Screw Compressor Rental Market Size, Share & Trends Analysis Report By Type (Stationary Portable), By Lubrication, By End-use (Manufacturing), By Region And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-356-2

- Number of Report Pages: 152

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Screw Compressor Rental Market Trends

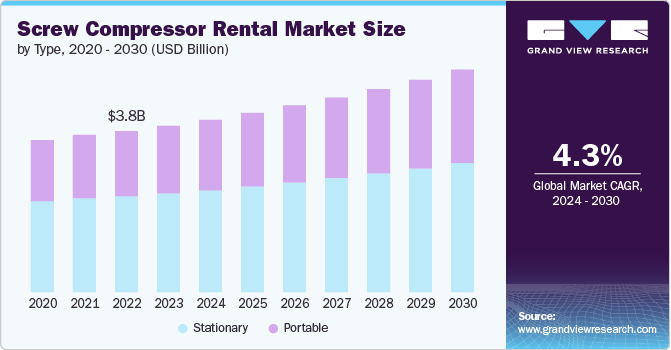

The global screw compressor rental market size was estimated at USD 3.87 billion in 2023 and is projected to grow at a CAGR of 4.3% from 2024 to 2030. The demand for market emerges from a combination of industry needs and broader economic trends. Many industries require compressed air for short-term or project-based operations, where investing in a permanent compressor is not cost-effective. This is particularly prevalent in construction, mining, and oil and gas exploration projects, where the site may be operational for a limited time, making rentals a more viable option.

Moreover, increasing emphasis on energy-efficient operations and the rise of industries where compressed air is critical. Additionally, technological advancements that enhance the performance, energy efficiency, or environmental footprint of screw compressors can expand the rental market by increasing the types of applications they can serve.

As air compressors are used in various stages of vehicle production, right from the usage of compressed air by spray painting guns to its utilization for pushing paints through robots or paint guns onto the body of automobiles, the surge in vehicle production is anticipated to fuel the growth of the screw compressor rental market. However, the presence of oil in compressed air can cause beading in the body paint, thereby affecting the quality and finish of the vehicle. In automotive vehicle production assembly lines, compressed air is required for operating pneumatic tools such as actuators and nut runners. Thus, increasing demand for compressed air in automotive production is expected to augment the market growth.

Drivers, Opportunities & Restraints

The market is significantly influenced by industrial applications where compressed air is indispensable, such as in the food and automotive industries.The food industry relies on compressed air for various processes, including pneumatic conveying of ingredients, packaging, product handling, and refrigeration. Screw compressors are favored for their reliability and ability to provide oil-free air, ensuring the safety and hygiene of food products. any segments within the food industry, such as agricultural produce processing or seasonal food products, experience peak periods where additional compressed air capacity is needed temporarily. Renting screw compressors offers a flexible solution to meet these seasonal demands without the need for permanent investment. The above factors will positively influence the demand for screw compressor rental market.

Automotive manufacturing processes, from assembly lines to painting and quality control, rely heavily on compressed air. Screw compressors are essential for ensuring these processes run smoothly and efficiently. The rental market caters to the automotive industry's need for high reliability and energy efficiency, especially during periods of increased production or in setting up new production lines.

The logistical aspects of delivering, installing, and maintaining rented screw compressors, especially in remote or challenging environments, can be significant. Additionally, ensuring that the compressors are properly maintained and quickly repaired when issues arise requires a substantial investment in service capabilities and can strain resources.

Type Insights

“The demand for portable type segment is expected to grow at a CAGR of 4.7% from 2024 to 2030 in terms of revenue”

The stationary type segment led the market and accounted for 59.4% of the global revenue share in 2023. The stationary market is strengthened by industries that require a continuous and reliable supply of compressed air but prefer not to incur the high capital and maintenance costs associated with ownership. Factors include the demand for flexible air supply solutions, the reluctance to invest upfront in expensive machinery, the need for temporary air supply solutions during peak periods or for project-based work, and the desire for updated technology without the associated costs of purchasing.

