- Home

- »

- Plastics, Polymers & Resins

- »

-

Seaweed Packaging Market Size And Share Report, 2030GVR Report cover

![Seaweed Packaging Market Size, Share & Trends Report]()

Seaweed Packaging Market Size, Share & Trends Analysis Report By Source (Plant, Animal), By Packaging Process, By Application (Food, Beverages, Pharmaceuticals), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-456-2

- Number of Report Pages: 180

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Seaweed Packaging Market Size & Trends

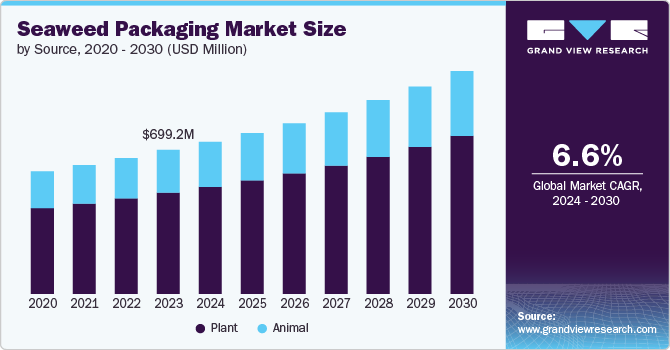

The global seaweed packaging market size was valued at USD 699.23 million in 2023 and is expected to expand at a CAGR of 6.6% from 2024 to 2030. The global seaweed packaging market is driven by growing environmental concerns and a shift towards sustainable packaging solutions. Seaweed-based packaging has emerged as a promising alternative to traditional plastics due to its biodegradable and renewable nature. This demand is primarily fuelled by increasing awareness toward plastic pollution, especially in oceans, and stringent environmental regulations globally, pushing industries to adopt eco-friendly packaging solutions.

Several companies are pioneering seaweed packaging solutions. For instance, Notpla, a UK-based startup, developed a seaweed-based packaging solution for liquid products, widely used in marathon events to replace single-use plastic bottles. Another innovation comes from Evoware, an Indonesian company that offers seaweed packaging for food wraps and sachets, designed to dissolve in water and are entirely edible. These instances reflect the growing trend of eco-friendly solutions gaining traction in consumer and industrial packaging markets.

In Europe, EU regulations are creating opportunities for the seaweed packaging industry by emphasizing a reduction in single-use plastics. The EU Directive on Single-Use Plastics (SUP) has banned the use of several disposable plastic items, making room for biodegradable alternatives like seaweed packaging. This regulation drives innovation and adoption across the European market, where plant-based packaging is expected to flourish.

Source Insights

On basis of source, the global market for seaweed packaging has been segmented into plant & animal. Plant is anticipated to dominate the overall market with a market share of over 70% in 2023, due to the environmentally friendly nature of the Source. Seaweed-derived materials, rich in polysaccharides, are biodegradable, reducing the burden of waste on landfills and oceans. Plant-based seaweed packaging is gaining widespread attention in food and beverage sectors, as companies seek alternatives to petroleum-based plastics that offer similar functionality without the environmental footprint.

Animal-based sources in seaweed packaging are less common compared to plant-based options. However, innovations are emerging that explore hybrid materials combining seaweed extracts with animal by-products to enhance packaging performance. These materials are still in the experimental phase, contributing marginally to the overall market.

Packaging Process Insights

Based on the packaging process, the seaweed packaging market is segmented into antimicrobial, nanotechnology, electro hydrodynamic, coatings, and microorganisms. Among these, antimicrobial packaging process dominates the seaweed packaging market due to its functional properties that extend product shelf life. Seaweed contains natural antimicrobial agents like fucoidan and laminarin, which inhibit the growth of harmful microorganisms, making it particularly useful for food packaging applications. This process is gaining popularity for its ability to reduce food waste by keeping perishable products fresh for longer periods.

The coatings segment is projected to grow rapidly as more manufacturers use seaweed-based coatings to improve the barrier properties of traditional packaging materials. Seaweed coatings offer excellent moisture resistance and can be applied to a variety of surfaces, making them versatile for multiple packaging applications, especially in the food and pharmaceutical industries.

Nanotechnology is an emerging area in the seaweed packaging industry, where nanoparticles derived from seaweed extracts are being used to enhance the mechanical and barrier properties of packaging materials. This helps improve resistance to water, oxygen, and other environmental factors that could degrade the packaged product.

