- Home

- »

- Healthcare IT

- »

-

Saudi Arabia Digital Health Market, Industry Report, 2030GVR Report cover

![Saudi Arabia Digital Health Market Size, Share & Trends Report]()

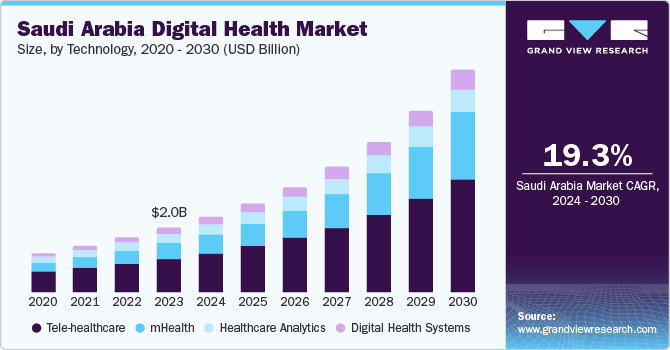

Saudi Arabia Digital Health Market Size, Share & Trends Analysis Report By Technology (Tele-healthcare, mHealth, Digital Health Systems), By Component, By Application (Diabetes, Cardiovascular), By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-220-2

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Saudi Arabia Digital Health Market Trends

The Saudi Arabia digital health market size was estimated at USD 2.01 billion in 2023 and is projected to grow at a CAGR of 19.3% from 2024 to 2030. The Saudi Arabian government’s initiatives to improve medical care infrastructure and enhance patient care primarily drive the rising adoption of digital health technologies within the healthcare sector, including electronic healthcare records (EHRs), telemedicine, wellbeing information, and quality of care delivery.

The Saudi Arabian government recently launched several initiatives to improve healthcare in the country, such as increasing the healthcare budget and promoting private sector contribution to the medical care system. For instance, in March 2022, Saudi Arabia introduced Seha Virtual Hospital. It is the country’s first & largest e-health platform that offers more than 30 specialized services and assistance through 130 hospitals virtually across the country. In addition, Saudi Arabia’s market value is rapidly increasing due to the developing strategies to reduce the cost of medical care, such as promoting a healthy lifestyle and increasing access to care through implementing telemedicine and other electronic services & technologies, preventative medicine, telemedicine, and other digital health technologies.

Some key players operating in the market including Philips, Siemens Healthineers, GE Healthcare, Cerner, and Epic Systems are investing significantly in the research and development of AI. These companies are working to make automated & virtual healthcare more accessible for the healthcare sector and the public.

Saudi Arabia’s digital health trends are highly driven by various initiatives, including Saudi Vision 2030 and the National Transformation Program, employed to enhance healthcare quality and access. The Saudi government is working hard to develop a digital health service reimbursement system as part of its "Vision 2030" agenda. However, due to restrictive reimbursements in Saudi Arabia, patients currently pay most of the expenses for electronic services. The government is developing a reimbursement system; however, it has yet to be determined when it is expected to be fully operational. The government is expected to provide transparency and communication to the participants regarding the progress and challenges confronted. It is essential for managing expectancies and promoting confidence in the subsequent efficiency of the reimbursement system.

Moreover, some private insurance companies in Saudi Arabia now cover digital health services. Furthermore, developments in automated medical technologies such as artificial intelligence (AI), big data analytics, and the Internet of Things (IoT) drive growth in connected healthcare. These technological advancements have enabled it to offer innovative and better medication solutions in Saudi Arabia's digital health sector; however, insurance coverage remains restricted and not generally accessible.

The National Digital Health Strategyaims to provide a general telemedicine program and digitize every aspect of the healthcare system. The Saudi Food and Drug Authority (SFDA) develops regulations governing digital medical products and services within the country. Furthermore, government measures and the increasing number of Saudi Arabian population using smartphones and other mobile devices have made it easier for citizens to use these devices to access automated medical services, including telemedicine. In addition, the nation's digital health sector is experiencing growth due to the aging population and the need for adequate and affordable healthcare solutions. For instance, according to the Knoema Report 2023, in Saudi Arabia, over 3.0%, of the population are aged above 65 years of the total population.

The Cooperative Health Insurance Council (CCHI), the National Health Information Center (NHIC), and the Ministry of Health collaborated to launch the National Platform for Health and Insurance Exchange Services (NPHIES), a healthcare information exchange platform designed to simplify insurance services and help healthcare providers aggregate patient care data.

