Seasoning & Spices Market Size, Share & Trends Analysis Report By Product (Spice, Salt & Salts Substitutes), By Brand (National Brand, Private Label Brand), By End-use (Retail, Foodservice), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-639-4

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Seasoning & Spices Market Size & Trends

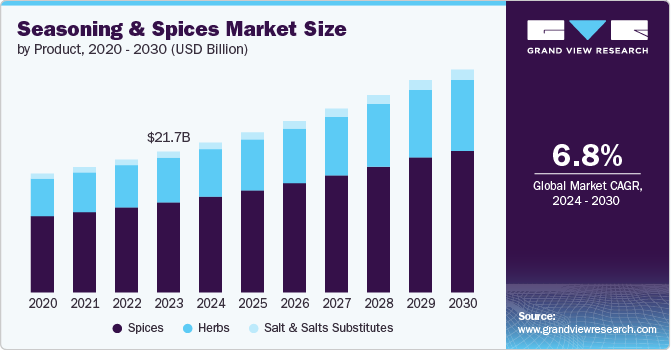

The global seasoning & spices market size was estimated at USD 21.69 billion in 2023 and is expected to grow at a CAGR of 6.8% from 2024 to 2030. The global market is experiencing growth, driven by increasing consumer interest in diverse and exotic flavors, as well as an increased focus on health and wellness. The market encompasses a wide range of products, including herbs, spices, blends, and condiments, with significant consumption in both household and industrial applications. In recent years, the market has seen an expansion due to the rising popularity of international cuisines and the demand for convenient, ready-to-use spice mixes.

According to the CBI EU, in January 2022, Europe was one of the world’s leading importing regions for herbs and spices and accounted for about one-quarter of the world’s total imports. In 2020, Asia was the leading importer of spices and herbs, with 47% of the market share, followed by Europe with 26%. Further, according to the first set of 2021 data for the first and second quarters, European imports of herbs and spices remained stable or grew slightly. European imports are likely to increase between 0 and 2% over the next few years, owing to the strong dependence on spice imports from developing countries.

Several key trends are shaping the global market. First, there is a growing consumer preference for clean-label and organic products, which are perceived as healthier and more natural. This trend is driving demand for spices and seasonings free from artificial additives and preservatives. Second, the rise of e-commerce and direct-to-consumer sales channels is transforming how spices and seasonings are marketed and sold, allowing companies to reach a broader audience and offer a wider variety of products. In addition, innovative packaging and product formulations, such as liquid seasonings and functional spice blends, are gaining popularity.

Manufacturers are actively introducing new products in the market to cater to evolving consumer preferences and trends. In April 2023, McCormick partnered with Tabitha Brown, an American actress, for the nationwide launch of five new salt-free, vegan seasoning products. This lineup includes two seasoning blends, and three recipe mixes designed to cater to both vegan and non-vegan consumers, offering versatile and flavorful options for everyday cooking. Notable products in this collection include the McCormick Taco Business Seasoning Mix and McCormick Like Sweet Like Smoky All Purpose Seasoning. Tabitha Brown, known for her vegan advocacy and accessible recipes, aims to inspire healthy and delicious meals through these new additions to the McCormick range.

Sustainability and ethical sourcing have become crucial considerations in the spices market. Consumers are increasingly interested in products that are sourced responsibly, ensuring fair labor practices and minimal environmental impact. McCormick’s commitment to sustainably sourcing 100% of its branded iconic ingredients by 2025 highlights this trend. The company works closely with farmers to implement sustainable farming practices and ensure fair wages. Similarly, Olam Spices launched the Olam Clean Pepper Project in the Chu Puh district of Gia Lai province, Vietnam. The initiative has enlisted 275 farmers so far, with a target to expand to 1,000 by 2020. The project focuses on training farmers in Good Agricultural Practices (GAP) and Integrated Pest Management (IPM) to enhance their livelihoods, minimize environmental impact, and elevate the quality of black pepper produced.

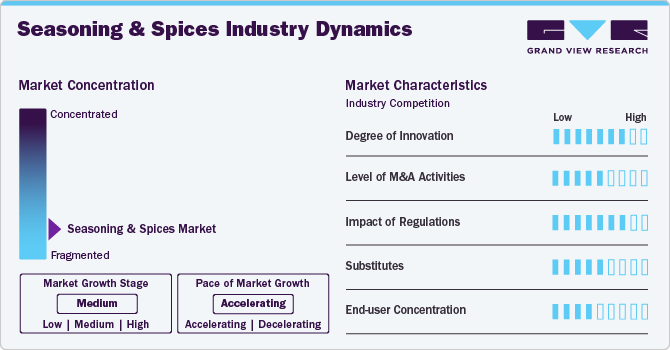

Market Concentration & Characteristics

The seasoning & spices market sees moderate innovation, primarily driven by consumer demand for organic, natural, and health-conscious products. Companies are developing new blends, incorporating exotic flavors, and focusing on sustainable sourcing. Innovation also extends to packaging, with eco-friendly and convenient designs gaining popularity to enhance user experience.

