SEO Software Market Size, Share & Trends Analysis Report By Deployment (On-premise, Cloud), By Enterprise Size (SMEs, Large Enterprises), By Type (Social Media Marketing, Email Marketing), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-397-9

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

SEO Software Market Size & Trends

The global SEO software market size was estimated at USD 68.34 billion in 2023 and is projected to grow at a CAGR of 12.9% from 2024 to 2030. The market growth can be primarily attributed to several key factors, including increased internet penetration, the expansion of e-commerce, and heightened competition in the digital landscape. As businesses strive to enhance their online visibility, they are increasingly turning to SEO software to boost their website rankings on search engine results pages without incurring additional costs from search engine providers. These tools offer valuable SEO insights by evaluating factors such as website traffic, performance, and user engagement. Consequently, SEO software helps businesses identify optimal strategies and techniques to enhance their website's performance and search relevancy.

As online search engines, including Google, frequently refine their algorithms to enhance the relevance of search results, businesses need advanced SEO software to remain competitive. These tools facilitate the analysis and adaptation to algorithmic changes, allowing websites to achieve and maintain high search rankings consistently. This ensures that businesses can effectively respond to evolving search engine criteria and sustain their online visibility.

The rising integration of artificial intelligence (AI) and machine learning (ML) in SEO software presents a substantial growth avenue in the global market. AI-driven tools offer more accurate keyword suggestions, predictive analytics, and personalized recommendations. In addition, the rise of voice search and mobile optimization opens new opportunities for SEO software providers to develop features tailored to these emerging trends, such as voice query analysis and mobile performance tracking.

The rising focus on data privacy and compliance across the world with regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) are among the key factors driving the demand for safe and secure SEO software. The key companies in the market are increasingly incorporating features that ensure compliance with these regulations, offering tools for data protection and user privacy management. Moreover, there is a noticeable shift towards integrating SEO with other digital marketing functions, such as content marketing and social media management, to provide a more holistic approach to digital strategy.

In markets such as the U.S. and Europe, the demand for SEO software is particularly robust due to highly competitive online environments and advanced digital infrastructure. Similarly, in emerging markets like India and Southeast Asia, the market growth is fueled by the rapid adoption of digital technologies and increasing internet access, presenting significant opportunities for market expansion.

Enterprise Size Insights

Based on enterprise size, the large enterprise segment led the market with the largest revenue share of 55.15% in 2023. In this segment, the market growth is driven by the complex digital strategies and extensive SEO needs of these organizations. Large enterprises typically have more intricate websites and diverse digital assets, which require advanced SEO tools capable of handling large volumes of data and providing in-depth analysis. The demand for sophisticated SEO software that integrates with other enterprise systems, such as customer relationship management (CRM) and content management systems (CMS), is a key driver of growth among large enterprises.

The SME segment is expected to grow at a significant CAGR during the forecast period. SMEs are recognizing the importance of SEO in driving online visibility and attracting customers without substantial advertising budgets. This trend is largely driven by the rise of affordable, user-friendly SEO tools that cater specifically to the needs of smaller businesses. SEO software often offers features including automated keyword tracking, on-page optimization suggestions, and easy-to-understand analytics, which enable SMEs to manage their SEO efforts effectively without requiring specialized knowledge or large teams.

