Security Robots Market Size, Share & Trends Analysis Report By Type, By End-user (Military & Defense, Residential, Commercial), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-272-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Security Robots Market Size & Trends

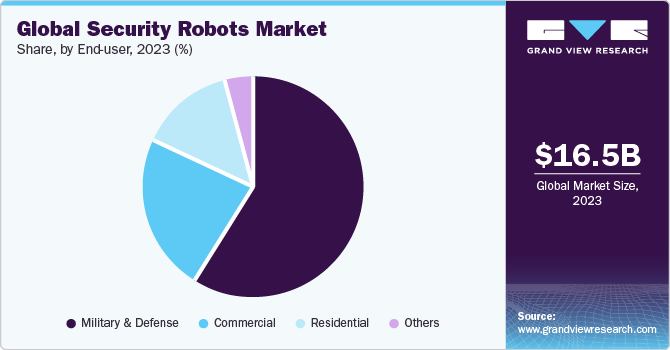

The global security robots market size was estimated at USD 16.54 billion in 2023 and is expected to grow at a CAGR of 14.9% from 2024 to 2030. The increasing allocation to defense budgets by governments worldwide drives the demand for security robots. According to the Stockholm International Peace Research Institute, the world's military expenditure increased by 3.7% in 2022, reaching a record high of USD 2,240 billion.

The growing use of security robots in commercial applications, such as retail, hospitality, and healthcare, is also driving market growth by expanding demand beyond traditional defense and law enforcement sectors. Security robots rapidly evolve due to technological developments such as artificial intelligence (AI), machine learning, sensor technology, and autonomous navigation. Incorporating AI and machine learning algorithms enables security robots to perform various tasks with increased efficiency, accuracy, and autonomy.

Sensor technology helps enhance security robots' perception and situational awareness capabilities, while autonomous navigation technologies enable them to navigate autonomously in active environments. For instance, in February 2024, Knightscope, Inc., a company specializing in robotics and artificial intelligence (AI) technologies for public safety, announced the deployment of two more K5 Autonomous Security Robots. The company's proprietary AI software powers these robots.

Security companies are increasingly utilizing robots due to security personnel and labor shortages. A growing emphasis on maintaining strong security measures, particularly in retail, hospitality, and manufacturing sectors, makes reliable and cost-effective security solutions essential. This shift towards robotic solutions helps mitigate the impact of labor shortages, enhances operational efficiency, improves response times, and ensures consistent security protocols, driving the adoption of security robots. For instance, in November 2023, Amazon announced the expansion of Astro's capabilities to operate as a security guard for stores to detect break-ins and other potential threats. They introduced a new version of the household robot called Astro for Business, designed to help prevent crime in retail, manufacturing, and other industries.

Acquiring and deploying security robots often involves substantial upfront investment costs. Purchasing sophisticated robotics hardware and implementing supporting infrastructure and software is relatively inexpensive for some organizations. Additionally, ongoing costs may be associated with maintenance, upgrades, and training, further adding to the total cost of ownership. These high initial investment costs may deter some potential buyers from adopting security robots, particularly smaller businesses with limited budgets.

Furthermore, the COVID-19 pandemic had a negative impact on the security robot market. Lockdown measures and reduced physical operations lowered the immediate need for security personnel and surveillance solutions. Supply chain disruptions further delayed the production and deployment of security robots.

Market Concentration & Characteristics

The security robots industry growth stage is high and the pace of growth is accelerating. The market is significantly fragmented, owing to the presence of large number of players worldwide. The industry is characterized by an active and rapidly evolving landscape driven by technological advancements, diverse applications, and a supportive ecosystem.