Regulations in the market, particularly related to food safety, labeling, and organic certifications, significantly impact manufacturers. Strict compliance with local and international food standards is essential to ensure product quality and avoid penalties. These regulations also influence the sourcing of raw materials, especially for companies focusing on organic and non-GMO products.

The impact of substitutes in the market is relatively low but present, as consumers can opt for alternative flavor enhancers like, sauces, or condiments. However, the unique flavors and health benefits of spices, particularly in traditional and ethnic cuisine, often make them irreplaceable in specific dishes.

The end-user concentration in the market is broad, with demand spread across households, food service industries, and processed food manufacturers. The retail sector for individual consumers remains highly fragmented, while large-scale food manufacturers represent more concentrated demand, driving bulk purchases for consistent seasoning needs.

Product Insights

The spices segment accounted for a revenue share of about 63% in 2023. The spices segment includes both commonly used spices and spice blends. Growing awareness of the health benefits and properties of varied spices will help increase their demand over the forecast period. Players in the food industry continuously develop new spice blends and seasonings to cater to changing consumer tastes and dietary trends. Ready-to-eat meals and convenience foods often contain a variety of spices to enhance flavor without the need for additional preparation.

In April 2023, Kraft Heinz Company (KHC) announced the launch of Just Spices in the U.S., marking a significant milestone just a year after acquiring a majority stake in the business. This innovative brand is expected to boost the company's Taste Elevation segment, emphasizing flavor enhancement. Just Spices aligns with Kraft Heinz's long-term growth strategy by becoming a key driver for its Taste Elevation platform. The brand's comprehensive line of premium spices and seasonings empowers consumers to elevate their culinary experiences easily and conveniently.

Moreover, the demand for salt & salts substitutes is expected to rise at a CAGR of 7.7% from 2024 to 2030. Since salt is the most basic ingredient in any kind of food, its usage cannot be stopped despite the many diseases associated with its high consumption. Salt substitutes often contain potassium chloride or other minerals in place of sodium chloride (salt). Potassium chloride provides a salty taste but with significantly less sodium. With the rising number of patients with hypertension and cardiovascular diseases, the demand for salt alternatives has increased globally. For instance, in April 2024, Kerry, a leading ingredient supplier, launched Tastesense Salt, a revolutionary ingredient that delivers a salty taste without sodium. This game-changing innovation is poised to reshape the snack industry, offering a healthier alternative for consumers while maintaining the flavors.

Brand Insights

National brands constituted a revenue share of about 87% in 2023. Many regional consumers indulge in various spices and seasonings imported from international companies, seeking authenticity and variety. However, in recent years, there has been a notable shift towards encouraging local spices and seasonings producers, steering the growth of national brands and a competitive landscape. To encourage local manufacturing, LifeSpice India, in November 2022, launched an innovative product: the "LifeSpice" mix, acclaimed as India's first science-baked spice blend. This groundbreaking product combines traditional flavors with cutting-edge scientific methods to enhance taste, aroma, and health benefits, establishing a new benchmark in the spice industry.

Demand for private label seasoning & spices is set to grow at a CAGR of 10.1% from 2024 to 2030. Consumers are now opting for private label and international brands as they offer spices and seasonings in different and exotic taste profiles. Private label manufacturers across the globe are expanding their range with sustainable, new or better-quality herbs and spices. In February 2024, U.S.-based leading food distributor and grocer, SpartanNash, expanded its portfolio with the launch of Finest Reserve by Our Family, a premium private-label brand. This curated collection offers an array of artisan-crafted products to enhance the culinary experience for shoppers. Finest Reserve features a diverse range of pasta, spices, sauces, frozen pizzas, dressings and marinades, salts and seasoning blends, chocolate, and wine.

End-use Insights

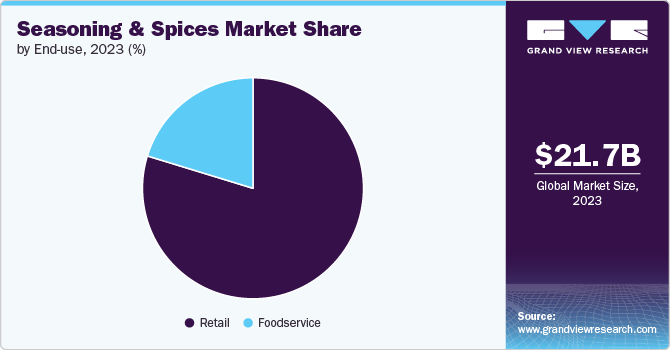

The use of seasoning & spices in retail accounted for a revenue share of about 79% in 2023. The consumption of seasonings and spices in the retail sector has significantly increased over the years as consumers prefer cooking at home over dining out, particularly since the global pandemic. In October 2022, Dan-O's Seasoning, the acclaimed diet-friendly blend of all-natural herbs and spices, announced a major retail expansion partnership with Tops Friendly Markets. This agreement marks a significant milestone for the company, placing Dan-O's Seasoning in over 10,000 retail stores in the U.S. The expansion also includes partnerships with Weis Markets, Wegmans, Stop & Shop, and Price Chopper in the Northeast.

