- Home

- »

- Water & Sludge Treatment

- »

-

Secondary Water & Wastewater Treatment Equipment Market Report, 2030GVR Report cover

![Secondary Water And Wastewater Treatment Equipment Market Size, Share & Trends Report]()

Secondary Water And Wastewater Treatment Equipment Market Size, Share & Trends Analysis Report By Equipment (Activated Sludge, Sludge Treatment), By Application (Municipal, Industrial), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-796-4

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Report Overview

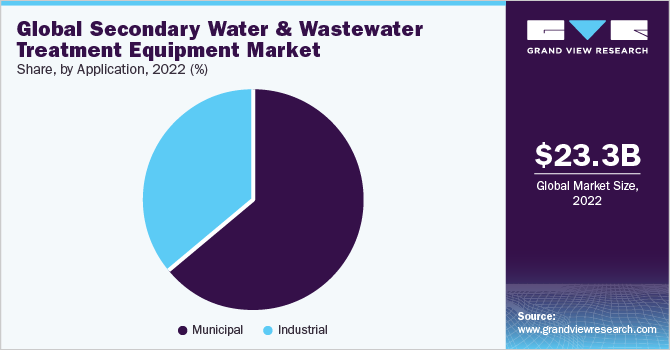

The global secondary water and wastewater treatment equipment market size was estimated at USD 23.3 billion in 2022 and is expected to grow at a compounded annual growth rate (CAGR) of 4.3% from 2023 to 2030. Growing demand for wastewater treatment plants coupled with stringent regulations concerning secondary water & wastewater treatment equipment is anticipated to drive the market growth. Secondary treatment is used mainly to remove soluble organic matter and chemicals through the usage of trickling filters, bio-towers, rotating biological contactors, and activated sludge systems. Furthermore, technological incorporation in terms of the development of new methods including moving bed biofilm reactors (MBBR) and integrated fixed film activated sludge (IFAS) for secondary treatment methods is expected to have a strong impact on the market. These aforementioned factors will drive the demand for secondary water & wastewater treatment equipment in the coming years.

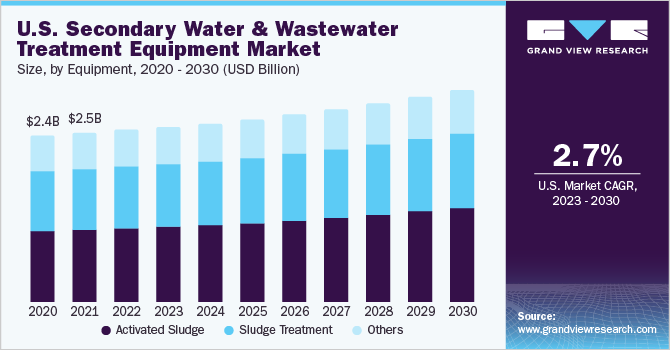

The U.S. dominated the North America secondary water & wastewater treatment equipment market in 2022 on account of the developed wastewater treatment infrastructure in the country coupled with stringent effluent regulations. Federal regulations such as the Clean Water Act that establish a regulatory framework for pollutant discharge in water bodies are expected to have a positive impact on market growth in the country.

Secondary treatment typically utilizes biological processes that use bacteria to remove pollutants. The main purpose of secondary wastewater treatment is to remove the suspended and dissolved organic matter from the wastewater to produce an environmentally safe effluent. This treatment consists of microorganisms that are either attached to a media or are in mixed suspension in a basin, where the organic material is broken down and consumed by the microorganisms.

The increased usage of public sewers by rural homes is anticipated to put stress on current centralized wastewater treatment facilities. This is likely to create the need for new capacity development or expansion of existing capacity, which is predicted to boost demand for wastewater secondary treatment equipment over the forecast period. For instance, Evoqua's BioMag system was chosen in January 2020 to enhance the existing secondary treatment capacity of the Bellefonte Borough Authority (BBA) Wastewater Treatment Plant in Pennsylvania, U.S.

A growing population, coupled with rapid urbanization, is anticipated to drive the demand for critical infrastructure, including wastewater treatment plants. In addition, new housing developments, most notably in developing countries, are likely to exert pressure on the existing wastewater treatment infrastructure, thereby driving the need for either capacity expansion of existing plants or the construction of new wastewater treatment plants.

Equipment Insights

The activated sludge segment accounted for a significant market share of 44.8%, in terms of revenue, in 2022. They are typically found after the wastewater has undergone primary and pre-treatment and before advanced tertiary treatment, which may include chemical, UV disinfection, activated carbon adsorption, sand filtration, and/or anaerobic digestion for the removal of additional pathogens, nutrients, organics, and suspended solids.

The primary objectives of sludge treatment include the removal of hazardous bacteria to lower the health risks for people and surroundings that may come into contact with the material. Additionally, the treatment method helps stabilize some of the organic materials in the sludge, lowering the final volume, often lowering the handling costs, and gathering the products and byproducts of the treatment process.

Other types of equipment used for secondary wastewater treatment include trickling filters, Integrated Fixed-film Activated Sludge (IFAS), Moving Bed Biofilm Reactors (MBBR), rotating biological contactors, and others. MBBR system uses a combination of two processes, namely the activated sludge process and the biofilter process. The system typically consists of aeration tanks that are filled with biofilm carriers, followed by a secondary clarifier system.

