Security Automation Market Size, Share & Trends Analysis Report By Offering (Solutions, Services), By Technology (AI & ML, RPA), By Deployment Mode, By Application, By Code, By Vertical, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-324-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Security Automation Market Size & Trends

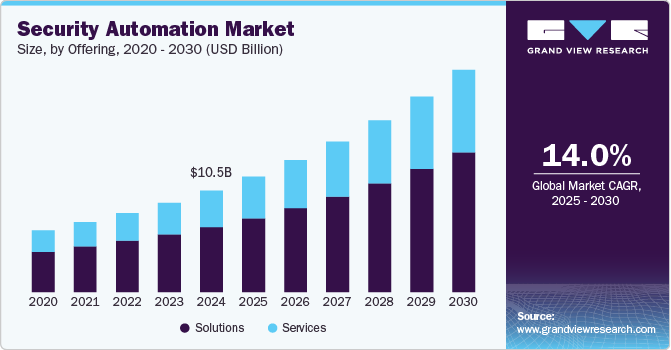

The global security automation market size was estimated at USD 10.45 billion in 2024 and is projected to grow at a CAGR of 14.0% from 2025 to 2030. This growth is driven by the increasing frequency and complexity of cyber-attacks, compelling organizations to adopt advanced security automation solutions to protect sensitive information. Technological advancements in AI, ML, and big data analytics are enhancing the effectiveness of these tools. In addition, stringent regulatory compliance requirements and the growing adoption of IoT and cloud services are expanding the demand for robust security measures.

The shortage of skilled cybersecurity professionals further drives organizations towards automation to manage security operations efficiently. Security automation also offers cost and operational efficiency by automating repetitive tasks and streamlining processes, while increased investment in IT infrastructure supports the integration of these advanced tools.

The rising incidents of phishing emails and ransomware are significantly driving the growth of the security automation industry. Phishing attacks have become more frequent, outpacing traditional security measures. For instance, according to the Cyber Security Breaches Survey 2024, phishing remains the most prevalent form of cyberattack in the UK, affecting 84% of businesses and 83% of charities. Automated security solutions leverage advanced algorithms and machine learning to analyze email patterns, detect anomalies, and block phishing attempts more effectively. In addition, these tools help mitigate employee vulnerability by training staff through simulated phishing attacks and providing real-time protection by automatically identifying and quarantining suspicious emails. Ransomware attacks, known for their high financial and operational impact, further compel organizations to invest in automated security solutions. These tools enable swift detection and response, isolating affected systems, initiating backup recovery, and deploying countermeasures without human intervention, thereby minimizing damage and downtime.

Advancements in quantum computing are creating significant opportunities for the security automation industry, specifically in mitigating quantum-based attacks. The development of quantum-resistant algorithms is essential as quantum computers could potentially break traditional encryption methods. Security automation tools can incorporate these new algorithms, ensuring data security in a quantum era. Automated cryptography updates can further reduce vulnerabilities from outdated encryption methods. Quantum computing enhances security analytics, enabling threat detection and real-time response. In addition, simulating quantum-based attacks helps organizations proactively address vulnerabilities. Increased investment in R&D for quantum-safe solutions promotes innovation in security automation, while collaborative efforts drive new standards.

Offering Insights

The solutions segment led the market and accounted for over 63% of the global revenue in 2024. The segment's growth is attributed to its comprehensive threat detection and response capabilities, automation of security operations, efficiency, scalability, and integration with existing security infrastructure. For instance, Palo Alto Networks' Cortex XDR platform automates security operations by providing advanced threat detection capabilities, which are crucial for addressing evolving cybersecurity challenges. These solutions also facilitate regulatory compliance and reporting while offering advanced threat detection capabilities, specifically evident in XDR platforms. These solutions are widely adopted across industries due to their maturity, innovation, and ability to address evolving cybersecurity challenges and play a crucial role in enhancing organizations' security measures worldwide.

The services segment is anticipated to grow at the fastest CAGR during the forecast period as organizations increasingly recognize the complexity of implementing solutions such as SOAR, SIEM, and XDR within their existing IT environments. Professional services providers offer expertise in solution design, deployment mode, configuration, and customization, addressing specific business needs and industry regulations. This customization enhances the relevance and effectiveness of security automation deployment modes. Moreover, these providers bridge the skills gap and resource constraints faced by many organizations, offering specialized knowledge and support to optimize security automation platforms. The rising demand for managed security services (MSS) reflects the need for ongoing monitoring, management, and support, allowing organizations to outsource security operations and focus on core activities.

