Self-checkout Systems Market Size, Share & Trends Analysis Report By Component (Systems, Services), By Type (Cash Based, Cashless), By Application (Supermarkets & Hypermarkets, Convenience Stores), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-411-6

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

Self-checkout Systems Market Size & Trends

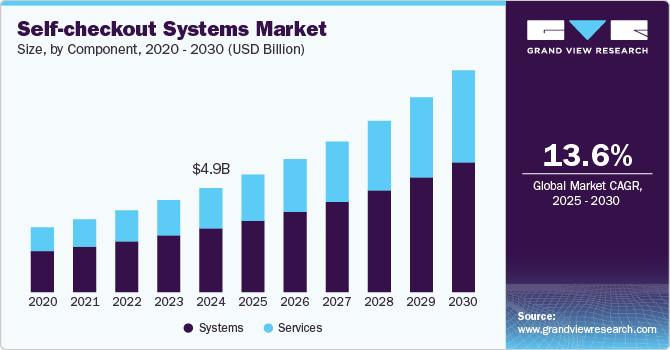

The global self-checkout systems market size was estimated at USD 4.91 billion in 2024 and is anticipated to grow at a CAGR of 13.6% from 2025 to 2030. The growth of the self-checkout systems market is being driven by several key factors, primarily centered around the increasing demand for automation and improved customer experience in the retail sector. Retailers are adopting self-checkout solutions to enhance operational efficiency, reduce labor costs, and streamline store operations. As businesses face ongoing labor shortages and rising wages, self-checkout systems offer a cost-effective solution by reducing reliance on human cashiers. Additionally, these systems enable faster transactions and shorter queues, improving customer satisfaction and encouraging repeat visits.

Technological advancements are also playing a significant role in the expansion of the self-checkout systems market. Innovations such as artificial intelligence (AI), computer vision, and contactless payment technologies are enhancing the capabilities of self-checkout systems, making them more user-friendly and secure. Retailers are leveraging these advanced features to reduce errors, minimize theft, and provide a seamless shopping experience. Furthermore, the integration of self-checkout systems with inventory management and customer relationship management (CRM) solutions allows businesses to gain valuable insights into consumer behavior and optimize inventory levels.

Changing consumer preferences and evolving shopping habits further contribute to market growth. Modern consumers increasingly prefer self-service options, valuing the autonomy and speed offered by self-checkout systems. The COVID-19 pandemic accelerated this trend, as shoppers sought contactless and socially distanced shopping experiences. As a result, retailers across grocery stores, supermarkets, convenience stores, and even non-food retail sectors are investing in self-checkout technology to meet customer expectations and enhance safety measures. This widespread adoption is expected to sustain the growth momentum of the self-checkout systems market in the coming years.

Another key driver of the self-checkout systems market is the rising adoption of omnichannel retail strategies and the growing emphasis on enhancing in-store digital experiences. Retailers are increasingly integrating self-checkout kiosks into their broader digital ecosystems, creating seamless transitions between online and offline shopping channels. By allowing customers to use mobile apps for product scanning, digital coupons, and mobile payments directly at self-checkout stations, retailers can provide a unified and personalized shopping journey. This integration not only enhances customer convenience but also enables retailers to gather valuable data on purchasing patterns and preferences, which can be used to improve marketing strategies and inventory planning.

Furthermore, the increasing presence of self-checkout systems in non-traditional retail environments, such as pharmacies, quick-service restaurants, and transportation hubs, is expanding the market’s scope. Businesses across diverse sectors are recognizing the benefits of reduced wait times and greater operational efficiency offered by self-checkout solutions. As technology costs decline and systems become more customizable to fit different retail formats, adoption rates are expected to rise across both large enterprises and small to medium-sized businesses. This trend is contributing to the sustained and widespread growth of the self-checkout systems market globally.

Component Insights

Systems accounted for the largest revenue share at over 61% in 2024 due to the high initial demand for hardware installations across various retail formats. Retailers and businesses are heavily investing in self-checkout kiosks, terminals, and supporting hardware to modernize their stores, enhance operational efficiency, and improve customer convenience. The need for reliable and user-friendly systems capable of handling high transaction volumes, integrating with existing point-of-sale infrastructure, and supporting multiple payment methods has driven consistent demand.

