- Home

- »

- Homecare & Decor

- »

-

Seam Tapes Market Size And Share, Industry Report, 2030GVR Report cover

![Seam Tapes Market Size, Share & Trends Report]()

Seam Tapes Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (PU, TPU, PVC), By Application (Waterproofing, Woven Fabrics), By End use (Healthcare, Automotive), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-490-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2026 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Seam Tapes Market Size & Trends

The global seam tapes market size was estimated at USD 174.66 billion in 2024 and is expected to grow at a CAGR of 6.5% from 2025 to 2030. One of the primary reasons for the growth of the seam tape industry is the increased application in apparel manufacturing. The rise of high-performance sportswear and outdoor clothing has created a substantial demand for seam tapes that provide waterproofing and durability. As consumers become more health-conscious and engaged in outdoor activities, the need for protective clothing has surged. This trend is particularly evident among millennials who prioritize quality and functionality in their apparel choices. The growing awareness about best-fit intimate apparel further fuels this demand, making seam tapes essential in producing garments that meet these consumer expectations.

The expansion of the automotive industry, particularly in regions like China and India, is another significant contributor to the seam tape industry’s growth. Seam tapes play a crucial role in automotive manufacturing by ensuring moisture control, fixing wire connections, and providing waterproofing solutions. With projections indicating a rise in vehicle production in these countries, the demand for seam tapes is expected to increase correspondingly. Government initiatives further support this trend to boost domestic manufacturing capabilities, creating lucrative opportunities for seam tape manufacturers.

In addition to automotive applications, the growing aerospace sector drives demand for seam tapes. The aerospace industry requires lightweight materials to withstand extreme conditions while ensuring passenger comfort. Seam tapes are used extensively in various applications within this sector, including insulation blankets and ductwork. As air travel expands globally, the need for reliable and efficient sealing solutions will likely increase, further boosting the seam tape industry.

Moreover, emerging economies are becoming key market players due to their growing populations and rising disposable incomes. Countries like India, China, Vietnam, and Bangladesh are witnessing a surge in demand for high-end value-added clothing as urbanization progresses and consumer purchasing power increases. This trend creates a favorable environment for seam tape manufacturers to capitalize on new market opportunities as they cater to an expanding middle-class population eager for quality apparel.

Lastly, increased investments in sports and outdoor activities have led to a heightened focus on protective clothing and accessories. The sports industry has seen rapid growth, with more people participating in activities that require specialized gear equipped with seam tape technology. As participation rates rise in various sports, including surfing and snowshoeing, so does the demand for high-performance apparel featuring advanced seam sealing solutions. This growing interest drives sales and encourages innovation within the seam tape industry as manufacturers strive to meet evolving consumer needs.

Overall, combining technological advancements, expanding industries such as automotive and aerospace, emerging markets' growth potential, and increasing consumer awareness about quality apparel collectively contribute to the robust market growth. A key challenge for the seam tape industry is the environmental concerns associated with traditional seam tapes. Many conventional seam tapes contain harmful chemicals or non-biodegradable components, raising significant ecological red flags. As consumer awareness regarding sustainability increases, manufacturers are increasingly pressured to develop eco-friendly alternatives. Stricter regulations concerning ecological impacts may require substantial investment in research and development to create compliant products, which could strain resources for some companies.

Product Insights

PU seam tapes were the most widely sold in the market and had a revenue of over 106.5 billion in 2023. The rising sports and outdoor apparel demand is one of the most significant drivers. As more consumers engage in outdoor activities and sports, there is a growing need for high-performance clothing that withstands harsh weather conditions. PU seam tapes are favored for their excellent waterproofing capabilities, flexibility, and durability, making them ideal for jackets, pants, and other outdoor gear. The trend towards active lifestyles has led to an increase in the production of functional clothing, which directly boosts the demand for PU seam tapes used in these applications.

Another key reason why PU seam tapes are favored is their cost-effectiveness. PU materials are less expensive than TPU, making them a more attractive option for manufacturers looking to keep production costs down. This affordability allows brands to offer competitive product pricing while maintaining quality, which is particularly important in price-sensitive markets. The lower cost of PU seam tapes can make a significant difference when used in large quantities across extensive production runs. Regarding performance characteristics, PU seam tapes provide a solid balance of waterproofing and flexibility. While TPU is known for its excellent abrasion resistance and durability, PU tapes provide effective waterproofing without compromising the softness and comfort of the fabric. This makes PU seam tapes particularly suitable for applications where user comfort is paramount, such as outdoor apparel and gear. The ability of PU to maintain a soft hand feel while ensuring reliable waterproofing is a critical factor in its preference over TPU.