Deployment Mode Insights

The cloud segment held the largest market revenue share in 2024, emphasizing the prominence of cloud-based security automation solutions. These solutions offer scalability and flexibility, allowing organizations to adjust resources based on demand and changing business needs, which is mainly beneficial for growing or fluctuating workloads. Cloud-based solutions offer cost efficiency by eliminating upfront hardware investments and reducing ongoing maintenance costs, while pay-as-you-go pricing models optimize expenses. Moreover, rapid deployment mode and provisioning of cloud-based solutions enable organizations to swiftly implement and configure security tools, accelerating time-to-value and enhancing agility in responding to emerging threats.

The on-premises segment is poised for substantial growth over the forecast period. Industries with strict regulatory requirements, such as government, healthcare, and finance, prefer on-premises solutions to maintain control over data sovereignty and ensure compliance. Organizations with sensitive data also prioritize on-premises deployment modes to mitigate security and privacy risks associated with cloud-based solutions, benefiting from greater visibility and control over their security infrastructure. Moreover, some organizations with legacy IT infrastructure or investments in on-premises security solutions opt to leverage existing assets rather than transitioning to the cloud.

Application Insights

The endpoint security segment dominated the market in 2024 as endpoints serve as primary entry points for cyber threats, making securing applications running on these endpoints the highest priority for organizations. With the proliferation of applications across various platforms, automation becomes essential for efficiently managing security in this expansive landscape. Moreover, the complexity of modern applications necessitates continuous monitoring and rapid threat detection, which automation facilitates effectively. Furthermore, integration with DevOps practices is facilitated by automated security solutions, ensuring seamless implementation of security controls throughout the software development lifecycle.

The incident response management segment is poised for significant growth as the threat landscape emphasizes the necessity for vital incident response capabilities. Security automation enables swift and effective detection and response to mitigate potential damage from security incidents. To address the shortage of skilled security professionals, automation streamlines routine tasks, enabling teams to focus on more complex activities. Moreover, automated systems facilitate rapid detection and response, minimizing attackers' dwell time within networks and reducing incident impact. Scalability is enhanced as automated solutions efficiently handle large volumes of security alerts, ensuring a coordinated response as organizations grow or face spikes in incidents. Integration with security orchestration platforms centralizes incident management and automation while aiding compliance with regulatory requirements through audit trails and automated reporting.

Code Insights

The full code segment held the largest market revenue share in 2024. The rise of DevSecOps practices, integrating security into the DevOps workflow, has propelled the adoption of full code security automation. This approach aligns well with DevSecOps principles, embedding security testing and compliance checks directly into the software development process. In addition, organizations are embracing a "shift-left" approach to security, addressing security considerations early in the software development lifecycle. Full code security automation enables developers to identify and remediate vulnerabilities during the coding phase, reducing the risk of security issues in production. Offering comprehensive security coverage, including SAST, DAST, SCA, and IAST, full code automation appeals to organizations seeking security measures across their entire codebase.

The no-code segment is positioned for significant growth over the forecast period as these platforms empower non-technical users to create and deploy automated security workflows without coding. Offering rapid deployment mode through pre-built templates and intuitive interfaces, they enable quick enhancement of security postures, which is important in time-sensitive environments. Despite the absence of traditional coding, these platforms provide flexibility and customization options, allowing tailored security workflows. Moreover, inherently agile and scalable, they facilitate adaptation to evolving security requirements and enable rapid expansion of automation initiatives across departments.

Technology Insights

The AI & ML segment held the largest market revenue share in 2024, driven by its advanced capabilities in threat detection and predictive analytics. Leveraging AI and ML technologies, security automation solutions excel in continuously monitoring network traffic and user behavior to detect suspicious activities in real time, enabling proactive responses to potential security breaches. Predictive analytics, powered by AI and ML algorithms, analyze historical security data to anticipate and mitigate emerging risks before they escalate. In addition, behavioral analysis of users and devices, enabled by AI and ML, detects deviations from normal patterns, triggering alerts or automated responses to potential threats.

