- Home

- »

- Medical Devices

- »

-

Semi-solid Dosage Contract Manufacturing Market Report, 2030GVR Report cover

![Semi-solid Dosage Contract Manufacturing Market Size, Share & Trends Report]()

Semi-solid Dosage Contract Manufacturing Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Topical, Transdermal, Oral), By Product (Creams, Gels), By End Use , By Company Size, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-345-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Semi Solid Dosage Contract Manufacturing Market Summary

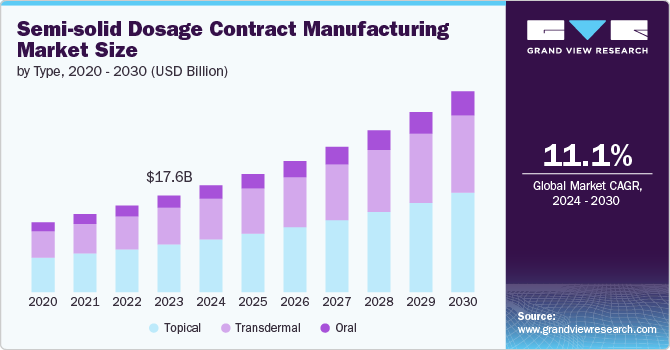

The global semi solid dosage contract manufacturing market size was estimated at USD 19,432.9 million in 2024 and is projected to reach USD 36,584.9 million by 2030, growing at a CAGR of 11.2% from 2025 to 2030. The rising demand for patient-friendly medications is aiding market growth.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, topical accounted for a revenue of USD 10,645.9 million in 2024.

- Transdermal is the most lucrative type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 19,432.9 Million

- 2030 Projected Market Size: USD 36,584.9 Million

- CAGR (2025-2030): 11.2%

- Asia Pacific: Largest market in 2024

Moreover, there is a growing demand for manufacturing outsourcing due to its cost-effectiveness. Furthermore, regulatory compliance and quality assurance, technological advancements including innovation in formulation technologies, are likely to boost their demand over the forecast period.

The high prevalence of chronic conditions such as skin diseases, arthritis and the requirement for pain management solutions due to the ageing population around the world is a major factor for the market growth. With an estimated 1.8 billion people affected by over 3,000 types of skin conditions at any given time, according to the World Health Organization, there's a massive demand for effective treatments. The U.S. population is experiencing a significant shift towards aging. According to the January 2024 fact sheet by the Population Reference Bureau, the number of Americans aged 65 and older is expected to surge from 58 million in 2022 to 82 million by 2050, representing a substantial 47% increase. Additionally, the proportion of the total population comprised of individuals aged 65 and older is projected to rise from 17% to 23%, marking the oldest age distribution in U.S. history.

In addition, according to the Global Burden of Disease Study 2021, skin diseases rank as the eighth leading cause of global health burden. Semi-solid dosage forms, such as creams and ointments, are a preferred method of administration for many skin diseases, offering a convenient and mess-free application. This surge in demand for skin condition and pain management treatments is propelling the growth of the market, as pharmaceutical companies seek out partners with the expertise to produce these medications efficiently and in large quantities. Further, according to the CDC report covering the period from 2019 to 2021, arthritis was most prevalent in 17.9% of men and 24.2% of women in the U.S. (NHIS).

Additionally, contract manufacturing enables pharmaceutical companies to access manufacturing capabilities, adhere to regulatory standards, and support to minimize costs associated with in-house production facilities. Strategic collaborations between pharmaceutical companies and contract manufacturers are instrumental in the efficient production of semi solid dosage forms, facilitating faster market entry for drugs further optimization of existing formulations. Setting up and maintaining in-house production lines for semi-solid medications requires substantial investments. This includes specialized equipment for mixing, filling, and packaging these dosage forms, as well as the expertise to operate them efficiently. By partnering with a contract manufacturer (CMO), pharmaceutical companies can bypass these upfront costs and ongoing maintenance expenses. CMOs specialize in semi-solid production and have economies of scale, allowing them to leverage their expertise and equipment for multiple clients.

The semi-solid dosage contract manufacturing market is witnessing a surge of innovative developments, driven by advancements in formulation technology and a growing focus on patient-centric solutions. Formulation innovations include the use of nano and micronized particles to enhance bioavailability, as well as sophisticated particle size distribution techniques to optimize stability and performance. Manufacturers are also prioritizing patient compliance, with the introduction of user-friendly packaging designs and self-administration features. Strategic collaborations between pharmaceutical companies and contract manufacturers are enabling efficient production and faster market entry of these specialized formulations.