Moreover, the integration of advanced technologies such as computer vision, artificial intelligence, and RFID into self-checkout systems has further strengthened the demand for innovative and technologically advanced hardware solutions, solidifying the dominance of the systems segment.

The services segment is expected to grow at a significant rate of 14.8% during the forecast period. The services segment is experiencing significant growth due to the increasing need for maintenance, software upgrades, system integration, and training services associated with self-checkout deployments. As retailers adopt more complex and customized self-checkout solutions, they require ongoing technical support to ensure optimal performance, data security, and system interoperability.

Additionally, the rising adoption of cloud-based and software-as-a-service (SaaS) models for self-checkout software has created new opportunities for managed services, remote monitoring, and data analytics services. The continuous evolution of self-checkout technology, combined with the need for regular software updates and the integration of new features, is driving the expansion of service-related revenues in the self-checkout systems market.

Type Insights

The cash based segment accounted for the largest revenue share in 2024. Cash based self-checkout systems currently dominate the self-checkout systems market due to their widespread adoption across traditional retail sectors, particularly in regions and industries where cash transactions remain prevalent. Many retailers, especially grocery stores, supermarkets, and convenience stores, continue to rely on cash-handling capabilities to serve a diverse customer base, including individuals who prefer or are limited to using cash.

Furthermore, established retail chains that introduced self-checkout systems several years ago often implemented cash-enabled solutions to ensure inclusivity and flexibility in payment options. The continued preference for hybrid systems that accept both cash and electronic payments has further reinforced the dominance of cash-based self-checkout systems in the global market.

The cashless segment is expected to grow at the fastest rate during the forecast period. The cashless self-checkout systems segment is experiencing significant growth, driven by the increasing adoption of digital payment methods and the rising preference for contactless transactions. Consumer behavior has shifted markedly toward mobile payments, digital wallets, and card-based transactions, especially following the COVID-19 pandemic, which heightened awareness around hygiene and contactless solutions.

Retailers are also recognizing the operational benefits of cashless systems, including faster transactions, reduced maintenance costs associated with cash-handling equipment, and enhanced security by minimizing cash-related theft and errors. The growing penetration of smartphone-based payment apps, government initiatives promoting cashless economies, and advancements in payment technologies are expected to continue driving the rapid expansion of cashless self-checkout systems in the coming years.

Application Insights

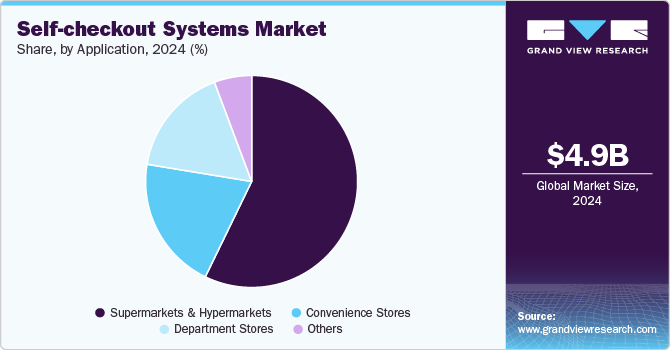

The supermarkets and hypermarkets segment accounted for the largest revenue share in 2024. Supermarkets and hypermarkets dominate the self-checkout systems market due to their large-scale operations, high transaction volumes, and the need to enhance customer throughput and operational efficiency. These retail formats typically experience heavy foot traffic, particularly during peak hours, making self-checkout systems an effective solution to reduce checkout lines and improve customer satisfaction.

Additionally, supermarkets and hypermarkets have the financial resources and infrastructure to invest in advanced self-checkout technologies, including systems with cash and cashless capabilities, product recognition features, and integration with loyalty programs. Their early adoption of self-checkout solutions, driven by the need for labor cost reduction and improved store efficiency, has solidified their leading position in the market.

