- Home

- »

- Next Generation Technologies

- »

-

Serverless Computing Market Size, Industry Report, 2030GVR Report cover

![Serverless Computing Market Size, Share, & Trends Report]()

Serverless Computing Market (2025 - 2030) Size, Share, & Trends Analysis Report By Service Model (Function-as-a-service, Backend-as-a-service), By Deployment, By Enterprise Size, End-use (BFSI, Transportation & Logistics ), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-502-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Serverless Computing Market Summary

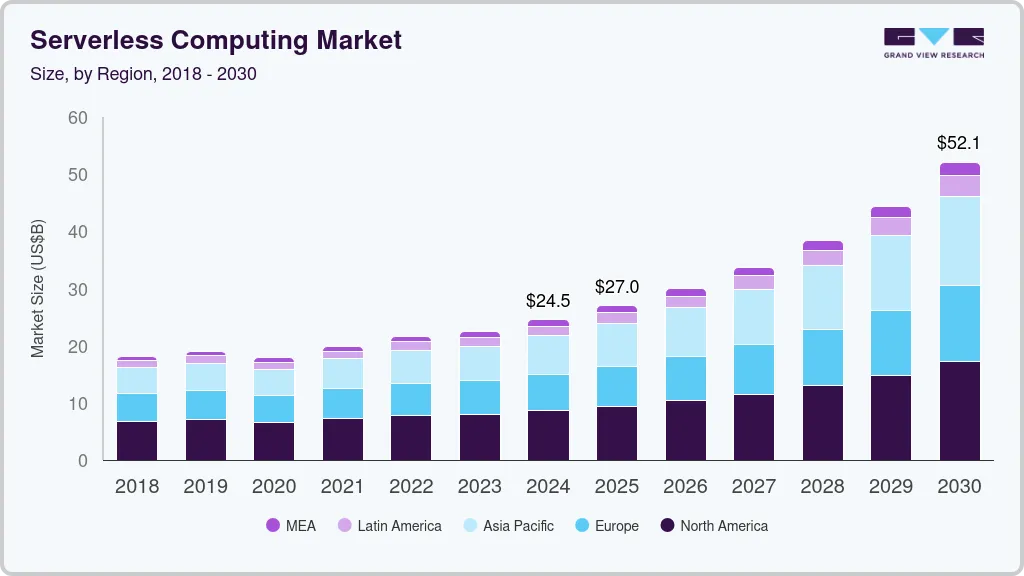

The global serverless computing market size was estimated at USD 24.51 billion in 2024 and is projected to reach USD 52.13 billion by 2030, growing at a CAGR of 14.1% from 2025 to 2030. The serverless computing industry is poised for significant growth, driven by enterprises' digital transformation initiatives, increasing adoption of cloud technologies, and the need for agile, cost-effective Function-as-a-service (FaaS)s.

Key Market Trends & Insights

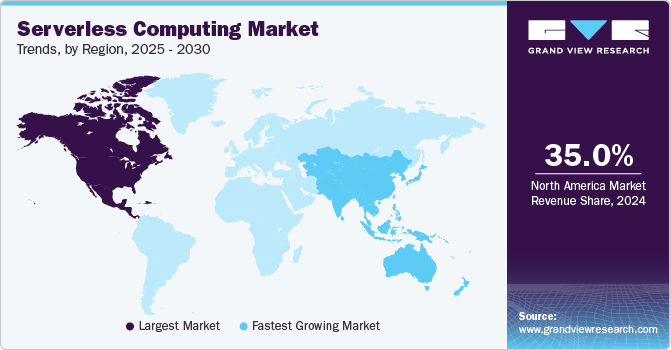

- North America dominated the global serverless computing industry with the largest share of over 35% in 2024.

- The serverless computing industry in Europe is growing significantly at a CAGR of over 13.0% from 2025 to 2030.

- The Asia Pacific serverless computing industry is growing significantly at a CAGR of over 15.0% from 2025 to 2030.

- Based on service model, the function-as-a-service (FaaS) segment dominated the serverless computing industry and accounted for a market share of over 61% in 2024.