While the market is primarily driven by the growing demand for pharmaceutical creams, ointments, and gels, CMOs can leverage their expertise in these semi-solid dosage forms to cater to the cosmetics industry as well. This allows them to expand their client base and optimize production lines. Furthermore, the growing consumer interest in topical skincare products creates additional opportunities for CMOs to partner with cosmetic companies in developing and manufacturing innovative creams, serums, and lotions. This synergy between the pharmaceutical and cosmetic sector helps to fuel the overall growth of the market.

Furthermore, the demand for personalized medicine is fueling the development of customized semi-solid dosage forms tailored to individual needs. Absorption-enhancing ingredients and novel excipients are also being leveraged to improve the efficacy and bioavailability of these topical treatments. These multifaceted innovations are transforming the semi-solid dosage form market, offering more effective, convenient, and personalized solutions for a wide range of skin, eye, and chronic pain conditions.

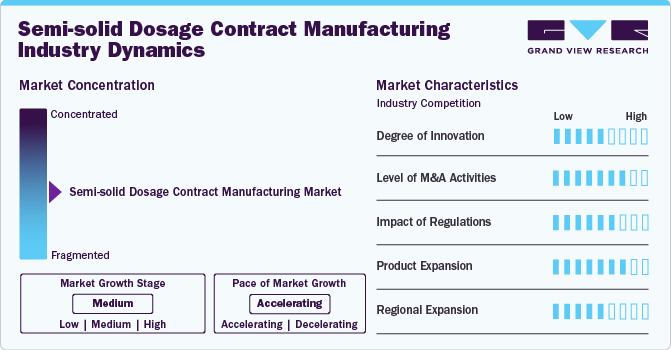

Market Characteristics & Concentration

The semi-solid dosage contract manufacturing industry growth stage is moderate and the market growth is accelerating. The market is characterized by the level of M&A activities, degree of innovation, the impact of regulations, product expansions, and regional expansions.

The semi-solid dosage contract manufacturing product categories have observed advancements due to new drug delivery methods being explored, the core technology for semi-solid production is established. Innovation is likely focused on optimizing formulations and production processes.

The growing presence of market players has made the market more competitive, leading to a rise in mergers and acquisitions. Besides, the market has been proven to facilitate gains, leadership retention, or international expansion.

Regulatory bodies and other authorities can influence the semi-solid dosage contract manufacturing market. These regulations support the production of various semi-solid dosage forms using in vivo models.

Rising expansions, increasing R&D activities, and rising demand for various semi-solid dosages have led to a rise in demand for in-vivo CMO, further influencing the market dynamics positively.

The increase in R&D expenditure, the existence of technologically advanced service providers, and the rising requirement for semi-solid dosage have led to market growth.

Type Insights

Based on type, the topical segment accounted for the largest revenue share of 49.46% in 2024. This high share is attributable to topical semi solid dosage forms, such as ointments, gels, and pastes, are widely used for their targeted delivery capabilities. These forms allow for direct application to the affected area, reducing systemic exposure and minimizing side effects. The demand for topical solid dosage forms is expected to grow due to increasing incidences of skin conditions, the rising prevalence of chronic diseases requiring topical treatment, and advancements in drug delivery technologies.

The transdermal segment is anticipated to witness the fastest growth over the forecast period, owing to the emergence of a non-invasive route of administration that enhances patient compliance and provides controlled drug release. This segment includes patches and other formulations that deliver medication through the skin. Recently, in January 2024, Starton Therapeutics announced the launch of its novel transdermal patch delivery platform, STARSILON, designed to enhance the delivery of difficult-to-formulate active pharmaceutical ingredients (APIs). The technology aims to improve drug efficacy, safety, and patient compliance by maintaining higher and prolonged delivery rates.

Product Insights

The creams segment accounted for the largest revenue share in 2024 and is also anticipated to witness the fastest growth over the forecast period. This high share is attributable due to these formulations, which are designed to deliver active ingredients through the skin, are popular for their ease of application, patient compliance, and efficacy.

The demand for creams is on the rise due to an increasing prevalence of dermatological conditions such as eczema, psoriasis, and acne, as well as a growing consumer interest in anti-aging and skincare products. Advances in formulation technology have enabled the development of creams with enhanced penetration, stability, and bioavailability, making them a preferred choice for both pharmaceutical and cosmeceutical companies.

