- Home

- »

- Plastics, Polymers & Resins

- »

-

Secondary Paper & Paperboard Luxury Packaging Market Report, 2030GVR Report cover

![Secondary Paper & Paperboard Luxury Packaging Market Size, Share & Trends Report]()

Secondary Paper & Paperboard Luxury Packaging Market Size, Share & Trends Analysis Report By Grade (Solid Bleached Sulfate, Coated Unbleached Kraft Paperboard), By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-353-4

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

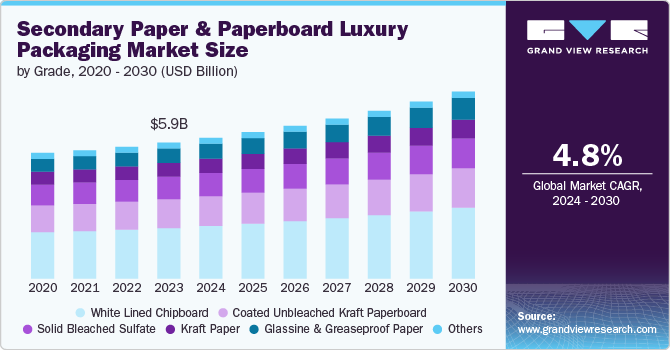

The global secondary paper & paperboard luxury packaging market size was estimated at USD 5.87 billion in 2023 and is projected to grow at a CAGR of 4.8% from 2024 to 2030. The global market is witnessing significant growth driven by several factors, primarily increased consumer demand for sustainable and high-quality packaging solutions. As environmental consciousness rises among consumers, brands are increasingly opting for eco-friendly packaging to enhance their appeal and meet regulatory requirements. For instance, materials like recycled paperboard and biodegradable coatings are gaining popularity due to their lower environmental impact compared to traditional plastics.

One of the primary drivers is the growing emphasis on sustainability. Consumers are becoming more eco-conscious, pushing brands to adopt sustainable packaging solutions. This trend is bolstered by government regulations aimed at reducing plastic waste. Companies like Nestlé have launched initiatives to replace plastic packaging with paper-based alternatives. The introduction of recyclable and biodegradable materials in luxury packaging aligns with consumer preferences and regulatory mandates, creating a significant opportunity for market growth. The demand for visually appealing and innovative packaging is another key driver. Luxury brands are increasingly investing in distinctive packaging designs to differentiate their products and enhance brand value. For example, premium cosmetics brands are launching new products with elaborate and aesthetically pleasing packaging to attract discerning customers. This trend extends to custom packaging solutions that offer a unique unboxing experience, further driving the market growth.

Economic growth in emerging markets is leading to higher disposable incomes, increasing demand for luxury goods and, consequently, luxury packaging. Consumers in regions like Asia-Pacific and Latin America are showing a growing preference for high-quality, premium products, creating a surge in demand for secondary paper and paperboard luxury packaging. Innovations in materials and production technologies are creating new opportunities for market growth. For instance, advancements in printing technologies are enabling high-quality, intricate designs on paperboard packaging, enhancing the aesthetic appeal and functionality of the packaging.

Grade Insights

Based on grades, the white lined chipboard (WLC) segment led the market with the largest revenue share of 37.19% in 2023. It is extensively used due to its excellent printability, strength, and cost-effectiveness. The versatility of WLC makes it a preferred choice for various applications, including cosmetics, confectionery, and premium beverages.

The solid bleached sulfate (SBS) segment is highly regarded for its superior quality and printability, making it a popular choice for high-end packaging. Its use is prominent in premium cosmetics and fragrances due to its ability to provide a smooth, bright surface that enhances the product's visual appeal.

The glassine & greaseproof paper segment is expected to grow at the fastest CAGR during the forecast period. Their use in packaging items that require a moisture-resistant and grease-resistant barrier, such as luxury confectionery and gourmet food items, is driving this growth.

