- Home

- »

- Semiconductors

- »

-

Semiconductor Laser Market Size And Share Report, 2030GVR Report cover

![Semiconductor Laser Market Size, Share & Trends Report]()

Semiconductor Laser Market (2024 - 2030) Size, Share & Trends Analysis Report By Type, By Application (Medical & Aesthetic, Instruments & Sensors, Aerospace, Defense, Military), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-030-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Semiconductor Laser Market Summary

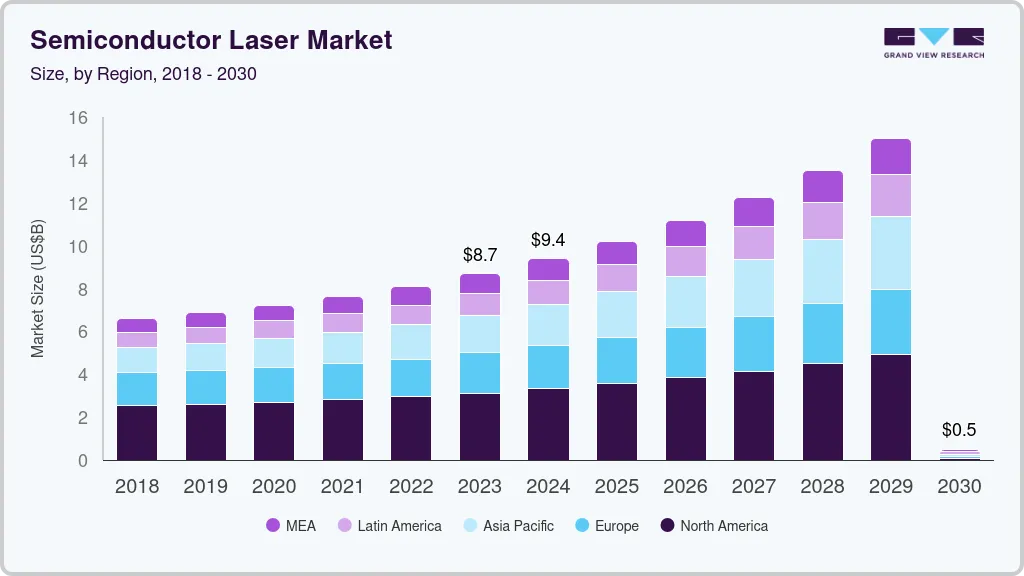

The global semiconductor laser market was estimated at USD 8.08 billion in 2023 and is projected to reach USD 14.98 billion by 2030, growing at a CAGR of 9.5% from 2024 to 2030. With the advent of the 5G network and the expansion of fiber optic communication systems, there is a growing need for advanced optical components that can handle vast amounts of data at incredibly high speeds.

Key Market Trends & Insights

- North America semiconductor laser market accounted for the largest market revenue share of 36.4% in 2023.

- The U.S. semiconductor laser market accounted for the largest market revenue share in North America in 2023.

- Based on type, the fiber optic laser segment dominated the market and accounted for a market revenue share of 27.2% in 2023.

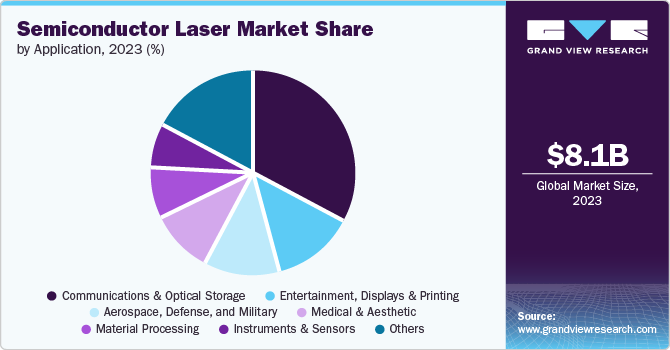

- Based on application, the communications & optical storage segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 8.08 Billion

- 2030 Projected Market Size: USD 14.98 Billion

- CAGR (2024-2030): 9.5%

- North America: Largest Market in 2023

- Asia Pacific: Fastest growing market

Semiconductor lasers, also known as laser diodes, are integral to these systems because they provide efficient, high-bandwidth data transmission. As global data consumption rises and the need for faster, more reliable communication networks escalates, the demand for semiconductor lasers is expected to grow correspondingly. Semiconductor lasers are used in various consumer devices, including Blu-ray players, laser printers, and optical disk drives. The increasing adoption of these technologies, driven by consumer preferences for high-definition media and advanced features in electronic devices, creates a continuous demand for semiconductor lasers. Moreover, as new consumer electronics technologies emerge, such as augmented reality (AR) and virtual reality (VR), which require high-resolution displays and sophisticated optical components, the need for semiconductor lasers in these applications is set to increase.