Application Insights

The municipal segment led the market and accounted for 68.1% of the global revenue share in 2022. Factors including rapid urbanization, most notably in emerging economies coupled with rapid housing infrastructural development are anticipated to drive the demand for wastewater treatment plants, which, in turn, is likely to have a positive impact on market growth over the forecast period.

The industrial application segment is anticipated to witness a CAGR of 4.7% over the forecast period. Rapid industrialization in developing countries, coupled with stringent regulations for the disposal of wastewater into the environment from various industries, is anticipated to drive the demand for secondary water and wastewater treatment equipment in the forthcoming years.

Water is utilized in several industrial processes, including manufacturing, power generation, and agriculture, among others. Chemicals and byproducts are often induced in the water as it runs through these processes owing to which industrial wastewater treatment is of utmost importance to remove the bacteria, solids, oil, grease, and other substances before the wastewater is either reused or discharged into the environment.

Regional Insights

Asia Pacific accounted for the largest revenue share of 35.0% of the global secondary water & wastewater treatment equipment market in 2022. Rapid urbanization, increased investments by governments, and rising consumer spending have boosted the Asian economy, thereby propelling infrastructure development in the construction industry. Emerging economies such as China, India, and Japan are the key countries driving the development of the manufacturing and building & construction industries in this region. The competition among Chinese capital markets and a few other Asian economies is generating lucrative growth opportunities for the industries, which has, in turn, created a favorable environment for investments in the secondary water & wastewater treatment equipment industry.

Several regulations, including the Clean Water Act, recommend that states in the U.S. designate surface waters used for drinking water and set water quality standards. This Act also establishes programs to prevent pollution from entering these waters. Furthermore, the Safe Drinking Water Act (SDWA) mandates the safety of U.S. public drinking water supplies. The presence of these aforementioned regulations in the region aims to provide good-quality water, thereby augmenting the demand for secondary water & wastewater treatment equipment industry.

The Europe region plays a crucial role in the global market for water and wastewater treatment equipment. Rapid technological advancements in the region to gain market dominance and maintain competitiveness are likely to boost market growth. Stringent government regulations, industrial automation, top mergers & acquisitions, strategic policies, and expansions have propelled the secondary water & wastewater treatment equipment industry’s growth.

Key Companies & Market Share Insights

The industry is extremely competitive due to the presence of both international and local players. Secondary water & wastewater treatment equipment manufacturers use a variety of strategies to increase market penetration and meet the dynamic technological demands of application, such as municipal, and industrial.

For instance, in January 2023, Xylem planned to acquire Evoqua. Evoqua engaged in the business of water treatment solutions for various end-use industries such as food and beverage, power generation, life sciences, and microelectronics. Some prominent players in the global secondary water and wastewater treatment equipment market include:

-

Xylem Inc.

-

Pentair plc

-

Evoqua Water Technologies LLC

-

Aquatech International LLC

-

Ecolab Inc.

-

Ovivo

-

Toshiba Water Solutions Private Limited

-

Veolia

-

Ecologix Environmental Systems, LLC

-

Parkson Corporation

-

Lenntech B.V.

-

H2O Innovation

-

Samco Technologies, Inc.

-

Koch Membrane Systems, Inc.

Secondary Water And Wastewater Treatment Equipment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 24.0 billion

Revenue forecast in 2030

USD 32.7 billion

Growth rate

CAGR of 4.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, trends

Segments covered

Equipment, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Norway; Finland; China; India; Japan; Australia; South Korea; Argentina; Brazil; Venezuela; Saudi Arabia; UAE; Egypt

Key companies profiled

Xylem Inc.; Pentair plc; Evoqua Water Technologies LLC; Aquatech International LLC; Ecolab Inc.; Ovivo; Toshiba Water Solutions Private Limited; Veolia; Ecologix Environmental Systems, LLC; Parkson Corporation; Lenntech B.V.; H2O Innovation; Samco Technologies, Inc.; Koch Membrane Systems, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Secondary Water And Wastewater Treatment Equipment Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global secondary water and wastewater treatment equipment market report based on equipment, application, and region:

-

Equipment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Activated Sludge

-

Sludge Treatment

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Municipal

-

Industrial

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Norway

-

Finland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Argentina

-

Brazil

-

Venezuela

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global secondary water and wastewater treatment equipment market size was estimated at USD 23.3 billion in 2022 and is expected to reach USD 24.0 billion in 2023.

b. The secondary water and wastewater treatment equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.3% from 2023 to 2030 and reach USD 32.7 billion by 2030.

b. Asia Pacific dominated the secondary water and wastewater treatment equipment market with a revenue share of 35.0% in 2022 owing to numerous investments and initiatives taken by the industry players and governments in the region to emerge as a global manufacturing hub.

b. Some of the key players operating in the secondary water & wastewater treatment equipment market include Xylem Inc., Pentair plc, Evoqua Water Technologies LLC, Aquatech International LLC, Ecolab Inc., Ovivo, Toshiba Water Solutions Private Limited, Veolia, Ecologix Environmental Systems, LLC, among others.

b. The key factors that are driving the secondary water & wastewater treatment equipment market include the rising water pollution levels in developing nations like Korea India, China, Japan, Malaysia, etc., as well as rising concerns about water scarcity and the need for freshwater resources as a result of rapidly expanding urbanization.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."