The PVC segment is expected to grow at a CAGR of 5.5% from 2024 to 2030 due to their excellent waterproofing capabilities. PVC is inherently resistant to water, making it an ideal material for seam sealing applications where moisture infiltration must be prevented. This property is particularly valuable in producing outdoor apparel, tents, and protective gear, where maintaining a dry interior is crucial for user comfort and safety. As demand for waterproof clothing and equipment rises, particularly in the outdoor and sports sectors, the need for effective seam sealing solutions like PVC tapes becomes more pronounced.

End Use Insights

Apparel & footwear were the most significant applications for seam tape and accounted for a market size of USD 60.12 billion in 2023. The growing trend towards health and fitness has led to increased outdoor activities and sports participation, directly boosting the demand for high-performance apparel and footwear. As consumers engage more in activities like hiking, running, and water sports, there is a heightened need for durable, waterproof, and breathable clothing. Seam tapes play a crucial role in enhancing the functionality of these products by providing effective sealing against water penetration and ensuring comfort during physical activities. Reports indicate a notable increase in sports participation rates, further driving the demand for seam-sealed gear designed for performance in challenging conditions.

The global footwear market is also a significant growth driver for seam tapes. With rising disposable incomes and changing fashion trends, consumers increasingly invest in high-quality footwear that offers style and functionality. Seam tapes enhance the durability and waterproofing of various types of footwear, from athletic shoes to casual wear. Integrating advanced seam sealing technologies allows brands to offer products that withstand wear and tear while providing comfort, a critical factor influencing consumer purchasing decisions.

The automotive application of seam tape is expected to grow fastest, at a CAGR of 7.3% from 2024 to 2030. The automotive seam tape industry is experiencing significant growth due to several key drivers that enhance its utility and effectiveness in vehicle manufacturing and maintenance. These drivers include the need for moisture control, advancements in adhesive technology, the focus on vehicle durability, and increasing regulatory standards for vehicle safety.

Application Insights

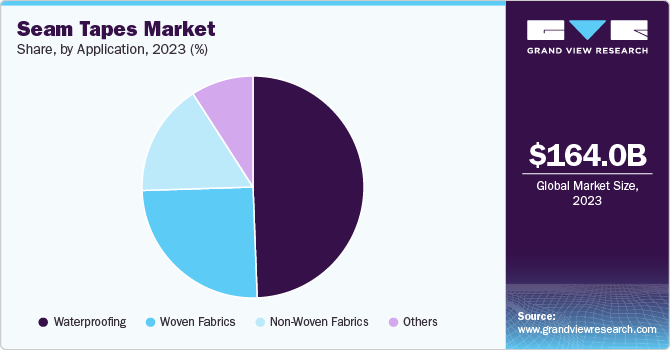

Waterproofing was the largest application for seam tape in 2023 and accounted for approximately 50% of the market share. The rising popularity of outdoor activities and sports has significantly boosted the demand for waterproof clothing and gear. Consumers increasingly seek high-performance apparel that withstand harsh weather conditions, such as rain and snow. Waterproof seam tapes are essential in these products, as they seal seams to prevent water penetration through needle holes created during the sewing process. This trend is particularly evident in technical outerwear designed for activities like skiing, hiking, and climbing, where maintaining dryness is crucial for comfort and safety.

The use of seam tape in woven fabric is expected to grow at a CAGR of 7.3% from 2024 to 2030. One of the primary drivers for using seam tape with woven fabrics is the need for enhanced structural integrity. Woven fabrics, particularly those used in garments, can be prone to stretching or distortion during construction and wear. Seam tapes reinforce seams, preventing them from pulling apart or losing shape. This is especially important for bias-cut or curved edges, where the risk of distortion is higher. Seem tape ensures that garments maintain their intended fit and durability over time, critical in high-quality apparel production.

The increasing consumer preference for performance textiles-such as activewear and outdoor clothing-has fueled the demand for woven fabric seam tapes. These products often require superior seam sealing capabilities to ensure waterproofing and breathability without sacrificing comfort. Seam tapes are essential in achieving these performance characteristics, making them indispensable in producing technical garments designed for hiking, skiing, and other outdoor sports. This trend towards performance-oriented textiles drives market growth.

Regional Insights

The seam tape market in North America exceeded USD 30 million in 2023. One of the primary market drivers in North America is the rising demand for protective clothing and accessories. This trend has been significantly influenced by the heightened awareness of safety standards across various sectors, including healthcare and industrial applications. The COVID-19 pandemic accelerated the need for personal protective equipment (PPE), which often incorporates seam tapes to ensure waterproofing and durability. As organizations prioritize employee safety, the demand for high-quality protective garments that utilize seam-sealing technologies continues to grow.

