- Home

- »

- Advanced Interior Materials

- »

-

Semiconductor Pellicle Market Size And Share Report, 2030GVR Report cover

![Semiconductor Pellicle Market Size, Share & Trends Report]()

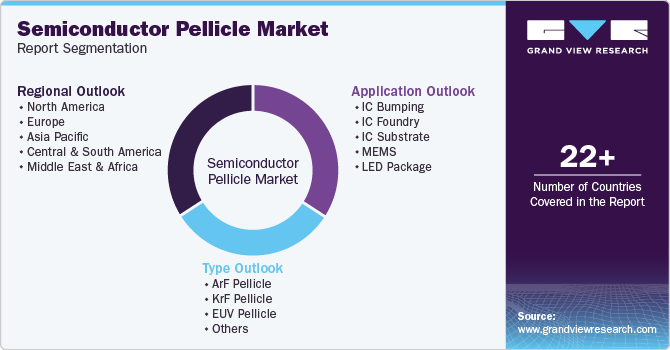

Semiconductor Pellicle Market Size, Share & Trends Analysis Report By Type (ArF Pellicle, KrF Pellicle, EUV Pellicle), By Application (IC Bumping, IC Foundry, IC Substrate, MEMS, LED Package), By Region, And By Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-471-8

- Number of Report Pages: 109

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Semiconductor Pellicle Market Size & Trends

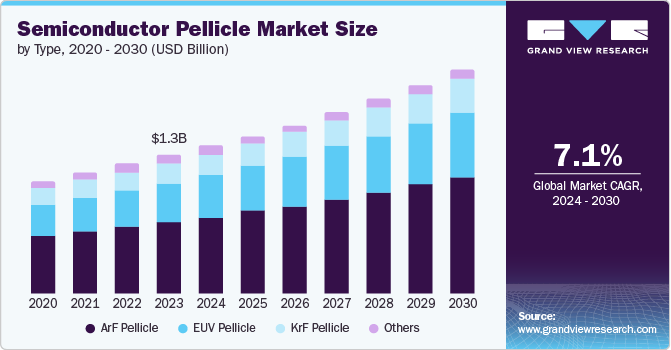

The global semiconductor pellicle market size was estimated at USD 1.33 billion in 2023 and is estimated to grow at a CAGR of 7.1% from 2024 to 2030. This growth is attributed to the rising advancements in semiconductor production technology, especially in extreme ultraviolet lithography (EUV). As the industry moves toward smaller and more intricate chip designs, the precision required during the photolithography process is likely to increase. With the shift to EUV lithography for producing smaller nodes such as 7nm, and 5nm rise, the use of pellicles is likely to become essential in maintaining mask integrity, reducing defects, and ensuring higher yields during chip production.

The rise in demand for advanced chips in industries such as artificial intelligence, 5G telecommunications, and electric vehicles is expected to accelerate the requirement for sophisticated semiconductor manufacturing processes, thereby fueling market growth.

The semiconductor pellicle market is extremely competitive in nature and characterized by the presence of several regional and international players. Prominent players are adopting various strategies to gain market share, such as investing in research and development to produce pellicles that can withstand the harsh conditions of extreme ultraviolet (EUV) lithography, which is essential for advanced chip manufacturing. Companies are also forming partnerships and collaborations with semiconductor manufacturers and equipment suppliers to align pellicle development with emerging lithography technologies. Some players are expanding production capacities and improving supply chain efficiency to meet the growing demand from leading semiconductor fabs.

Type Insights

ArF (Argon Fluoride) pellicle dominated the market with a revenue share of 51.9% in 2023 and is further expected to grow at a significant rate over the forecast period. ArF immersion lithography is widely used in the manufacturing of sub-10nm chips, which are critical for high-performance computing, artificial intelligence (AI), and 5G technologies. With the growing demand for smaller and more powerful chips, the requirement for ArF pellicles that can protect photomasks during the lithography process without impacting the resolution is also likely to increase, especially in high-volume production environments.

Demand for KrF pellicle is expected to grow at a significant rate over the period of 2024-2030. This is due to the growing production of legacy nodes and chips used in applications such as automotive electronics, industrial devices, and IoT. KrF lithography operates at a longer wavelength compared to ArF and is more cost-effective for producing larger feature sizes. The rising demand for semiconductors in these sectors is expected to increase the need for high-quality KrF pellicles to maintain mask integrity and ensure yield in production processes is driving their increased adoption in the semiconductor pellicle market.