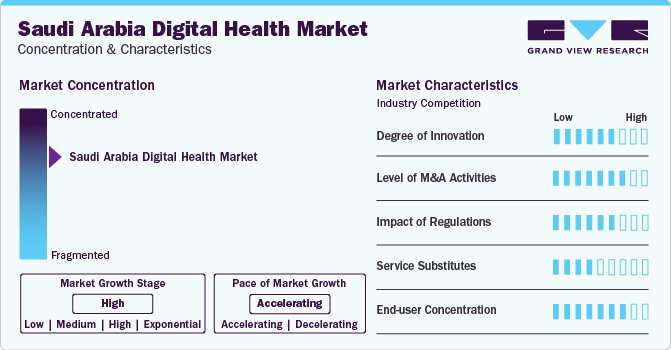

Market Concentration & Characteristics

Market growth stage is high, and the pace of growth is accelerating. This concentration is primarily driven by the presence of established medical management technology companies and government initiatives promoting electronic transformation in medical care.

The market is also characterized by a high level of merger and acquisition (M&A) and partnership activities between technology firms and medical providers, as these collaborations aim to enhance the quality and accessibility of healthcare services through programmed channels. Despite the concentration of major players, there is also opportunity for smaller, niche companies to expand by offering specialized products or services adopting specific medication challenges in the country.

The Saudi Arabia digital health market is also subject to increasing regulatory scrutiny. It involves stringent oversight and compliance measures imposed by government agencies to ensure digital medical solutions' safety, efficacy, and ethical standards. These regulations encompass various aspects, including data privacy protection, patient confidentiality, cybersecurity, and the accuracy of medical information provided by automated medications platforms. In addition, regulatory bodies evaluate the qualifications and authorizations of medical professionals delivering telemedicine services and monitor the collusion of digital health systems to assure seamless integration within the healthcare infrastructure.

There are a limited number of direct product substitutes for programmed medical services. However, a few expertise can be used to achieve similar outcomes to digital healthcare, such as telemedicine platforms, wearable medical devices such as fitness trackers and smartwatches equipped with health monitoring features, and health-focused mobile applications.

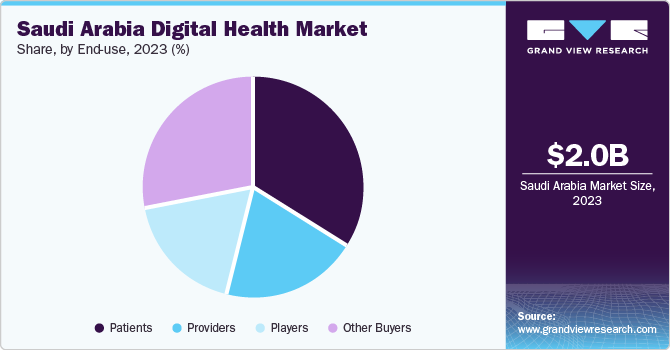

End-user concentration is a significant factor in the Saudi Arabia digital health industry. Multiple end-user industries are driving demand for electronic health platforms. The demand for digital health solutions creates opportunities for companies that focus on developing programmed medical applications for these industries. However, it also creates challenges for companies trying to compete in a crowded market. In Saudi Arabia, the distribution of digital medication solutions among various end-users can vary based on factors such as access to technology, healthcare infrastructure, regulatory policies, and cultural preferences.

Technology Insights

The tele-healthcare segment dominated the market and accounted for a share of over 45% in 2023 and is also expected to register the fastest CAGR over the forecast period. This growth can be attributed to factors such as improving internet connectivity, an increase in the number of smartphones in use, advanced technological readiness, rising medical costs, a scarcity of medical providers, the ease of access to telehealth applications, and the growing patient and physician adoption of these technologies. Rapid technology advancements and the ongoing development of telehealth applications equally contribute to the segment's growth.

According to the International Trade Administration, Ministry of Communication, and Information Technology (MCIT), in accordance with Saudi Arabia's 2023 ICT Strategy, the industry is expected to create over 25,000 new employments, double its GDP contribution to USD over 13.0 billion, and expand the size of the IT and emerging technologies markets by 50%. It also aims to promote women's involvement in this industry and engage in international investment.

