Sentinel Node Biopsy Market Size, Share & Trends Analysis Report By Product (Surgical Instruments, Imaging Agents, Diagnostic Kits), By Application (Breast Cancer), By Procedure, By End Use (Hospitals & Clinics, Others), By Region And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-479-6

- Number of Report Pages: 111

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Sentinel Node Biopsy Market Size & Trends

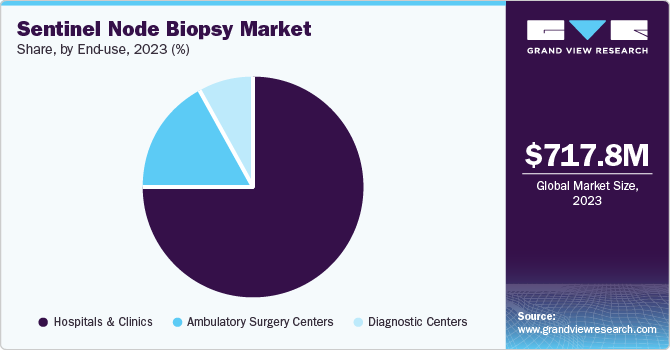

The global sentinel node biopsy market size was estimated at USD 717.8 million in 2023 and is projected to grow at a CAGR of 7.0% from 2024 to 2030. This growth is driven by technological advancements in instruments used for sentinel node biopsy and the rising prevalence of cancer. According to the World Health Organization (WHO), more than 35 million new cancer patients are projected in 2050, showcasing a 77% growth from the estimated 20 million cases in 2022.

The increasing prevalence of various types of cancers, such as breast cancer, melanoma, colon cancer, and gynecological cancer, is expected to drive market growth in the coming years. According to data published by the National Cancer Institute in August 2024, in the U.S., 623,405 individuals are living with metastatic breast, colorectal, lung, prostate, and bladder cancer. That number is projected to increase to 693, 452 by the year 2025. Sentinel node biopsy is useful for identifying whether cancer is spread or not. Thus, the growing prevalence of numerous cancers is expected to fuel the market growth in the coming years.

The increasing number of clinical trials for sentinel node biopsy is expected to drive market growth in the coming years. Industry stakeholders, including research institutions, academic institutions, and industry players, are conducting various clinical studies and trials to assess the devices used in sentinel node biopsy and the safety and effectiveness of the procedure in different cancers, such as breast cancer.

For instance, in August 2023, Clinicaltrials.gov published data reporting about the University of Wisconsin, Madison sponsored study focusing on topical pain management for breast cancer patients undergoing pre-operative radiotracer for sentinel lymph node mapping, using the Buzzy device. These ongoing clinical trials and studies using various medical devices for sentinel node biopsy are expected to fuel market growth in the forecast period.

Moreover, rising healthcare expenditures are expected to drive the market due to the increasing availability of healthcare facilities and easy access to advanced technologies and treatments. According to the Canadian Institute for Health Information, health expenditures in Canada are projected to grow by 2.8% in 2023 after a 1.5% increase in 2022. Increased funding allows for better surgical training and the development of advanced products that can lead to better patient outcomes in cancer management. Thus, rising healthcare spending is anticipated to support market growth over the forecast period

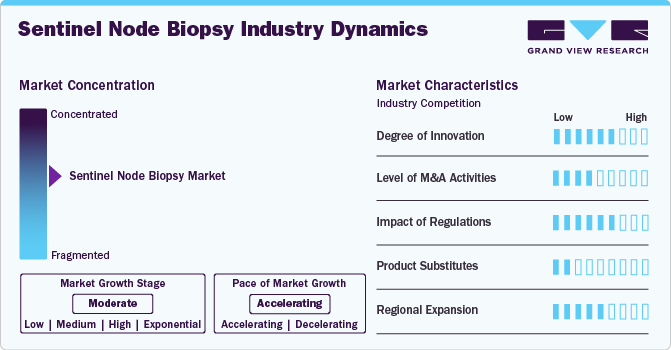

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of growth is accelerating. The market is growing due to an increase in cancer cases and a rise in studies focusing on sentinel node biopsy procedures.

Players in the industry and researchers are working on various initiatives to bring innovation to the sentinel node biopsy market. Companies are evaluating novel medical imaging technologies that can be used in sentinel node biopsy. For instance, KUBTEC Medical Imaging, a manufacturer of sentinel node biopsy products, launched the latest wireless sentinel lymph node localization technology at the 23rd annual meeting of the American Society of Breast Surgeons in April 2022. Such innovations are anticipated to drive the market growth in the coming years.

