- Home

- »

- Agrochemicals

- »

-

Seed Coating Market Size, Share & Trends Report, 2030GVR Report cover

![Seed Coating Market Size, Share & Trends Report]()

Seed Coating Market Size, Share & Trends Analysis Report By Form (Powder, Liquid), By Additive (Polymers, Colorants), By Crop Type, By Process, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-363-6

- Number of Report Pages: 200

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

Seed Coating Market Size & Trends

The global seed coating market size was estimated at USD 2.0 billion in 2023 and is projected to grow at a CAGR of 8.8% in terms of revenue from 2024 to 2030. The market driven by driven by rising demand for high-quality seeds that offer better yield, disease resistance, and improved germination rates. The growing global population has led to an increased demand for food production. Seed coating materials help improve seed performance, protect against pests and diseases, and enhance crop yields. The need to meet the food demands of a growing population has driven the adoption of seed coating. Technological advancements in agriculture related practices have further contributed to the growth of the market.

Seed coating helps improve seed uniformity by giving them a consistent size, shape, and weight. This uniformity facilitates easier planting and ensures even distribution in the field, improving crop performance. They also act as a protective barrier, shielding seeds from external elements such as excess moisture, dust, and diseases. Coatings can contain fungicides, insecticides, or beneficial microorganisms that help prevent damage caused by pests and pathogens.

The rising demand for high-value commercial crops, such as fruits, vegetables, and specialty grains, has led to the increased use of seed coating. Coatings help improve the quality and marketability of these crops, leading to higher yields and better returns for farmers. Technological advancements in coating materials, such as polymers and nanomaterials, have expanded the application possibilities. These advancements have improved the effectiveness and efficiency of seed coating, driving its adoption in the market.

Stringent regulations imposed on the use of chemicals can pose challenges for market growth. Compliance with these regulations requires careful formulation and adherence to safety standards, which can increase costs and limit the availability of certain coating materials. The use of non-biodegradable coating materials can raise environmental concerns, particularly regarding waste management and pollution. There is a growing need for sustainable coating materials that minimize environmental impact and align with the principles of circular agriculture.

Form Insights

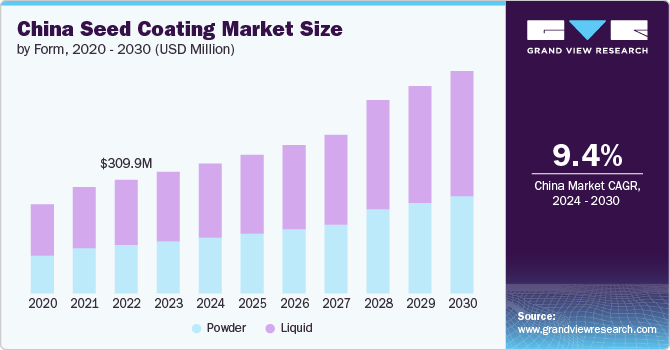

“Powder emerged as the fastest growing form with a CAGR of 9.2%”

Liquid coatings dominated the market and accounted for a revenue share of approximately 57.3% in 2023. Their effectiveness in protecting against diseases, pests, and environmental factors, along with other benefits such as enhanced seed germination, improvement in seedling vigor, and uniform coverage, play a key role in driving utilization. Moreover, these coatings can be easily applied using specialized equipment, ensuring precise and uniform coating. They are designed to enhance seed treatment efficiency, promote establishment, and protect against diseases.

Powder coatings involve applying dry, powdered materials to the surface of seeds. These coatings can be made from polymers, colorants, minerals, and active ingredients. They protect against diseases, pests, and environmental stressors. They also enhance seed performance, improve flowability, and facilitate uniform seed distribution during planting. Additionally, powder coatings can be easily applied using specialized equipment, ensuring efficient and precise seed coating.

Additive Insights

“Polymers emerged as the fastest growing additive with a CAGR of 9.1%”

Polymers dominated the market and accounted for a revenue share of approximately 31.7% in 2023. Polymers are used in seed coating to enhance the performance and protection of seeds. They provide a protective layer around the seed, which helps prevent damage from pathogens, pests, and environmental factors. Polymers also improve the appearance and nutritional value of products. They improve the germination process, enhance the physio-morphological attributes, and contribute to higher crop yields. Polymers also play a crucial role in seed establishment and restoration of degraded agricultural systems.

Colorants are another important additive segment in the market. They are used to add color to seed coating, making it easier to identify and differentiate products. Colorants can be natural or synthetic and are typically applied as powders or liquids. They are mixed with other coating materials and applied to the surface. The use of colorants in seed coating serves multiple purposes. Colorants can also indicate the presence of specific treatments or additives in the seed coating, such as pesticides or fungicides.