Advanced driver-assistance systems (ADAS) and autonomous vehicles rely on various optical technologies, including Light Detection and Ranging (LIDAR) systems, which use semiconductor lasers for precise distance measurement and object detection. As the automotive sector moves towards greater automation and safety enhancements, the demand for semiconductor lasers in LIDAR systems and other optical sensors is expected to rise. This growth is bolstered by increased investment in automotive technology and the push for vehicle safety and navigation systems innovation.

Type Insights

The fiber optic laser segment dominated the market and accounted for a market revenue share of 27.2% in 2023. Due to their high beam quality, precision, and efficiency, fiber optic lasers are increasingly used for applications such as laser cutting, welding, marking, and engraving. These lasers offer advantages over conventional laser systems, including higher power output, greater operational stability, and lower maintenance requirements. As industries seek to enhance productivity, reduce costs, and improve the quality of their manufacturing processes, the demand for fiber optic lasers in industrial applications is expected to increase, fueling growth in this segment.

The infrared laser segment is anticipated to grow significantly at a CAGR of 10.3% during the forecast period. Infrared lasers are crucial in optical fiber communication systems, facilitating high-speed data transmission over long distances. As the demand for bandwidth increases with the expansion of high-speed internet services, cloud computing, and data centers, the need for efficient, high-performance infrared lasers is escalating. These lasers enable the transfer of vast amounts of data at rapid speeds, supporting the backbone of modern communication infrastructure and driving market growth.

Application Insights

The communications & optical storage segment accounted for the largest market revenue share in 2023. As global data consumption continues to surge due to the proliferation of internet services, streaming media, and cloud computing, there is an increasing need for advanced optical communication technologies. Semiconductor lasers, particularly those used in fiber optic communication systems, are central to meeting these demands. They enable high-speed data transmission over long distances with minimal signal degradation, making them indispensable for expanding telecommunication networks and the backbone of modern internet infrastructure.

The medical & aesthetic segment is anticipated to register fastest CAGR over the forecast period. Minimally invasive techniques, such as laser eye surgery, laser hair removal, and non-surgical skin rejuvenation, offer patients shorter recovery times, less discomfort, and reduced risk of complications compared to traditional surgical methods. Semiconductor lasers are integral to these procedures due to their precision and ability to target specific tissues with minimal damage to surrounding areas. As more patients and healthcare providers recognize the benefits of these minimally invasive options, the demand for advanced laser technologies is expected to grow.

Regional Insights

North America semiconductor laser market accounted for the largest market revenue share of 36.4% in 2023. The region's robust semiconductor industry, substantial investments in research and development, and a strong presence of key market players contribute to North America's dominance in the semiconductor laser market. The technological innovation and high adoption of laser-based technologies in North America, particularly in applications such as high-speed internet, data storage solutions, and medical & aesthetic procedures, drive its leadership in the semiconductor laser market.

U.S. Semiconductor Laser Market Trends

The U.S. semiconductor laser market accounted for the largest market revenue share in North America in 2023. The deployment of 5G technology and the early-stage research into 6G networks proliferates the country's market. The U.S. government and major telecom companies are investing in 5G infrastructure to enhance network speed, reduce latency, and support many new applications, including smart cities, autonomous vehicles, and high-definition video streaming. Semiconductor lasers are essential components in the optical transceivers used for high-speed data transmission in 5G networks. These lasers enable efficient data transfer across fiber optic cables and facilitate the construction of high capacity backhaul networks.

Europe Semiconductor Laser Market Trends

Europe semiconductor laser market was identified as a lucrative region in 2023. The region's proliferation of high-definition displays, smartphones, and wearables necessitates using semiconductor lasers for various applications, including displays and optical communication. Innovations in display technologies, such as OLED screens and microLEDs, rely on semiconductor lasers for improved brightness, efficiency, and color accuracy.

The UK semiconductor laser market is expected to grow rapidly in the coming years. The UK government’s focus on modernizing its defense capabilities and investing in advanced aerospace technologies creates substantial demand for high-performance semiconductor lasers. Initiatives such as the National Shipbuilding Strategy and the Combat Air Strategy are leading to increased procurement of advanced technologies for military and defense purposes. Additionally, the UK’s involvement in international defense collaborations and aerospace projects further fuels the demand for cutting-edge semiconductor laser solutions.