Application Insights

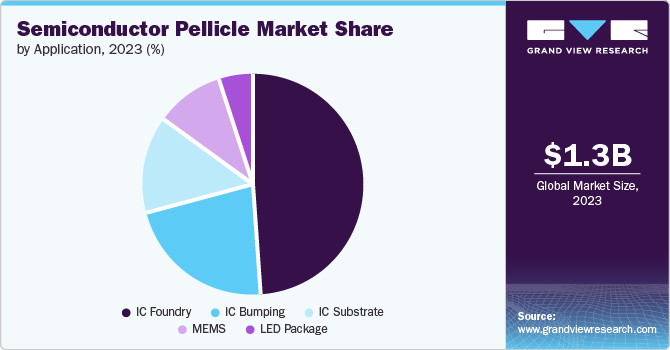

IC foundry accounted for the largest revenue share of 49.0% in 2023. The shift toward smaller process nodes and the widespread adoption of extreme ultraviolet lithography (EUV) are anticipated to fuel the demand for the product in IC foundry applications. Foundries manufacture increasingly advanced integrated circuits (ICs) for a variety of industries, including automotive, AI, and telecommunications, ensuring the highest yield and reducing defects becomes critical. Pellicles play an essential role in protecting the photomasks used in the lithography process from contamination, which can lead to costly defects and lower yields. These factors are expected to boost the demand for the product in IC foundry applications.

IC bumping applications are anticipated to grow at a significant rate over the forecast period. In IC bumping applications, where tiny solder bumps are used to connect chips to substrates or other components, the demand for semiconductor pellicles is also likely to grow. Bumping processes require extreme precision to ensure proper alignment and functionality, even minor defects or contamination in the photomask can lead to significant issues in the final product. Pellicles help prevent such contamination, ensuring that the photomask remains clean during the lithography process. As the demand for high-performance ICs increases, particularly in sectors like 5G and advanced computing, the requirement for pellicles in IC bumping applications becomes more pronounced to maintain quality and efficiency in the manufacturing process.

Regional Insights

North America semiconductor pellicle market accounted for a revenue share of 23.5% in 2023. The region's growing investments in semiconductor manufacturing and innovation, especially in the United States are likely to boost the product demand. Moreover, government initiatives, such as the CHIPS Act, are aimed at bolstering domestic semiconductor production to reduce reliance on foreign supply chains, thereby fueling market growth.

U.S. Semiconductor Pellicle Market Trends

The semiconductor pellicle market in the U.S. is expected to grow at a CAGR of 7.5% over the forecast period. The country’s increasing efforts to strengthen its semiconductor manufacturing capabilities are anticipated to fuel the product demand. With a focus on reducing dependency on foreign semiconductor supplies, major chip manufacturers are highly investing in new fabs and advanced technologies like EUV lithography. This growth, coupled with government backing through funding and incentives, is driving up the need for high-performance pellicles to ensure the reliability and efficiency of the semiconductor production process.

Europe Semiconductor Pellicle Market Trends

The semiconductor pellicle market in Europe is expected to grow at a CAGR of 6.6% from 2024-2030. The European Union has been promoting initiatives to increase local semiconductor production, focusing on industries like automotive, aerospace, and healthcare, which require advanced chips. With companies like ASML, a leader in EUV lithography equipment, headquartered in Europe, there is a strong drive to support the local semiconductor supply chain, including pellicle development, further boosting the market growth.

Asia Pacific Semiconductor Pellicle Market Trends

The semiconductor pellicle market in Asia Pacific is expected to grow at the highest CAGR over the forecast period. The Asia Pacific region, particularly countries like Taiwan, South Korea, and Japan, is seeing an increase in demand for semiconductor pellicles owing to the presence of leading chipmakers such as TSMC, Samsung, and SK Hynix. These companies are at the forefront of cutting-edge semiconductor technology and heavily rely on EUV lithography for advanced chip production. As they continue to scale up production to meet global demand, especially for consumer electronics and 5G, the demand for high-quality pellicles is further predicted to increase over the coming years.

Key Semiconductor Pellicle Company Insights

Some of the key players operating in the market include Nichia Corporation and Shin-Etsu Chemical Co., Ltd.