The portable segment caters to a wide array of applications requiring flexibility and mobility in compressed air supply, from construction sites and road works to mining operations and outdoor events. This market thrives on the versatility of portable screw compressors, which are designed to be easily transported and quickly deployed in various field conditions, offering on-demand, efficient, and reliable air power. Key factors driving this market include the need for temporary and emergency air supply solutions, the rise in infrastructure projects and seasonal demand in industries such as agriculture and event management, and the avoidance of capital expenditure on equipment that may not be in constant use.

Lubrication Insights

“The demand for oil free lubrication segment is expected to grow at a CAGR of 5.3% from 2024 to 2030 in terms of revenue”

Oil-filled compressor lubrication segment accounted for 61.6% of the global market revenue share in 2023. The oil-filled market serves industries where high-quality, reliable compressed air is crucial, including manufacturing, automotive, and energy sectors, where oil-lubricated compressors are favored for their efficiency and durability. Key drivers include the demand for compressors that provide stable and continuous air flow with a lower risk of thermal degradation, particularly in heavy-duty and high-temperature industrial applications. Additionally, the flexibility of renting allows businesses to manage capital expenditure more effectively, adapt to fluctuating market demands, and ensure production continuity during periods of maintenance or unexpected downtime. Which will drive the oil-filled screw compressor rental market.

The oil-free market is driven by industries that require high-quality, contaminant-free compressed air, such as pharmaceuticals, food and beverage, electronics, and healthcare. These sectors value the oil-free screw compressor for its ability to deliver clean air, crucial for maintaining product purity and safety standards. A significant feature of this market is the emphasis on environmental compliance and energy efficiency, as oil-free compressors eliminate oil waste and reduce the risk of contamination, aligning with stringent regulatory standards for air quality. The flexibility of rental arrangements allows businesses to adjust to seasonal demands, temporary production increases, or project-specific needs without the heavy investment in permanent equipment.

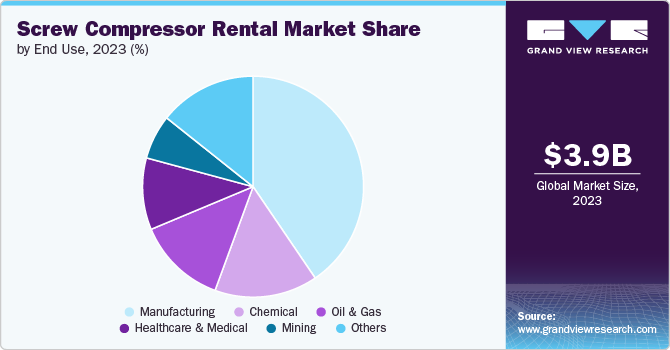

End Use Insights

“The demand from manufacturing end use segment is expected to grow at a CAGR of 3.9 % from 2024 to 2030 in terms of revenue”

The manufacturing end use segment accounted for 40.5% of the global market revenue share in 2023. The screw compressor is a crucial component of the manufacturing industry, providing flexible, cost-effective solutions for a wide range of air compression needs. A key feature of this market is the ability to offer manufacturers short-term and scalable air supply solutions, enabling them to overcome periods of increased demand or maintain productivity during equipment maintenance without the need for capital investment in additional permanent units. Additionally, the rental market caters to the industry's evolving needs by providing access to the latest compressor technologies, including oil-free and variable-speed models, which offer enhanced performance and environmental benefits.

The market plays a pivotal role in supporting the operational demands of the oil and gas industry, a sector characterized by its requirement for reliable, high-capacity compressed air solutions for exploration, drilling, production, and maintenance activities. These compressors are critical for a range of applications, including pipeline testing, underbalanced drilling, gas lift, and flare gas recovery, where their efficiency and durability under harsh operating conditions are highly valued. One of the key features of this market is the provision of rugged, portable screw compressors that can be quickly deployed to remote or offshore locations, offering flexibility and reducing downtime during critical operations.

