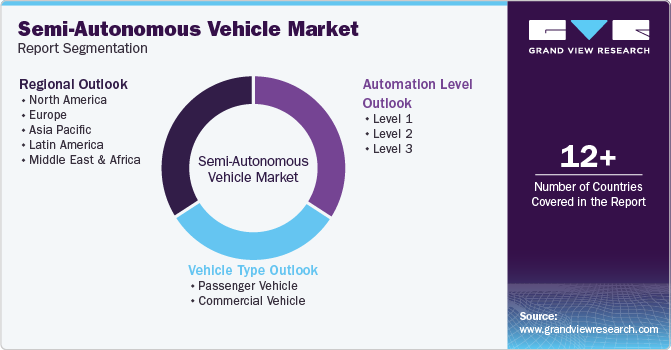

Semi-Autonomous Vehicle Market Size, Share & Trends Analysis Report By Level of Automation (Level 1, Level 2, Level 3), By Vehicle Type (Passenger, Commercial), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-397-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Semi-Autonomous Vehicle Market Trends

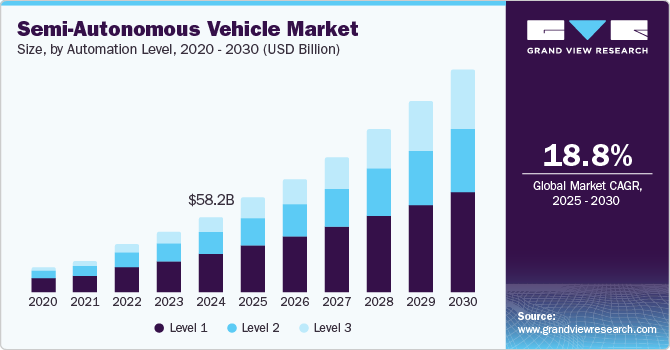

The global semi-autonomous vehicle market size was valued at USD 58.17 billion in 2024 and is projected to grow at a CAGR of 18.8% from 2025 to 2030. The rising need for safer and more efficient driving systems promotes the development and adoption of semi-autonomous vehicles. Semi-autonomous offers better driving control and driver safety, thus offering promising growth opportunities. Moreover, several regional governments have implemented stringent driving and safety laws, further encouraging companies to offer these technologies in their automobiles.

Ongoing advancements in AI, sensors, and connectivity enhance the reliability and capabilities of semi-autonomous systems, encouraging consumer interest in these vehicles. For instance, the use of machine learning (ML) algorithms has further enhanced the functionality and efficiency of automobiles. This technology has several applications, such as object detection and classification, driver monitoring, and deep-learning-based vision to react to the vehicle’s environment in real time. Moreover, machine learning algorithms analyze real-time traffic data and conditions to determine the most efficient route. Using reinforcement learning models can train vehicles to make driving decisions by simulating various driving scenarios, such as when to merge, stop, or overtake other vehicles. ML models can predict the actions of other road users, such as pedestrians and cyclists, based on historical data and patterns, allowing the vehicle to anticipate potential hazards. Autonomous vehicles collect substantial amounts of data during their operations, which can be used to refine and improve machine learning models continuously. This process helps enhance performance in a range of driving conditions.

Semi-autonomous driving has witnessed high demand in developed economies such as the U.S., Germany, France, Japan, and Australia, while its popularity is steadily growing in developing economies. According to a report by Goldman Sachs, around 10% of new car sales globally by 2030 are expected to be Level 3 vehicles, highlighting a shifting customer perspective regarding the advantages of these technologies over manual driving and their role in minimizing the risk of accidents. Continued developments in promising concepts such as automated valet parking (AVP) are expected to help drivers efficiently park their cars without requiring any manual inputs while also preventing the occurrence of accidents in parking lots, aiding stronger demand for autonomous cars. Bosch, in partnership with Mercedes-Benz, has developed the Intelligent Park Pilot that received approval from Germany’s Federal Motor Transport Authority (KBA) in November 2022 to be used at the Stuttgart Airport. This made it the first highly automated parking system globally to be approved for commercial usage, indicating positive growth prospects for the autonomous and semi-autonomous vehicle ecosystems in the coming years.

Automation Level Insights

Level 1 automation accounted for the largest revenue share of 50.6% in the global semi-autonomous vehicle market in 2024. This substantial contribution can be attributed to increasing awareness regarding autonomous driving technologies among consumers globally and the subsequent demand to incorporate these systems in their vehicles. Level 1 automation provides an optimum level of easy maneuverability and manual control through the presence of technologies such as adaptive cruise control and enhanced lane assistance. As these vehicles offer a basic level of assistance while also requiring manual control while driving, they have proved to be popular among consumers who want to select autonomous features in their vehicles. Manufacturers such as BMW, Mercedes, and General Motors have introduced a range of models integrated with Level 1 automation systems, ensuring competitive advantage. Emerging economies are expected to hold significant promises for this segment, as these nations have recently started implementing regulations that would allow the use of Level 1 DAS in vehicles.

