- Home

- »

- Advanced Interior Materials

- »

-

Selective Laser Sintering Equipment Market Report, 2030GVR Report cover

![Selective Laser Sintering Equipment Market Size, Share & Trends Report]()

Selective Laser Sintering Equipment Market Size, Share & Trends Analysis Report By Material (Metal, Plastics), By Laser Type (Solid Laser, Gas Laser), By Technology (Desktop Printer, Industrial Printer), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-268-0

- Number of Report Pages: 152

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

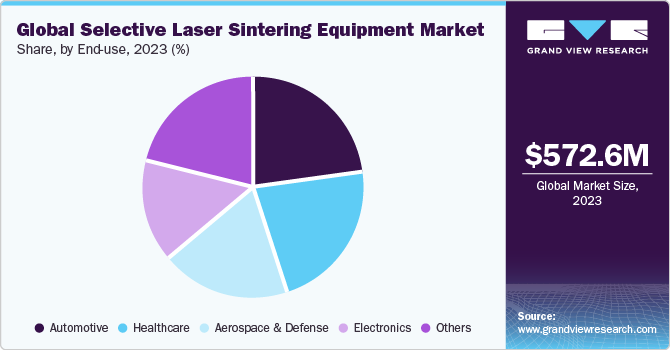

The global selective laser sintering equipment market size was estimated at USD 572.6 million in 2023 and is anticipated to grow at a CAGR of 23.7% from 2024 to 2030. The increasing demand for customization and personalization across various industries is a significant driver for market growth. Consumers are increasingly seeking products tailored to their specific needs and preferences, prompting manufacturers to adopt selective laser sintering (SLS) technology for on-demand production of highly intricate and bespoke components. This trend not only satisfies consumer demands but also enables manufacturers to differentiate their offerings in competitive markets.

Technological advancements play a pivotal role in propelling SLS equipment demand. As SLS technology evolves, manufacturers are continually refining processes, improving precision, and expanding the range of materials. These advancements not only enhance the performance and versatility of SLS equipment but also contribute to its cost-effectiveness, making it an attractive option for a wide array of applications.

The increasing emphasis on cost efficiency is driving companies to explore alternative manufacturing methods such as SLS. While initial investment costs for SLS equipment are significant, the technology offers long-term cost savings through reduced material waste, lower tooling expenses, and enhanced production efficiency. As companies seek to optimize their manufacturing processes and streamline production workflows, the demand for SLS equipment is expected to augment in the upcoming years.

The environmentally friendly nature of SLS technology is becoming increasingly important for companies seeking sustainable manufacturing solutions. SLS equipment generates less waste compared to traditional manufacturing methods and allows for the use of recyclable materials, aligning with the growing emphasis on sustainability in industry practices.

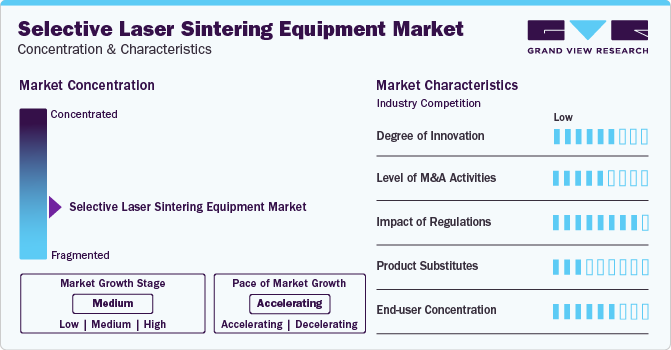

Market Concentration & Characteristics

The market growth stage is medium, and the pace is accelerating. The market is characterized by a high degree of innovation, which is attributable to rapid technological advancements. Moreover, market players are adopting organic and inorganic growth strategies, such as product launches, geographical expansions, mergers & acquisitions, and collaborations, to strengthen their position in the global market.

Regulations governing safety and quality standards are crucial for the market. Compliance with regulatory requirements ensures that SLS equipment meets specified safety standards and maintains consistent quality. Manufacturers must adhere to these regulations to ensure the safety of operators, mitigate risks associated with laser technology, and maintain product quality, thereby enhancing market credibility and customer trust.

The market is characterized by a high degree of innovation, driven by advancements in technology and increasing demand for additive manufacturing solutions. SLS equipment manufacturers are continuously pushing the boundaries of innovation to improve the performance, reliability, and versatility of their systems. This innovation extends across various aspects of SLS equipment, including laser systems, scanning mechanisms, powder handling systems, and software solutions.