The security robotics industry is highly competitive, with numerous players offering various products and services. This competition drives innovation and encourages companies to develop more advanced and efficient solutions to stay ahead of their competitors. Moreover, partnerships, collaborations, investments, research grants, and mergers and acquisitions are common strategies companies employ to expand their industry presence, address new market segments, and capitalize on emerging opportunities in the rapidly evolving security robots market. For instance, in September 2023, AeroVironment, Inc. acquired Tomahawk Robotics. The acquisition allows security forces to operate various interconnected robotic solutions on the battlefield with one joint controller. Tomahawk Robotics became a part of AeroVironment’s Unmanned Systems business unit.

Type Insights

Based on type, the market is bifurcated into unmanned aerial vehicle (UAV), unmanned ground vehicle (UGV), and unmanned underwater vehicle (UUV). The UAV segment accounted for the largest revenue share of 64.7% in 2023, owing to the increasing demand for enhanced security measures and cost-effective solutions, fueling the adoption of UAVs in various security operations. UAVs are increasingly used against illegal smuggling and immigration, as well as other security issues.

The UUV segment is anticipated to witness significant growth during the forecast period. Governments, coast guards, and maritime security agencies are investing in UUVs to strengthen maritime security capabilities due to increased maritime threats such as piracy, smuggling, and illegal fishing. For instance, in March 2023, Hydroid, an underwater technology company based in the US and a subsidiary of shipbuilding firm Huntington Ingalls Industries (HII), launched The REMUS 300. It is a new unmanned underwater vehicle (UUV) designed for military and commercial applications.

End-user Insights

Based on end-user, the market is divided into military & defense, residential, commercial, and others. The military & defense segment accounted for the largest revenue share in 2023. The increasing emphasis on enhancing military capabilities and readiness in response to evolving security threats, including asymmetric warfare, terrorism, and geopolitical tensions, is driving demand for advanced security robots.

The residential segment is anticipated to witness significant growth during the forecast period. The rising concerns about property crime, burglary, and home invasion intensified homeowners' demand for advanced security solutions. Moreover, the increasing adoption of smart home technologies and connected devices created opportunities for integrating security robots into residential ecosystems. Security robots integrate with smart home platforms, such as security cameras, motion sensors, and smart locks, to provide a comprehensive and interconnected security solution.

Application Insights

The patrolling segment accounted for the largest revenue share in 2023. Integrating analytics and AI algorithms enables security robots to analyze sensor data, identify patterns, and predict potential security threats, further enhancing their proactive patrolling capabilities. In September 2023, Ascento, a robotics start-up, launched an autonomous outdoor security patrolling robot. The robot is designed to address the shortage of security guard personnel and improve security providers' businesses by reducing costs and enhancing security.

The rescue operations segment is anticipated to witness significant growth during the forecast period owing to security robots' ability to access confined spaces, navigate rough terrain, and operate in hazardous conditions, enhancing the efficiency and effectiveness of rescue operations and enabling responders to reach survivors more quickly and efficiently. For instance, in October 2023, DEEP Robotics Company launched its flagship product, the X30 quadruped robot. The robot is designed to fulfill industry needs in various fields, including power station inspection, pipeline corridor inspection, factory inspection, fire detection, emergency rescue, scientific research, etc.

Regional Insights

North America dominated the industry with a share of 37.5% in 2023, owing to the increasing emphasis on enhancing security measures across various sectors, including government, defense, commercial, and critical infrastructure, which is driving the adoption of security robots. The growing adoption of automation and robotics technologies across industries in North America is fueling demand for security robots.