- In terms of enterprise size, the large enterprises segment accounted for the largest market share of over 59% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 24.51 Billion

- 2030 Projected Market Size: USD 52.13 Billion

- CAGR (2025-2030): 14.1%

- North America: Largest market in 2024

Serverless computing offers a transformative approach to cost management by eliminating the need for organizations to maintain and manage physical or virtual server infrastructure. Unlike traditional IT environments that require upfront investments in servers, storage, and ongoing maintenance, serverless Function-as-a-service (FaaS) operate on a pay-as-you-go pricing model. This means businesses are charged only for the compute resources consumed during the execution of their end uses, significantly reducing capital expenditure and operating costs. This model is particularly advantageous for small and medium enterprises (SMEs), which often have limited IT budgets and cannot afford to invest heavily in infrastructure.

Additionally, serverless architectures offload tasks like server provisioning, patching, and capacity planning to the cloud provider, enabling organizations to focus on innovation and development rather than operational overheads. By minimizing idle resource costs and allowing precise scaling, serverless computing ensures optimal resource utilization, making it a cost-effective Function-as-a-service (FaaS) for end uses with variable or unpredictable workloads. Key players, including AWS, Microsoft Azure, and Google Cloud, dominate the serverless computing market with continuous innovations and comprehensive serverless FaaS.

Unlike traditional infrastructure, where scaling up requires manual intervention or significant lead time, serverless architectures scale automatically in response to demand. This ensures that businesses can efficiently manage peak traffic without over-provisioning resources, avoiding the risks of downtime or performance bottlenecks. For instance, an e-commerce platform can handle sudden spikes in traffic during holiday sales without requiring pre-planned infrastructure upgrades. Serverless function-as-a-service dynamically allocates computer power and resources to match workload requirements, making them ideal for event-driven end uses, such as real-time analytics or API backends. Furthermore, this scalability is achieved without upfront resource allocation, allowing businesses to pay only for the resources consumed. This flexibility not only optimizes operational efficiency but also supports innovation by enabling developers to experiment and deploy end uses rapidly without worrying about infrastructure constraints.

The future of serverless computing is bright, with significant advancements expected in AI-driven workload optimization and the integration of edge computing to enhance real-time data processing. Hybrid and multi-cloud serverless FaaS will address vendor lock-in concerns, providing organizations with greater flexibility. IoT proliferation and sustainability goals will further drive adoption, as serverless computing aligns with energy-efficient IT practices. However, addressing current challenges like security, cold starts, and monitoring complexities will be critical to unlocking its full potential across diverse industries. Cold start latency, the delay in initializing serverless functions during their first invocation, can significantly impact performance-sensitive end uses requiring real-time responsiveness. This limitation deters adoption in critical use cases like financial transactions or Healthcare & Life Sciences monitoring, where milliseconds matter, potentially slowing market growth by restricting serverless computing's applicability in such scenarios.

Service Model Insights

The function-as-a-service (FaaS) segment dominated the serverless computing industry and accounted for a market share of over 61% in 2024. The growing reliance on event-driven architecture significantly boosts the adoption of Function-as-a-Service (FaaS), as it excels in handling discrete, event-triggered tasks such as IoT data processing, real-time analytics, and API management. This makes FaaS ideal for dynamic end uses requiring efficient, scalable solutions to process events in real time. Additionally, FaaS offers unmatched cost optimization through its pay-per-use pricing model, charging businesses only for the execution time of functions. This eliminates the need for maintaining idle infrastructure and makes it highly appealing for intermittent workloads. By minimizing operational costs and enabling agile responses to event-driven scenarios, FaaS continues to attract organizations across diverse industries.

The Backend-as-a-Service (BaaS) segment is anticipated to register a considerable grow during the forecast period. Backend-as-a-Service (BaaS) simplifies backend development by offering pre-built services like database management, user authentication, and server-side logic, enabling developers to focus on frontend and end use functionality. This significantly reduces development time and complexity. Additionally, the growing demand for mobile and web end uses fuels BaaS adoption, as it provides a reliable backend infrastructure to support essential real-time features such as push notifications, geolocation services, and cloud storage for seamless user experiences.