SLS equipment finds extensive utilization across sectors such as aerospace, automotive, healthcare, consumer goods, and industrial manufacturing. Each industry has unique requirements and demands, driving the development of specialized applications and solutions within the market. In aerospace and automotive industries, SLS technology is leveraged for rapid prototyping, tooling, and the production of lightweight and complex components. The ability of SLS equipment to produce parts with high strength-to-weight ratios and intricate geometries is particularly advantageous in these sectors, where performance, durability, and efficiency are paramount.

Product substitutes in the market exist primarily in the form of other additive manufacturing technologies and traditional manufacturing methods. While SLS offers unique advantages, such as the ability to produce complex geometries without the need for support structures and the capability to work with a wide range of materials, there are alternative technologies and methods that may serve as substitutes in certain applications. One notable substitute is Stereolithography (SLA), an additive manufacturing technology that uses a photopolymer resin cured by ultraviolet light to build parts layer by layer. While SLA offers high precision and surface finish, it may not be as suitable for producing functional, load-bearing parts as SLS due to differences in material properties and build process.

Material Insights

The metal segment held the largest revenue share of 45.7% in 2023. The use of metal materials in SLS equipment opens up a wide range of application opportunities across various industries, including aerospace, automotive, healthcare, and industrial manufacturing. Metal parts produced using SLS technology are required to meet stringent requirements for strength, durability, and performance, making them suitable for end-use applications in demanding environments.

The plastic segment is expected to grow at a significant CAGR from 2024 to 2030. The ability to produce highly customized and functional prototypes using SLS with plastic materials is a significant driver. Companies across various industries leverage SLS equipment to rapidly prototype parts with complex geometries, enabling faster product development cycles and facilitating design optimization before mass production.

Laser Type Insights

The gas laser type segment held the largest revenue share in 2023. Gas lasers offer versatility in material processing, enabling the sintering of a wide range of materials, including polymers, metals, ceramics, and composites. This versatility allows SLS equipment with gas lasers to cater to diverse industries and applications, thereby expanding its market potential.

The demand for solid laser type segment is expected to grow at a substantial CAGR from 2024 to 2030 in terms of revenue. Solid-state lasers exhibit greater reliability and durability compared to gas lasers, as they have fewer moving parts and require less maintenance. Their solid-state construction ensures long-term stability and consistent performance, minimizing downtime and maximizing productivity in SLS manufacturing processes.

Technology Insights

The industrial printer technology segment held the largest share in 2023. Industrial SLS printers typically feature large build volumes, allowing for the production of large and complex parts in a single build. This scalability enables manufacturers to optimize production efficiency and accommodate diverse part sizes and geometries, making industrial SLS printers suitable for a wide range of applications.

The demand for desktop printer technology segment is expected to grow at a significant CAGR from 2024 to 2030 in terms of revenue. Desktop SLS printers offer a more accessible and cost-effective entry point into additive manufacturing compared to larger industrial systems. These printers are typically more affordable and require less space, making them suitable for small businesses, research labs, educational institutions, and other applications.

End-use Insights

The automotive segment dominated the market and accounted for 23.1% in 2023. The automotive industry is increasingly focused on lightweight vehicles to improve fuel efficiency and reduce emissions. SLS technology enables the production of lightweight, yet durable components by using advanced materials like carbon fiber-reinforced polymers and metal alloys. These lightweight parts contribute to overall vehicle weight reduction, enhancing fuel efficiency and sustainability.

The healthcare application segment is projected to grow at a lucrative CAGR over the forecast period. SLS equipment can process a wide range of biocompatible materials suitable for healthcare applications, including medical-grade polymers, ceramics, and metals. These materials offer biocompatibility, sterilizability, and mechanical properties necessary for medical device manufacturing, ensuring safety and efficacy in clinical settings.

Regional Insights

North America dominated the market and accounted for 36.3% in 2023. The region boasts a mature and advanced manufacturing ecosystem, particularly in industries such as aerospace, automotive, healthcare, and consumer goods. The demand for innovative manufacturing technologies like SLS is driven by the need for rapid prototyping, customization, and production of complex components, aligning well with the capabilities of SLS equipment.

