- Home

- »

- Power Generation & Storage

- »

-

Secondary Battery Market Size, Share, Industry Report 2030GVR Report cover

![Secondary Battery Market Size, Share & Trends Report]()

Secondary Battery Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Lithium-ion, Lead Acid, Nickel Metal Hydride), By Application (Motor Vehicles, Industrial Batteries, Portable Devices, Electronics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-529-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Secondary Battery Market Summary

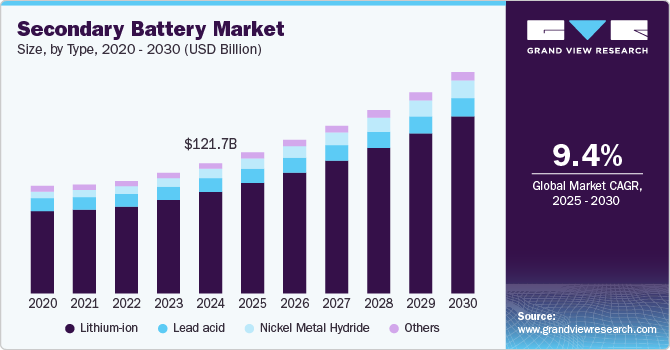

The global secondary battery market size was estimated at USD 121,728.3 million in 2024 and is projected to reach USD 207,188.0 million by 2030, growing at a CAGR of 9.4% from 2025 to 2030. The demand for secondary batteries is likely to grow significantly in the coming years, driven by the rapid adoption of electric vehicles (EVs), the expansion of renewable energy storage systems, and the increasing use of portable electronic devices.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, lithium-ion accounted for a revenue of USD 103,389.4 million in 2024.

- Nickel Metal Hydride is the most lucrative type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 121,728.3 Million

- 2030 Projected Market Size: USD 207,188.0 Million

- CAGR (2025-2030): 9.4%

- Asia Pacific: Largest market in 2024

Governments worldwide are implementing stringent emission regulations and offering incentives for clean energy solutions, further boosting the need for efficient energy storage.

Additionally, advancements in battery technologies, such as lithium-ion and solid-state batteries, are enhancing performance and reducing costs, making secondary batteries more accessible for a wide range of applications. This growth is expected to be particularly strong in regions like Asia Pacific, North America, and Europe, where EV adoption and renewable energy investments are accelerating.

Drivers, Opportunities & Restraints

The global shift toward electric vehicles is one of the primary drivers of the secondary battery industry. Governments worldwide are implementing stringent emission regulations and offering incentives for EV adoption, boosting demand for lithium-ion batteries. Major Portable Devices manufacturers are investing heavily in EV production, further accelerating the need for high-performance secondary batteries.

Innovations such as solid-state batteries, sodium-ion batteries, and lithium-sulfur batteries present significant opportunities for the market. These technologies promise higher energy density, faster charging, and improved safety.

The high cost of lithium-ion batteries, driven by the prices of raw materials like lithium, cobalt, and nickel, remains a significant restraint. This can hinder widespread adoption, especially in price-sensitive markets.

Type Insights

Lithium-ion batteries are the cornerstone of the secondary battery industry, driven primarily by the rapid adoption of electric vehicles (EVs), which rely heavily on these batteries for their high energy density, long cycle life, and fast charging capabilities. Government policies promoting clean energy and reducing carbon emissions, such as subsidies for EVs and stricter emission standards, further accelerate demand.

The proliferation of consumer electronics, including smartphones, laptops, and wearable devices, also fuels demand, as consumers seek longer battery life and faster charging. Together, these factors position lithium-ion batteries as a critical enabler of the global transition to sustainable energy and advanced technology.

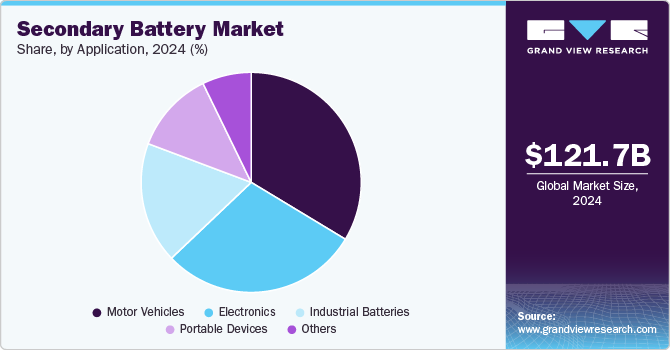

Application Insights

Governments worldwide are implementing stringent emission regulations and offering incentives to promote clean transportation, accelerating the demand for high-performance batteries, particularly lithium-ion. Additionally, advancements in battery technology, such as increased energy density and faster charging capabilities, are making EVs more appealing to consumers. The growing infrastructure for EV charging stations and significant investments by Portable Devices manufacturers in electrification further bolster this trend.