The convenience stores segment is expected to grow at a significant rate during the forecast period. The convenience stores segment is witnessing significant growth in self-checkout system adoption, fueled by evolving consumer preferences for faster and more convenient shopping experiences. As consumers increasingly seek quick, frictionless purchases at smaller retail outlets, convenience store operators are investing in self-checkout systems to enhance service speed and reduce dependency on staff for routine transactions. Additionally, the limited physical space in convenience stores makes compact self-checkout systems particularly appealing, enabling efficient use of floor space while maintaining customer flow. The rapid expansion of urban convenience store chains, combined with growing demand for contactless payments and unmanned store concepts, is accelerating the adoption of self-checkout systems in this segment.

Regional Insights

North America self-checkout systems industry held the major revenue share of over 43% in 2024, driven by widespread retail digitalization, labor shortages, and increasing consumer preference for faster, self-service options. Retailers across supermarkets, hypermarkets, and convenience stores are investing heavily in advanced self-checkout technologies, including AI-powered product recognition and mobile-integrated systems, to enhance efficiency and improve customer experience.

U.S. Self-checkout Systems Market Trends

The self-checkout systems industry in the U.S. is expected to grow significantly from 2025 to 2030. The U.S. leads the North American market due to its extensive network of large retail chains, early adoption of self-checkout technology, and growing demand for contactless and frictionless shopping experiences. Retailers are increasingly deploying self-checkout solutions to address rising labor costs and meet evolving consumer preferences for faster transactions.

Europe Self-checkout Systems Market Trends

Europe self-checkout systems industry is growing significantly at a CAGR of over 13% from 2025 to 2030. The European self-checkout systems market is experiencing steady growth, driven by rising labor costs, technological innovation, and the strong push for automation across retail sectors. Retailers are also responding to increasing consumer demand for self-service options, particularly in grocery and convenience formats.

The self-checkout systems industry in the UK is expected to grow rapidly in the coming years. In the UK, self-checkout systems are widely adopted across leading supermarket chains, driven by a focus on operational efficiency and customer convenience. The growing popularity of smaller, urban-format stores and autonomous retail concepts is further accelerating adoption.

The Germany self-checkout systems industry held a substantial market share in 2024. Germany is witnessing increased adoption of self-checkout systems, particularly in supermarkets and hypermarkets, as retailers seek to modernize store operations and improve customer service. Regulatory support for digital payments and the growing acceptance of self-service technologies among consumers are contributing to market expansion.

Asia Pacific Self-checkout Systems Market Trends

The self-checkout systems industry in the Asia Pacific is growing significantly at a CAGR of over 15% from 2025 to 2030. The Asia Pacific self-checkout systems market is growing rapidly, driven by the expansion of modern retail formats, rising urbanization, and increasing consumer preference for contactless and cashless payment options. Technology advancements and rising investments in retail automation further support the growth of self-checkout solutions across the region.

China self-checkout systems industry held a substantial revenue share in 2024. In China, the self-checkout systems market is expanding rapidly due to the government's push for digital infrastructure development, the rise of e-commerce, and large-scale cloud adoption by both state-owned and private enterprises. The focus on cybersecurity and data localization regulations also plays a crucial role.

The self-checkout systems industry in Japan held a substantial share in 2024. Japan’s self-checkout systems market is growing steadily, supported by the country’s aging population, labor shortages, and strong technological infrastructure. Retailers are increasingly adopting compact and efficient self-checkout solutions, especially in convenience stores, to streamline operations and enhance customer service.

India's self-checkout systems industry is expanding rapidly. In India, the self-checkout systems market is in a relatively early stage, but growing urbanization, increasing penetration of organized retail, and rising digital payment adoption are driving interest in self-checkout technology. Modern supermarkets and hypermarkets in metropolitan areas are gradually exploring self-checkout solutions to enhance operational efficiency and customer convenience.

Key Self-checkout Systems Company Insights

Key players operating in the self-checkout systems market include Diebold Nixdorf, Incorporated, ePOS HYBRID, Fujitsu, Gilbarco Veeder-Root Company, ITAB, MetroClick, NCR Corporation, Pyramid Computer GMBH, StrongPoint, and Toshiba Global Commerce Solutions. The company’s focus on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Self-checkout Systems Companies:

The following are the leading companies in the self-checkout systems market. These companies collectively hold the largest market share and dictate industry trends.