Regional Insights

“China to witness fastest market growth at 5.0% CAGR”

North America Screw Compressor Rental Market Trends

The screw compressor rental market of North America is characterized by a strong demand driven by various sectors including construction, manufacturing, oil and gas, and the burgeoning renewable energy sector. This market benefits from the region's advanced industrial base and the continuous push for innovation and efficiency improvements in operational processes. A significant feature of the North American market is its emphasis on sustainability and environmental compliance, which has led to increased adoption of oil-free screw compressors that minimize the risk of air contamination and are in line with strict environmental regulations.

Asia Pacific Screw Compressor Rental Market Trends

Asia Pacific screw compressor rental market is experiencing significant growth, driven by rapid industrialization, infrastructure development, and the expansion of manufacturing activities across countries like China, India, Japan, and Southeast Asia. This region benefits from a robust demand for flexible, cost-effective compressed air solutions in sectors such as automotive, electronics, construction, and oil and gas, where screw compressors are valued for their efficiency, reliability, and ability to provide consistent air quality. Features that distinguish the Asia Pacific market include a strong emphasis on energy efficiency and environmental sustainability, prompting a shift towards oil-free screw compressors that meet stringent air quality standards.

The screw compressor rental market of China is estimated to grow at a significant CAGR of 5.0% over the forecast period. China market is expanding, primarily fuelled by the country's expansive manufacturing sector, ongoing infrastructure projects, and increasing investments in renewable energy sources. As one of the world's largest economies, China's demand for reliable and efficient compressed air solutions spans across several industries including automotive, electronics, construction, and renewable energy sectors, which are integral to its industrial growth and development strategy. A distinctive feature of the Chinese market is its strong emphasis on technological innovation and sustainability, leading to a rising preference for energy-efficient and environmentally friendly screw compressors, particularly oil-free models that minimize contamination risks. The rental model's appeal in China lies in its flexibility, allowing businesses to scale operations without the considerable capital outlay required for purchasing new equipment.

Europe Screw Compressor Rental Market Trends

Europe screw compressor rental market is driven by the region's focus on energy efficiency, environmental sustainability, and advanced manufacturing and construction sectors. Europe's stringent environmental regulations have encouraged the adoption of oil-free screw compressors, which are preferred for their lower environmental impact and capability to provide clean, contamination-free air, crucial for industries such as pharmaceuticals, food and beverage, and electronics manufacturing. In addition to environmental considerations, the demand for rental screw compressors in Europe is bolstered by the need for flexibility in capital expenditure, allowing businesses to scale operations according to project demands without the heavy investment in purchasing equipment.

Key Screw Compressor Rental Company Insights

Some of the key players operating in the market include Atlas Copco AB, Caterpillar Inc., and Kaeser Kompressoren SE among others.

-

Atlas Copco specializes in the innovation, development, and manufacturing of oil-free compressor technologies. The company's air compressors are ISO-certified. It also rents, services, manufactures, and develops assembly systems, construction systems, and industrial tools. The company majorly operates through four segments, namely, industrial technology, power technology, vacuum technology, and compressor technology.

-

KAESER KOMPRESSOREN produces compressed air and vacuum products such as condensate management systems, filters, desiccant dryers refrigerated, high-speed turbo blowers, rotary screw blowers, rotary lobe blowers, oil-free reciprocating compressors, rotary screw compressors, and other related items. The company offers consulting, rentals, and services. Kaeser Compressors, Inc. is a subsidiary of Kaeser Kompressoren, which is based in Coburg, Germany.

Lewis System, CAPS Australia, and Metro Air Compressor, are some of the emerging market participants in the industry.

-

Lewis System engaged in the rental market of air compressors. Company provides various types of air compressors, including rotary screw, piston (reciprocating), and centrifugal compressors. Each has its own set of uses and benefits, with rotary screw compressors being popular for continuous use applications due to their efficiency and durability.

