- Home

- »

- Homecare & Decor

- »

-

Second-hand Furniture Market Size & Share Report, 2030GVR Report cover

![Second-hand Furniture Market Size, Share & Trends Report]()

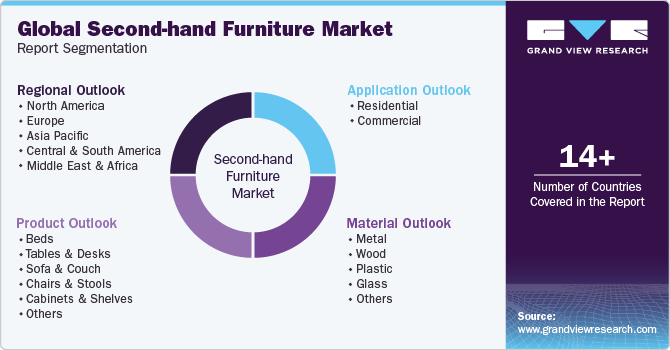

Second-hand Furniture Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Beds, Tables & Desks, Sofa & Couch, Chairs & Stools, Cabinets & Shelves), By Material (Metal, Wood, Plastic, Glass), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-257-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Second-hand Furniture Market Summary

The global second-hand furniture market size was estimated at USD 34.01 billion in 2023 and is projected to reach USD 56.66 billion by 2030, growing at a CAGR of 7.7% from 2024 to 2030. Increasing environmental consciousness and a growing emphasis on sustainable living are driving consumers to opt for pre-owned furniture, driving the market growth.

Key Market Trends & Insights

- The Asia Pacific second-hand furniture market held a share of 32.45% of the global revenue in 2023.

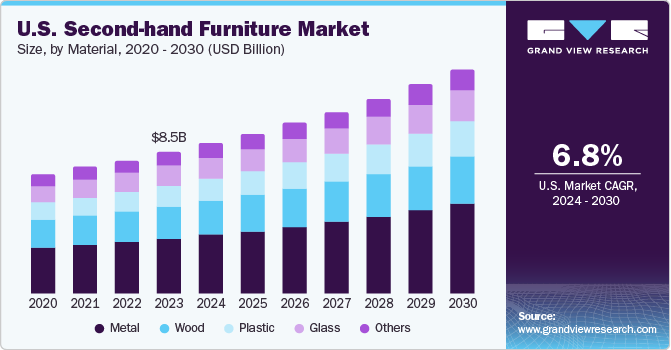

- The second-hand furniture market in the U.S. is expected to grow at a CAR of 6.8% from 2024 to 2030.

- By product, the second-hand bed sales accounted for a share of 24.15% in 2023.

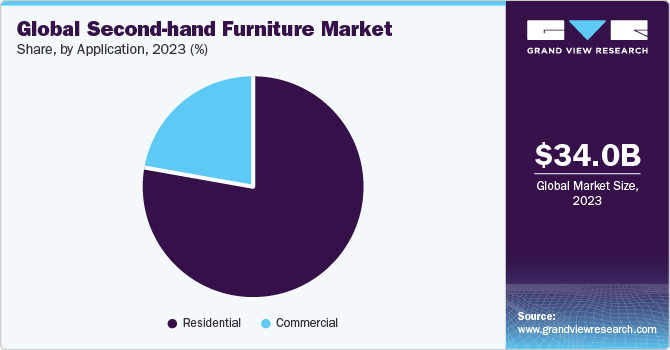

- Based on application, the residential segment held a revenue share of 78.23% in 2023.

- In terms of material, the second-hand wooden furniture segment accounted for a revenue share of 39.33% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 34.01 billion

- 2030 Projected Market Size: USD 56.66 billion

- CAGR (2024-2030): 7.7%

- Asia Pacific: Largest market in 2023

The rising popularity of vintage and unique designs, coupled with economic considerations, is also expected to drive the demand for second-hand furniture. Online platforms are facilitating easy buying and selling of used furniture that also contributes to the market growth, providing convenience and accessibility for consumers. Made.com, a home décor brand underwent a partnership with Geev, an online marketplace selling used furniture in May 2021. The collaboration empowers Made.com customers to give away preloved furniture through the Geev platform, encouraging circular economy practices. This initiative contributes to the global second-hand furniture market's growth, driven by increasing environmental awareness, consumer demand for sustainable options, and the convenience offered by online platforms.

The demand for home furnishings is high among millennials and Gen Z in the U.S., being responsible for nearly 70% of purchases in the latter half of 2022, according to a blog on Home News Now. Younger consumers’ inclination toward stylish and personalized living spaces will positively impact the demand for second-hand furniture. As these generations prioritize change in aesthetics in their homes, there is a growing market for used furniture that caters to their design preferences.