- Diebold Nixdorf, Incorporated

- ePOS HYBRID

- Fujitsu

- Gilbarco Veeder-Root Company.

- ITAB

- MetroClick

- NCR Corporation

- Pyramid Computer GMBH

- StrongPoint

- Toshiba Global Commerce Solutions

Recent Developments

-

In January 2024, ITAB entered into an agreement with a leading European grocery chain for the supply of 7,200 self-checkout systems, to be deployed across the retailer’s stores in multiple countries. The implementation is already underway and is expected to be completed by February 2025. The total contract value for 2024 was estimated to be approximately EUR 16 million (USD 17.4 million).

-

In January 2024, Diebold Nixdorf, Incorporated, a provider of retail solutions supporting transactions and customer experiences globally, commenced the rollout of its latest AI-based checkout solutions. These solutions are specifically designed to address and prevent the most common causes of shrinkage at both self-service and traditional point-of-sale checkouts. The new offering, powered by Smart Vision technology, complements Diebold Nixdorf’s existing AI-based solutions, which are already enhancing processes such as fresh produce scanning and age verification for restricted items. By integrating these technologies into a unified platform, the company aims to deliver one of the most comprehensive and scalable anti-shrink solutions available in the market. Furthermore, Diebold Nixdorf’s new AI-powered solutions can be seamlessly deployed through the company’s existing in-store integrations, ensuring minimal disruption to retailers’ operations.

Self-Checkout Systems Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 5.55 billion |

|

Revenue forecast in 2030 |

USD 10.49 billion |

|

Growth rate |

CAGR of 13.6% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments |

Component, type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Diebold Nixdorf; Incorporated; ePOS HYBRID; Fujitsu; Gilbarco Veeder-Root Company; ITAB; MetroClick; NCR Corporation; Pyramid Computer GMBH; StrongPoint; Toshiba Global Commerce Solutions |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Self-checkout Systems Market Report Segmentation

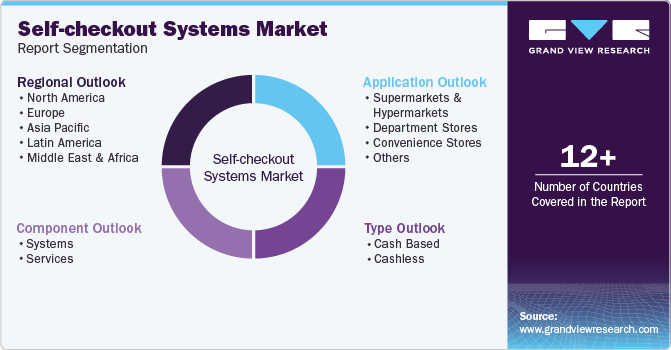

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global self-checkout systems market report based on component, type, application, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Systems

-

Services

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cash Based

-

Cashless

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Department Stores

-

Convenience Stores

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The growth of the self-checkout systems market is being driven by several key factors, primarily centered around the increasing demand for automation and improved customer experience in the retail sector. Retailers are adopting self-checkout solutions to enhance operational efficiency, reduce labor costs, and streamline store operations. As businesses face ongoing labor shortages and rising wages, self-checkout systems offer a cost-effective solution by reducing reliance on human cashiers.

b. The global self-checkout systems market size was estimated at USD 4.91 billion in 2024 and is expected to reach USD 5.55 billion in 2025.

b. The global self-checkout systems market is expected to grow at a compound annual growth rate of 13.6% from 2025 to 2030 and reach USD 10.49 billion by 2030.

b. North America dominated the self-checkout systems market with a share of over 43% in 2024. This is attributable to the increasing adoption of these systems by the supermarkets and hypermarkets in the U.S. and Canada to improve the in-store consumer checkout experience.

b. Some key players operating in the self-checkout systems market include Diebold Nixdorf, Incorporated, ePOS HYBRID, Fujitsu, Gilbarco Veeder-Root Company, ITAB, MetroClick, NCR Corporation, Pyramid Computer GMBH, StrongPoint, and Toshiba Global Commerce Solutions.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."