The level 3 automation segment is anticipated to witness the fastest growth in the global market from 2025 to 2030. Increasing investments to enable the integration of higher-level autonomous systems in cars and commercial vehicles by major automotive manufacturers, coupled with growing interest among consumers in developed economies, is expected to shape segment demand positively. Besides performing Level 1 and Level 2 systems functions, vehicles with Level 3 automation can perform all driving tasks in certain conditions (highway driving) without human intervention, including steering, acceleration, and braking. Additionally, the system can continuously monitor the environment and make decisions based on real-time data, such as detecting obstacles, changing traffic conditions, and responding to emergencies.

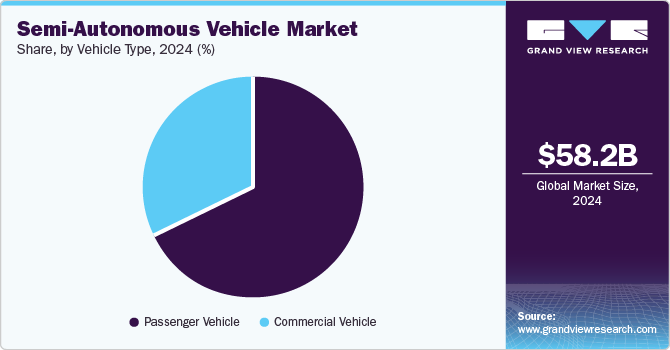

Vehicle Type Insights

The passenger cars segment accounted for the leading revenue share in the global market in 2024. Increasing sales of passenger vehicles globally and consumer preference for autonomous features, especially in developed economies, drive segment growth. Incorporating semi-autonomous systems allows drivers to safely navigate sharp turns and move through traffic, thus ensuring a more comfortable driving experience. Furthermore, connected solutions, obstacle avoidance, and advanced driver-assistance systems (ADAS) have also become very popular, compelling automakers to develop vehicles with these features. Partnerships and collaborations between manufacturers and technological leaders are expected to provide promising growth opportunities for the market further. For instance, in October 2024, Waymo announced a multi-year partnership with Hyundai Motor Company. As per this agreement, Waymo will integrate its sixth-generation and fully autonomous ‘Waymo Driver’ technology into Hyundai’s electric IONIQ 5 SUV model.

The commercial vehicle segment is anticipated to advance at the fastest growth rate during the forecast period. Commercial vehicles are generally deployed over long distances to move products and goods that are essential for other businesses. As a result, companies are strategizing the development of autonomous vehicles such as trucks, semi-trucks, and tractors that can ensure safe movement of such goods while also allowing drivers to maintain their health and posture during such physically intensive journeys. The use of platooning technology allows multiple trucks to travel closely together, with the lead truck controlling speed and braking, which enables the following trucks to reduce fuel consumption and improve traffic flow.

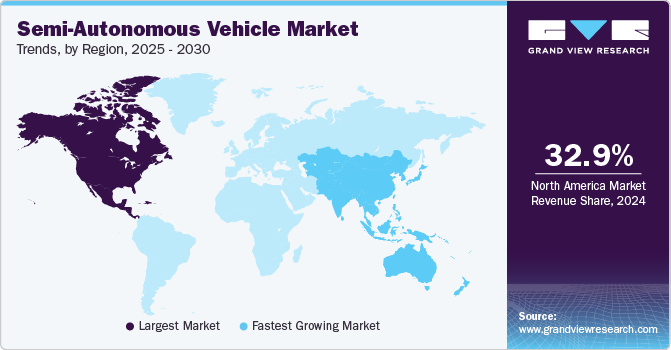

Regional Insights

North America semi-autonomous vehicle market accounted for a leading revenue share of 32.9% in the global market in 2024. Government initiatives to support autonomous driving in the region, along with implementing regulations supporting safety and efficiency in autonomous vehicles, are factors expected to aid regional growth. The region has been an early adopter of vehicles with automation levels from 1 to 3, with regions such as Ontario, New York, British Columbia, and California having set specific rules and guidelines concerning the testing and operation of such vehicles. For instance, in British Columbia, while vehicles with Level 1 and Level 2 automation are permitted for use, those with an SAE autonomy rating of Level 3 and higher have been banned since April 2024 as part of an update to the province's Motor Vehicle Act.

U.S. Semi-Autonomous Vehicle Market Trends

The U.S. semi-autonomous vehicle market accounted for a dominant revenue share in the regional market in 2024. The country has made significant progress in the autonomous vehicle segment, led by companies such as General Motors, Ford, and Tesla. The launch of semi-automated and fully-automated trucks in the country is expected to improve convenience and safety for drivers, with emerging companies such as Aurora enabling developments in this space. Moreover, both technological advancements and favorable regulatory initiatives have boosted the development and deployment of semi-autonomous vehicles. For instance, the National Highway Traffic Safety Administration (NHTSA) has issued guidelines for testing and deploying automated vehicles, emphasizing safety, innovation, and accountability. On the other hand, the AV Testing Policy has encouraged states to establish their own regulations while providing a framework for manufacturers to follow.