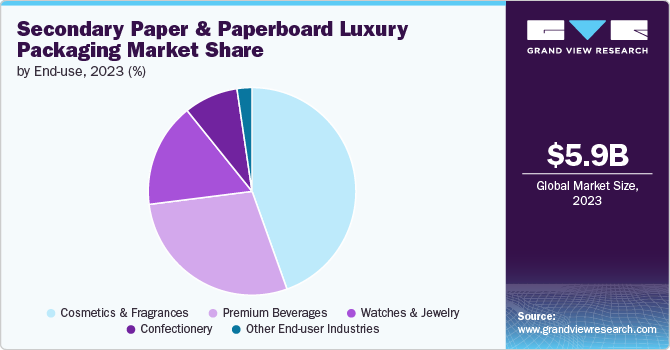

End Use Insights

Based on end use, the market is segmented into cosmetics and fragrances, premium beverages, watches and jewelry, confectionery and other end uses. The cosmetics and fragrances segment led the market with the largest revenue share of 44.45% in 2023. The luxury packaging for these products emphasizes aesthetics and functionality, with brands investing in high-quality, visually appealing packaging to enhance their market presence and attract premium consumers.

The watches and jewelry segment is expected to grow at the fastest CAGR of 5.1% during the forecast period. The demand for luxurious and secure packaging solutions that reflect the exclusivity and value of these products is driving growth. Innovative packaging designs that provide both protection and aesthetic appeal are becoming increasingly important in this segment.

Luxury packaging for premium beverages focuses on delivering a unique and high-quality consumer experience. This includes the use of premium materials and intricate designs that enhance the brand's image and appeal to affluent consumers.

Regional Insights

North America dominated the secondary paper & paperboard luxury packaging market with the largest revenue share of 34.64% in 2023. The region is particularly witnessing growth on account of the increasing demand from a robust luxury goods sector. The North America has a significant affluent population with a strong preference for premium and luxury products. This drives the demand for high-quality packaging that reflects the luxury and exclusivity of the products, such as cosmetics, fragrances, and premium beverages.

U.S. Secondary Paper & Paperboard Luxury Packaging Market Trends

The secondary paper & paperboard luxury packaging market in the U.S. is characterized by significant investments in packaging innovation. Advanced printing technologies and novel material developments enable the creation of unique, high-quality packaging designs that cater to the luxury segment. For example, cosmetic brands are increasingly using customized, intricate paperboard packaging to enhance their product's appeal. There is a strong movement towards sustainable and eco-friendly packaging solutions in the U.S., driven by consumer awareness and regulatory pressures. Companies like Procter & Gamble and Estee Lauder are shifting towards recyclable and biodegradable packaging materials, boosting the market growth.

Europe Secondary Paper & Paperboard Luxury Packaging Market Trends

The secondary paper & paperboard luxury packaging market in Europe includes high-end automotive, watches, jewelry, and premium beverages, which fuels the demand for luxury packaging. Brands like BMW and Porsche use high-quality paperboard packaging for their luxury accessories, reflecting the premium nature of their products. Strict environmental regulations in region encourage the use of eco-friendly packaging materials. This aligns with the increasing consumer demand for sustainable luxury packaging. Companies are investing in recyclable and biodegradable materials, driving market growth.

The Germany secondary paper & paperboard luxury packaging market accounted for the largest market share in Europe in 2023, due to its strong industrial base, advanced manufacturing capabilities, and a well-established luxury market. Germany's advanced manufacturing capabilities and strong industrial base provide a competitive edge in producing high-quality packaging materials. The country is home to leading packaging companies that leverage cutting-edge technologies to create innovative and sustainable packaging solutions.

Asia Pacific Secondary Paper & Paperboard Luxury Packaging Market Trends

The secondary paper & paperboard luxury packaging market in Asia Pacific is anticipated to grow at the fastest CAGR of 4.9% during the forecast period, driven by rapid economic growth, rising disposable incomes, and an expanding luxury goods market. The market for luxury goods, including cosmetics, fragrances, and premium beverages, is expanding rapidly. Brands are investing in visually appealing and high-quality packaging to attract Chinese consumers, who place a high value on packaging aesthetics.

The India secondary paper & paperboard luxury packaging market is projected to grow at the fastest CAGR of 5.3% during the forecast period. India's burgeoning middle class and increasing disposable incomes are leading to greater demand for luxury products. Brands are investing in luxury packaging to cater to the tastes of affluent Indian consumers who value high-quality, aesthetically pleasing packaging.