Company Size Insights

Large-sized companies accounted for the largest revenue share in 2024. This high share is attributable due to pharmaceutical companies leverage contract manufacturing for semi-solid dosage forms to focus on core competencies, reduce costs, and enhance production efficiency. This segment is characterized by high-volume orders and stringent regulatory requirements. This allows them to focus their resources on core competencies like drug discovery and development, while ensuring efficient and cost-effective production of their semi-solid dosage forms.

Medium & small-sized companies are anticipated to grow at the fastest CAGR over the forecast period. Cosmeceutical companies are increasingly turning to contract manufacturers for semi-solid dosage forms to meet the rising consumer demand for high-quality skincare and personal care products. These products often require sophisticated formulations and manufacturing expertise. These CMOs, traditionally focused on pharmaceutical production, possess the necessary skills and equipment for manufacturing creams, serums, lotions, and other topical skincare products. This collaboration benefits cosmeceutical companies in several ways. First, CMOs can handle large-scale production efficiently, allowing cosmeceutical companies to meet growing consumer demand. Secondly, CMOs' knowledge of regulatory requirements ensures that cosmeceutical products adhere to safety and quality standards.

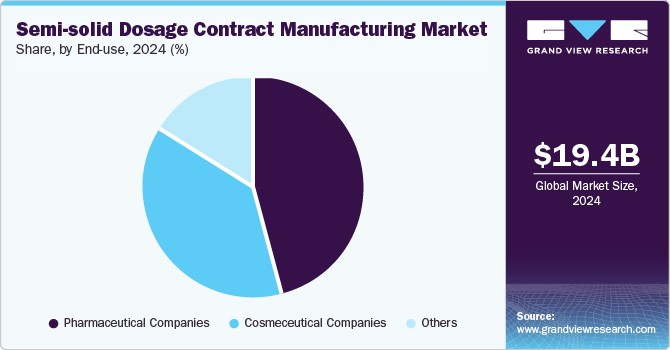

End Use Insights

Pharmaceutical companies accounted for the largest revenue share in 2024. This high share is attributable to pharmaceutical companies leveraging contract manufacturing for semi-solid dosage forms to focus on core competencies, reduce costs, and enhance production efficiency. This segment is characterized by high-volume orders and stringent regulatory requirements. This allows them to focus their resources on core competencies like drug discovery and development, while ensuring efficient and cost-effective production of their semi-solid dosage forms.

Cosmeceutical companies are anticipated to witness the fastest growth over the forecast period. Cosmeceutical companies are increasingly turning to contract manufacturers for semi-solid dosage forms to meet the rising consumer demand for high-quality skincare and personal care products. These products often require sophisticated formulations and manufacturing expertise. These CMOs, traditionally focused on pharmaceutical production, possess the necessary skills and equipment for manufacturing creams, serums, lotions, and other topical skincare products. This collaboration benefits cosmeceutical companies in several ways. First, CMOs can handle large-scale production efficiently, allowing cosmeceutical companies to meet growing consumer demand. Secondly, CMOs' knowledge of regulatory requirements ensures that cosmeceutical products adhere to safety and quality standards.

Regional Insights

North America semi-solid dosage contract manufacturing market is expected to grow at the considerable CAGR of 10.55% during the forecast period. This can be attributed to technologically advanced CMOs in this region. The U.S. has the highest per capita healthcare spending, and the availability of funding and grants from government organizations such as the National Institute of Health (NIH) promotes research activities. Further countries like, the U.S. boasts a significant presence of leading contract manufacturing organizations (CMOs) like Catalent, Thermo Fisher Scientific, and Lonza Group. These companies offer advanced manufacturing capabilities and extensive experience in handling semi-solid dosage forms. Whereas countries like Canada might cater to smaller companies or specialize in niche areas within the semi-solid dosage form category.

U.S. Semi-solid Dosage Contract Manufacturing Market Trends

The semi-solid dosage contract manufacturing market in the U.S. accounted for the highest share of the North American market in 2024. Owing to the factors like the aging population, rising prevalence of skin diseases, and increasing focus on patient-friendly medications all contribute to the market growth. According to the American Academy of Dermatology, Acne is the most prevalent skin condition in the U.S., impacting an estimated 50 million individuals each year. In fact, a staggering 85% of people in the age range of 12 to 24 will experience some degree of acne. In addition, about 7.5 million people in the U.S. have psoriasis. Further the market is poised to grow in countries with further prevalence of conditions such as atopic dermatitis, contact dermatitis and others, Coupled with presence of standard CMO’s providing regulatory compliance and quality assurance.