Demand for seasoning & spices in foodservice is anticipated to rise at a CAGR of 8.9% from 2024 to 2030. Spice and seasoning producers are increasingly adopting expansion and diversification strategies to enhance their offerings in the food service sector. In March 2024, Rumi Spice, renowned for its exceptional flavors and commitment to sustainable livelihoods in Afghanistan, expanded into the food service industry. This expansion brings Rumi Spice's premium saffron and chef-grade spices to a wider range of culinary professionals in the San Antonio and Austin areas. Rumi Spice's entry into the food service sector is an extension of its mission to elevate flavors while empowering communities in Afghanistan.

Regional Insights

The seasoning & spices market in North America accounted for a revenue share of around 2% in 2023. The growing demand for convenience and ready-to-eat foods, coupled with the increasing popularity of ethnic cuisines, has contributed to the growth of the North American market. Consumers are seeking bold flavors and spices to enhance their home-cooked meals.

There is an increasing desire among U.S. consumers to explore diverse taste profiles and authentic ethnic cuisines. This trend is being driven by the popularity of online recipe tutorials and the growing influence of Southeast Asian, Indian, North African, and Eastern Mediterranean cuisines. The rising number of Asian immigrants in the U.S. and Canada, particularly from India and other parts of Asia, is contributing to the demand for spices and seasonings used in traditional ethnic dishes.

U.S. Seasoning & Spices Market Trends

The seasoning & spices market in the U.S. accounted for market share of around 79% in 2023 in the North American market. Nutritional programs are exploring innovative ways to promote healthy eating habits and are increasingly focused on health and well-being in the U.S. In February 2024, the McCormick Science Institute, in partnership with Jackey and the health and nutrition team at the University of Maryland Eastern Shore (UME), awarded a grant of over USD 90,000 to expand and refine the 'Capture the Flavor: Herbs and Spices' program for a nationwide audience. Currently offered exclusively in Maryland, the program consists of an engaging 75-minute interactive workshop that educates participants on the historical significance, culinary uses, proper storage techniques, safety guidelines, and health-boosting benefits of incorporating herbs and spices into their cooking.

Asia Pacific Seasoning & Spices Market Trends

The Asia Pacific seasoning & spices market is accounted for a revenue share of about 78% of the global market in 2023. This booming market is reinforced by the region's role as a global spice powerhouse. Countries like India, Vietnam, China, and Thailand are major producers and exporters, making Asia Pacific a leading player in the global spice trade. Furthermore, globalization and migration have significantly altered food preferences, creating a demand for diverse seasonings. This trend has led foodservice outlets to embrace a wider range of flavors, catering to a more discerning palate. The dynamic APAC market presents a wealth of opportunities for spice & seasoning producers, retailers, and foodservice operators alike.

Europe Seasoning & Spices Market Trends

The seasoning & spices market in Europe is anticipated to grow at a CAGR of 7.6% from 2024 to 2030. Increasing buyers’ willingness to pay a premium for fresh flavors and the growing preference for various ethnic cuisines have been driving the demand for various seasonings and spices across Europe. Eastern Mediterranean, North African, Eastern and Southeast Asian, and Indian cuisines are among the top influencers for trending ingredients in the Europe seasoning market. Furthermore, economies including Germany, the U.K., the Netherlands, and Spain present the highest growth opportunities for seasonings and spices. Spices, including ginger, Curcuma, fenugreek seeds, and processed nutmeg, are in great demand as they contribute to healthy lifestyles.

Key Seasoning & Spices Company Insights

The seasoning & spices market is fragmented. Branding, collaborations, expansions, and product launches are some of the strategies adopted by key players in this market to compete effectively. For instance, in July 2024, Bart Ingredients Company collaborated with The Space Creative, a Bristol-based agency, to revamp its brand and packaging to attract modern food enthusiasts while still appealing to its traditional customer base. Initially focusing on redesigning the packaging for Bart’s assortment of spice blends inspired by global cuisines, this new concept extended to cover its extensive product line of more than 100 items, including herbs, spices, chopped ingredients, pastes, salts, peppers, and seasonings.

Key Seasoning & Spices Companies:

The following are the leading companies in the seasoning & spices market. These companies collectively hold the largest market share and dictate industry trends.