Regulatory agencies such as the European Union, the Food and Drug Administration (FDA), and Health Canada, among others, set quality and safety standards for medical equipment, including sentinel node biopsy products. Growing marketing approvals from regulatory authorities for new imaging agents or technologies that help in sentinel node biopsy are expected to propel market growth in the coming years.

Mergers and acquisitions in the market focus on improving product portfolios and expanding reach of products. Industry players acquire manufacturers of sentinel node biopsy products to improve patient care and leverage advancements in cancer treatment. Some of the companies undertaking this strategy include LabLogic Systems Ltd. and Hologic, Inc.

The market for sentinel node biopsy is fragmented among numerous small, medium, and large-sized companies that offer different sentinel node biopsy products. For instance, Stryker, a company operating in the industry, provides a SPY Portable Handheld Imager, which helps surgeons in locating and visualizing the sentinel lymph node during cancer surgical procedures.

Manufacturers and companies working in the industry focus on expanding their presence in numerous countries. Several industry participants, such as Stryker, Hologic, Inc., and Devicor Medical Products, Inc., can increase their vast distributions and wide regional presence to distribute and market their sentinel node biopsy products in various countries.

Product Insights

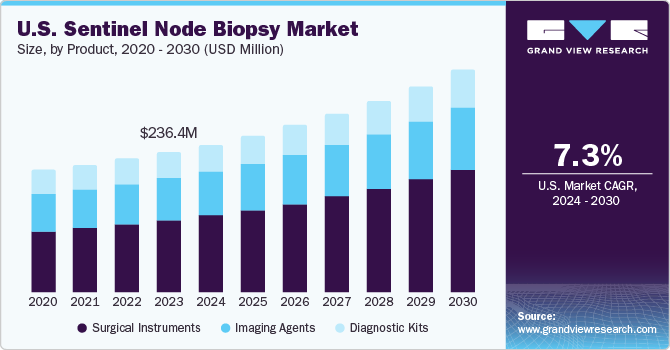

The surgical instruments segment dominated the market and accounted for a revenue share of 50.63% in 2023. It is also anticipated to grow fastest, with the highest CAGR in the coming years. Numerous surgical instruments, such as needles and probes, are used during sentinel node biopsy procedures. The advantages associated with these procedures, such as a smaller incision, lower risk of side effects such as tissue swelling and lymphedema, and reduced recovery time, are expected to support the segment's growth over the forecast period.

The imaging agents segment is anticipated to grow significantly over the forecast period. This growth can be attributed to advancements in imaging agents that enhance the accuracy and effectiveness of the procedure. Several studies are being published focusing on using radioactive tracers in the efficacy of sentinel node biopsy. For instance, the study published by the National Library of Medicine in June 2021 found that the single-agent approach utilizing a radioactive isotope is not inferior to other methods and is a feasible option for Sentinel lymph node biopsy (SLNB). Such studies demonstrating the favorable results for radioactive tracers are projected to support the segment growth over the forecast period.

Application Insights

The breast cancer segment dominated the market in 2023 and accounted for a revenue share of 61.51% in 2023. The growing prevalence of breast cancer is anticipated to support the market growth. According to estimates from the American Cancer Society, approximately 310,720 new cases of breast cancer is projected to be diagnosed in females in the U.S. in 2024. In addition, the same source indicates that around 42,250 females will succumb to breast cancer in the U.S. in 2024. Therefore, the rising incidence of breast cancer is expected to fuel the segment's growth in the coming years.

The other segment is expected to grow fastest, with the highest CAGR during the forecast period. Other segments include different cancers, such as melanoma and gynecological cancers. The sentinel node biopsy is widely used among melanoma patients. The growing prevalence of skin and gynecological cancers is expected to support the segment growth in the coming years. According to the data published by the American Academy of Dermatology Association in October 2023, over 1 million Americans are suffering from melanoma.

Procedure Insights

The open surgery segment dominated the market in 2023. Open surgery provides the surgeon with a clear and direct view of the surgical site, enabling better control during the procedure. The widespread use of sentinel node biopsy for treating various cancers is expected to further bolster the growth of the open surgery segment in the future.

On the other hand, the minimally invasive surgery segment is anticipated to grow fastest, with the highest CAGR of 8.35% over the forecast period. This growth is attributed to various advantages, including minimal scarring, reduced hospital stays, less trauma, and faster recovery times associated with minimally invasive surgery. These benefits are expected to lead to increased adoption of minimally invasive surgeries among patients and healthcare professionals in the coming years.