The UEBA (User Behavior & Entity Behavior Analytics) segment is poised for significant growth. UEBA solutions excel in advanced threat detection by analyzing patterns of user and entity behavior to identify deviations indicative of malicious activity or insider threats, enhancing organizations' ability to detect and respond to security incidents effectively. With insider threats posing a significant risk, UEBA platforms monitor user activity across networks and systems, detecting suspicious behavior and unauthorized access promptly. Real-time monitoring and alerting capabilities enable organizations to respond quickly to security incidents, supported by continuous analysis of behavior patterns and automated response actions. By establishing behavioral baselines and profiling users and entities, UEBA solutions identify deviations that may indicate security threats or policy violations, facilitating prompt corrective action.

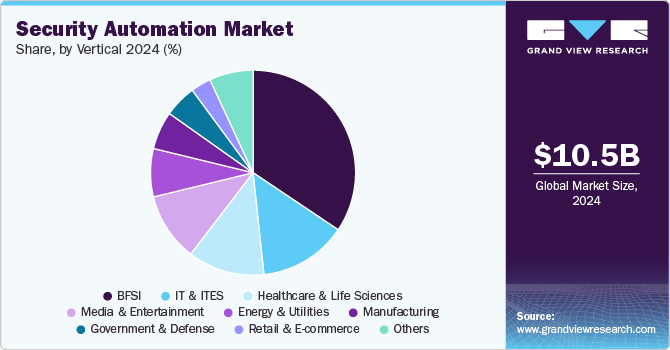

Vertical Insights

The BFSI segment led the market revenue share in 2024. Stringent regulatory compliance requirements from authorities such as the Financial Industry Regulatory Authority (FINRA), Securities and Exchange Commission (SEC), and European Banking Authority (EBA) necessitate robust security measures fulfilled by security automation, ensuring continuous monitoring, incident response and compliance reporting. With vast amounts of sensitive data at stake, BFSI organizations leverage automation to proactively identify vulnerabilities, detect behavior, and respond to security incidents promptly, mitigating the risk of data breaches. Continuous monitoring and rapid response to emerging threats are facilitated by automation, enabling BFSI organizations to stay ahead of evolving cyber threats and minimize the impact of security breaches.

The healthcare and life sciences segment is poised for significant growth, owing to the increasing cybersecurity threats targeting valuable patient data and intellectual property, prompting the adoption of security automation to enhance threat detection and response capabilities, thus mitigating the risk of data breaches and cyberattacks. As the industry undergoes rapid digitization and embraces IoT devices, security automation becomes essential for securing digital infrastructure and monitoring for vulnerabilities and suspicious activities. Protecting patient data against unauthorized access and tampering is paramount, with security automation facilitating the implementation of robust access controls, encryption mechanisms, and data loss prevention measures.

Regional Insights

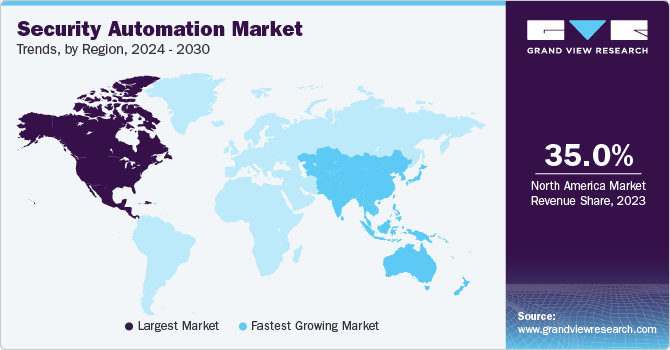

North America security automation industry represented a significant global market share of over 35% in 2024, driven by its advanced technological infrastructure, majorly in the U.S. and Canada, which supports rapid adoption across industries. The high incidence of cyber threats in the region fuels the demand for robust security solutions as organizations prioritize protecting their data and infrastructure. In addition, strict regulatory requirements such as the CCPA in the U.S. necessitate advanced security measures, including automation. Substantial investments in research and development by leading North American security technology firms further propel innovation and deployment mode of cutting-edge security automation tools.

U.S. Security Automation Market Trends

The security automation industry in the U.S. is expected to grow substantially over the forecast period. The increasing volume of cybersecurity threats, such as ransomware, phishing, and cyber espionage, drive the need to protect necessary infrastructure and sensitive data. Technological advancements in AI, ML, and automation enhance security systems' capabilities, enabling faster threat detection and response. Stringent regulatory and compliance standards, such as GDPR, CCPA, and HIPAA, compel businesses to adopt automated security solutions to ensure compliance and avoid penalties.