Consumers are drawn to the cost-effectiveness of purchasing used furniture, as it often comes at a significantly lower price compared to new items. This economic advantage appeals to budget-conscious individuals and drives them to purchase used, remanufactured, and refurbished furniture. For instance, AptDeco, an online used furniture selling marketplace offers pre-loved home furnishings at up to 70% savings from renowned brands such as West Elm, Jonathan Adler, and Pottery Barn. The substantial savings on high-quality items appeal to budget-conscious consumers seeking stylish and sustainable alternatives. Therefore, cost-effectiveness is one of the key factors encouraging consumers to buy second-hand furniture.

Market Concentration & Characteristics

The market growth stage is medium, and pace of the growth is accelerating. The second-hand furniture market shows a high degree of innovation driven by a confluence of environmental consciousness and shifting consumer preferences. Online platforms like Chairish and AptDeco have revolutionized the buying and selling experience for consumers, offering virtual marketplaces that connect sellers with a broader audience.

The level of collaborations and partnerships is moderately high. The collaborative efforts and strategic partnerships with major home retailers and brands are projected to drive widespread adoption of sustainable and circular practices in the second-hand furniture industry.

Second-hand furniture sales are growing across regions as consumers are recognizing the importance of a circular economy. In November 2022, AptDeco, an online furniture resale marketplace announced national expansion through national shipping, across the U.S. The company announced its status as the only end-to-end platform for all furniture resale. The initiative to ship its products in the national market makes furniture resale accessible to a broader audience across the U.S., promoting a circular economy by extending the lifecycle of home furnishings and reducing furniture sent to landfills.

Product Insights

Second-hand bed sales accounted for a share of 24.15% in 2023. This is mainly attributed to the increasing awareness of sustainable living practices prompting consumers to opt for pre-owned beds, to minimize the environmental impact. In November 2022, Kaiyo, a major furniture resale marketplace highlighted that half of the platform’s customers said that sustainability is a key factor driving their decision to sell pre-owned furniture on online marketplaces.

Second-hand sofa & couch sales are projected to grow at a CAGR of 8.7% from 2024 to 2030. As sustainability becomes a primary factor influencing consumers' decisions, the demand for second-hand living room furniture is expected to rise. Consumers are becoming more aware of the carbon-offsetting advantages associated with secondhand shopping. Kaiyo, an online marketplace to sell used furniture, estimates this impact at 173 kilograms of CO2 saved when furnishing a living room with resale items. This highlights the potential environmental benefits of choosing pre-owned living room furniture such as sofa & couch.

Material Insights

The second-hand wooden furniture segment accounted for a revenue share of 39.33% in 2023. This is mainly attributed to the enduring appeal of wooden furniture for its durability and timeless aesthetic that attracts consumers looking for long-lasting and classic pieces at more affordable prices. The sustainable aspect of reusing wooden furniture along with the growing availability of wooden furniture on resale platforms contribute to the growing sales of wooden second-hand furniture. According to a 2020 survey published at NC State University, consumers perceive wood as a natural and organic material, associating it with enjoyment and happiness. The majority of consumers, 82.5%, prefer using wood in the form of furniture at home.

The sales of second-hand plastic furniture is projected to grow at a CAGR of 8.7% from 2024 to 2030. The preference for second-hand plastic furniture is on the rise owing to plastic furniture being maintenance-free and it eliminates the need for costly upkeep like painting or rust prevention. The growing recyclability of plastic furniture also appeals to eco-conscious consumers. Additionally, plastic furniture is affordable, stylish, and versatile, making it an attractive choice for various interiors. Its lightweight nature ensures easy mobility. Therefore, second-hand plastic furniture is projected to witness high growth in the market.

Application Insights

The residential segment held a revenue share of 78.23% in 2023. The demand for second-hand furniture in the residential sector is projected to grow over the forecast period due to increasing demand for furniture in the living room and bedroom coupled with rising real estate construction projects initiated by governments, especially in urban areas. For instance, the Ministry of Housing and Urban Affairs in India is responsible for initiating and approving infrastructure development in urban towns and other metropolitan cities of India. Urban consumers switching places are more likely to opt for second-hand furniture owing to cost-effectiveness.

Commercial second-hand furniture sales are projected to grow at a CAGR of 9.1% from 2024 to 2030. The cost-effectiveness of purchasing second-hand furniture is particularly attractive for businesses aiming to optimize their budgets while maintaining a professional and aesthetically pleasing workspace. Additionally, the diverse range of styles and configurations available in the furniture resale market allows businesses to create unique and customized office environments. The convenience of online platforms for procuring used furniture further accelerates its adoption in the commercial sector.

