Self-storage Market Size, Share & Trends Analysis Report By Unit Size (Small, Medium, Large), By Application (Personal, Business), By Region (North America, Europe, Asia Pacific), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-341-2

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Self-storage Market Size & Trends

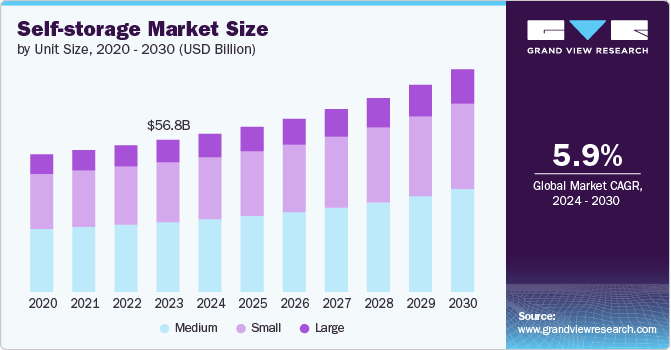

The global self-storage market size was estimated at USD 56.81 billion in 2023 and is projected to grow at a CAGR of 5.9% from 2024 to 2030. Several factors are driving the growth of the global self-storage market, contributing to its expansion and increasing relevance in the real estate and logistics sectors. These include urbanization & population growth and expansion of e-commerce and retail. Self-storage is a service offering secure and convenient storage units that individuals or businesses can rent whenever they require additional space for storing their belongings.

Self-storage facilities are ideal for individuals and businesses seeking temporary or long-term storage solutions. Self-storage proves invaluable during relocation, offering a secure space to store belongings while people search for their new home or apartment. Additionally, it provides a haven for items that may not fit into a new residence. Self-storage is well-suited for businesses requiring additional space for inventory or equipment. Business owners can securely store items such as furniture and office supplies, ensuring these items do not occupy valuable workspace.

Self-storage facilities are ideal for individuals and businesses seeking temporary or long-term storage solutions. Self-storage proves invaluable during relocation, offering a secure space to store belongings while people search for their new home or apartment. Additionally, it provides a haven for items that may not fit into a new residence. Self-storage is well-suited for businesses requiring additional space for inventory or equipment. Business owners can securely store items such as furniture and office supplies, ensuring these items do not occupy valuable workspace.

The self-storage sector is experiencing a significant trend toward improving customer convenience, highlighting a focus on delivering smooth user experiences. Facilities are investing more in intuitive websites and online platforms, enabling customers to conveniently book and manage their storage units remotely. Additionally, the implementation of contactless access options allows individuals to retrieve their belongings without physical contact, addressing safety considerations. These efforts are part of broader industry initiatives aimed at adapting to changing customer expectations and preferences.

Amid increasing environmental awareness, there is a heightened focus on sustainability within the self-storage sector. Facilities are integrating energy-efficient technologies such as Light Emitting Diode (LED) lighting and smart climate-control systems to reduce energy usage. Some are also investigating renewable energy options, such as solar panels, to support their operational needs. These sustainable practices are aimed at lowering the industry's carbon footprint, cutting utility costs, and potentially enhancing property valuations.

The growing adoption of technology is expected to present significant growth opportunities for the market. Companies are launching new technology solutions for the self-storage sector. For instance, in September 2023, Vantiva, a France-based company, announced the launch of Vantiva Smart Storage, a software-as-a-service solution for the self-storage sector, integrating Wi-Fi and Internet of Things (IoT) capabilities. This platform enhances operational efficiencies, reduces costs, and improves customer experiences by integrating various technologies and delivering actionable insights, aiming to modernize self-storage facilities into smart spaces.

Unit Size Insights

Based on unit size, the market is classified into small, medium, and large. The medium segment dominated the market with the largest share of over 45.0% in 2023. The segment’s growth is attributed to the versatility and cost-effectiveness of the medium-sized self-storage units. Medium-sized units offer a balance between space and cost, making them versatile for a wide range of storage needs. They are ideal for storing household items, furniture, and business inventory, catering to both individual and business customers. Medium units provide a cost-effective storage solution for customers who need more space than small units but do not require the extensive capacity of large units. This makes them an attractive option for a wide range of customers.