- Ajinomoto Co. Inc.

- Sensient Technologies Corporation

- Associated British Food PLC

- Kerry Group plc

- McCormick & Company Inc.

- Baria Pepper

- Döhler GmbH

- DS Group

- Everest Spices

- Bart Ingredients

Recent Developments

-

In July 2024, Bart Ingredients Companycollaborated with The Space Creative, a Bristol-based agency, to revamp its brand and packaging to attract modern food enthusiasts while still appealing to its traditional customer base. Initially focusing on redesigning the packaging for Bart’s assortment of spice blends inspired by global cuisines, this new concept extended to cover its extensive product line of more than 100 items, including herbs, spices, chopped ingredients, pastes, salts, peppers, and seasonings.

-

In May 2024, Döhler announced the expansion of its manufacturing facility in Paarl, South Africa, which represents a significant advancement in its operations in the African market. By improving product availability and tailoring its offerings, Döhler aims to strengthen its relationships with local customers and establish itself as a leading player in the food, beverage, life science, and nutrition industry in the region.

-

In April 2024, DS Group announced plans to invest USD 1.25 billion in advertising and marketing for its flagship Catch Spices brand in FY25. This investment aims to increase the brand’s visibility, expand its distribution in India's tier II and III cities, and capitalize on quick commerce platforms to stimulate growth. The considerable funding demonstrates the company's dedication to boosting the brand's presence in the spice market.

Seasoning & Spices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 23.08 billion |

|

Revenue forecast in 2030 |

USD 34.31 billion |

|

Growth rate |

CAGR of 6.8% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

September 2024 |

|

Quantitative units |

Revenue in USD billion, metric tons, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, brand, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; Poland; Belgium; Netherlands; China; India; Japan; Australia & New Zealand; Brazil; South Africa |

|

Key companies profiled |

Ajinomoto Co. Inc.; Sensient Technologies Corporation; Associated British Food PLC; Kerry Group plc; McCormick & Company Inc.; Baria Pepper; Döhler GmbH; DS Group; Everest Spices; Bart Ingredients |

|

Customization |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Seasoning & Spices Market Report Segmentation

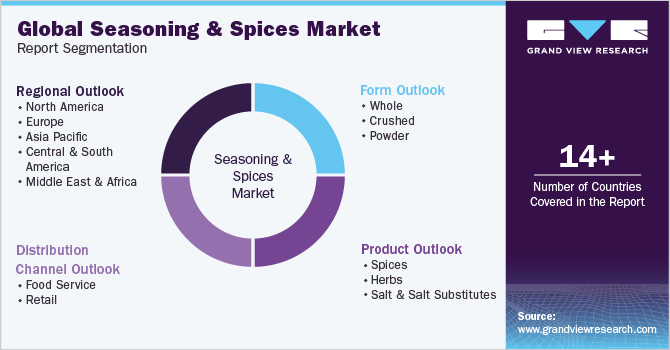

This report forecasts revenue growth at the global, regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global seasoning & spices market report based on the product, brand, end-use, and region:

-

Product Outlook (Revenue, USD Billion, Metric Tons, 2018 - 2030)

-

Spices

-

Pepper

-

Ginger

-

Cinnamon

-

Cumin

-

Turmeric

-

Coriander

-

Cardamom

-

Cloves

-

Others

-

-

Herbs

-

Garlic

-

Oregano

-

Mint

-

Parsley

-

Rosemary

-

Fennel

-

Others

-

-

Salt & Salts Substitutes

-

-

Brand Outlook (Revenue, USD Billion, Metric Tons, 2018 - 2030)

-

National Brand

-

Private Label Brand

-

-

End-use Outlook (Revenue, USD Billion, Metric Tons, 2018 - 2030)

-

Retail

-

Foodservice

-

-

Regional Outlook (Revenue, USD Billion, Metric Tons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Poland

-

Belgium

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global seasoning & spices market size was estimated at USD 21.69 billion in 2023 and is expected to reach USD 23.08 billion in 2024.

b. The global seasoning & spices market is expected to grow at a compound annual growth rate of 6.8% from 2024 to 2030 to reach USD 34.31 billion by 2030.

b. The Asia Pacific dominated the seasoning & spices market with a share of 78.25% in 2023. This is attributable to the rising demand for ethnic flavored foods among middle-income groups in countries including China and India.

b. Some key players operating in the seasoning & spices market include Ajinomoto Co, Inc., Sensient Technologies Corporation, Associated British Food PLC, Kerry Group plc, McCormick & Company Inc., Baria Pepper, Döhler GmbH, DS Group, Everest Spices, Bart Ingredients.

b. Key factors that are driving the seasoning & spices market growth include increasing buyers’ willingness to pay a premium for new flavors and ethnic tastes and rising demand for ready-to-use spice mixes as convenient options in the food service industry.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."