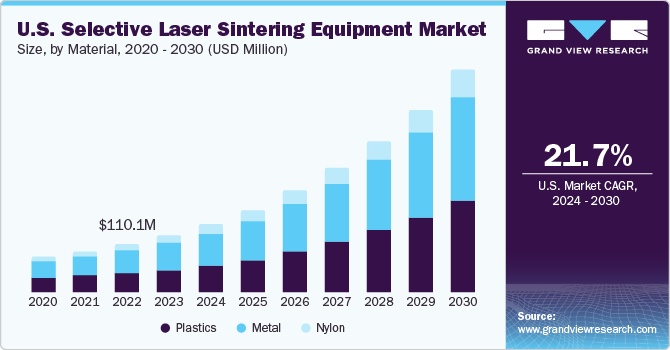

U.S. Selective Laser Sintering Equipment Market Trends

The market in the U.S. is projected to grow at a CAGR of 21.7% from 2024 to 2030. The U.S. has a diverse and strong manufacturing base across various industries, including aerospace, automotive, healthcare, and consumer goods. The demand for customized, lightweight, and complex components within these industries fuels the adoption of SLS equipment for rapid prototyping and low-volume production, contributing to market expansion.

The selective laser sintering equipment market in Canada is anticipated to witness lucrative growth over the forecast period. The Canadian government initiatives and funding programs support the adoption of advanced manufacturing technologies. Programs such as the Strategic Innovation Fund (SIF) and the National Research Council's Industrial Research Assistance Program (NRC IRAP) provide financial incentives and resources for research and development, fostering the growth of the market.

Europe Selective Laser Sintering Equipment Market Trends

The market in Europe is anticipated to witness lucrative growth from 2024 to 2030. European manufacturers are embracing digitalization and Industry 4.0 principles to enhance productivity, efficiency, and flexibility. SLS equipment, with its capability for on-demand production, digital integration, and customization, aligns well with the goals of Industry 4.0, driving its adoption among European manufacturers.

The Germany selective laser sintering equipment market is expected to grow significantly at a CAGR of 25.2%. Germany has a long-standing tradition of precision manufacturing and engineering excellence. This tradition fosters a conducive environment for the adoption of advanced manufacturing technologies such as SLS, as German manufacturers prioritize quality, efficiency, and innovation in their production processes.

The selective laser sintering equipment market in UK held a significant share in the European market owing to the rising demand from end-use industries. The UK possesses a strong and diverse manufacturing sector, with significant contributions from industries such as aerospace, automotive, healthcare, and consumer goods. The demand for advanced manufacturing technologies like SLS is driven by the need for rapid prototyping, customization, and production of complex components within these industries.

Asia Pacific Selective Laser Sintering Equipment Market Trends

Asia Pacific selective laser sintering equipment is expected to register the fastest CAGR of 27.3% over the forecast period. The Asia Pacific region is experiencing rapid industrialization and manufacturing growth, driven by emerging economies such as China, India, Japan, South Korea, and Taiwan. As these countries continue to invest in advanced manufacturing technologies, including additive manufacturing, the demand for SLS equipment is expected to rise significantly.

The China selective laser sintering equipment market is estimated to grow at a lucrative CAGR over the forecast period. The Chinese government actively promotes advanced manufacturing technologies through strategic initiatives such as ‘Made in China 2025’ and the ‘Internet Plus’ action plan. These initiatives aim to enhance domestic manufacturing capabilities, foster innovation, and drive the adoption of additive manufacturing technologies such as SLS equipment across various industries.

The selective laser sintering equipment market in India is projected to grow at an exceptional growth rate during the forecast period. The expansion of key industries such as automotive, aerospace, healthcare, and electronics in India has created a demand for advanced manufacturing technologies. These industries require customized and lightweight components, which can be efficiently produced using SLS equipment.

Central & South America Selective Laser Sintering Equipment Market Trends

The market in Central & South America is estimated to grow rapidly over the coming years. The Central and South America region is experiencing rapid industrialization and economic growth, leading to the development of a burgeoning manufacturing sector. As industries such as automotive, aerospace, healthcare, and consumer goods expand in the region, there is a growing demand for advanced manufacturing technologies, including SLS, to meet production needs.