The demand for secondary batteries in portable devices is driven by the rapid proliferation of consumer electronics such as smartphones, laptops, tablets, wearables, and IoT devices. Consumers increasingly prioritize longer battery life, faster charging, and compact designs, pushing manufacturers to adopt advanced battery technologies like lithium-ion and lithium-polymer.

Regional Insights

The North America secondary battery market is driven by the rapid adoption of electric vehicles (EVs), supported by government incentives, stringent emission regulations, and commitments to decarbonization. The region is also witnessing significant growth in renewable energy storage, with increasing investments in solar and wind energy projects that require efficient battery storage systems.

U.S. Secondary Battery Market Trends

The secondary battery market in U.S. is driven by increasing demand for electric vehicles (EVs), the growing need for energy storage solutions, and advancements in battery technologies. Government incentives for clean energy, rising environmental concerns, and stringent emission regulations are accelerating the adoption of lithium-ion and other rechargeable batteries. The expanding consumer electronics sector, coupled with the push for grid stabilization through renewable energy integration, further fuels market growth. Additionally, investments in domestic battery manufacturing and recycling initiatives aim to reduce dependency on imports and enhance supply chain resilience

Asia Pacific Secondary Battery Market Trends

The APAC secondary battery market is primarily driven by the rapid adoption of electric vehicles (EVs), fueled by government policies, subsidies, and stringent emission regulations in countries like China, India, and Japan. The region is a global hub for battery manufacturing, with major players like CATL, LG Chem, and Panasonic leading production.

Europe Secondary Battery Market Trends

The Europe secondary battery market is driven by the region's strong push toward electric vehicle (EV) adoption, supported by stringent emission regulations and government incentives such as subsidies and tax benefits. The European Union's ambitious climate goals and the Green Deal initiative are accelerating investments in renewable energy storage, creating significant demand for secondary batteries. Additionally, the presence of leading Portable Devices manufacturers and battery producers, along with increasing consumer awareness of sustainability, further fuels the growth of the secondary battery market in Europe.

Central & South America Secondary Battery Market Trends

The Central and South America secondary battery market is driven by the increasing adoption of renewable energy projects, particularly solar and wind, which require efficient energy storage solutions to address intermittency issues. Governments in the region are also promoting electric vehicle (EV) adoption through incentives and infrastructure development, boosting demand for lithium-ion batteries.

Middle East & Africa Secondary Battery Market Trends

The Middle East and Africa (MEA) secondary battery market is driven by the region's increasing focus on renewable energy projects, such as solar and wind, to diversify energy sources and reduce reliance on fossil fuels. Governments are investing in energy storage systems to stabilize grids and support sustainable development.

Key Secondary Battery Company Insights

Some of the key players operating in the market include LG Chem, Hitachi High-Tech India Private Limited, Aquion Energy LLC, Johnson Controls, among others. These companies are driving innovation, expanding production capacities, and forming strategic partnerships to strengthen their market positions.

Key Secondary Battery Companies:

The following are the leading companies in the secondary battery market. These companies collectively hold the largest market share and dictate industry trends.

- LG Chem

- Hitachi High-Tech India Private Limited

- Aquion Energy LLC

- Johnson Controls

- BTI

- Amperex Technologies

- Panasonic Corporation

- BYD Company Ltd.

- SAMSUNG SDI CO., LTD.

- Energizer Holdings Inc.

Recent Developments

-

In November 2024, BYD launched its new Blade Batteries that shall power EVs. The battery is composed of lithium iron phosphate chemistry and shall be used by automakers such as Hyundai, Kia, Ford, Toyota, and Tesla.

Secondary Battery Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 132.0 billion

Revenue forecast in 2030

USD 207.19 billion

Growth rate

CAGR of 9.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South Africa, Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

LG Chem; Hitachi High-Tech India Private Limited; Aquion Energy LLC; Johnson Controls; BTI; Amperex Technologies; Panasonic Corporation; BYD Company Ltd.; SAMSUNG SDI CO., LTD.; Energizer Holdings Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Secondary Battery Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global secondary battery market report on the basis of type, application, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Lithium-ion

-

Lead Acid

-

Nickel Metal Hydride

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Motor Vehicles

-

Industrial Batteries

-

Portable Devices

-

Electronics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global secondary battery market size was estimated at USD 121.73 billion in 2024 and is expected to reach USD 132.04 billion in 2025.

b. The global secondary battery market is expected to grow at a compound annual growth rate of 9.4% from 2025 to 2030 to reach USD 207.19 billion by 2030.

b. Based on type segment, Lithium-ion held the largest revenue share of more than 78.0% in 2024 owing to high energy density and thus are very suitable for use in electric cars and other portable gadgets.

b. Some of the key vendors of the global secondary battery market are Hitachi High-Tech India Private Limited, Aquion Energy LLC, Johnson Controls, among others.

b. The key factors driving the secondary battery market include the increasing deployment of renewable energy sources like solar and wind requires efficient energy storage solutions to address intermittency issues. Secondary batteries, particularly lithium-ion, are critical for grid stabilization and energy storage systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.