Rapid advancements in technology and the rising incidence of chronic diseases, including diabetes and cardiovascular diseases, are driving the growth of remote patient monitoring. The demand is also expected to increase due to the estimated growth of the geriatric population globally. Increasing health care IT expenditure, government funding, and legislation encouraging medical digitization also contributes to the growth of the digital health market in Saudi Arabia.

Component Insights

The services segment accounted for the largest revenue share in 2023 owing to the growing need for modern software programs like Electronic Medical Records (EMRs), remote patient care, and other services such as virtual training, setup, and upkeep. The demand for remote patient monitoring services, post-acute care and chronic illness management services, autonomous aging solutions, and strengthened healthcare systems are driving the market's expansion.

The software segment is expected to register the fastest CAGR over the forecast period due to consumers and healthcare providers’ growing use of digital healthcare platforms among the patients and healthcare providers. AI has propelled technology to the front lines of companies, strengthening its position as a fundamental component of this sector. The increasing number of developers providing application update services and the demand for software platforms with improved capabilities are also driving the market growth. Healthcare institutions are adopting advanced software solutions to improve clinical operations, optimize techniques, and improve financial outcomes. The desire for individualized medicine and preference for value-based care is driving the market growth.

Application Insights

The diabetes segment held the largest share of around 30% in 2023 and is anticipated to register the fastest growth over the forecast period. Diabetes is one of the most common lifestyle related conditions. The requirements of people with diabetes can be creatively met by digital health technologies. Digital health technologies enable patients to participate actively in their diabetes treatment. The devices include smartphone applications for glucose testing and wearable gadgets that detect physical activity and offer real-time medical data. Furthermore, by enabling remote patient monitoring, these technologies enable healthcare professionals to manage diabetes more effectively by offering them the ability to obtain appropriate data, develop accurate decisions, and deliver prompt treatment.

Furthermore, there is a growing demand for early intervention techniques and preventive measures owing to the increased incidence of diabetes. Automated medical solutions are essential because they provide personalized, data-driven insights that enable people to manage risk factors and change their lifestyles successfully. Consequently, the diabetes market is expanding primarily because of the growing demand for easily available, effective, and patient-focused treatments that improve the general standard of diabetes treatment and improve health outcomes. The increased prevalence of obesity in Saudi Arabia and the growing demand for efficient weight-management solutions have made this application uphold.

End-use Insights

The patient segment dominated the market with the largest share of over 30% in 2023 and is anticipated to grow at the fastest CAGR over the forecast period. The growth is attributed to the shift in healthcare toward a patient-centered approach along with individual healthiness management awareness. Digital services technologies have completely transformed the healthcare industry by giving patients the means to manage their care, access Saudi Arabia’s health records, and engage in remote monitoring. The focus on enhancing patient engagement, encourage proactive health management, and create a more informed and collaborative healthcare experience is reflected in the patient segment's focus, which includes telehealth platforms that enable virtual consultations and mobile health apps that monitor vital signs.

The provider segment held the second-largest revenue share in the country owing to extensive use of advanced technologies like digital medicines and telemedicine. To provide evidence-based therapies, individualized treatment plans, and remote consultations besides regular care locations, medical practitioners are increasingly utilizing digital technologies. Better patient outcomes are a result of caretakers being able to provide more accessible and customized care due to the incorporated of digital tools.

Riyadh digital health is a comprehensive healthcare initiative launched by the Saudi Arabian government aiming to leverage technology and innovation to enhance healthcare delivery, improve patient experiences, and create a more efficient and sustainable healthcare system. For instance, in October 2022, the Global Health Exhibition was organized at the Riyadh International Convention and Exhibition Center to deal with digital health revolution. The event took place under the Saudi Ministry of Health and under the theme of “A new era of healthcare in KSA”. Over 200 international and local exhibitors from more than 30 countries showcased the recent healthcare solutions and innovations.

Key Saudi Arabia Digital Health Company Insights

Some of the key players operating in the market include Apple Inc.; Vodafone Group; Samsung Electronics Co., Ltd.; and Veradigm.

-

Apple Inc. has a global reach and offers more than 40,000 apps that provide consumers, doctors, and researchers access to medication services. The company offers a range of networking solutions, third-party digital content & applications, accessories, services, and related software.

-

Veradigm provides data-driven insights and solutions developed to assist health care stakeholders in improving patient lives. Physicians, hospitals, healthcare systems, insurance companies, governments, pharmacies, retail pharmacies, life sciences businesses, employer wellness clinics, and post-acute organizations are among the clients it services.

