- Home

- »

- Semiconductors

- »

-

Semiconductor Fabless Market Size & Share Report, 2030GVR Report cover

![Semiconductor Fabless Market Size, Share & Trends Report]()

Semiconductor Fabless Market (2024 - 2030) Size, Share & Trends Analysis Report By Type, By End-use (Application Specific Integrated Circuits (ASIC), Graphic Processing Units (GPUs)), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-462-9

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Semiconductor Fabless Market Summary

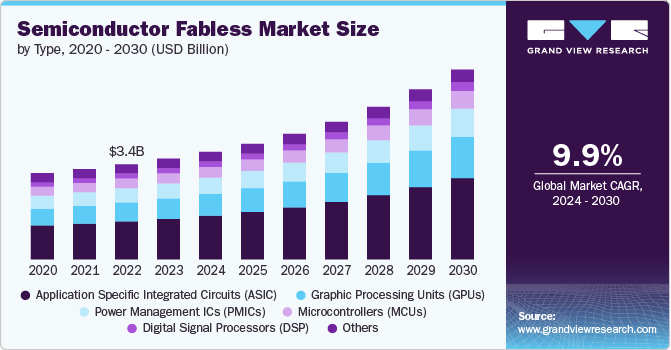

The global semiconductor fabless market size was estimated at USD 3.56 billion in 2023 and is projected to reach USD 6.71 billion by 2030, growing at a CAGR of 9.9% from 2024 to 2030. The market's growth can be attributed to the increasing demand for advanced semiconductor devices, particularly in sectors such as consumer electronics, healthcare, and automotive electronics.

Key Market Trends & Insights

- The Asia Pacific semiconductor fabless market accounted for a 56.05% share of the global market in 2023.

- The U.S. semiconductor fabless market is expected to grow at a significant CAGR over the forecast period.

- Based on type, the application specific integrated circuits (ASIC) segment dominated the market in 2023.

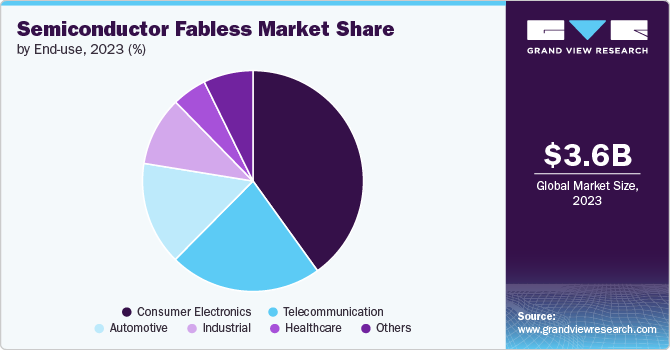

- Based on end-use, the consumer electronics segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3.56 Billion

- 2030 Projected Market Size: USD 6.71 Billion

- CAGR (2024-2030): 9.9%

- Asia Pacific: Largest market in 2023

Technological advancements in semiconductor fabrication processes also play a pivotal role in the market's growth. In addition, the rise of digital transformation across various industries is accelerating the demand for semiconductor components, thereby driving the market’s growth.The rapid advancement of artificial intelligence (AI) and machine learning (ML) technologies is driving the growth of the market. As AI and ML applications become increasingly prevalent across industries such as automotive, healthcare, and consumer electronics, the demand for specialized semiconductor solutions that can handle complex computations and large data sets is growing. Semiconductor fabless companies focus on designing innovative chips without the need for manufacturing facilities. They are focusing on this trend by developing advanced processors and accelerators tailored for AI and ML workloads. This focus on high-performance and energy-efficient chips supports the growing ecosystem of AI-driven applications and helps market companies gain a competitive edge in the market.

The expansion of 5G networks is another significant growth factor for the semiconductor fabless market. As 5G technology continues to roll out globally, there is an increasing demand for semiconductor components that can support high-speed data transmission, low latency, and enhanced connectivity. Several semiconductor companies are designing advanced radio frequency (RF) components, high-bandwidth transceivers, and network processors that are critical for the successful deployment of 5G infrastructure. Thus, increasing demand for specialized components to support the growth of 5G networks across the globe is further driving the growth of the market.