Binders adhere the coating materials to the seed surface, ensuring the coating remains intact and providing the desired protection and benefits. They act as a binding agent, helping the coating materials stick to the seed and form a cohesive layer. The incorporation of binders offers several advantages. They improve the durability and longevity of the coating, preventing it from quickly wearing off during handling and planting. Binders also contribute to the overall strength and stability of the coating, ensuring that it remains intact even under adverse environmental conditions.

Crop Type Insights

“Cereals & Grains emerged as the fastest growing crop type with a CAGR of 9.5%”

Cereals & Grains dominated the market and accounted for a revenue share of 37.3% in 2023. Cereals and grains, such as maize, rice, wheat, sorghum, and other grains, are widely consumed as essential food sources worldwide. The demand for coated seeds in this segment is increasing due to the need to expand output to sustain the growing population. Coating cereals & grains with chemicals helps improve crop yields, protect against seed diseases, and enhance performance.

Fruits and vegetables play a crucial role in our daily diets and are in high demand for both consumption and commercial purposes. This segment has various sub-segments, such as cucurbits, roots and bulbs, brassicas, solanaceae, leafy vegetables, and other fruits and vegetables. Seed Coating in this segment helps improve germination, protect against pests and diseases, and enhance overall crop performance.

The oilseeds & pulses segment is a prominent crop type segment in the market. This segment includes grains primarily grown to extract edible oil, such as soybeans, sunflower, canola, and other oilseeds. Pulses, which are members of the pea family, have a higher protein content and are also included in this segment. Coating in this segment helps improve seed quality, protect against pests and diseases, and enhance crop productivity.

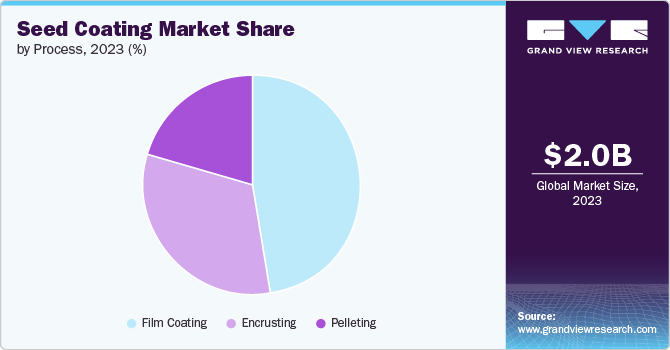

Process Insights

“Encrusting emerged as the fastest growing process with a CAGR of 9.2%”

Film coating dominated the market and accounted for a revenue share of 47.4% in 2023. In this process, a thin water-permeable polymer-based coating is applied to the seed or pellet, providing benefits such as improved appearance, reduced dust-off, and enhanced market attractiveness. Film coating allows for incorporating colorants, coverage characteristics, opacities, and finishes, providing flexibility in options. This process helps protect products from diseases and insect pests at all stages of development, contributing to improved crop health and yield.

Encrusting is another process segment in the market. Similar to seed pelleting, encrusting involves coating with a layer that increases their size, weight, and uniformity while retaining more of their original shape compared to pelleting. The encrusting process helps improve planting efficiency and accuracy by providing more significant, uniform product sizes. It also allows for the inclusion of crop protection products, nutrients, and biologicals within the coating.

Pelleting is a widely used process segment in the market. In this process, seeds are surrounded by a shell or coating, increasing their size and weight. Pelleting offers several advantages, including faster and more efficient sowing, improved handling and flowability of seeds, and the ability to incorporate active ingredients for seed protection. The coating in pelleted products acts as a carrier for protection and nutritional products, providing added benefits to the plants.

Regional Insights

“North America emerged as the fastest growing market with a CAGR of 9.3% from 2024-2030”

North America seed coating market has a well-established market for seed coating materials, with widespread awareness of the benefits of seed coating in key crop-producing economies such as the U.S. and Canada. The favorable regulatory scenario associated with coloring seeds after they have been treated has further boosted the market's growth in the region.

Asia Pacific Seed Coating Market Trends

The seed coating market of Asia Pacific dominated the market and accounted for a 40.5% share in 2023. The region's dominance can be attributed to several factors. Firstly, countries like China and India have a strong agricultural sector, with extensive farming practices. The increased usage of crop protection products and technologies in these countries has contributed to the growth of the seed coating materials industry. Additionally, the growing concern about food security as the regional population expands has further fueled the demand for these agricultural products.