End Use Insights

In 2023, the hospitals & clinics segment dominated the market and accounted for the largest revenue share of 74.77%. This growth can be attributed to the presence of skilled healthcare professionals and advanced technological equipment in hospital settings. In addition, the increasing number of hospitals is expected further to drive the segment's growth in the coming years. In addition, hospitals are launching facilities for cancer care. For instance, in October 2022, Wockhardt Hospitals collaborated with Specialty Surgical Oncology to set up a Cancer Care Center in India.

The ambulatory surgery center segment is expected to grow fastest over the forecast period. The rising number of ambulatory surgery centers is expected to contribute significantly to this growth. Moreover, the advantages of these facilities over hospitals, such as reduced waiting times, faster patient discharge, lower overall procedural costs, and the capacity to treat more patients, are driving demand for this segment.

Regional Insights

North America held the largest revenue share of 44.62% in the market in 2023. It is also expected to grow fastest in the coming years due to the rising cancer incidence and advanced healthcare infrastructure. Moreover, the growing adoption of minimally invasive procedures is projected to propel the demand for sentinel node biopsy products in the coming years.

U.S. Sentinel Node Biopsy Market Trends

The sentinel node biopsy market in the U.S. is expected to dominate the North American market over the forecast period. The presence of players such as Hologic, Inc., Devicor Medical Products, Inc., KUBTEC, and Stryker, among others, is projected to support the country's market growth.

Europe Sentinel Node Biopsy Market Trends

The sentinel node biopsy market in Europe is anticipated to grow significantly in the coming years. This growth can be attributed to increasing awareness about cancer treatments and a growing focus by industry players on developing new products. In addition, the availability of domestic and international companies offering sentinel node biopsy is expected to boost market growth. For instance, SurgicEye GmbH, a Germany-based company, produces and manufactures sentinel node biopsy products such as the SentiGuide System, which allows for preoperative mapping of the sentinel lymph node to enable needle biopsy.

The sentinel node biopsy market in the UK is expected to grow significantly over the forecast period. The growing number of cancer patients is expected to drive the country’s market growth. The Macmillan Cancer Support estimates that there will be around 5.3 million cancer cases in the UK by 2040.

France's sentinel node biopsy market is expected to experience growth over the forecast period, driven by the rising awareness about cancer treatments and rising healthcare spending. For instance, according to the data published by the Institut Montaigne in January 2022, France spends over 11% of its Gross domestic product (GDP) on healthcare.

The sentinel node biopsy market in Germany is witnessing steady growth owing to a high incidence of breast cancer and melanoma, which increases the demand for precise staging techniques. The country's advanced healthcare infrastructure and strong focus on research and development foster innovation in imaging technologies and surgical instruments. In addition, the growing number of specialized cancer treatment centers also improves access to these procedures, further propelling regional market growth.

Asia Pacific Sentinel Node Biopsy Market Trends

The sentinel node biopsy market in the Asia Pacific region has been experiencing significant growth due to increasing awareness of cancer screening and treatment options among patients and healthcare professionals. In addition, the growth of specialized oncology centers is further enhancing the demand for accurate diagnostic methods, contributing to the overall market growth. Moreover, the organizations working in this region are working to provide guidelines for sentinel node biopsy. For instance, in December 2022, the Australasian College of Dermatologists (ACD) issued guidelines for sentinel node biopsy. Such initiatives of industry stakeholders are expected to propel regional growth in the coming years.

The sentinel node biopsy market in China is expected to grow throughout the forecast period. This growth can be attributed to a rising cancer incidence, improved healthcare infrastructure, and growing awareness of advanced treatment options for cancer.

The Japan sentinel node biopsy market is projected to grow during the forecast period due to several key factors, including a rising number of cancer patients and rapid technological advancements. For instance, the National Cancer Center of Japan estimated approximately 1,019,000 new cancer cases and 380,400 cancer-related deaths in 2022.

Middle East and Africa Sentinel Node Biopsy Market Trends

The market of the Middle East and Africa sentinel node biopsy is anticipated to witness substantial growth in the future due to the growing healthcare expenditure, increasing investment in healthcare, and rising prevalence of cancer.

The sentinel node biopsy market in Saudi Arabia is anticipated to grow over the forecast period. The growing focus of industry stakeholders on developing infrastructure for cancer treatment and the rising development of healthcare facilities is expected to drive the country's market growth. For instance, in September 2024, Oncoclínicas &Co extended its operations into the Kingdom of Saudi Arabia to improve cancer care in Saudi Arabia.