The proliferation of Internet of Things (IoT) devices is expected to drive the demand for semiconductor components. IoT applications span across smart home devices, industrial automation, and wearable technology, all of which require a diverse range of semiconductor components. Increasing demand for highly integrated and efficient chips for various IoT applications is boosting the market’s growth. Some of these include low-power microcontrollers, sensors, and communication modules that enable seamless connectivity and data exchange. As the IoT ecosystem continues to expand, the demand for semiconductor fabless components is expected to increase from 2024 to 2030.

The increasing complexity and cost of semiconductor design is one of the major factors that could hamper the growth of the market. In addition, market companies depend heavily on third-party foundries for manufacturing, which can lead to supply chain vulnerabilities and potential disruptions if foundry capacity is constrained or if there are geopolitical issues affecting global trade. Furthermore, the rapid pace of technological advancement necessitates continuous innovation, posing a risk for companies that struggle to keep up with the latest trends and standards. These factors create a challenging environment for semiconductor fabless companies, potentially slowing their growth and affecting their ability to capitalize on emerging opportunities.

Type Insights

The application specific integrated circuits (ASIC) segment dominated the market in 2023 and accounted for 40.35% share of global revenue. The segment is experiencing robust growth due to the increasing demand for tailored solutions across various industries. ASICs are designed for specific applications, which allows them to deliver optimized performance, efficiency, and functionality. The surge in technologies such as AI, ML, and 5G communications is fueling the need for ASICs that can handle complex tasks with minimal power consumption. In addition, industries such as automotive, consumer electronics, and telecommunications are investing heavily in ASIC development to enhance their product offerings and meet the demands of digital transformation, thereby driving segment growth.

The Graphic Processing Units (GPUs) segment is projected to witness significant growth from 2024 to 2030. The growing demand for high-performance computing and graphics rendering drives the segment’s growth. GPUs have evolved beyond their traditional role in gaming to become essential components in various applications, including artificial intelligence, data centers, and cryptocurrency mining. As workloads become increasingly data-intensive, the need for powerful GPUs that can efficiently process large volumes of information is surging. The rise of gaming, virtual reality, and augmented reality technologies further increases this demand, as consumers demand immersive experiences that require advanced graphical capabilities.

End Use Insights

The consumer electronics segment dominated the market in 2023. An increasing demand for advanced, feature-rich electronic devices is a major driver behind the segment’s growth. As technology evolves, consumer electronics such as smartphones, tablets, smart watches, and smart home devices require more sophisticated and efficient semiconductor solutions. In addition, the growing trend toward IoT devices and wearable technology further drives the need for specialized semiconductor solutions. Thus, several semiconductor companies are developing cutting-edge components for consumer electronics to meet the demands of tech-savvy consumers, thereby improving the segment’s growth.

The automotive segment is projected to witness significant growth from 2024 to 2030. The automotive industry is undergoing a transformation with the rise of advanced driver-assistance systems (ADAS), electric vehicles (EVs), and autonomous driving technologies. This shift is fueling demand for sophisticated semiconductor solutions that support these innovations. Semiconductor companies are developing a range of automotive-grade chips, including those for in-vehicle networks, sensor fusion, and advanced computing systems. Thus, the demand for high-reliability and high-performance components in the automotive sector is increasing owing to the evolving needs of modern vehicles, thereby driving the segment’s growth.

Regional Insights

The semiconductor fabless market in North America is expected to witness notable growth from 2024 to 2030. Factors such as strong technological infrastructure, high levels of R&D investment, and the presence of major tech companies can contribute to the growth of the market.

U.S. Semiconductor Fabless Market Trends

The U.S. semiconductor fabless market is expected to grow at a significant CAGR from 2024 to 2030. The U.S. is home to numerous leading fabless companies that drive advancements in various technology sectors, including consumer electronics, automotive, and data centers. The country's substantial investment in R&D and a skilled workforce contribute to its growth in semiconductor design. In addition, the increasing focus on emerging technologies such as 5G and AI, along with efforts to strengthen domestic semiconductor manufacturing capabilities, further propels the growth of the market.

Asia Pacific Semiconductor Fabless Market Trends

The Asia Pacific semiconductor fabless market dominated the market in 2023 and accounted for a 56.05% share of the global revenue. The growth of the market is driven by the region's strong focus on electronics manufacturing and technological innovation. Countries such as China, South Korea, Japan, and India are significant contributors, with a high concentration of both fabless companies and end-use industries. The region's growing consumer electronics industry, expanding IoT applications, and advancements in 5G technology are further driving the demand for innovative semiconductor components in the market.