Europe Semi-solid Dosage Contract Manufacturing Market Trends

The semi-solid dosage contract manufacturing market in Europe is expected to grow significantly due to presence of a large number of CMOs, growing focus on R&D activities, increasing trend of outsourcing to European countries is expected to contribute to the increasing demand for the market in this region.

Germany semi-solid dosage contract manufacturing market held substantial share in 2023, owing to the government initiative for clinical research activities and rising strategic partnerships among companies. Besides, advancements in technology and innovations by manufacturers such as use of nano and micronized particles to enhance bioavailability, as well as the development of patient-centric packaging to cater to global clientele and self-administration features to improve compliance are expected to propel this market over the forecast period.

The semi-solid dosage contract manufacturing market in the UK is anticipated to grow over the forecast period owing to increased demand for CMO. To gain a larger market, further decreasing production costs by complying with the regulatory structure prevalent across the EU is expected to contribute to market growth. In addition, strategic collaborations between UK pharmaceutical companies and contract manufacturers are instrumental in the efficient production of semi-solid dosage forms, further supports for faster market entry for new drugs and optimization of existing formulations.

Asia Pacific Semi-solid Dosage Contract Manufacturing Market Trends

In 2024, the semi-solid dosage contract manufacturing market in Asia Pacific accounted for 31.67% of the global market. The region is renowned for its low operating costs, which include reduced labor expenses and lower costs of raw materials, making it an attractive destination for pharmaceutical companies seeking cost-effective manufacturing solutions. Additionally, supportive government policies across countries like India, China, and Japan further enhance the appeal of the region. These policies often include tax incentives, streamlined regulatory processes, and initiatives aimed at boosting the pharmaceutical sector. Coupled with its strategic location and robust infrastructure, the Asia Pacific region has emerged as a prominent hub for outsourcing pharmaceutical manufacturing. This convergence of economic advantages and government support is propelling the expansion of the semi-solid dosage CMO market in Asia Pacific.

China semi-solid dosage contract manufacturing market held a significant share in 2024 due to the growing focus on R&D of novel treatments, increasing pharmaceutical companies outsourcing, and higher cost efficiency provided by Chinese CMOs has led to the growth of the market.

The semi-solid dosage contract manufacturing in Japan is expected to grow substantially over theforecast period due to increasing demand of manufacturing outsourcing, due to cost-effectiveness and growing adoption of outsourcing models driving the market.

India semi-solid dosage contract manufacturing market in India is anticipated to grow over the forecast period, owing to the availability of established market players and rising creams, ointments, gels, innovations. Besides, partnerships between pharma, biotech, and CMOs drive the market.

Latin America Semi-solid Dosage Contract Manufacturing Market Trends

The semi-solid dosage contract manufacturing market in Latin America is anticipated to grow at a substantial rate over the forecast period. Besides, globally the personal care, pharmaceutical, and biopharmaceutical companies outsource manufacturing of cosmeceutical products for clinical trials or sales in emerging countries such as Brazil and Argentina.

Brazil semi-solid dosage contract manufacturing market is anticipated to grow at a significant CAGR over the forecast period due to presence of restrictive pricing policies, a complex regulatory framework, and a well-established generic industry are certain factors impacting the growth of regulatory affairs outsourcing market in the forthcoming years. Furthermore, country is witnessing a rise in demand for generic medicines, spurred by the need for affordable healthcare solutions. The region's regulatory environment is becoming more harmonized and supportive, encouraging foreign investments and partnerships.

Middle East & Africa Semi-solid Dosage Contract Manufacturing Market Trends

The semi-solid dosage contract manufacturing market in the Middle East & Africa (MEA) region is expected to grow substantially over the forecast period due to rapid urbanization and improving healthcare infrastructure are increasing demand for pharmaceutical products, including semi-solid dosage forms. The region's growing population and rising prevalence of chronic diseases are also contributing to market growth. Additionally, many pharmaceutical companies are looking to expand their presence in emerging MEA markets, often partnering with local CMOs to navigate regulatory landscapes and cultural nuances.

Saudi Arabia semi-solid dosage contract manufacturing market is anticipated to grow at the fastest CAGR over the forecast period owing to the Saudi government's Vision 2030 plan, which aims to diversify the economy away from oil dependence, has identified healthcare and life sciences as key growth sectors. This has led to increased investment in pharmaceutical manufacturing capabilities, including semi-solid dosage forms. The country's growing population, coupled with a high prevalence of lifestyle-related diseases, is driving demand for topical medications. Saudi Arabia's efforts to localize pharmaceutical production to reduce reliance on imports are creating opportunities for CMOs.