Deployment Insights

The public cloud segment accounted for the largest market share in 2024. As organizations increasingly migrate their infrastructure to the cloud, they are looking for flexible, scalable, and cost-efficient solutions to support their end uses. Serverless computing, which eliminates the need for manual infrastructure management, fits perfectly within the cloud model, enabling businesses to focus on building and deploying end uses without worrying about provisioning or maintaining servers. The public cloud offers the scalability and on-demand resources required for serverless computing, making it an attractive choice for businesses of all sizes. This growing reliance on cloud infrastructure naturally drives the adoption of serverless computing models.

The hybrid cloud segment is expected to grow at a significant CAGR during the forecast period. Hybrid cloud solutions allow organizations to combine the benefits of both public and private clouds, offering greater control over sensitive data while leveraging the scalability and cost efficiency of public cloud resources. This balance is particularly beneficial for enterprises adopting serverless computing, as they can run critical workloads in private clouds and scale fewer sensitive workloads serverless in the public cloud.

Enterprise Size Insights

The large enterprises segment accounted for the largest market share of over 59% in 2024. Large enterprises often face substantial operational costs for infrastructure maintenance and scaling. Serverless computing offers cost efficiency through a pay-per-use model, eliminating upfront server investments and enabling organizations to pay only for the resources consumed. This is especially advantageous for businesses with fluctuating workloads. Additionally, serverless computing accelerates the development and deployment process by abstracting the complexities of infrastructure management. By allowing enterprise teams to focus on coding and innovation, serverless models enhance agility, reduce time-to-market, and enable faster rollouts of end uses, products, and services. This speed is crucial for large enterprises striving to stay competitive in rapidly evolving industries.

The small & medium-sized enterprises segment is expected to grow at a significant CAGR during the forecast period. Serverless computing abstracts the complexities of managing and maintaining infrastructure, enabling SMEs to focus on building and growing their businesses rather than on server provisioning, scaling, or maintenance. This reduces the need for specialized IT expertise, making it easier for SMEs to adopt and benefit from cloud technologies.

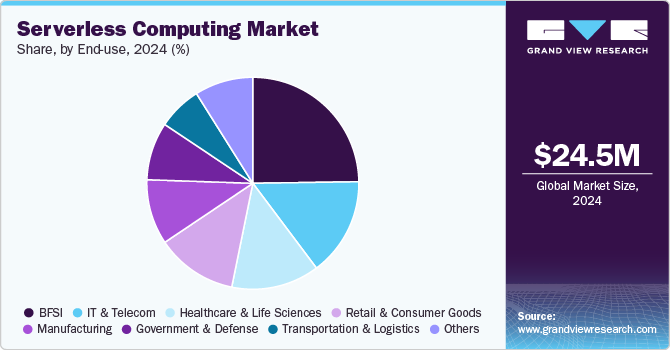

End-use Insights

The BFSI segment accounted for the largest market share in 2024. The BFSI sector faces fluctuating workloads, especially during peak periods like the month-end or tax season, requiring scalable infrastructure to ensure smooth operations. Serverless computing addresses this need with auto-scaling capabilities, allowing financial institutions to handle spikes in demand without over-provisioning resources. This ensures cost-effective and seamless service delivery. Additionally, BFSI operations increasingly depend on real-time data analytics for critical tasks such as fraud detection, risk assessment, and personalized customer experiences. Serverless computing supports event-driven architectures, enabling efficient real-time data ingestion and processing. This enhances operational efficiency, improves decision-making, and empowers institutions to deliver timely, data-driven financial services in a dynamic market.

The retail & consumer goods segment is expected to grow at a significant CAGR during the forecast period. The Retail & Consumer Goods sector increasingly depends on real-time data analytics to understand customer behavior, personalize shopping experiences, and optimize inventory. Serverless computing supports event-driven architectures, enabling real-time data processing for better decision-making. Additionally, the growth of e-commerce and omnichannel strategies demands robust IT solutions. Serverless computing allows to rapidly develop and deploy scalable end uses, enhancing the online shopping experience while ensuring seamless integration across multiple sales channels, helping businesses stay agile and competitive in a dynamic market.