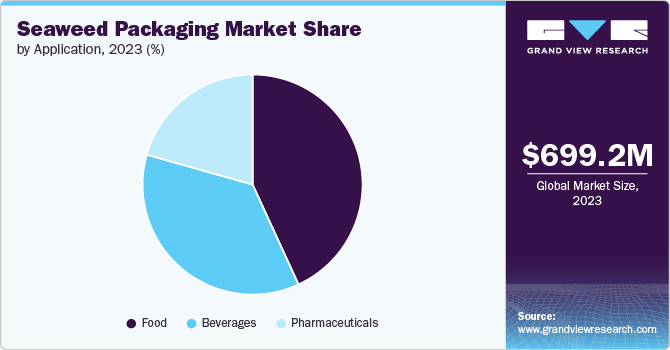

Application Insights

Based on the application, the seaweed packaging market is segmented into food, beverages, pharmaceuticals, and others. The food and beverage sector holds the highest market share within the seaweed packaging market. Seaweed packaging materials are widely used for wrapping fresh produce, processed foods, and ready-to-eat meals. Due to their biodegradability and edible properties, seaweed-based packaging is becoming a preferred choice among food manufacturers looking for sustainable alternatives to plastic.

The beverage industry is exploring seaweed packaging primarily for liquid sachets and edible pods. While adoption is slower than in the food sector, innovations like edible water pods made from seaweed are gaining attention for their eco-friendly approach to reducing single-use plastic bottles and packaging in events and festivals.

The pharmaceutical industry is the fastest-growing segment in the seaweed packaging market. The antimicrobial and biodegradable properties of seaweed packaging make it an attractive option for packaging drugs and medical devices. As the industry moves toward sustainable solutions, seaweed-based packaging materials are increasingly being adopted for their low environmental impact and protective properties.

Regional Insights

In North America, the seaweed packaging market is emerging as companies respond to growing consumer demand for sustainable packaging. The US and Canada are witnessing increasing awareness of plastic pollution, leading to the adoption of biodegradable packaging solutions. Companies like Loliware, which produces seaweed-based straws and cups, are expanding their market presence, pushing the trend for eco-friendly packaging alternatives.

U.S. Seaweed Packaging Market Trends

The U.S. food and beverage industry, particularly, is a significant driver for the adoption of seaweed packaging. Many companies are looking for ways to reduce their carbon footprint and meet the expectations of environmentally conscious consumers. For example, LOLIWARE INC., a U.S.-based company, developed edible seaweed straws and packaging, which have gained popularity among environmentally friendly brands and consumers. The use of seaweed in food packaging not only offers biodegradability but also improves the shelf life of certain products, providing additional functional benefits.

Asia Pacific Seaweed Packaging Market Trends

Asia Pacific, particularly countries like Japan, South Korea, and China, is witnessing rapid growth in seaweed packaging due to the region’s abundant seaweed resources and the rising demand for eco-friendly packaging. The growing awareness of environmental issues and government initiatives promoting biodegradable materials have further boosted market expansion. Japan has long embraced seaweed-based packaging for food products like sushi, and innovations are now expanding into other sectors such as personal care and pharmaceuticals.

India Seaweed Packaging Market Trends

India’s seaweed packaging market is growing, driven by the country’s large coastline, which provides abundant seaweed resources. Government initiatives like the Seaweed Mission aim to enhance seaweed cultivation, creating opportunities for local seaweed packaging industries. Additionally, the demand for sustainable packaging in the food and agricultural sectors is pushing growth as businesses look for eco-friendly alternatives to plastic packaging.

Europe Seaweed Packaging Market Trends

Europe is a leading region in the seaweed packaging market due to strong government regulations supporting the reduction of plastic waste. The European Union’s Single-Use Plastics Directive has created opportunities for seaweed packaging to replace conventional plastics. Countries like France and the UK are at the forefront of this shift, with various companies introducing seaweed packaging solutions across the food, beverage, and cosmetics sectors.

Key Seaweed Packaging Company Insights

The market is competitive in nature with the presence of a significant number of companies. Sustainable packaging industry has been witnessing a significant number of new product launches and expansions over the past few years. This can be attributed to the circular economy initiatives, innovation in materials and technologies, and consumer demand for sustainability.

-

On August 20, 2024, PA Consulting (PA), the global innovation and transformation consultancy, has joined forces with Searo Labs, innovators in sustainable materials, to develop cutting-edge seaweed-based products that offer alternatives to plastic and single-use items. The collaboration is focused on accelerating and scaling the adoption of seaweed-based materials in consumer products and packaging within the food, personal care, and home care sectors.