Kuwait's sentinel node biopsy market is expected to grow over the forecast period due to increasing cancer incidence and government initiatives to improve cancer diagnostics and treatment options in the coming years.

Breast Cancer Statistics

Sentinel node biopsy is helpful in breast cancer. It is used for axillary node staging in patients with early breast cancer. Thus, the growing prevalence of breast cancer and the rising number of patients who have breast cancer across the globe is anticipated to drive the demand for sentinel node biopsy in the coming years. The above graphs show that the highest incidence of breast cancer was in China in 2022. Moreover, a study published by the National Library of Medicine in September 2022 predicts that the burden of breast cancer will increase to over 3 million new cases and 1 million deaths annually by 2040 worldwide.

Key Sentinel Node Biopsy Company Insights

Hologic, Inc., Devicor Medical Products, Inc., KUBTEC, SurgicEye GmbH, Varay Laborix, LabLogic Systems Ltd (Care Wise), Gamma Medical Technology, and Stryker are some of the major players in the sentinel node biopsy market. Players are launching products and focusing on acquisitions and mergers to gain a competitive advantage in the coming years. In addition, the growing number of clinical trials in this field is expected to propel the competitive rivalry in the market.

Key Sentinel Node Biopsy Companies:

The following are the leading companies in the sentinel node biopsy market. These companies collectively hold the largest market share and dictate industry trends.

- Hologic, Inc.

- Devicor Medical Products, Inc.

- KUBTEC

- SurgicEye GmbH

- Varay Laborix

- LabLogic Systems Ltd (Care Wise)

- Gamma Medical Technology

- Stryker

Recent Developments

-

In April 2024, Hologic, Inc. signed a definitive agreement to acquire Endomagnetics Ltd, a manufacturer of breast cancer surgery technologies, for about USD 310 million. Endomagnetics Ltd is a UK-based firm that sells and develops breast surgery localization and lymphatic tracing technologies such as the Sentimag platform, Magseed marker, and Magtrace lymphatic tracing injectables.

-

In January 2024, Sahlgrenska University Hospital, a hospital based in Sweden, completed a clinical trial focusing on the use of ultra-low doses of superparamagnetic iron oxide nanoparticles during sentinel lymph node localization in patients with breast cancer. A total of 220 individuals participated in this trial from January 2023 to January 2024.

Sentinel Node Biopsy Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 755.9 million |

|

Revenue forecast in 2030 |

USD 1.1 billion |

|

Growth rate |

CAGR of 7.0% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis |

|

Segments covered |

Product, application, procedure, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country Scope |

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Hologic, Inc., Devicor Medical Products, Inc., KUBTEC, SurgicEye GmbH, Varay Laborix, LabLogic Systems Ltd (Care Wise), Gamma Medical Technology, Stryker |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Sentinel Node Biopsy Market Report Segmentation

This report forecasts revenue growth at global, regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sentinel node biopsy market report based on product, application, procedure, end use, and region:

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Surgical Instruments

-

Needles

-

Probes

-

Others

-

-

Imaging Agents

-

Radioactive Tracers

-

Fluorescent Dyes

-

Contrast Agents

-

-

Diagnostic Kits

-

Equipment

-

Reagents

-

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Breast Cancer

-

Colon Cancer

-

Esophageal Cancer

-

Others

-

-

Procedure Outlook (Revenue, USD Million; 2018 - 2030)

-

Open Surgery

-

Minimally Invasive Surgery

-

-

End Use Outlook (Revenue, USD Million; 2018 - 2030)

-

Hospitals & Clinics

-

Ambulatory Surgery Centers

-

Diagnostic Centers

-

-

Regional Outlook (Revenue, USD Million 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global sentinel node biopsy market size was estimated at USD 717.83 million in 2023 and is expected to reach USD 755.9 million in 2024.

b. The global sentinel node biopsy market is expected to grow at a compound annual growth rate of 7.0% from 2024 to 2030 to reach USD 1.1 billion by 2030.

b. The breast cancer segment held the largest revenue share of 61.51% in the market in 2023 due to the increasing prevalence of breast cancer worldwide.

b. Some key market players operating in the global sentinel node biopsy market include Hologic, Inc., Devicor Medical Products, Inc., KUBTEC, SurgicEye GmbH, Varay Laborix, LabLogic Systems Ltd (Care Wise), Gamma Medical Technology, and Stryker.

b. The growth of the sentinel node biopsy market can be attributed to the technological advancements in instruments used for sentinel node biopsy and the rising prevalence of cancer.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."