Europe Security Automation Market Trends

The security automation industry in Europe is expected to witness significant growth over the forecast period. The European Union has launched multiple initiatives to enhance cybersecurity across member states, addressing the increasing surge of cyberattacks on infrastructure, financial institutions, and private companies. For instance, the European Union Agency for Cybersecurity (ENISA) has shown its support for the initiative aimed at improving cybersecurity within the healthcare sector and is committed to working alongside the European Commission, Member States, healthcare providers, and the cybersecurity community. The initiative includes a proposal for ENISA to create a pan-European Cybersecurity Support Centre that would deliver customized guidance, tools, services, and training specifically designed for hospitals and healthcare providers.

Asia Pacific Security Automation Market Trends

The security automation industry in the Asia Pacific region is anticipated to register the fastest CAGR over the forecast period, driven by rapid digital transformation across sectors such as manufacturing, healthcare, and finance. The increasing adoption of IoT, AI, and cloud computing necessitates robust security automation to manage associated risks. In addition, government initiatives and regulations emphasize the importance of advanced cybersecurity measures, including automation, to protect critical infrastructure and ensure data security. In 2021, the ASEAN Digital Masterplan (ADM) 2025 was created to provide a framework for actions that the ASEAN Member States and regulators can implement to achieve the vision of ASEAN as a prominent economic bloc and digital community. This vision is supported by secure and transformative digital services, technologies, and ecosystems.

China security automation industry is positioned for substantial growth, propelled by the government's prioritization of cybersecurity as a national security imperative. Key policies such as the Cybersecurity Law of the People's Republic of China and the National Cybersecurity Strategy emphasize the need for robust cybersecurity measures across industries. Government-led initiatives often stimulate demand for security automation solutions as organizations strive to meet regulatory requirements and safeguard critical infrastructure.

Key Security Automation Company Insights

Some key companies in the security automation industry include CyberArk Software Ltd., CrowdStrike IBM Corporation, and Red Hat, Inc.

-

CyberArk Software Ltd. offers comprehensive solutions designed to enhance organizational cybersecurity. It provides comprehensive security offerings for both human and machine identities across various environments, including cloud, on-premises, and DevOps. Its solutions help enterprises protect against insider threats and cyberattacks by securing privileged accounts and ensuring compliance with regulatory requirements. Its security platform supports businesses in managing high-stakes compliance and audit needs while enhancing their security posture.

-

IBM Corporation is a multinational technology company that plays a significant role in the security automation industry. IBM offers a range of AI-powered cybersecurity solutions designed to optimize threat detection and response. Its security products include tools for intelligence analysis, fraud protection, and network security automation, which help streamline security operations and enhance compliance. IBM's solutions are integrated with AI and machine learning to provide real-time threat detection and response capabilities, supporting businesses in managing complex security landscapes and protecting sensitive data.

Key Security Automation Companies:

The following are the leading companies in the security automation market. These companies collectively hold the largest market share and dictate industry trends.

- CyberArk Software Ltd.

- CrowdStrike

- Cisco Systems, Inc.

- Palo Alto Networks

- IBM Corporation

- Red Hat, Inc.

- Secureworks, Inc.

- Splunk Inc.

- Swimlane Inc.

- Tufin

Recent Developments

-

In March 2025, CrowdStrike partnered with NVIDIA to enhance its Charlotte AI Detection Triage system by leveraging NVIDIA’s AI software and NIM microservices. This collaboration doubled the speed of automated detection triage while halving computing resource use, improving Security Operations Centers' efficiency. By integrating NVIDIA’s reasoning models like Llama Nemotron, the partnership aims to boost detection accuracy, reduce false positives, and enable faster threat responses, representing a shift towards autonomous security operations that combine intelligent automation with human expertise.

-

In June 2024, Intezer Labs Inc., a pioneer in AI-driven security operations automation, announced a new partnership with RSM US LLP, a leader in the professional services industry. This collaboration aims to fully automate and enhance RSM US LLP's alert triage and incident response processes. By utilizing Intezer's technology, RSM Defense's experienced cybersecurity practitioners receive a detailed analysis of every alert, enabling them to uncover hidden cyberattacks and swiftly protect clients worldwide.