Middle East & Africa Selective Laser Sintering Equipment Market Trends

The market in the Middle East & Africa is experiencing rapid development due to ongoing industrialization and urbanization. As the demand for additive manufacturing technologies grows in the MEA region, there is a need to develop a skilled workforce capable of operating and maintaining SLS equipment effectively. Training programs, vocational courses, and educational initiatives focused on additive manufacturing help address this need and support the growth of the market in the region.

Key Selective Laser Sintering Equipment Company Insights

Some of the key players operating in the selective laser sintering equipment market include 3D Systems Inc., EOS GmbH, and Farsoon Technologies.

-

3D Systems Inc. has been at the forefront of technological advancements in the industry for several decades. The company offers a comprehensive portfolio of 3D printing solutions, including SLS equipment. Its SLS machines are known for their reliability, accuracy, and versatility, catering to a wide range of applications across industries such as aerospace, automotive, healthcare, and consumer goods.

-

EOS GmbH specializes in developing and manufacturing high-quality 3D printers and materials for industrial applications. Its portfolio includes a wide range of SLS and DMLS systems capable of producing complex geometries and functional parts with high precision and reliability.

Prodways Group; Formlabs Inc.; and Ricoh Company Ltd are some of the emerging market participants in the market.

-

Prodways Group has expertise in various applications of additive manufacturing, including prototyping, tooling, and end-use part production. It collaborates closely with customers to understand their specific requirements and deliver customized solutions tailored to their needs.

-

Formlabs offers a diverse range of 3D printers, including the Form series and Form 3D printers, catering to different application needs and budgets. Additionally, the company provides a wide selection of resin materials optimized for various applications, from engineering prototypes to dental models.

Key Selective Laser Sintering Equipment Companies:

The following are the leading companies in the selective laser sintering equipment market. These companies collectively hold the largest market share and dictate industry trends.

- 3D Systems Inc.

- EOS GmbH

- Farsoon Technologies

- Prodways Group

- Formlabs Inc.

- Ricoh Company Ltd

- Concept Laser GmbH (General Electric)

- Renishaw PLC

- Sinterit Sp. Zoo

- Sintratec AG

- Sharebot SRL

- Red Rock SLS

- Natural Robotics

- Z Rapid Tech

- Aerosint

Recent Developments

-

In June 2022, 3D Systems and EMS GRILTECH announced a strategic partnership to enhance additive manufacturing materials development. Both companies planned to introduce a novel nylon copolymer DuraForm PAx Natural- designed to be used with any commercially-available selective laser sintering (SLS) printer.

Selective Laser Sintering Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 692.3 million

Revenue forecast in 2030

USD 2.5 billion

Growth rate

CAGR of 23.7% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, laser type, technology, end-use, region

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Singapore; Brazil

Key companies profiled

3D Systems Inc.; EOS GmbH; Farsoon Technologies; Prodways Group; Formlabs Inc.; Ricoh Company Ltd; Concept Laser GmbH (General Electric); Renishaw PLC; Sinterit Sp. Zoo; Sintratec AG; Sharebot SRL; Red Rock SLS, Natural Robotics; Z Rapid Tech; Aerosint

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Selective Laser Sintering Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global selective laser sintering equipment market report based on material, laser type, technology, end-use, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Metal

-

Plastics

-

Nylon

-

-

Laser Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Solid Laser

-

Gas Laser

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Desktop Printer

-

Industrial Printer

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Aerospace & Defense

-

Healthcare

-

Electronics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Singapore

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global selective laser sintering equipment market size was estimated at USD 572.6 million in 2023 and is expected to reach USD 692.3 million in 2024.

b. The selective laser sintering equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 23.7% from 2024 to 2030 to reach USD 2.5 billion by 2030.

b. North America dominated the global selective laser sintering equipment market and accounted for a 36.3% share, in terms of revenue, in 2023. North America boasts a mature and advanced manufacturing ecosystem, particularly in industries such as aerospace, automotive, healthcare, and consumer goods. The demand for innovative manufacturing technologies like SLS is driven by the need for rapid prototyping, customization, and production of complex components, aligning well with the capabilities of SLS equipment.

b. Some of the key players operating in the selective laser sintering equipment market include 3D Systems Inc., EOS GmbH Electro Optical Systems, Farsoon Technologies, Prodways Group, Formlabs Inc., Ricoh Company Ltd, Concept Laser GmbH (General Electric), Renishaw PLC, Sinterit Sp. among others.

b. The increasing demand for customization and personalization across various industries is a significant driver for the selective laser sintering equipment market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."