Philips, Siemens Healthineers, GE Healthcare, Cerner, Epic Systems, are some of the other market participants.

-

Philips operates in various sectors, including healthcare, lighting, and consumer lifestyle. The company is known for its wide range of products and services, including medical equipment, consumer electronics, and lighting solutions. With a focus on improving people's lives through meaningful innovation, Philips has established itself as a prominent and influential global brand.

-

Siemens Healthineers is a leading medical technology company that provides a wide range of medical solutions and services to improve patient outcomes and reduce costs. It offers products and services in diagnostic imaging, laboratory diagnostics, and advanced therapies, aiming to advance healthcare delivery globally.

Key Saudi Arabia Digital Health Companies:

- Advanced Micro Devices

- Philips, Siemens

- Healthineers

- GE Healthcare

- Cerner

- Epic Systems

- Apple Inc.

- Vodafone Group

- Samsung Electronics Co., Ltd.

- Veradigm

Recent Developments

-

In February 2023, Digital Diagnostics declared a partnership agreement with Tamer Healthcare Co. which is an incorporated wellness & healthcare corporation with over 100 years of established firm in Saudi Arabia. The partnership is aimed to expand and improve healthcare and development in the Saudi Arabia. In addition, Digital Diagnostics is a manufacturer of IDx-DR, which was the foremost diabetic retinopathy’s diagnosis self-directed AI systems cleared by FDA.

-

In May 2023, the Saudi Data and Artificial Intelligence Authority in collaboration with the multinational technology company Nvidia, introduced the Center of Excellence for Generative Artificial Intelligence. Additionally, the authorities unveiled a beta version of Allam, an AI chat program which is known as the first of its type in the region and enables the use of Arabic.

Saudi Arabia Digital Health Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 6.8 billion

Growth rate

CAGR of 19.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, component, application, end-use

Country scope

Saudi Arabia

Key companies profiled

Philips; Siemens; Healthineers; GE Healthcare; Cerner; Epic Systems; Apple Inc.; Vodafone Group; Samsung Electronics Co., Ltd.; Veradigm.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Saudi Arabia Digital Health Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Saudi Arabia digital health market report based on technology, component, application, and end-use:

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Tele-healthcare

-

Tele-care

-

Activity Monitoring

-

Remote Medication Management

-

-

Tele-health

-

LTC Monitoring

-

Video Consultation

-

-

-

mHealth

-

Wearables

-

BP Monitors

-

Glucose Meters

-

Pulse Oximeters

-

Sleep Apnea Monitors

-

Neurological Monitors

-

Activity Trackers/Actigraphs

-

-

mHealth Apps

-

Medical Apps

-

Fitness Apps

-

-

Services

-

mHealth Service, By Type

-

Monitoring Services

-

Independent Aging Solutions

-

Chronic Disease Management & Post-acute Care Services

-

-

Diagnosis Services

-

Healthcare Systems Strengthening Services

-

Others

-

-

mHealth Services, By Participants

-

Mobile Operators

-

Device Vendors

-

Content Players

-

Healthcare Providers

-

-

-

-

Healthcare Analytics

-

Digital Health Systems

-

EHR

-

E-prescribing Systems

-

-

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Obesity

-

Diabetes

-

Cardiovascular

-

Respiratory Diseases

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Patients

-

Providers

-

Players

-

Other Buyers

-

Frequently Asked Questions About This Report

b. Saudi Arabia digital health market size was estimated at USD 2.01 billion in 2023.

b. The Saudi Arabia digital health market is expected to grow at a compound annual growth rate (CAGR) of 19.3% from 2024 to 2030 to reach USD 6.8 billion by 2030.

b. The tele-healthcare segment dominated the market with the largest market share of over 45% in 2023. This high share is attributable to increasing usage of smartphones, advanced technological readiness, rising medical costs, a growing scarcity of medical providers, and the ease of access to telehealth applications.

b. Some key players operating in the Saudi Arabia digital health market include Philips, Siemens; Healthineers; GE Healthcare; Cerner; Epic Systems; Apple Inc.; Vodafone Group; Samsung Electronics Co., Ltd.; and Veradigm; among others.

b. Key factors that are driving the market growth include the government's initiatives to develop medical care infrastructure and enhance patient care including healthcare budget and promoting private sector contribution to the medical care system across the country.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."