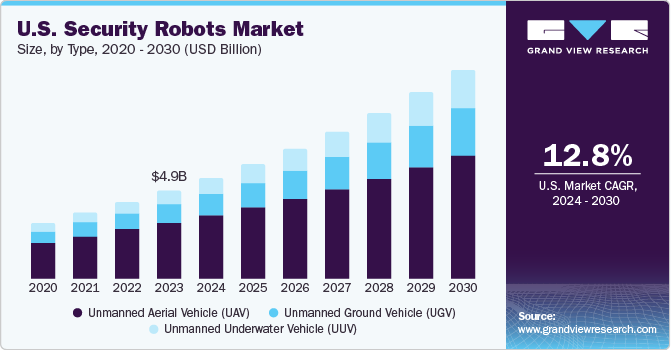

U.S. Security Robots Market Trends

The U.S. accounted for 30.0% of the global security robots market in 2023. The increasing funding and investment opportunities for security robot companies in North America are accelerating market growth. Venture capital firms, government agencies, and private investors are funding startups and companies developing innovative security robot technologies. For instance, in August of 2023, Markus Nemitz, a researcher at Worcester Polytechnic Institute (WPI), a U.S.-based engineering and technology university, was awarded a grant of around USD 600,000 by the National Science Foundation, U.S. A low-cost, customizable 3D printable soft robots are being developed using the grant. These robots are suitable for search and rescue operations due to their flexible movement capabilities.

Asia Pacific Security Robots Market Trends

The security robots market in the Asia Pacific is expected to witness the fastest CAGR over the forecast period, owing to the increasing focus on enhancing security measures in response to rising security threats and geopolitical tensions. Countries in the region face diverse security challenges, including terrorism, border disputes, organized crime, and cybersecurity threats. In response, governments and organizations are investing in advanced security technologies, including security robots, to strengthen security infrastructure, protect critical assets, and safeguard public safety.

The security robots market in China is expected to grow over the forecast period due to increasing emphasis on leveraging technology to enhance security measures and address public safety concerns. With rapid urbanization, population growth, and economic development, China faces diverse security challenges, including crime prevention, traffic management, and public order maintenance. This native innovation is driving the domestic security robot market's growth while positioning Chinese companies as leading players in the global robotics industry.

The India security robots market is expected to grow over the forecast period owing to favorable government initiatives, increasing investments in infrastructure development, and a growing focus on safety and security. For instance, in December 2023, Svaya Robotics collaborated with DRDO Labs and Defense Bio-engineering & Electro Medical Laboratory to develop India's first quadruped robot and wearable exoskeleton. This initiative aligns with DRDO's "Make in India" program, which aims to create indigenous robotics technology for the defense and security sectors.

Middle East & Africa Security Robots Market Trends

The security robots market in MEA is expected to grow over the forecast period. The government's strong emphasis on enhancing security measures and infrastructure to safeguard citizens, residents, and critical assets drives the adoption of security robots. In January 2024, Milrem Robotics, a subsidiary of Edge Group, signed a contract with the UAE government. As per the agreement, Milrem Robotics will supply the UAE military with 60 robotic combat vehicles and unmanned ground vehicles.

Key Security Robots Company Insights

Some of the key players operating in the market include Knightscope, Inc.; ReconRobotics; and Yokogawa Electric Corporation:

-

Knightscope, Inc. specializes in offering autonomous security robots that integrate self-driving technology, robotics, artificial intelligence (AI), and electric vehicles to bolster security measures. The company's objective is to aid in safeguarding properties, reducing expenses, and enhancing the efficiency and safety of security personnel.

-

ReconRobotics specializes in developing tactical micro-robots and personal sensor systems that enhance safety in hazardous environments. The company offers two main product lines, Recon Scout and Throwbot, and several conversion kits, such as the RXL, CT, and Deluxe kits, that extend the capabilities of existing Throwbot models.

-

Yokogawa Electric Corporation offers advanced measurement, control, and information solutions across various industries. The company also develops robotics for inspecting hazardous environments. It provides solutions that enable the adoption of industrial robots and drones for autonomous operations, addressing challenges such as safety risks and human limitations in tasks.

Key Security Robots Companies:

The following are the leading companies in the security robots market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- AeroVironment, Inc.

- BAE Systems

- Boston Dynamics

- Elbit Systems Ltd.

- Enova Robotics

- Fuji Electric Co., Ltd.

- Hitachi, Ltd.

