Sepsis Diagnostics Market Size, Share & Trends Analysis Report By Product (Assay Kits & Reagents, Blood Culture Media), By Technology (Microbiology, Immunoassays), By Pathogen, By Testing, By Method, By End-usse, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-352-2

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Sepsis Diagnostics Market Size & Trends

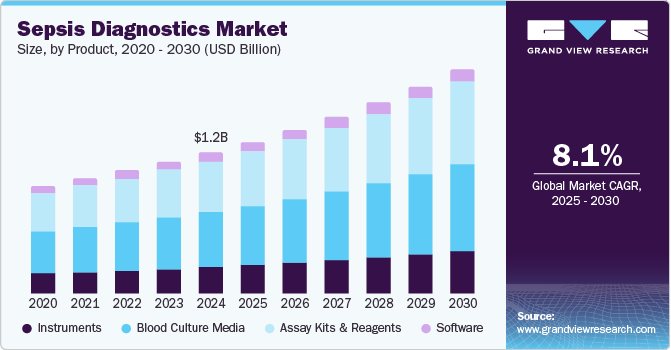

The global sepsis diagnostics market size was valued at USD 1.15 billion in 2024 and is projected to grow at a CAGR of 8.09% from 2025 to 2030. Factors such as the introduction of technologically advanced diagnostic solutions, high prevalence of sepsis, and increasing awareness are responsible for market growth over the forecast period. Sepsis is the leading cause of death in high-income countries, such as the U.S., with approximately 270,000 people dying from the condition annually, according to the Centers for Disease Control and Prevention (CDC).

It is also prevalent in low and middle-income countries, where it often is undiagnosed and untreated due to limited access to healthcare. In 2020, the Global Sepsis Alliance reported that it is responsible for an estimated 11 million deaths worldwide each year, which is more than the combined number of deaths from breast cancer, prostate cancer, and HIV/AIDS. The situation is particularly severe in low-income countries, where disease-related mortality is the highest. As such, there is an urgent need for improved awareness, prevention, and treatment, particularly in these regions.

Pneumonia is the leading cause of sepsis and septic shock, affecting individuals of all ages. While community-acquired pneumonia and hospital-acquired pneumonia differ in symptom duration, both can result in severe pneumonia and an increased risk of developing sepsis. Recent studies indicate that sepsis is a direct outcome of pneumonia, with more than half of patients having suffered from pneumonia. Pneumonia and sepsis cases have significantly increased globally as a result of the COVID-19 pandemic. A study published in The Lancet Respiratory Medicine in August 2021 indicates that the prevalence of sepsis and mortality linked to sepsis have considerably increased throughout the pandemic.

The COVID-19 pandemic has further highlighted the importance of early diagnosis; it can lead to organ dysfunction and increase in risk of developing sepsis. While the pathogenesis of COVID-19 is not yet fully understood, research suggests that cytokine and chemokine levels in severe COVID-19 patients are similar to those found in patients, highlighting the need for improved diagnostic tools for sepsis. Some companies offering advanced diagnostics for the disease are T2 Biosystems, Becton, Dickinson and Company (BD), and F. Hoffmann-La Roche. These companies are actively involved in developing diagnostic tools that can provide faster and more accurate diagnoses, improving patient outcomes and reducing the global burden of disease.

Hospital-acquired infections continue to be a major contributor to the development of sepsis diagnostics, particularly among patients with chronic conditions, such as diabetes. CDC reports that approximately 1 in 31 hospital patients in the U.S. acquire hospital-acquired infection each year. These infections often result from invasive medical procedures, such as catheter insertions, and can lead to sepsis. Catheter-Associated Urinary Tract Infections (CAUTIs) and Surgical Site Infections (SSIs) are the most common types of hospital-acquired infections.

Market Dynamics

The sepsis diagnostics industry is being driven by technological advancements, such as molecular diagnostic technologies, multiplex assays, and biomarkers. For example, Roche Diagnostics offers products, such as the Elecsys BRAHMS PCT assay, which measures the levels of PCT in the blood. Several emerging trends are likely to shape the market in the future. These include the development of POC diagnostic tools, integration of Al & machine learning algorithms into diagnostics, and the growing use of biomarkers for disease diagnosis.

Regulatory bodies are crucial in driving market growth setting standards and guidelines for product development and approval. Recent trends show a focus on streamlining approval processes, promoting innovative technologies, and evidence-based clinical practices. The FDA has approved the T2Bacteria Panel, which detects the disease-causing bacteria directly from a patient's blood sample without waiting for cultures to grow, which is an example of this trend, likely to drive market growth during the forecast period.

