs aiming to stay competitive and agile. The use of serverless security tools ensures that security is integrated into the development lifecycle from the start, reducing the risk of vulnerabilities and compliance issues. SMEs can leverage automated security checks and continuous integration/continuous deployment (CI/CD) pipelines to accelerate their go-to-market strategies while maintaining robust security measures.

End Use Insights

The IT and telecommunications segment dominated the market and accounted for a 23.6% share of the global revenue in 2023 due to the increasing reliance on cloud-native applications within the industry. Serverless computing offers unparalleled flexibility and scalability, which are critical for handling the dynamic workloads typical in this sector. The shift towards cloud-native environments necessitates advanced security measures tailored to serverless architectures, fostering the growth of specialized security solutions. These solutions are designed to address the unique challenges of serverless environments, such as securing ephemeral functions, ensuring proper identity and access management, and providing real-time threat detection and response capabilities.

The retail and e-commerce segment is projected to witness significant growth from 2024 to 2030. The increasing frequency and sophistication of cyber threats, such as data breaches, phishing attacks, and distributed denial-of-service (DDoS) attacks, highlight the need for advanced security measures. Serverless security solutions provide comprehensive protection against these threats, ensuring that customer data remains secure and business operations are not disrupted.

Regional Insights

The North America serverless security market dominated in 2023 and accounted for a 39.1% share of the global revenue. The adoption of Industry 4.0 and emerging technologies is a significant growth driver for the North American economy. Industry 4.0 encompasses a range of advanced technologies, including the Internet of Things (IoT), artificial intelligence (AI), machine learning, and big data analytics, which are transforming manufacturing and industrial processes. As companies integrate these technologies, they enhance operational efficiency, reduce costs, and improve product quality, driving substantial economic growth.

U.S. Serverless Security Market Trends

The serverless security market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030 owing to the increasing adoption of cloud-native architectures among businesses. Companies are moving away from traditional infrastructure to influence the scalability and flexibility offered by serverless computing. As organizations shift, the demand for robust security solutions to protect serverless environments grows, leading to investments in specialized security tools and services.

Asia Pacific Serverless Security Market Trends

The serverless security market in Asia Pacific is expected to grow at the highest CAGR of 32.5% from 2024 to 2030. The rapid adoption of cloud computing across the Asia Pacific region is a significant driver for the serverless security market. Organizations are increasingly migrating to cloud-based solutions to enhance agility, reduce costs, and improve operational efficiency. As businesses transition to serverless architectures, the demand for robust security solutions to protect their applications and data in these environments is rising, fostering market growth.

Europe Serverless Security Market Trends

The Europe serverless security market is expected to witness notable growth from 2024 to 2030, driven by several key factors. The integration of edge computing with serverless technologies is emerging as a growth opportunity for the serverless security market in Europe, as it enables new use cases and security requirements.

Key Serverless Security Company Insights:

Key players operating in the market are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Serverless Security Companies:

The following are the leading companies in the serverless security market. These companies collectively hold the largest market share and dictate industry trends.

- Aqua Security

- Check Point Software Technologies

- Datadog

- Imperva

- Palo Alto Networks

- Protego

- StackHawk

- Thundra

- Trend Micro

- Zscaler

Recent Developments

-

In May 2024, StackHawk, integrated with Microsoft Defender for Cloud to enhance secure software development. This integration offers security professionals improved visibility into API security status during development, complementing the runtime capabilities of Defender for APIs.

-

In November 2023, Datadog announced enhanced security and observability features for AWS serverless applications utilizing AWS Lambda and Step Functions. These new capabilities assist users in identifying security threats, provide an overview of state machine performance at any given moment, and enable monitoring of services integrated with OpenTelemetry.

Serverless Security Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.49 billion |

|

Revenue forecast in 2030 |

USD 12.49 billion |

|

Growth rate |

CAGR of 30.8% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Service Model, security type, deployment, enterprise size, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

Aqua Security; Check Point Software Technologies; Datadog; Imperva; Palo Alto Networks; Protego, StackHawk; Thundra; Trend Micro; Zscaler |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Serverless Security Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global serverless security market based on service model, security type, deployment, enterprise size, end use, and region.

-

Service Model Outlook (Revenue, USD Million, 2018 - 2030)

-

Function as a Service (FaaS)

-

Backend as a Service (BaaS)

-

-

Security Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Data Security

-

Network Security

-

Application Security

-

Perimeter Security

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-Premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Healthcare

-

Retail and E-commerce

-

IT and Telecommunications

-

Government and Public Sector

-

Manufacturing

-

Energy and Utilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global serverless security market size was estimated at USD 2.19 billion in 2023 and is expected to reach USD 2.49 billion in 2024.

b. The global serverless security market is expected to grow at a compound annual growth rate of 30.8% from 2024 to 2030 to reach USD 12.49 billion by 2030.

b. The Function as a Service (FaaS) segment dominated the market in 2023 and accounted for a 69.8% share of the global revenue. The proliferation of DevOps and microservices architectures is fueling the growth of the FaaS segment within the serverless security market.

b. Key players operating in the smart building market include Aqua Security, Check Point Software Technologies, Datadog, Imperva, Palo Alto Networks, Protego, StackHawk, Thundra, Trend Micro, and Zscaler

b. The rapid adoption of serverless computing by organizations seeking to reduce operational costs and improve scalability, as well as the increasing complexity and frequency of cyber threats targeting serverless environments, are driving the growth of the serverless security market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."