-

Mitsui Chemicals, Inc. is a leading Japanese manufacturer and supplier of chemicals and advanced materials. The company produces a wide range of products, including high-performance polymers, elastomers, and specialty chemicals used in industries such as automotive, healthcare, electronics, and packaging. Mitsui Chemicals is also a significant player in the semiconductor market, providing critical materials like pellicles for semiconductor lithography, particularly for EUV (extreme ultraviolet) and DUV (deep ultraviolet) lithography processes.

-

Shin-Etsu Chemical Co., Ltd. is a leading global manufacturer and supplier of chemical products, specializing in silicone, semiconductor materials, PVC, and rare earth magnets. The company provides a wide range of products, including semiconductor-grade silicon wafers, pellicles for lithography, and various chemical solutions for industries like electronics, construction, automotive, healthcare, and energy.

Toppan Photomasks Inc. and Micro Lithography Inc. are some of the emerging participants in the market.

-

Toppan Photomasks, Inc. is a leading global manufacturer and supplier of photomasks, which are crucial components used in the photolithography process of semiconductor manufacturing. The company provides a wide range of photomask products, including advanced masks for deep ultraviolet (DUV) and extreme ultraviolet (EUV) lithography, as well as pellicles for photomask protection. Serving the semiconductor, microelectronics, and integrated circuit (IC) industries, Toppan Photomasks plays a critical role in enabling the production of advanced chips for applications such as consumer electronics, telecommunications, and automotive technologies.

-

Micro Lithography Inc. is a manufacturer and supplier specializing in advanced lithography equipment and solutions for the semiconductor industry. The company provides products such as pellicles, photomasks, and related lithography materials, which are essential for the photolithographic processes used in semiconductor fabrication. Micro Lithography Inc. serves a range of markets, including semiconductor manufacturing, microelectronics, and advanced nanotechnology industries, helping these sectors improve yield, precision, and efficiency in chip production.

Key Semiconductor Pellicle Companies:

The following are the leading companies in the semiconductor pellicle market. These companies collectively hold the largest market share and dictate industry trends.

- Mitsui Chemicals

- ASML

- Shin-Etsu Chemical Co., Ltd.

- Canatu

- Teledyne DALSA

- Micro Lithography Inc.

- SEMI

- AGC Inc.

- NEPCO

- Toppan Photomasks

Recent Developments

-

In December 2023, Mitsui Chemicals partnered with IMEC to accelerate the development of pellicles for extreme ultraviolet (EUV) lithography. This collaboration is likely to enhance Mitsui's position in the semiconductor market, supporting its growth in advanced lithography solutions and strengthening its role as a key supplier of next-generation semiconductor technologies.

Semiconductor Pellicle Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.42 billion

Revenue forecast in 2030

USD 2.15 billion

Growth rate

CAGR of 7.1% from 2023 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina

Key companies profiled

Mitsui Chemicals; ASML; Shin-Etsu Chemical Co., Ltd.; Canatu; Teledyne DALSA; Micro Lithography Inc.; SEMI; AGC Inc.; NEPCO; Toppan Photomasks

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Semiconductor Pellicle Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global semiconductor pellicle market report on the basis of type, application, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

IC Bumping

-

IC Foundry

-

IC Substrate

-

MEMS

-

LED Package

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

ArF Pellicle

-

KrF Pellicle

-

EUV Pellicle

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global semiconductor pellicle market size was estimated at USD 1.33 billion in 2023 and is expected to reach USD 1.42 billion in 2024.

b. The global semiconductor pellicle market is expected to grow at a compound annual growth rate (CAGR) of 7.1% from 2024 to 2030 to reach USD 2.15 billion by 2030.

b. IC foundry segment accounted for the largest revenue share of over 49.0% in 2023. The shift toward smaller process nodes and the widespread adoption of extreme ultraviolet (EUV) lithography is anticipated to fuel the demand for the product in IC foundry application.

b. Some key players operating in the semiconductor pellicle market include Mitsui Chemicals, ASML, Shin-Etsu Chemical Co., Ltd., Canatu, Teledyne DALSA, Micro Lithography Inc., SEMI, AGC Inc., NEPCO, Toppan Photomasks.

b. The key factors that are driving the market growth are the rapid growth of the rising advancements in semiconductor production technology, especially in extreme ultraviolet (EUV) lithography.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."