Regional Insights

The second-hand furniture market in North America held 31.56% of the global revenue in 2023. According to a March 2023 YouGov survey focused on 17 markets including North America revealed that 36% of consumers are most likely to buy second-hand furniture. Growing consumer inclination towards pre-owned furniture is driving the regional market growth.

U.S. Second-hand Furniture Market Trends

The second-hand furniture market in the U.S. is expected to grow at a CAR of 6.8% from 2024 to 2030. The market is experiencing growth due to the country’s increased expenditure on interior décor and renovation. According to JCHS (Joint Center for Housing Centers of Harvard University), spending on home improvement projects increased from USD 328 billion in 2019 to USD 472 billion in 2022. Americans are ramping up their expenditure on home improvements, renovations, and repairs, which increased by 11.8% between 2020 and 2021. The growing consumer interest in home renovation and improvement bodes well for the growth of the second-hand furniture industry in the U.S. residential settings.

Asia Pacific Second-hand Furniture Market Trends

The Asia Pacific second-hand furniture market held a share of 32.45% of the global revenue in 2023. The growing urbanization and changing consumer lifestyles in countries across Asia Pacific contribute to an increased sale of second-hand furniture. The growth in relocation for job opportunities, education, or lifestyle changes, in countries such as India, has led to a rising need for cost-effective and flexible furnishing solutions. Second-hand furniture provides an affordable and sustainable option, allowing consumers to furnish their new homes quickly and easily without the high costs associated with purchasing brand-new items. This is projected to drive the growth in demand for second-hand furniture in Asia Pacific.

Key Second-hand Furniture Company Insights

The global second-hand furniture market is fragmented and unorganized. Key companies are actively innovating and undergoing partnerships to gain a competitive advantage. Companies are increasingly focusing on sustainability initiatives, encouraging consumers to buy and sell pre-owned items. Most companies are forming partnerships with resale platforms, enhancing convenience for users. Additionally, some brands are exploring circular economy models, aiming to extend the lifecycle of furniture through refurbishment and recycling, contributing to a more eco-friendly and cost-effective industry.

Key Second-hand Furniture Companies:

The following are the leading companies in the second-hand furniture market. These companies collectively hold the largest market share and dictate industry trends.

- IKEA

- Envirotech Products Company

- Beverly Hills Chairs

- Steelcase Inc.

- Second Hand Office Furniture Co.

- Pottery Barn

- Rework Office Furniture

- Thrift Super Store

- Almost Perfect Furniture

- OneUp Furniture

Recent Developments

-

In April 2022, IKEA made its Buy Back & Resell program permanent in the U.S., allowing customers to sell used fully assembled and functional furniture for store credit. The program aims to promote sustainability in the furniture industry.

-

In May 2021, Made.com and Geev partnered to allow consumers to sell used furniture and homewares, reducing waste and environmental impact. This offers customers a platform to post ads on Geev for unwanted items. Geev aims to expand its zero-waste donations on a larger scale and work with more companies for sustainable solutions.

Second-hand Furniture Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 36.40 billion

Revenue forecast in 2030

USD 56.66 billion

Growth rate

CAGR of 7.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; Brazil; South Africa; Saudi Arabia

Key companies profiled

IKEA; Envirotech Products Company; Beverly Hills Chairs; Steelcase Inc.; Second Hand Office Furniture Co.; Pottery Barn; Rework Office Furniture; Thrift Super Store; Almost Perfect Furniture; OneUp Furniture

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Second-hand Furniture Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030.For this study, Grand View Research has segmented the global second-hand furniture market report based on product, material, application, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Beds

-

Tables & Desks

-

Sofa & Couch

-

Chairs & Stools

-

Cabinets & Shelves

-

Others

-

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Metal

-

Wood

-

Plastic

-

Glass

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global second-hand furniture market size was estimated at USD 34.01 billion in 2023 and is expected to reach USD 36.4 billion in 2024.

b. The global second-hand furniture market is expected to grow at a compound annual growth rate of 7.7% from 2024 to 2030 to reach USD 56.66 billion by 2030.

b. In 2023, Asia Pacific accounted for a 32.45% share of global second-hand furniture sales, owing to the region's growing urbanization and evolving consumer lifestyles.

b. Some of the key market players include IKEA, Envirotech Products Company, Beverly Hills Chairs, Steelcase Inc., Second Hand Office Furniture Co., Pottery Barn, Rework Office Furniture, Thrift Super Store, Almost Perfect Furniture, and OneUp Furniture.

b. Key factors that are driving the second-hand furniture market growth include the cost-effectiveness of second-hand furniture, the surge in environmental awareness, and a heightened focus on sustainable lifestyles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.