Despite the advancements, several challenges still exist in the market. Some of the significant challenges facing the market include the high cost of diagnostics tests, the lack of awareness about the disease & its diagnosis, and the limited availability of diagnostic tools in developing countries.

Product Insights

Blood culture media dominated the market in 2024 with a revenue share of more than 38.90%, as blood culture is considered to be the most cost-effective and convenient mode of testing. Moreover, several organizations are developing novel solutions to further enhance the effectiveness of blood culture media by combining them with advanced solutions. For instance, in June 2024, Magnolia Medical, a company that provides technology solutions for hospitals, launched Magnolia Analytics, a service designed to help hospitals collect and analyze data related to the prevention of sepsis misdiagnosis.

The assay kits & reagents segment is estimated to register the fastest CAGR during the forecast period. Assay kits, coupled with different analyzers, provide high-throughput analytical outcomes for the detection of the disease. For instance, in February 2024, a panel of sepsis experts assessed the potential of NET-associated circulating nucleosome assay for detecting NET components and evaluating disease severity. The panel concluded that this test could significantly assist in the early diagnosis of sepsis.

Technology Insights

In terms of technology, the market is segmented into microbiology, molecular diagnostics, immunoassays, and flow cytometry.The microbiology technology segment dominated the global market in 2024 and accounted for the largest share of more than 48.77% of the overall revenue. Microbial culture is the primary and gold standard method for detecting infectious disease-causing organisms in laboratory settings. In addition, new strategic initiatives by key players will further drive the segment growth in the near future. For instance, in February 2024, doctors at The Helgeland Hospital Trust in Arctic Norway reported a new method to analyze blood samples to detect suspected sepsis, allowing them to receive the test results 2 days prior to previous tests. The development of such methods for blood sample analysis marks a significant step in offering faster and enhanced patient treatment for sepsis in local hospitals.

The molecular diagnostics segment is anticipated to grow at the fastest CAGR over the coming years. Molecular diagnostic technique is another important tool in the detection of sepsis. It also assists in reducing the time of pathogen identification, thus, allowing early detection and initiation of treatment at a faster rate as compared to conventional diagnostic methods. Methicillin-resistant Staphylococcus Aureus (MRSA) most commonly causes skin infections. PCR and Nucleic Acid Sequence-based Amplification (NASBA) are used to detect MRSA. However, the molecular diagnostic technique is considered the standard pathogen identification technique after blood culture.

Pathogen Insights

Bacterial segment held the largest revenue share of 86.22% in 2024 and is anticipated to maintain its lead over the forecast period owing to the rise in cases of bacterial sepsis, higher occurrence of hospital-transmitted infections, and rising number of surgical procedures conducted. According to the study published by SAGE Journals in January 2019, the bacterial segment is the most common type, with 62.2% of patients infected with gram-negative bacteria and 46.8% with gram-positive bacteria. In the bacterial segment, the gram-negative bacteria sub-segment is anticipated to dominate the market over the forecast period.

The fungal segment, although having less revenue share, is expected to grow at a significant CAGR over the forecast period. One of the major drivers is the increasing availability and introduction of a new and wide range of disease diagnosis devices for pathogen detection. One of the key tests used to detect fungal infections is an ELISA developed by Laboratory Corporation of America Holdings. This assay is used to detect IgG, IgA, and IgM antibodies to Candida albicans, which is a major cause of bloodstream infection leading to septic shock & sepsis. BacT/ALERT Culture Media by bioMérieux SA and BD BACTEC Media by BD are other key products available in the market for the isolation & identification of fungal sepsis.

Method Insights

The conventional diagnostics segment held the largest revenue share of 57.12% of the sepsis diagnostics industry in 2024. The conventional method relies on the expertise of healthcare professionals to evaluate the patient's clinical presentation and interpret laboratory and imaging results. Early detection and prompt treatment are crucial to improve patient outcomes.

The automated diagnostic method is the fastest-growing segment over the forecast period. Clinical Decision Support Systems (CDSS), machine learning algorithms, biomarkers, and continuous monitoring systems are some of the automated diagnostics methods available for diagnostics. In February 2024, a new study published in Nature Scientific Reports introduced a novel diagnostic tool for sepsis, which combined AI algorithms and advanced biomarkers for early & accurate detection. This innovative approach significantly reduced the time needed for diagnosis, allowing prompt medical intervention and improving patient outcomes.