China seed coating market is dominant within the Asia Pacific region. Chinese farmers have increasingly used technology to elevate crop quality, boost yields, and reduce pesticide reliance. This adoption trend has propelled the growth of the market in China. The increased planting of crops like corn and soybeans in emerging markets such as China has also driven the demand for polymer seed coating.

Europe Seed Coating Market Trends

The seed coating market of Europe has a well-developed agricultural sector known for its advanced farming practices. The market in Europe is driven by factors such as high awareness about its benefits, favorable regulatory scenarios, and the presence of key market players. Europe is one of the key regions where agricultural treatment products are extensively used, and diverse landscapes and various application segments characterize the market.

Key Seed Coating Company Insights

The competitive landscape of the global market is characterized by key players and their strategic initiatives, market trends, consolidation, and other significant effects. The elevating trend of using organic food production and sustainable farming practices is an essential factor fueling the demand for seed coating. Additionally, the inflating usage of low-impact and natural product variants contributes to the market's growth. The extensive applications of these products in modern farming practices to enhance crop quality further augment the global market.

-

Solvay is a public limited company and is involved in the development of sustainable, cleaner, and safer technological solutions. The company manufactures products such as additives and polymers that find applications in markets such as automotive, agriculture, aerospace, consumer goods, building & construction, oil & gas, coatings, and mining, as well as the food and feed industries. It completed the acquisition of Bayer’s seed coatings business in 2021.

-

BASF SE is a chemical production company based in Germany and offers products to several end-use industries, including agriculture, chemicals, construction, electronic & electric, energy & resources, pharmaceuticals, and automotive & transportation. The company offers seed coatings under its agriculture business segment with brands such as Sepiret, Flo Rite, Secompla and Color Coat.

-

CLARIANT produces, develops, and distributes its specialty chemicals to various end-use markets such as coatings, paints & inks, digital printing, electronics, and others. The company provides wax ingredients to be used in seed coatings in its range of renewable solutions. It offers Licocare RBW as a solution for customers seeking agricultural coating products.

Key Seed Coating Compound Companies:

The following are the leading companies in the seed coating market. These companies collectively hold the largest market share and dictate industry trends.

- Solvay

- BASF SE

- Croda International Plc

- Clariant

- DSM

- Precision Laboratories LLC

- Chromatech Incorporated

- Germains Seed Technology

- Universal Coating Systems

- Michelman Inc.

Recent Developments

-

In December 2023, Inera Cropscience unveiled its latest range of next generation bio stimulants and seed coating offering in COP28 summit. The product is aimed at setting up new benchmark for bio stimulant performance to improve crop quality and yield.

-

In November 2023, Lucent Bio announced that it managed to secure funding of USD 3.6 million via PacificCan through its productivity and business scale-up program. The funding would be used to develop Nutreos, a biodegradable innovative seed treatment technology applied to promote crop establishment and strong germination.

Seed Coating Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.12 billion

Revenue forecast in 2030

USD 3.52 billion

Growth rate

CAGR of 8.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Volume and Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, additive, crop type, process, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Solvay; BASF SE; Croda International Plc; Clariant; DSM; Precision Laboratories LLC; Chromatech Incorporated; Germains Seed Technology; Universal Coating Systems; Michelman Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Seed Coating Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global seed coating market report based on form, additive, process, crop type, and region.

-

Form Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Powder

-

Liquid

-

-

Additive Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Polymers

-

Colorants

-

Binders

-

Minerals

-

Active Ingredients

-

Other Additives

-

-

Crop Type Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Cereals & Grains

-

Oilseeds & Pulses

-

Fruits & Vegetables

-

Flowers & Ornamentals

-

Other Crop Types

-

-

Process Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Film Coating

-

Encrusting

-

Pelleting

-

-

Regional Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global seed coatings market size was estimated at USD 2.0 billion in 2023 and is expected to reach USD 2.12 billion in 2024.

b. The global seed coatings market is expected to grow at a compound annual growth rate of 8.8% from 2024 to 2030 to reach USD 3.52 billion by 2030.

b. Asia Pacific dominated the seed coatings market with a share of 40.5% in 2023. This is attributable to increased usage of crop protection products and technologies in these countries and growing concern about food security in the region.

b. Some key players operating in the seed coatings market include Solvay, BASF SE, Croda International Plc, Clariant, DSM, Precision Laboratories LLC, Chromatech Incorporated, Germains Seed Technology, Universal Coating Systems and Michelman Inc.

b. Key factors that are driving the market growth include an increased demand for food production because of growing global population. Technological advancements in agriculture-related practices have further contributed to the seed coating market's growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."