Asia Pacific Semiconductor Laser Market Trends

The Asia Pacific semiconductor laser market is anticipated to register the fastest CAGR during the forecast period. The shift towards electric vehicles (EVs) and advancements in autonomous driving technologies contribute to the growth of the region's market. Semiconductor lasers are integral to several automotive technologies, including LiDAR systems, essential for autonomous vehicle navigation and safety. LiDAR systems utilize semiconductor lasers to measure distances and create detailed environmental maps, enabling features such as adaptive cruise control and collision avoidance.

China semiconductor laser market held a substantial market share in 2023. Programs such as the “Made in China 2025” plan aim to enhance the country’s advanced manufacturing and technology capabilities, including the semiconductor industry. This policy framework provides funding for research and development, offers tax incentives for technology companies, and supports the establishment of innovation hubs and high-tech parks. Additionally, China’s focus on becoming self-reliant in semiconductor production and reducing dependency on foreign technology sources is creating a favorable environment for the growth of the semiconductor laser market.

Key Semiconductor Laser Company Insights

Some of the key companies in the semiconductor laser market include Coherent Corp., Sharp Corporation, Nichia Corporation, TT Electronics, and others. Market vendors are focusing on increasing their clientele to secure a competitive edge in the market. Therefore, key companies are undertaking different strategic measures, such as mergers, acquisitions, and partnerships with other prominent companies.

-

Coherent Corp. offers a diverse semiconductor laser portfolio that caters to various industries, such as microelectronics, materials processing, scientific research, and medical diagnostics. These semiconductor lasers are utilized in material processing, optical pumping, medical procedures, telecommunications, and more.

-

IPG Photonics Corporation offers a diverse range of semiconductor laser solutions that cater to the stringent requirements of the semiconductor industry. The company manufactures cost-effective nanosecond pulsed fiber lasers, ultrafast pulsed fiber lasers, continuous wave fiber lasers, and fully automated laser processing workstations covering wavelengths ranging from IR to UV.

Key Semiconductor Laser Companies:

The following are the leading companies in the semiconductor laser market. These companies collectively hold the largest market share and dictate industry trends.

- Coherent Corp.

- Sharp Corporation

- Nichia Corporation

- IPG Photonics Corporation

- TTElectronics

- Sumitomo Electric Industries Ltd.

- Sheaumann Laser Inc.

- Newport Corporation

- Panasonic Industry Co. Ltd.

- ROHM CO., LTD.

Recent Developments

-

In June 2024, Sheaumann Laser, Inc. launched laser diodes mounted on a cutting-edge dual lead, CMD Submount, aimed at significantly improving the dependability of customers' laser systems by ensuring electrical isolation between the laser diode and the sub-mount.

-

In November 2023, ROHM CO., LTD. launched a new high-power 120W laser diode designed specifically for LiDAR applications. This innovative laser diode enhances LiDAR systems by increasing the measurement range and significantly reducing wavelength temperature dependence.

Semiconductor Laser Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.68 billion

Revenue forecast in 2030

USD 14.98 billion

Growth rate

CAGR of 9.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; South Arabia; UAE; South Africa

Key companies profiled

Coherent Corp.; Sharp Corporation; Nichia Corporation; IPG Photonics Corporation ; TT Electronics; Sumitomo Electric Industries Ltd.; Sheaumann Laser Inc.; Newport Corporation; Panasonic Industry Co. Ltd. (Panasonic); ROHM CO., LTD.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Semiconductor Laser Market Report Segmentation

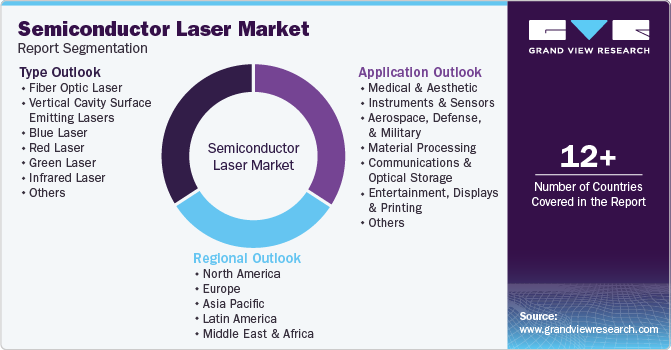

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the semiconductor laser market report based on type, application, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fiber Optic Laser

-

Vertical Cavity Surface Emitting Lasers

-

Blue Laser

-

Red Laser

-

Green Laser

-

Infrared Laser

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Medical & Aesthetic

-

Instruments & Sensors

-

Aerospace, Defense, and Military

-

Material Processing

-

Communications & Optical Storage

-

Entertainment, Displays & Printing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.