End-use Insights

The hospital and clinics segment held the largest revenue share of 79.42% in 2024, owing to an increase in hospitalization. Several ongoing developments to advance diagnostic tests are anticipated to boost the segment. In January 2023, the FDA authorized IntelliSep, a novel diagnostic test that can assist in identifying patients with sepsis before the potentially fatal condition becomes too difficult to treat. Early detection is crucial for proper results, as sepsis is responsible for one in three hospital deaths.

Pathology & reference laboratories are estimated to be the fastest end use segment over the forecast period. Reference laboratories play an important role in sepsis diagnostics by providing specialized testing services that are not available in most hospitals or clinics. The presence of several pathology and reference laboratories globally, which offer a comprehensive range of testing services for sepsis, has further contributed to segment growth. For instance, Arup Laboratories offers specialized testing services for sepsis. Its offerings include blood culture testing, biomarker testing, and PCR testing for specific pathogens.

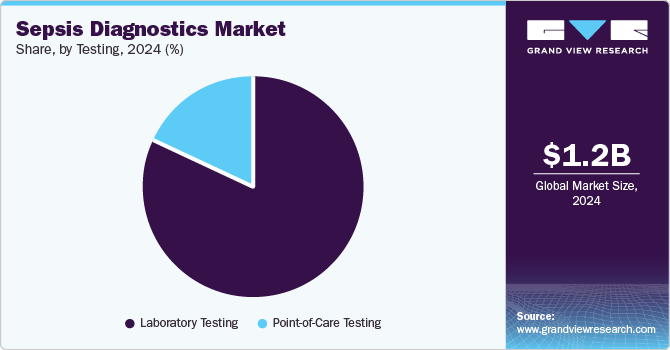

Testing Insights

Based on testing, the market has been further categorized into laboratory testing and POC testing. The laboratory testing segment dominated the market in 2024 in terms of revenue share. Advancements in laboratory testing have made it easier and faster to detect sepsis, leading to better outcomes for patients. These tests use biomarkers, such as procalcitonin or cytokines, to identify the presence of infection in the body. The tests are highly sensitive and can provide results within hours, allowing for earlier detection and treatment of sepsis. Thus, these factors would further contribute to the development of more effective and personalized approaches to diagnosis.

PoC testing is estimated to grow at a significant CAGR over the forecast period. Technological advancements in POC test kits in terms of shorter turnaround times and error-free results are expected to boost the market in the future. In November 2023, Inflammatix announced that it is aiming to launch its TriVerity Acute Infection and Sepsis Test System in late 2024. The test aims to identify bacterial & viral infections and assess the risk of severe illness within 30 minutes using a cartridge-based system called the Myrna Instrument. This device analyzes 29 mRNAs to interpret the body's immune response, offering rapid diagnostics in emergency settings. Inflammatix's system has received FDA Breakthrough Device Designation, with clinical studies expected to conclude by spring 2024.

Regional Insights

North America sepsis diagnostics market dominated globally in 2024 and accounted for the largest revenue share of more than 43.9%. The high incidence of sepsis and infectious diseases is expected to fuel demand for novel diagnostic solutions. Several developments have been reported in the region, which contributes to the market growth. For instance, in January 2023, Cytovale announced receiving FDA authorization for its IntelliSep Sepsis Test for early detection of sepsis.

Asia Pacific Sepsis Diagnostics Market Trends

Asia Pacific sepsis diagnostics market is estimated to be the fastest-growing regional market from 2024 to 2030 majorly attributed to rising demand for diagnostic solutions in countries with a high prevalence of infectious diseases, such as China and India. Furthermore, constant developments in molecular diagnostics technology, such as the introduction of Point-Of-Care (POC) testing devices & next-generation sequencing technology, and integration of machine learning & artificial intelligence, are contributing to the region’s market growth. For instance, in January 2023, Asep Medical Holdings, Inc. entered into a joint venture with Sansure Biotech Inc., a medical diagnostics company in China, to commercialize the Sepset(ER) Sepsis Diagnostic Test in the country.

Key Sepsis Diagnostics Company Insights

The key players operating in the market are adopting inorganic growth strategies, such as mergers and partnerships, for the development of novel diagnostic solutions.