Regional Insights

North America dominated the global serverless computing industry with the largest share of over 35% in 2024. North America leads in cloud computing adoption, driven by the presence of major providers like AWS, Microsoft Azure, and Google Cloud. This robust cloud infrastructure, coupled with the region's early embrace of serverless computing models, significantly propels market growth. Additionally, North America is a hub for technological advancements, with businesses heavily investing in emerging technologies like IoT, AI, and big data. Serverless computing supports these innovations by offering scalable, event-driven architectures that streamline End Use development and deployment. This synergy between advanced cloud infrastructure and cutting-edge technologies establishes North America as a dominant force in the market, fostering continuous growth and innovation.

U.S. Serverless Computing Market Trends

The serverless computing industry in the U.S. is expected to grow significantly from 2025 to 2030. The U.S. hosts a thriving startup ecosystem, especially in tech hubs like Silicon Valley, where serverless computing is highly valued for its cost efficiency, scalability, and simplicity. These features enable startups to develop and deploy end uses rapidly without significant infrastructure investment. Additionally, the expanding e-commerce and SaaS sectors in the U.S. leverage serverless solutions to handle dynamic workloads, ensure consistent uptime, and deliver superior customer experiences, making serverless computing a vital component in their growth and innovation strategies.

Europe Serverless Computing Market Trends

The serverless computing industry in Europe is growing significantly at a CAGR of over 13.0% from 2025 to 2030. European organizations are increasingly migrating to cloud platforms to enhance efficiency and scalability. Serverless computing, as a natural progression of cloud adoption, is gaining traction for its ability to reduce infrastructure costs and optimize resources. Similarly, European Government & Defenses and enterprises are heavily investing in digital transformation strategies. Serverless computing supports these initiatives by enabling faster development cycles, scalability, and agility in deploying modern end uses.

The UK serverless computing market is expected to grow rapidly in the coming years. The rapid growth of e-commerce in the UK drives demand for scalable IT solutions. Serverless computing allows online retail & consumer goods to manage fluctuating workloads, enhance customer experiences, and integrate omnichannel strategies seamlessly.

The serverless computing market in Germany held a substantial revenue share in 2024. Germany’s strong manufacturing and automotive sectors increasingly rely on real-time data processing, predictive analytics, and automation. Serverless computing helps these industries manage fluctuating workloads, particularly in IoT-based end uses that require scalability and low-latency processing.

Asia Pacific Serverless Computing Market Trends

The Asia Pacific serverless computing industry is growing significantly at a CAGR of over 15.0% from 2025 to 2030. The Asia Pacific region is experiencing rapid cloud adoption across both developed and emerging markets. Leading countries like China, Japan, India, and Australia are increasingly embracing cloud computing, which facilitates the adoption of serverless computing. As businesses move away from traditional on-premises infrastructure, serverless computing offers scalable, cost-efficient alternatives that drive the regional market growth.

The China serverless computing market held a substantial revenue share in 2024 China's focus on smart manufacturing and the Industrial Internet of Things (IIoT) is creating significant demand for real-time data processing and scalable IT infrastructure. Serverless computing’s ability to process large volumes of data from connected devices efficiently supports these end uses, particularly in industries like automotive, electronics, and industrial automation.

The serverless computing market in Japan held a substantial revenue share in 2024. E-commerce in Japan is expanding rapidly, driven by a shift in consumer behavior toward online shopping. Serverless computing is well-suited for the high-demand, variable workloads associated with e-commerce platforms, providing the scalability needed during peak shopping seasons like holidays or special sales events. This flexibility allows businesses to efficiently manage their operations without the need for constant infrastructure upgrades.

The India serverless computing industry is growing rapidly due to small and medium-sized enterprises (SMEs) in India increasingly turning to serverless computing to optimizeoperational costs and reduce infrastructure overhead. The pay-per-use pricing model, where businesses only pay for the resources they use, is particularly beneficial for cost-conscious SMEs, allowing them to focus on innovation and business growth without the burden of maintaining on-premise servers.

Key Serverless Computing Company Insights

The key market players in the global serverless computing industry include Amazon Web Services (AWS); Microsoft Corporation; Google, Inc.; IBM Corporation; Alibaba Cloud; Oracle Corporation; Red Hat, Inc.; Cloudflare, Inc.; Tencent Cloud; and SAP SE. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In April 2024, Cloudflare, Inc. completed the acquisition of Baselime, a cloud-native observability platform. This acquisition enhances Cloudflare's developer platform, offering advanced serverless observability tools. These tools help developers gain insights into the performance, errors, and behavior of their serverless end uses, aiding in debugging, optimization, and cost management. By integrating Baselime’s capabilities, Cloudflare aims to provide comprehensive observability for serverless end uses, making it easier for developers to troubleshoot and optimize performance in real-time, thereby strengthening its position as a leading platform for modern cloud computing.