U.S. Seam Tapes Market Trends

The U.S. seam tape market is expected to reach USD 38 million by 2023. U.S. consumers are becoming more discerning about product quality, leading to increased demand for high-performance apparel and gear that incorporate advanced features like waterproofing and breathability. This consumer preference drives manufacturers to utilize seam tapes to enhance product quality and functionality. Focusing on performance-driven clothing has led to greater adoption of seam sealing technologies across various segments, including fashion apparel, footwear, and outdoor gear.

Asia Pacific Seam Tapes Market Trends

Asia Pacific was the largest market for seam tape with a revenue share of 55.18% and is expected to grow at a CAGR of 7% from 2024 to 2030. Asia Pacific is home to some of the largest garment manufacturing hubs globally, including China, India, Vietnam, Bangladesh, and Indonesia. The region's dominance in textile production is a significant market driver. This growth is fueled by low labor costs and easy access to raw materials, making it an attractive location for manufacturers to produce seam tapes for various applications in clothing and footwear. The automotive industry in Asia-Pacific is another critical market driver. China leads global automotive production, with domestic vehicle manufacturing projected to reach 35 million units by 2025. Seam tapes are increasingly used in automotive applications for moisture control, fixing wire connections, and waterproofing components within vehicles 48. The growth of this sector creates substantial opportunities for seam tape manufacturers as they cater to the needs of automotive producers.

Key Seam Tapes Company Insights

The market features diverse players who contribute to its growth through innovation, sustainability efforts, and geographical expansion. Companies like 3M, Bemis Associates, Toray Industries, and others play crucial roles by offering advanced products tailored to meet the needs of various industries, driving the overall demand for seam sealing solutions globally.

Key Seam Tapes Companies:

The following are the leading companies in the seam tapes market. These companies collectively hold the largest market share and dictate industry trends.

- 3M Company

- Bemis Associates Inc.

- Toray Industries Inc.

- Himel Corp.

- Sealon Co., Ltd.

- Loxy AS

- Gerlinger Industries GmbH

- Adhesive Films, Inc.

- DingZing Advanced Materials Inc.

- San Chemicals, Ltd.

- Essentra PLC

- GCP Applied Technologies Inc.

- Framis Italia S.P.A.

- Koch Industries, Inc.

- E. Textint Corp.

Seam Tapes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 186.01 billion

Revenue forecast in 2030

USD 254.85 billion

Growth rate (revenue)

CAGR of 6.5% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Indonesia; Vietnam; Bangladesh; Brazil; South Africa

Key companies profiled

3M Company; Bemis Associates Inc.; Toray Industries Inc.; Himel Corp.; Sealon Co., Ltd.; Loxy AS; Gerlinger Industries GmbH; Adhesive Films, Inc.; DingZing Advanced Materials Inc.; San Chemicals, Ltd.; Essentra PLC; GCP Applied Technologies Inc.; Framis Italia S.P.A.; Koch Industries, Inc.; E. Textint Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Seam Tapes Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global seam tape market report based on product, packaging, and region:

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

PU

-

PVC

-

TPU

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Waterproofing

-

Woven Fabrics

-

Non-Woven Fabrics

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Apparel & Footwear

-

Healthcare

-

Automotive

-

Packaging

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Vietnam

-

Indonesia

-

Bangladesh

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global seam tapes market size was estimated at USD 164.0 billion in 2023 and is expected to reach USD 174.7 billion in 2024.

b. The global seam tapes market is expected to grow at a compound annual growth rate of 6.5% from 2024 to 2030, reaching USD 254.9 billion by 2030.

b. Some key players operating in the seam tape market include 3M Company; Bemis Associates Inc.; Toray Industries Inc.; Himel Corp.; Sealon Co., Ltd.; Loxy AS; Gerlinger Industries GmbH; Adhesive Films, Inc.; DingZing Advanced Materials Inc.; San Chemicals, Ltd.; Essentra PLC; GCP Applied Technologies Inc.; Framis Italia S.P.A.; Koch Industries, Inc.; E. Textint Corp.

b. Asia Pacific dominated the seam tapes market with a share of 55.2% in 2023. The region is home to some of the largest garment manufacturing hubs globally, including China, India, Vietnam, Bangladesh, and Indonesia. Its dominance in textile production is a significant driver for the seam tape market.

b. One of the primary reasons for the growth of the seam tape market is the increased application in apparel manufacturing. The rise of high-performance sportswear and outdoor clothing has created a substantial demand for seam tapes that provide waterproofing and durability.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.