-

In May 2024, Swimlane Inc., a prominent provider of security automation, unveiled the Swimlane Marketplace, the first comprehensive modular marketplace for security automation. The new marketplace simplifies automation and enables seamless integration, empowering organizations to streamline security operations across any use case or technology stack with customized solutions.

-

In April 2024, Cypago Security Ltd., a Cyber GRC software company, introduced a new automation solution for risk management, AI governance, and compliance. This solution incorporates the implementation of ISO/IEC 42001 and NIST AI RMF, the latest frameworks for AI security and governance. As more companies integrate AI tools into their daily operations, business processes, and customer-facing products and services, ensuring the safe use of AI has become a crucial challenge.

Security Automation Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 11.90 billion |

|

Revenue forecast in 2030 |

USD 22.92 billion |

|

Growth Rate |

CAGR of 14.0% from 2025 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

March 2025 |

|

Quantitative units |

Revenue in USD billion/million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Offering, deployment mode, application, code, technology, vertical, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, India, Japan, Australia, South Korea, Brazil, UAE, South Africa, KSA |

|

Key companies profiled

|

CyberArk Software Ltd.; CrowdStrike; Cisco Systems, Inc.; Palo Alto Networks; IBM Corporation; Red Hat, Inc.; Secureworks, Inc.; Splunk Inc.; Swimlane Inc.; Tufin |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Security Automation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global security automation market report based on offering, deployment mode, application, code, technology, vertical, and region.

-

Offering Outlook (Revenue, USD Million, 2017 - 2030)

-

Solutions

-

SOAR

-

SIEM

-

XDR

-

-

Services

-

Professional Services

-

Managed Services

-

-

-

Deployment Mode Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-premises

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Network Security

-

Intrusion Detection and Prevention System

-

Firewall Management

-

Network Access Control

-

Network Traffic Analysis

-

Others

-

-

Endpoint Security

-

Threat Detection and Prevention

-

Malware Detection and Protection

-

Configuration Management

-

Phishing and Email Protection

-

Others

-

-

Incident Response Management

-

Incident Triage and Escalation

-

Incident Categorization and Prioritization

-

Workflow Orchestration

-

Evidence Gathering

-

Others

-

-

Vulnerability Management

-

Vulnerability Scanning and Assessment

-

Prioritization

-

Vulnerability Remediation and Ticketing

-

Patch Management and Remediation

-

Others

-

-

Identity and Access Management

-

User Provisioning and Deprovisioning

-

Single Sign On (SSO)

-

Multi-Factor Authentication

-

Access Policy Enforcement

-

Others

-

-

Compliance and Policy Management

-

Automated Compliance Auditing

-

Policy Enforcement Automation

-

Regulatory Compliance Reporting

-

Audit Trail Generation

-

Others

-

-

Data Protection and Encryption

-

Encryption Key Management

-

File and Database Encryption

-

Data Loss Prevention

-

-

Others

-

-

Code Outlook (Revenue, USD Million, 2017 - 2030)

-

Low Code

-

No Code

-

Full Code

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

AI & ML

-

Predictive Analytics

-

Robotic Process Automation (RPA)

-

User & Entity Behaviour Analytics (UEBA)

-

Others

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

Manufacturing

-

Media & Entertainment

-

Healthcare & Life Sciences

-

Energy & Utilities

-

Government & Defence

-

Retail & E-commerce

-

IT & ITES

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global security automation market size was estimated at USD 10.45 billion in 2023 and is expected to reach USD 11.89 billion in 2025.

b. The global security automation market is expected to grow at a compound annual growth rate of 14.0% from 2024 to 2030 to reach USD 22.92 billion by 2030.

b. North America dominated the market in 2024, accounting for over 36.1% of the global revenue, driven by its advanced technological infrastructure, mainly in the U.S. and Canada, which supports rapid adoption across industries.

b. Some key players operating in the security automation market include Cisco Systems, Inc.; CrowdStrike; CyberArk Software Ltd.; IBM Corporation; Palo Alto Networks; Red Hat, Inc.; Secureworks, Inc.; Splunk Inc.; Swimlane Inc.; Tufin

b. Key factors driving the security automation market growth include the increasing cybersecurity threats and complexity and advancements in AI and machine learning for enhanced threat detection

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."