-

On June 07, 2024, Kelpi, a startup that's developing seaweed-based packaging as an alternative to plastic, has secured a Euro 4.35 million investment. These funds will be used to advance manufacturing pilots and gain regulatory approval for its proprietary coatings for paper and card as well as continue a commercial roll-out which has already seen it win R&D contracts ith L’Oréal, Diageo and Waitrose.

Key Seaweed Packaging Companies:

The following are the leading companies in the seaweed packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Regeno

- JRF Technology, LLC

- Evo &Co.

- Monosol LLC

- Amtrex Nature Care Pvt. Ltd.

- EnviGreen

- Devro

- Montrose UK Ltd.

- Marine Innovation

- KELP INDUSTRIES LTD

- Searo

- FlexSea

- AGreenPlus

- ZEROCIRCLE ALTERNATIVES PVT. LTD.

- LOLIWARE Inc.

- Evoware

- Sway Innovation Co.

- Notpla Limited

- BZEOS

- PT Seaweedtama Biopac Indonesia

Seaweed Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 737.98 million

Revenue forecast in 2030

USD 1,081.97 million

Growth rate

CAGR of 6.6% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2024 to 2030

Report coverage

Volume Forecast, Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Source, packaging process, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Southeast Asia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Regeno; JRF Technology LLC; Evo &Co.; Monosol LLC; Amtrex Nature Care Pvt. Ltd.; EnviGreen, Devro; Montrose UK Ltd.; Marine Innovation; KELP INDUSTRIES LTD; Searo; FlexSea; AGreenPlus; ZEROCIRCLE ALTERNATIVES PVT. LTD.; LOLIWARE Inc.; Evoware; Sway Innovation Co.; Notpla Limited; BZEOS; PT Seaweedtama Biopac Indonesia

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Seaweed Market Report Segmentation

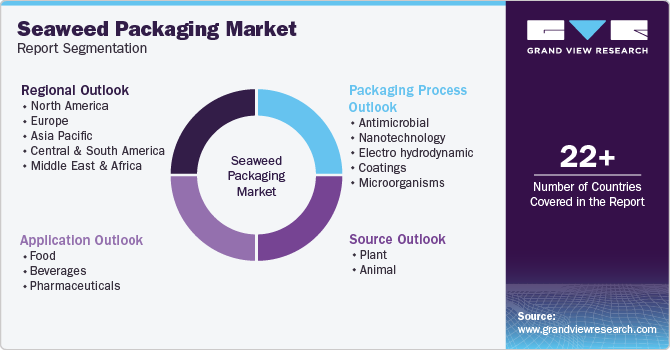

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the seaweed packaging market report on the basis of source, packaging process, application, and region:

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Plant

-

Animal

-

-

Packaging Process Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Antimicrobial

-

Nanotechnology

-

Electro hydrodynamic

-

Coatings

-

Microorganisms

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food

-

Beverages

-

Pharmaceuticals

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global seaweed packaging market was estimated at USD 699.23 million in 2023 and is expected to reach USD 737.98 million in 2024.

b. The global seaweed packaging market is expected to grow at a compound annual growth rate of 6.6% from 2024 to 2030, reaching around USD 1,081.97 million by 2030.

b. Plants are anticipated to dominate the overall market, with a market share of over 70% in 2023, due to their environmentally friendly nature. Seaweed-derived materials, rich in polysaccharides, are biodegradable, reducing the burden of waste on landfills and oceans. Plant-based seaweed packaging is gaining widespread attention in the food and beverage sectors as companies seek alternatives to petroleum-based plastics that offer similar functionality without an environmental footprint.

b. Some key players in the seaweed packaging market include Regeno, JRF Technology, LLC, Evo &Co., Monosol LLC, Amtrex Nature Care Pvt. Ltd., EnviGreen, Devro, Montrose UK Ltd., Marine Innovation, KELP INDUSTRIES LTD, Searo, FlexSea, AGreenPlus, ZEROCIRCLE ALTERNATIVES PVT. LTD., LOLIWARE Inc., Evoware, Sway Innovation Co., Notpla Limited, BZEOS, and PT Seaweedtama Biopac Indonesia.

b. The global seaweed packaging market is driven by growing environmental concerns and a shift towards sustainable packaging solutions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."