The large segment is projected to witness the fastest CAGR of 6.6% from 2024 to 2030. The large segment’s growth is attributed to the convenience and security offered by them. Large units offer convenience by allowing customers to store all their items in one place rather than renting multiple smaller units. Enhanced security features at storage facilities also make these units appealing for storing valuable or bulky items. Moreover, large units are particularly attractive to businesses that need substantial space for storing inventory, equipment, or seasonal stock. As e-commerce and retail sectors expand, the demand for sizable storage solutions increases.

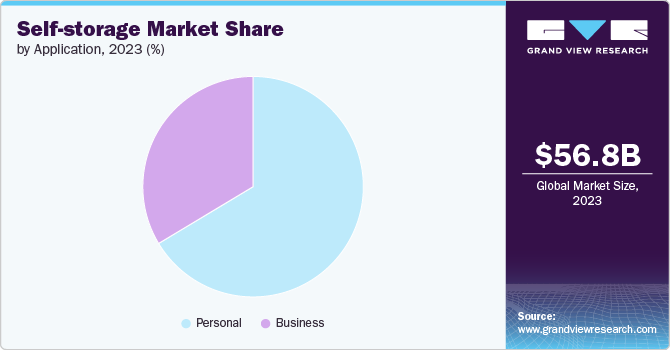

Application Insights

Based on application, the personal segment dominated the market in 2023 and accounted for more than 66.0% share of the global revenue. The factors contributing to the segment's growth include growing urbanization, a rise in smaller living spaces, and lifestyle changes. As more people move to urban areas, living spaces tend to be smaller, creating a need for additional storage solutions for personal belongings that can't fit in smaller apartments or homes. According to The World Bank Group, the percentage of the global urban population has grown from 52% in 2010 to 57% in 2023. Moreover, increased mobility, frequent relocations, and lifestyle changes such as downsizing, retirement, or divorce drive the demand for personal storage. People often need temporary storage during transitions.

The business segment is projected to witness the fastest CAGR of 6.5% from 2024 to 2030. The expansion of the e-commerce sector is contributing to the growth of the segment. The rise of e-commerce has led to increased demand for storage space to manage inventory, packaging materials, and shipping supplies. Small and medium-sized businesses (SMBs) often turn to self-storage as a cost-effective solution for warehousing needs. Moreover, businesses benefit from the flexibility to scale their storage space up or down based on demand, allowing them to respond quickly to market changes without committing to long-term leases.

Regional Insights

North America self-storage marketdominated the global industry and accounted for a revenue share of over 47.0% in 2023. An aging population and the growing integration of technology for self-storage units drive the market’s growth in the region. The aging population in North America often downsizes their living spaces, requiring storage for personal belongings they wish to keep but cannot accommodate in smaller homes or retirement communities. Moreover, the adoption of technology in self-storage operations, including online booking platforms, digital access controls, and security enhancements, improves customer convenience and satisfaction, driving market growth.

U.S. Self-storage Market Trends

The self-storage market in the U.S. is expected to grow at a CAGR of 5.0% from 2024 to 2030. Numerous self-storage providers, such as CubeSmart, Life Storage Inc., and Prime Storage, contribute to the market’s growth in the country. Moreover, high domestic migration rates within the country have led to an increase in demand for self-storage that aids in storing household items and swift relocation.

Asia Pacific Self-storage Market Trends

The self-storage market in Asia Pacific is expected to grow at the fastest CAGR of 7.1% from 2024 to 2030. Rapid urbanization and increasing population density in major cities across Asia Pacific lead to smaller living spaces, creating a need for external storage solutions for personal belongings and household items. Manila, Philippines; Mumbai, India; and Dhaka, Bangladesh, are among the cities with the highest population densities across the globe. Moreover, the significant expansion of e-commerce in the region leads to increased demand for storage space to manage inventory, packaging materials, and shipping supplies.