Europe Semiconductor Fabless Market Trends

The semiconductor fabless market in Europe is expected to grow at a moderate CAGR from 2024 to 2030. The region's focus on advancing technologies such as autonomous vehicles, Industry 4.0, and smart infrastructure drives demand for specialized semiconductor solutions. Furthermore, Europe's strategic initiatives to enhance semiconductor supply chain resilience and promote technological sovereignty further contribute to market growth.

Key Semiconductor Fabless Company Insights

Key players are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In August 2024, VanEck, a global investment management firm, announced the launch of VanEck Fabless Semiconductor ETF (SMHX), the latest addition to its range of thematic equity ETFs. SMHX focuses on fabless semiconductor companies that prioritize design and R&D over manufacturing.

-

In May 2024, Mindgrove Technologies, a fabless semiconductor startup backed by Peak XV Partners, introduced India’s first commercial high-performance system on chip (SoC), named Secure IoT. This RISC-V-based chip enables Indian OEMs to integrate a locally developed SoC into their products, helping to lower the cost of their feature-rich devices without sacrificing advanced capabilities. The Secure IoT chip is expected to be 30 percent more affordable than comparable chips in its segment.

Key Semiconductor Fabless Companies:

The following are the leading companies in the semiconductor fabless market. These companies collectively hold the largest market share and dictate industry trends.

- Broadcom Inc.

- Qualcomm Inc.

- Nvidia Corporation

- Advanced Micro Devices Inc. (AMD)

- MediaTek Inc.

- Novatek Microelectronics Corp.

- UNISOC (Shanghai)Technologies Co., Ltd.

- XMOS

- LSI Corporation

- SMIC

Semiconductor Fabless Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.80 billion

Revenue forecast in 2030

USD 6.71 billion

Growth rate

CAGR of 9.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Broadcom Inc.; Qualcomm Inc.; Nvidia Corporation; Advanced Micro Devices Inc. (AMD); MediaTek Inc.; Novatek Microelectronics Corp.; UNISOC (Shanghai)Technologies Co., Ltd.; XMOS; LSI Corporation; SMIC

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Semiconductor Fabless Market Report Segmentation

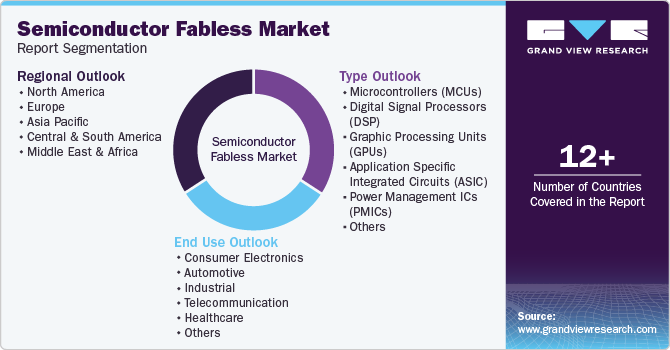

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global semiconductor fabless market report based on type, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Microcontrollers (MCUs)

-

Digital Signal Processors (DSP)

-

Graphic Processing Units (GPUs)

-

Application Specific Integrated Circuits (ASIC)

-

Power Management ICs (PMICs)

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumer Electronics

-

Automotive

-

Industrial

-

Telecommunication

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global semiconductor fabless market size was estimated at USD 3.56 billion in 2023 and is expected to reach USD 3.80 billion in 2024.

b. The global semiconductor fabless market is expected to grow at a compound annual growth rate of 9.9% from 2024 to 2030 to reach USD 6.71 billion by 2030.

b. Asia Pacific dominated the semiconductor fabless market with a share of 56.05% in 2023. The growth of the market is driven by the region's strong focus on electronics manufacturing and technological innovation.

b. Some key players operating in the semiconductor fabless market include Broadcom Inc., Qualcomm Inc., Nvidia Corporation, Advanced Micro Devices Inc. (AMD), MediaTek Inc., Novatek Microelectronics Corp., UNISOC(Shanghai)Technologies Co., Ltd., XMOS, LSI Corporation, and SMIC.

b. Key factors that are driving the market growth include the increasing demand for advanced semiconductor devices and the expansion of 5G networks.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.