-

In December 2024, Microsoft introduced Neon Serverless Postgres as an Azure native integration in preview. This integration enables developers to leverage Neon’s serverless PostgreSQL database solution within Azure's ecosystem. Neon offers instant provisioning, automatic scaling, and seamless developer workflows, ideal for AI, SaaS, and real-time end uses. The integration supports Single Sign-On (SSO) and unified billing, simplifying database management and enhancing developer experience, making it easier for businesses to scale end uses efficiently while minimizing infrastructure complexities.

-

In November 2023, Amazon Web Services (AWS) introduced three new serverless innovations to enhance data analysis and management at any scale. These innovations focus on simplifying data ingestion, processing, and visualization, offering automated scaling and increased flexibility for large-scale operations. By expanding serverless capabilities, AWS aims to streamline complex workflows, making data management more efficient and accessible for customers across industries. This approach supports businesses in handling vast amounts of data without the need for manual infrastructure management.

Key Serverless Computing Companies:

The following are the leading companies in the serverless computing market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services (AWS)

- Microsoft Corporation

- Google, Inc.

- IBM Corporation

- Alibaba Cloud

- Oracle Corporation

- Red Hat, Inc.

- Cloudflare, Inc.

- Tencent Cloud

- SAP SE

Serverless Computing Market Report Scope

Report Attribute

Details

Market size in 2025

USD 26.98 billion

Market size forecast in 2030

USD 52.13 billion

Growth rate

CAGR of 14.1% from 2025 to 2030

Actual data

2018 - 2023

Base year

2024

Forecast period

2025 - 2030

Quantitative units

Market size in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Service model, deployment, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK: Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Amazon Web Services (AWS); Microsoft Corporation; Google, Inc.; IBM Corporation; Alibaba Cloud; Oracle Corporation; Red Hat, Inc.; Cloudflare, Inc.; Tencent Cloud; SAP SE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Serverless Computing Market Report Segmentation

This report forecasts market size growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the serverless computing market report based on service model, deployment, enterprise size, end use, and region:

-

Service Model Outlook (Market Size, USD Million, 2018 - 2030)

-

Function-as-a-service (FaaS)

-

Backend-as-a-service (BaaS)

-

-

Deployment Outlook (Market Size, USD Million, 2018 - 2030)

-

Public Cloud

-

Private Cloud

-

Hybrid Cloud

-

-

Enterprise Size Outlook (Market Size, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Sized Enterprises

-

-

End-use Outlook (Market Size, USD Million, 2018 - 2030)

-

IT & Telecom

-

BFSI

-

Healthcare & Life Sciences

-

Retail & Consumer Goods

-

Government & Defense

-

Transportation & Logistics

-

Manufacturing

-

Others

-

-

Regional Outlook (Market Size, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global serverless computing market size was estimated at USD 24.51 billion in 2024 and is expected to reach USD 26.98 billion in 2025

b. The global serverless computing market is expected to grow at a compound annual growth rate of 14.1% from 2025 to 2030 to reach USD 52.13 billion by 2030

b. The Function-as-a-service (FaaS) segment accounted for a market share of over 60% in 2024. The growing reliance on event-driven architecture significantly boosts the adoption of Function-as-a-Service (FaaS), as it excels in handling discrete, event-triggered tasks such as IoT data processing, real-time analytics, and API management.

b. The key players in the serverless computing market are Amazon Web Services (AWS), Microsoft Corporation, Google, IBM Corporation, Alibaba Cloud, Oracle Corporation, Red Hat, Inc., Cloudflare, Inc., Tencent Cloud, SAP SE

b. The serverless computing market is poised for significant growth, driven by enterprises' digital transformation initiatives, increasing adoption of cloud technologies, and the need for agile, cost-effective Function-as-a-service (FaaS)s.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.