Key Semi-solid Dosage Contract Manufacturing Company Insights

Several key players are adopting various strategic initiatives to strengthen their market position, offering CMO services for innovating various semi solid dosage formulations. The prominent strategies companies adopt are new launches, partnerships, agreements, mergers and acquisitions/joint ventures, expansions, and others to increase market presence and revenue and gain a competitive edge, driving market growth.

Key Semi-solid Dosage Contract Manufacturing Companies:

The following are the leading companies in the semi-solid dosage contract manufacturing market. These companies collectively hold the largest market share and dictate industry trends.

- Lonza Group Ltd.

- Lubrizol Life Science

- Cambrex Corporation

- Contract Pharmaceuticals Limited

- Bora Pharmaceutical CDMO

- Ascendia Pharmaceuticals

- Pierre Fabre group

- Piramal Pharma Solutions

- DPT Laboratories, LTD

- MedPharm Ltd

- Catalent, Inc.

- Recipharm AB

- Aenova Group

- Almac Group

- Ajinomoto Bio-Pharma Services

Recent Developments

-

In April 2024, Recipharm announced its plans to sell seven of its manufacturing and development facilities including semi solid dosage in Europe to Blue Wolf Capital, including plants in Spain, France, and Sweden. This divestment aligns with Recipharm’s strategy to expand its biologics production. Blue Wolf Capital is likely to form a new CDMO company with these sites.

- In September 2023, HERMES PHARMA disclosed a USD 27.44 million (€25 million) investment to enhance its manufacturing capabilities. This financial commitment will empower the company with state-of-the-art equipment, expanded production & storage capacity, and improved operational efficiency, aligning with the increasing demand for user-friendly oral dosage forms.

-

In March 2023, Adragos Pharma acquired Clinigen’s development unit, Lamda Laboratories, manufacturers of topical medications significantly enhancing its pharmaceutical product development, regulatory affairs, and supply chain management services. Lamda’s experienced team will continue focusing on complex product development for markets in Europe, Japan, and North America, offering services for various dosage forms.

Semi-solid Dosage Contract Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 21.52 billion

Revenue forecast in 2030

USD 36.58 billion

Growth rate

CAGR of 11.20% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, end use, company size and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Lonza Group Ltd.; Lubrizol Life Science; Cambrex Corporation; Contract Pharmaceuticals Limited; Bora Pharmaceutical CDMO; Ascendia Pharmaceuticals; Pierre Fabre group; Piramal Pharma Solutions; DPT Laboratories, LTD; MedPharm Ltd; Catalent, Inc.; Recipharm AB; Aenova Group; Almac Group; and Ajinomoto Bio-Pharma Services.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Semi-solid Dosage Contract Manufacturing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global semi-solid dosage contract manufacturing market report on the basis of type, product, end use, company size and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Topical

-

Transdermal

-

Oral

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Creams

-

Ointments

-

Gels

-

Lotions

-

Pastes

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical Companies

-

Cosmeceutical Companies

-

Others

-

-

Company Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Size Companies

-

Medium & Small Size Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global semi-solid dosage contract manufacturing market size was estimated at USD 19.43 billion in 2024 and is expected to reach USD 21.52 billion in 2025.

b. The global semi-solid dosage contract manufacturing market is expected to grow at a compound annual growth rate of 11.20% from 2025 to 2030 to reach USD 36.58 billion by 2030.

b. The creams accounted for largest revenue share of 50.93% in 2024 and is also anticipated to witness the fastest growth over the forecast period. This is attributed to growing demand for precise formulations, which are designed to deliver active ingredients through the skin, and are popular options owing to ease of application, patient compliance, and efficacy.

b. Some key players operating in the semi-solid dosage contract manufacturing include Lonza Group Ltd., Lubrizol Life Science, Cambrex Corporation, Contract Pharmaceuticals Limited, Bora Pharmaceutical CDMO, Ascendia Pharmaceuticals, Pierre Fabre group, Piramal Pharma Solutions, DPT Laboratories, LTD, MedPharm Ltd, Catalent, Inc., Recipharm AB, Aenova Group, Almac Group, and Ajinomoto Bio-Pharma Services among others.

b. The rising demand for patient-friendly medications coupled with growing prevalence of chronic diseases such as skin diseases, arthritis, and pain management. In addition, growing requirement semi-solid dosage manufacturing outsourcing, due to cost-effectiveness acts as driver for market growth. Furthermore, regulatory compliance and quality assurance, technological advancements including innovation in formulation technologies, will likely boost their demand over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.