Europe Self-storage Market Trends

The self-storage market in Europe is expected to grow at a significant CAGR of 5.7% from 2024 to 2030. The presence of a significant expatriate population in major European cities drives demand for temporary storage solutions for personal belongings during relocations. According to Eurostat, in 2022, 5.1 million immigrants entered the European Union (EU) from non-EU countries, growing by 117% from 2021.

Key Self-storage Company Insights

Some of the key companies operating in the market include CubeSmart, Public Storage, Life Storage Inc., and Safestore, among others.

-

CubeSmart, headquartered in Pennsylvania, U.S., is a self-administered and self-managed Real Estate Investment Trust (REIT) specializing in owning, acquiring, operating, and developing self-storage facilities. It provides various storage unit sizes and types, including climate-controlled and outdoor options, prioritizing customer service and convenience with advanced facility technologies.

SmartStop Self Storage and Storage Giant are some of the emerging companies in the target market.

-

SmartStop Self Storage is a diversified real estate company specializing in self-storage assets. It operates as a self-administered and self-managed REIT. SmartStop Self Storage owns and operates a portfolio of self-storage facilities across the U.S. and Canada. They offer storage solutions for personal, business, and vehicle storage needs.

Key Self-storage Companies:

The following are the leading companies in the self-storage market. These companies collectively hold the largest market share and dictate industry trends.

- CubeSmart

- Metro Storage LLC

- SmartStop Self Storage

- Life Storage Inc.

- Safestore

- W. P. Carey Inc.

- Public Storage

- Prime Storage

- Shurgard Self Storage

- Storage Giant

- Big Yellow Self Storage Company

Recent Developments

-

In April 2024, SmartStop Self Storage announced the acquisition of a self-storage facility in Colorado, U.S., spanning approximately 64,700 net rentable square feet. The facility consists of 20 single-story buildings with around 450 units and 100 parking spaces. It features 24-hour video surveillance, drive-up access, and climate-controlled office suites, serving the local communities and nearby military installations.

-

In November 2022, Storage Giant, a U.K.-based self-storage service provider, announced the launch of a new high-security storage facility, Bridgend. The Bridgend facility offers over 41,000 sq ft of domestic, personal, and business storage space. Over 600 storage rooms are available, with sizes ranging from 10 sq ft to 250 sq ft. The new storage facility is expected to help the company attract new customers and increase its market share in the U.K.

Self-storage Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 59.08 billion |

|

Revenue forecast in 2030 |

USD 83.20 billion |

|

Growth rate |

CAGR of 5.9% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Unit Size, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; and South Africa |

|

Key companies profiled |

CubeSmart; Metro Storage LLC; SmartStop Self Storage; Life Storage Inc.; Safestore; W. P. Carey Inc.; Public Storage; Prime Storage; Shurgard Self Storage; Storage Giant; Big Yellow Self Storage Company |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Self-storage Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global self-storage market report based on unit size, application, and region.

-

Unit Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Small

-

Medium

-

Large

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Personal

-

Business

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global self-storage market size was estimated at USD 56.81 billion in 2023 and is expected to reach USD 59.08 billion in 2024.

b. The global self-storage market is expected to grow at a compound annual growth rate of 5.9% from 2024 to 2030 to reach USD 83.20 billion by 2030.

b. North America dominated the self-storage market with a share of over 47.0% in 2023. This is attributable to the aging population and the presence of numerous market players in the region.

b. Some key players operating in the self-storage market include CubeSmart, Metro Storage LLC, SmartStop Self Storage, Life Storage Inc., Safestore, W. P. Carey Inc., Public Storage, Prime Storage, Shurgard Self Storage, Storage Giant, and Big Yellow Self Storage Company.

b. Key factors driving market growth include the expansion of the e-commerce sector and the growing urbanization.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."