Europe Semi-Autonomous Vehicle Market Trends

Europe semi-autonomous vehicle market accounts for a substantial revenue share in 2024 globally on account of the high pace of regional development, increased awareness regarding autonomous driving among consumers, and the presence of several key manufacturers such as Audi, Mercedes, and Volvo. Moreover, roadways in regional economies, particularly in Western Europe and Scandinavian countries, are highly developed, making them well-suited for autonomous vehicles. Regional authorities are also establishing various initiatives and programs to boost market expansion. For instance, the European Commission has established a framework to enhance road safety and promote smart mobility. This includes support for advanced driver-assistance systems (ADAS) and autonomous driving technologies. Furthermore, the EU Automated Driving Roadmap aims to support the testing and deployment of automated vehicles, focusing on safety, cybersecurity, and interoperability. Such developments are expected to ensure substantial expansion of the regional market.

Asia Pacific Semi-Autonomous Vehicle Market Trends

The Asia Pacific region is anticipated to advance at the fastest CAGR from 2025 to 2030. The continued modernization of roadways and transport infrastructure in the region, which has led to steady improvements in safety and convenience for vehicles, is anticipated to encourage the launch of semi-autonomous vehicles in economies such as China, Japan, and India.

China has made substantial advancements in developing and adopting semi-autonomous vehicles, aided by strong government support, technological innovations by research institutes and vehicle manufacturers, and a rapidly growing consumer market. The Chinese government has actively promoted the development of autonomous driving technology through favorable policies, funding, and regulations aimed at enabling innovations. In 2024, the government announced the launch of a pilot program for Level 3 autonomous driving, with plans to expand it to fully automated driving. Furthermore, in June 2024, nine Chinese companies were granted licenses to test level 3 autonomous driving in seven cities, including Beijing, Shanghai, and Guangzhou. The pilot program is being conducted by the Ministry of Industry and Information Technology (MIIT), in collaboration with other departments.

Key Semi-Autonomous Vehicle Company Insights

Some of the major companies involved in the global semi-autonomous vehicles market include Audi AG, BMW AG, and General Motors, among others.

-

Audi AG is a German automotive manufacturer that designs, engineers, produces, markets, and distributes luxury vehicles. The company produces a range of vehicles, including sedans (A series), SUVs (Q series), sports cars (R series), and electric models (e-tron series). For instance, the Audi A8 is known for its high performance and luxury, while the Q5 and Q7 SUVs are well-known for their versatility. Since 2021, Audi has launched four concept cars that aim to boost innovations in the automation space, known as the Audi activesphere (2023), Audi urbansphere (2022), Audi grandsphere sedan (2021), and Audi skysphere roadster (2021).

Key Semi-Autonomous Vehicle Companies:

The following are the leading companies in the semi-autonomous vehicle market. These companies collectively hold the largest market share and dictate industry trends.

- Audi AG

- BMW AG

- Continental AG

- Mercedes-Benz Group AG

- Ford Motor Company

- General Motors

- Honda Motor Co., Ltd.

- Nissan Motor Co., Ltd.

- TOYOTA MOTOR CORPORATION

- AB Volvo

- Valeo S.A.

- Volkswagen Group

Recent Developments

-

In June 2024, BMW announced that it had received approval to offer a combination of Level 2 and Level 3 driving assistance systems, known as the BMW Highway Assistant and the BMW Personal Pilot L3, respectively, in its newly launched BMW 7 Series.

-

In September 2023, Mercedes-Benz announced the launch of its production-ready DRIVE PILOT version, which is a partially automated driving technology, in the U.S.

Semi-Autonomous Vehicle Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 72.86 billion |

|

Revenue forecast in 2030 |

USD 172.20 billion |

|

Growth Rate |

CAGR of 18.8% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2017 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Automation level, vehicle type, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, U.K., France, China, Japan, India, South Korea, Australia, Brazil, UAE, Saudi Arabia, South Africa |

|

Key companies profiled |

Audi AG; BMW AG; Continental AG; Mercedes-Benz Group AG; Ford Motor Company; General Motors; Honda Motor Co., Ltd.; Nissan Motor Co., Ltd.; TOYOTA MOTOR CORPORATION; AB Volvo; Valeo S.A.; Volkswagen Group |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Semi-Autonomous Vehicle Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global semi-autonomous vehicle market report based on automation level, vehicle type, and region:

-

Automation Level Outlook (Revenue, USD Million, 2017 - 2030)

-

Level 1

-

Level 2

-

Level 3

-

-

Vehicle Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Passenger Vehicle

-

Commercial Vehicle

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

MEA

-

Saudi Arabia

-

UAE

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."