Key Secondary Paper & Paperboard Luxury Packaging Company Insights

The market is fragmented with the presence of a significant number of companies. Secondary Paper & Paperboard Luxury packaging industry has been witnessing a significant number of new product launches, merger & acquisitions, and expansions over the past few years. This can be attributed to the circular economy initiatives, innovation in materials and technologies, and consumer demand for sustainability.

Key Secondary Paper & Paperboard Luxury Packaging Companies:

The following are the leading companies in the secondary paper & paperboard luxury packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Holmen Iggesund

- Metsä Group

- Sappi

- Fedrigoni S.P.A.

- Arjowiggins Graphic

- Mondi

- Smurfit Kappa

- Coveris

- Winter & Company

- Mayr-Melnhof Karton AG

- SURTECO GmbH

- Stora Enso

- International Paper

- WestRock Company

- KOLBUS GmbH & Co. KG

Recent Development

-

In July 2023, Robinson plc was selected by AVEDA CORP to manufacture two promotional boxes. Both the boxes have outer design in available in options such as matt varnish, and UV gloss varnish with the interior made with black lined board. These boxes were manufactured using the company’s new SATE rigid box line which helps in producing high quality boxes

-

In June 2023 Veuve Clicquot, a Reims based champagne producer introduced a virgin tree-free, low impact, and low carbon luxury champagne box in collaboration with NGO Canopy at business-to-business trade show Luxe Pack. The new box is manufactured from 50% hemp and 50% recycled paper

-

In January 2023, Cosfibel Group, one of the leading companies in luxury promotional packaging was acquired by GPA Global. The Cosfibel Group produces secondary packaging products such as boxes for fine foods, wine, spirits, and personal care companies. This acquisition will help GPA Global to strengthen its market position in luxury packaging business

Secondary Paper & Paperboard Luxury Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.09 billion

Revenue forecast in 2030

USD 8.07 billion

Growth rate

CAGR of 4.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2024 to 2030

Report coverage

Volume Forecast, Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Grade, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Holmen Iggesund; Metsä Group; Sappi; Fedrigoni S.P.A.; Arjowiggins Graphic; Mondi; Smurfit Kappa; Coveris; Winter & Company; Mayr-Melnhof Karton AG; SURTECO GmbH; Stora Enso; International Paper; WestRock Company; KOLBUS GmbH & Co. KGr

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Secondary Paper & Paperboard Luxury Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global secondary paper & paperboard luxury packaging market report based on grade, end use, and region:

-

Grade Outlook (Revenue, USD Million, Volume, Kilotons; 2018 - 2030)

-

Solid Bleached Sulfate (SBS)

-

Coated unbleached Kraft Paperboard (CUK)

-

White Lined Chipboard (WLC)

-

Kraft Paper

-

Glassine & Greaseproof Paper

-

Others

-

-

End Use Outlook (Revenue, USD Million, Volume, Kilotons; 2018 - 2030)

-

Cosmetics & Fragrances

-

Confectionery

-

Watches & Jewellery

-

Premium Beverages

-

Others

-

-

Regional Outlook (Revenue, USD Million, Volume, Kilotons; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global secondary paper & paperboard luxury packaging market size was estimated at USD 5.87 billion in 2023 and is expected to reach USD 6.09 billion in 2024.

b. The global secondary paper & paperboard luxury packaging market is expected to grow at a compound annual growth rate of 4.8% from 2024 to 2030, reaching USD 8.07 billion by 2030.

b. The cosmetics and fragrances segment holds the highest market share of over 44% in 2023. The luxury packaging for these products emphasizes aesthetics and functionality, with brands investing in high-quality, visually appealing packaging to enhance their market presence and attract premium consumers.

b. Key market players include Holmen Iggesund, Metsä Group, Sappi, Fedrigoni S.P.A., Arjowiggins Graphic, Mondi, Smurfit Kappa, Coveris, Winter & Company, Mayr-Melnhof Karton AG, SURTECO GmbH, Stora Enso, International Paper, WestRock Company, and KOLBUS GmbH & Co. KG.

b. The Global Secondary Paper & Paperboard Luxury Packaging Market is witnessing significant growth due to increased consumer demand for high-quality packaging solutions. Brands are increasingly opting for eco-friendly packaging to enhance their appeal and meet regulatory requirements.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."