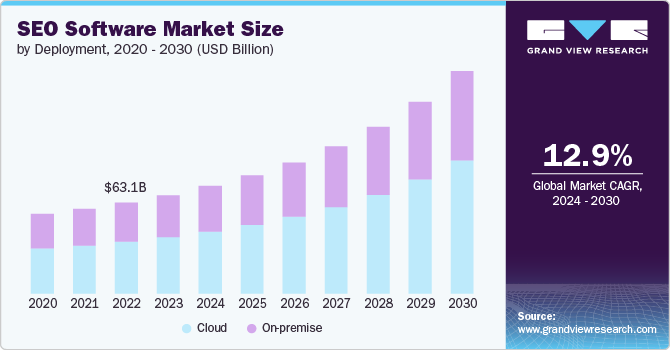

Deployment Insights

Based on deployment, the cloud segment led the market with the largest revenue share of 57.44% in 2023. The segment is experiencing significant growth due to its scalability and flexibility. As businesses increasingly shift towards remote work and distributed teams, cloud-based solutions offer a collaborative environment where multiple users can access and manage SEO data from anywhere, enhancing productivity and efficiency. In addition, the subscription-based model of cloud software provides cost-effective scalability, allowing businesses to adjust their services based on their evolving needs without substantial upfront investments. This model aligns well with the growing trend of pay-as-you-go services and the need for agile, adaptive business solutions in today’s fast-paced digital environment.

The on-premise segment is expected to grow at a significant CAGR during the forecast period. The on-premise segment continues to thrive due to its appeal among enterprises with stringent data security and privacy requirements. Organizations that handle sensitive or confidential information often prefer on-premise solutions as they offer greater control over data management and security protocols. This trend is driven by increasing concerns about data breaches and privacy regulations, which necessitate robust security measures that on-premise solutions can provide. The ability to customize and integrate on-premise software with existing IT infrastructure also presents a significant advantage, catering to businesses that require specialized features tailored to their specific needs.

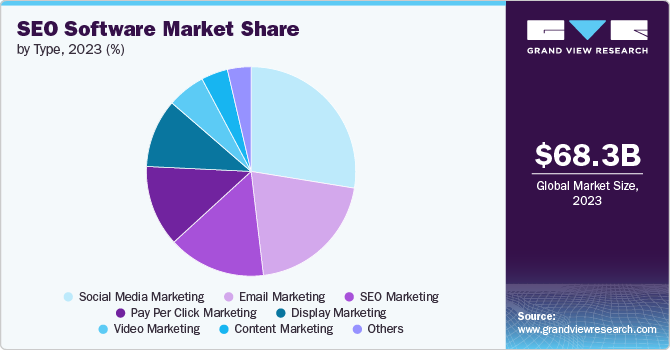

Type Insights

Based on type, the social media marketing segment led the market with the largest revenue share of 27.56% in 2023. The rising importance of social media platforms in driving online engagement and brand visibility is among the primary factors driving the demand for SEO software in the segment. Further, there is a rise in demand for advanced social media analytics tools, which enable businesses to gain deeper insights into user behavior and campaign performance. These tools leverage AI and machine learning algorithms to analyze vast amounts of social media data, providing actionable insights that help businesses optimize their social media strategies. As companies seek to enhance their social media presence, the demand for SEO software that integrates seamlessly with social media platforms and provides real-time performance metrics is expanding.

The video marketing segment is expected to grow at a significant CAGR during the forecast period. The video marketing segment within the market is gaining momentum due to the rising consumption of video content across various digital platforms. The application of SEO software is evolving to include features that optimize video content for search engines, such as video keyword research, metadata optimization, and video performance analytics. These tools help businesses ensure that their video content ranks well in search results, attracts more viewers, and engages audiences effectively.

Regional Insights

North America dominated the SEO software market with a largest revenue share of 35.95% in 2023. The North America market is characterized by rapid technological advancements and high adoption rates driven by the proliferation of digital marketing strategies among businesses. In addition, the growing dependence on data analytics for precision marketing, combined with the presence of major SEO software companies in the region, encourages innovation and competitive pricing strategies in the market.

U.S. SEO Software Market Trends

The SEO software market in the U.S. is anticipated to grow at a significant CAGR of 9.5% from 2024 to 2030. In the U.S., the market benefits from a mature digital landscape and high digital advertising spending. Similarly, the demand for localized and personalized content is also growing in the state, creating opportunities for SEO software that can deliver highly targeted results.

Asia Pacific SEO Software Market Trends

The SEO software market in Asia Pacific is expected to grow at a significant CAGR of 15.9% from 2024 to 2030. The market is experiencing growth in the Asia Pacific region owing to the rapid digital transformation and increasing internet penetration. In addition, the expanding e-commerce sector and the rise of mobile internet usage in the region also necessitate sophisticated SEO software to capture and retain a diverse online audience.