- Honeywell International Inc

- Knightscope, Inc.

- ReconRobotics

- Yokogawa Electric Corporation

Recent Developments

-

In February 2024, Boston Dynamics partnered with Zepth, an India-based construction management software provider, to deploy their robotic dogs at a construction site to revolutionize project oversight and safety protocols. The robotic dogs are designed to streamline operations at construction sites by generating 3D models, conducting surveillance, and identifying potential risks.

-

In June 2022, the Nippon Foundation announced a contract with Mitsubishi Heavy Industries and Yokogawa Electric Corporation for a project that aims to promote decarbonization in the offshore oil and natural gas sector. The project aims to develop an automatic inspection system using robots to determine and predict hazards in offshore facilities.

-

In February 2021, AeroVironment, Inc., a California, U.S.-based firm specializing in designing and producing unmanned aircraft systems (UAS), acquired Intelligent Systems Group (ISG) from Progeny Systems Corporation. This strategic acquisition is poised to significantly enhance AeroVironment's capacity to innovate advanced autonomy functionalities across its expanding portfolio of intelligent, multi-domain robotic systems.

Security Robots Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 19.21 billion |

|

Revenue forecast in 2030 |

USD 44.31 billion |

|

Growth rate |

CAGR of 14.9% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, end-user, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; U.K.; Germany; France; Italy; China; India; Japan; South Korea; Australia; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

ABB, AeroVironment Inc.; BAE Systems; Boston Dynamics; Elbit Systems Ltd.; Enova Robotics; Fuji Electric Co. Ltd.; Hitachi Ltd.; Honeywell International Inc.; Knightscope Inc.; ReconRobotics; Yokogawa Electric Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Security Robots Market Report Segmentation

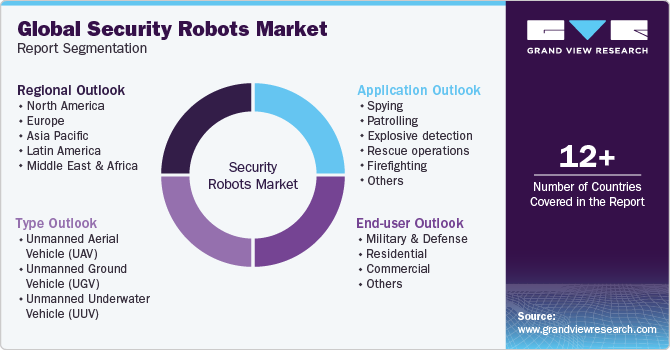

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global security robots marketreport based on type, application, end-user, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Unmanned Aerial Vehicle (UAV)

-

Unmanned Ground Vehicle (UGV)

-

Unmanned Underwater Vehicle (UUV)

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Spying

-

Patrolling

-

Explosive detection

-

Rescue operations

-

Firefighting

-

Others

-

-

End-user Outlook (Revenue, USD Billion, 2018 - 2030)

-

Military & defense

-

Residential

-

Commercial

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global security robots market size was estimated at USD 16.54 billion in 2023 and is expected to reach USD 19.21 billion in 2024

b. The global security robots market is expected to grow at a compound annual growth rate of 14.9% from 2024 to 2030 to reach USD 44.31 billion by 2030

b. North America dominated the security robots market with a share of 37.5% in 2023, owing to the increasing emphasis on enhancing security measures across various sectors, including government, defense, commercial, and critical infrastructure, is driving the adoption of security robots.

b. Some key players operating in the security robots market are ABB, AeroVironment, Inc., BAE Systems, Boston Dynamics, Elbit Systems Ltd., Enova Robotics, Fuji Electric Co., Ltd., Hitachi, Ltd., Honeywell International Inc., Knightscope, Inc., ReconRobotics, Yokogawa Electric Corporation

b. Factors such as rising security concerns worldwide and increasing adoption of automation and AI technologies across industries is driving the market growth

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."