-

CAPS Australia is a leading provider of industrial air compressor solutions, recognized for its comprehensive range of products and services tailored to meet the diverse needs of various industries. Established over four decades ago, CAPS Australia has built a reputation for delivering high-quality, reliable, and energy-efficient compressed air systems, including rotary screw compressors, reciprocating compressors, and oil-free compressors, along with a host of related products such as blowers, generators, and air receivers.

Key Screw Compressor Rental Companies:

The following are the leading companies in the screw compressor rental market. These companies collectively hold the largest market share and dictate industry trends.

- Lewis System

- CAPS Australia

- Metro Air Compressor

- Stewart & Stevenson LLC

- United Rentals Inc.

- Ingersoll-Rand plc

- Aggreko plc

- Atlas Copco AB

- Air Energy Group LLC

- Caterpillar Inc.

- BOGE KOMPRESSOREN Otto Boge GmbH & Co. KG

- Kaeser Kompressoren SE

Recent Developments

-

In April 2023, Atlas Copco successfully finalized its acquisition of Shandong Bozhong Vacuum Technology Co., Ltd., a pioneering creator and producer of vacuum systems and pumps. Following the acquisition, the company has been integrated as a division within the Industrial Vacuum Division of Atlas Copco's Vacuum Technique business area.

-

In February 2023, Atlas Copco disclosed its purchase of CVS Engineering GmbH, a company that specializes in producing industrial blowers and vacuum pumps designed for tanker and truck applications. This acquisition aims to broaden the scope of Atlas Copco's Industrial Vacuum Division.

Screw Compressor Rental Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 4.01 billion |

|

Revenue forecast in 2030 |

USD 5.18 billion |

|

Growth rate |

CAGR of 4.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, lubrication, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Germany; France; Italy; UK; Spain; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE |

|

Key companies profiled |

Lewis System; CAPS Australia; Metro Air Compressor; Stewart & Stevenson LLC; United Rentals Inc; Ingersoll-Rand plc; Aggreko plc; Atlas Copco AB; Air Energy Group LLC; Caterpillar Inc; BOGE KOMPRESSOREN Otto Boge GmbH & Co. KG; Kaeser Kompressoren SE |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Screw Compressor Rental Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the screw compressor rental market based on type, lubrication, end use, and region:

-

Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Stationary

-

Portable

-

-

Lubrication Outlook (Revenue, USD Million; 2018 - 2030)

-

Oil-filled compressor

-

Oil-free compressor

-

-

End use Outlook (Revenue, USD Million; 2018 - 2030)

-

Healthcare & Medical

-

Manufacturing

-

Oil & Gas

-

Mining

-

Chemical

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global screw compressor rental market size was estimated at USD 3.87 billion in 2023 and is expected to reach USD 4.01 billion in 2024

b. The global screw compressor rental market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.3% from 2024 to 2030 to reach USD 5.18 billion by 2030

b. Asia Pacific dominated the screw compressor rental market with a revenue share of 44.5% in 2023. The screw compressor rental market in the Asia Pacific region is experiencing significant growth, driven by rapid industrialization, infrastructure development, and the expansion of manufacturing activities across countries like China, India, Japan, and Southeast Asia

b. Some of the key players operating in the screw compressor rental market include Lewis System CAPS Australia, Metro Air Compressor, Stewart & Stevenson LLC, United Rentals Inc., Ingersoll-Rand plc, Aggreko plc, Atlas Copco AB, Air Energy Group LLC, Caterpillar Inc., BOGE KOMPRESSOREN Otto Boge GmbH & Co. KG, Kaeser Kompressoren SE

b. The demand for screw compressor rental market emerges from a combination of industry needs and broader economic trends. Many industries require compressed air for short-term or project-based operations, where investing in a permanent compressor is not cost-effective

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."