Europe SEO Software Market Trends

The SEO software market in Europe is anticipated to grow at a significant CAGR of 12.6% from 2024 to 2030. The European market is growing due to the increasing adoption of digital marketing across various industries and the rise of GDPR compliance requirements. Key drivers in the region include the need for advanced SEO tools that can handle multilingual content and diverse regional regulations. Thus, there is a significant demand for SEO solutions in the region that support localization and adhere to data protection standards.

Key SEO Software Company Insights

Some of the key players operating in the market include Ahrefs Pte. Ltd.; BrightEdge Technologies, Inc.; Conductor, and among others. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key SEO Software Companies:

The following are the leading companies in the SEO software market. These companies collectively hold the largest market share and dictate industry trends.

- Ahrefs Pte. Ltd.

- BrightEdge Technologies, Inc.

- Conductor

- HubSpot, Inc.

- Next Net Media

- Semrush

- Screaming Frog Ltd;

- SEOMoz, Inc.

- WebFX

- OuterBox

Recent Developments

-

In June 2024, OuterBox, a prominent performance marketing and web development company, announces the acquisition of TopSpot, a leading Houston-based digital marketing firm known for its expertise in SEO, paid media, and website design for the industrial manufacturing sector. This strategic acquisition significantly expands the company’s positioning by doubling its size and establishing it as one of the largest independent performance marketing agencies in the U.S.

-

In February 2023, Conductor, a leading enterprise SEO platform provider, announced its acquisition of Searchmetrics, a prominent SEO platform based in Europe. Through this acquisition, Conductor aims to leverage Searchmetrics' technical expertise and regional customer base to enhance its capabilities and expand its market presence across Europe

-

In October 2023, Next Net Media, a global digital marketing solutions provider supporting over 200,000 websites, announced its acquisition of LinkBuilder.io, a premier SEO and link-building firm. This strategic move aims to enhance Next Net Media’s portfolio, which includes Authority Builders, The HOTH, and SEOJet, solidifying the company’s position as a leader in the digital marketing industry

SEO Software Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 74.57 billion |

|

Revenue forecast in 2030 |

USD 154.60 billion |

|

Growth rate |

CAGR of 12.9% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Enterprise size, deployment, type, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa. |

|

Key companies profiled |

Ahrefs Pte. Ltd.; BrightEdge Technologies, Inc.; Conductor; HubSpot, Inc.; Next Net Media; Semrush; Screaming Frog Ltd; SEOMoz, Inc.; WebFX; and OuterBox |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global SEO Software Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global SEO software market report based on enterprise size, deployment, type, and region:

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Social Media Marketing

-

Email Marketing

-

SEO Marketing

-

Pay Per Click Marketing

-

Display Marketing

-

Video Marketing

-

Content Marketing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global SEO software market size was estimated at USD 68.34 billion in 2023 and is expected to reach USD 74.57 billion in 2024.

b. The global SEO software market is expected to grow at a compound annual growth rate of 12.9% from 2024 to 2030 to reach USD 154.60 billion by 2030.

b. The social media marketing segment accounted for the largest market share of over 28% in 2023. The rising importance of social media platforms in driving online engagement and brand visibility is among the primary factors driving the demand for SEO software in the segment.

b. Some key players operating in the SEO software market include Ahrefs Pte. Ltd.; BrightEdge Technologies, Inc.; Conductor; HubSpot, Inc.; Next Net Media; Semrush; Screaming Frog Ltd; SEOMoz, Inc.; WebFX; and OuterBox.

b. The growth of the SEO software market can be primarily attributed to several key factors, including increased internet penetration, the expansion of e-commerce, and heightened competition in the digital landscape. As businesses strive to enhance their online visibility, they are increasingly turning to SEO software to boost their website rankings on search engine results pages without incurring additional costs from search engine providers.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."