-

In October 2024, Trinity Biotech announced the acquisition of 12.5% equity stakes in Novus Diagnostics, which has a market value of USD 2.5 million. This investment aims to accelerate the commercialization and development of Novus Diagnostics, point-of-care solutions.

-

In April 2024, F. Hoffmann-La Roche entered into a distribution collaboration with Prenosis, Inc. for the distribution of ImmunoScore, an AI-driven software as a medical device (AI SaMD) designed to support the rapid diagnosis of sepsis and predict adverse outcomes.

-

In November 2023, Danaher partnered with the University of Oxford to develop a test that can use rapid molecular diagnostic technologies offered by Cepheid, a Danaher subsidiary, to identify various subtypes of sepsis, allowing the development of novel personalized care paths.

-

In February 2023, Immunexpress commercialized its SeptiCyte Rapid test in the U.S., which can quickly diagnose sepsis in patients within an hour. The point-of-care test can help clinicians identify patients at an earlier stage, leading to timely intervention and better outcomes.

-

In January 2023, Cytovale announced the launch of its new IntelliSep sepsis diagnostics test. The new test is launched to address patients in emergency department suffering from sepsis.

-

In January 2023, PERSOWN Inc. launched SMASH-H, a real-time sepsis monitoring system with an aim to address the increasing burden of sepsis.

Key Sepsis Diagnostics Companies:

The following are the leading companies in the sepsis diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- BD

- bioMérieux SA

- Thermo Fisher Scientific, Inc.

- Danaher Corporation (Beckman Coulter, Inc.)

- F. Hoffmann-La Roche AG

- Cepheid

- Luminex Corp.

- Koninklijke Philips N.V.

- Bruker

- Immunexpress, Inc.

Sepsis Diagnostics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.23 billion |

|

Revenue forecast in 2030 |

USD 1.82 billion |

|

Growth rate |

CAGR of 8.09% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion/million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, technology, pathogen, testing, method, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; Spain; France; Italy; Russia;Denmark, Sweden, Norway, Japan; India; China; South Korea; Singapore; Australia, Thailand, Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE, Kuwait |

|

Key companies profiled |

bioMérieux SA; Becton, Dickinson & Company; Thermo Fisher Scientific, Inc.; F. Hoffmann-La Roche AG; Danaher Corp. (Beckman Coulter, Inc.); Luminex Corp.; Bruker; Cepheid, Bruker Corporation, Immunexpress, Inc., Koninklijke Philips N.V. |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Sepsis Diagnostics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sepsis diagnostics market report based on product, method, end-use, technology, pathogen, testing, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Blood Culture Media

-

Assay Kits and Reagents

-

Software

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Microbiology

-

Molecular Diagnostics

-

Polymerase Chain Reaction (PCR)

-

DNA Microarrays

-

Syndromic Panel testingOthers

-

-

Immunoassays

-

Flow Cytometry

-

Others

-

-

Pathogen Outlook (Revenue, USD Million, 2018 - 2030)

-

Bacterial Sepsis

-

Gram-positive Bacteria

-

Gram-negative Bacteria

-

-

Fungal Sepsis

-

Viral Sepsis

-

Others

-

-

Testing Outlook (Revenue, USD Million, 2018 - 2030)

-

Laboratory Testing

-

PoC Testing

-

-

Method Outlook (Revenue, USD Million, 2018 - 2030)

-

Automated Diagnostics

-

Conventional Diagnostics

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Pathology & Reference Laboratories

-

Research Institutes and Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

Russia

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Singapore

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global sepsis diagnostics market size was estimated at USD 1.15 billion in 2024 and is expected to reach USD 1.23 billion in 2025.

b. The global sepsis diagnostics market is expected to witness a compound annual growth rate of 8.09% from 2025 to 2030 to reach USD 1.82 billion in 2030.

b. Based on products, blood culture segment held the largest share of 38.90% in 2024 since blood culture is considered to be the most convenient and cost-effective mode of testing by clinicians.

b. Some key players operating in the sepsis diagnostics market include Becton, Dickinson and Company; bioMérieux SA; Sysmex Corporation; F. Hoffmann-La Roche AG; Beckman Coulter, Inc.; Thermo Fisher Scientific, Inc.; Cepheid Inc.; Bruker Corporation; and Nanosphere, Inc.

b. Key factors driving the sepsis diagnostics market growth include an increase in the prevalence of sepsis, rise in the incidence of hospital-acquired infections, increase in the number of pneumonia cases, and approval and launch of advanced sepsis diagnostic systems.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."