- Home

- »

- Medical Devices

- »

-

Saudi Arabia Digital Diabetes Management Market, Industry Report 2030GVR Report cover

![Saudi Arabia Digital Diabetes Management Market Size, Share & Trends Report]()

Saudi Arabia Digital Diabetes Management Market Size, Share & Trends Analysis Report By Product (Smart Glucose Meters, Smart Insulin Pens), By Type, By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-263-5

- Number of Report Pages: 195

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

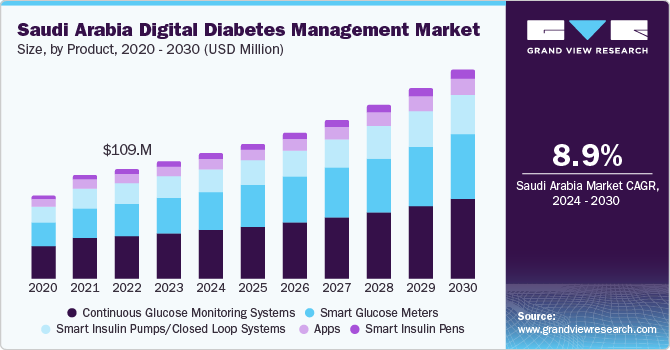

The Saudi Arabia digital diabetes management market size was estimated at USD 116.4 million in 2023 and is projected to grow at a CAGR of 8.9% from 2024 to 2030. The rising prevalence of diabetes in the region is a crucial driver, necessitating the adoption of advanced digital solutions for effective management. For instance, according to the International Diabetes Federation (IDF), over 10% of the population in Saudi Arabia currently has diabetes, and this prevalence is projected to nearly double by the year 2045.

The IDF report indicates that 4,274.1 thousand individuals in Saudi Arabia are diagnosed with diabetes, with an additional 1,863.5 thousand cases undiagnosed. By 2030, the number of diabetes cases is expected to reach 5,631.0 thousand; by 2045, it is forecasted to rise to 7,537.3 thousand . In addition, the increasing awareness about diabetes and the importance of regular monitoring and management among the population is driving the demand for digital diabetes management solutions.

Furthermore, the growing adoption of smartphones and other digital devices in Saudi Arabia facilitates the uptake of digital diabetes management platforms, as these devices enable convenient access to health information and monitoring tools. Moreover, the government's initiatives to promote digital healthcare solutions and improve access to healthcare services are further fueling market growth. According to the International Trade Administration, in January 2024 , the healthcare industry remains a top priority for the Saudi Arabian government, with Saudi Arabia bearing 60% of the Gulf Cooperation Council's (GCC) total healthcare expenditures. With a budget of USD 1.5 billion, the government is investing in healthcare IT and digital transformation initiatives. As part of Vision 2030, Saudi Arabia prioritizes local manufacturing and technology transfer, conducts clinical trials domestically, and enhances the training of the Saudi workforce.

Telemedicine is experiencing significant growth in the market due to rising internet accessibility, government backing, and the demand for remote healthcare services, particularly amidst the COVID-19 pandemic. This expansion enhances healthcare access, optimizes patient outcomes, and mitigates healthcare expenditures in diabetes management. For instance, according to the National Center for Biotechnology Information (NCBI) in December 2023 , in Saudi Arabia (KSA), digital healthcare holds promise for significantly improving patient outcomes and operational efficiency.

Technological advancements, such as the development of wearable devices and mobile applications specifically designed for diabetes management, are enhancing the effectiveness and convenience of digital diabetes management solutions. Moreover, integrating artificial intelligence and machine learning algorithms into these platforms enables personalized and proactive diabetes management, thereby driving market growth.

The Ministry of Health (MoH) serves as the overseer of all healthcare-related operations and services in the nation. The Health Holding Company is set to take over the daily management of healthcare services from the MoH and deliver services to beneficiaries through primary healthcare enhancement initiatives, which encompass advanced digital health solutions and remote medical care.

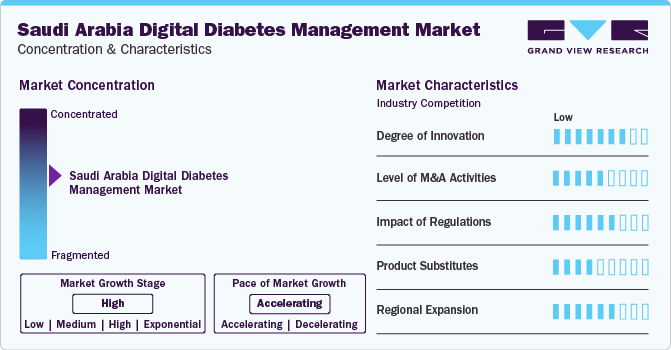

Market Concentration & Characteristics

The market growth stage is high, and the pace is accelerating. The market has witnessed a high degree of innovation, marked by several instances of regulatory approvals, partnerships, and collaborations. In recent years, the market has seen a surge in the number of new product launches, making it increasingly challenging for market leaders to sustain themselves in the ever-changing market. However, leading players are investing heavily in R&D activities to develop advanced imaging technologies, which is expected to fuel market growth.

The innovations in the industry are driving progress, with advanced diagnostic tools enabling early detection. For instance, in January 2024, KAUST and amplifAI Health teamed up to tackle diabetes with AI-driven early detection. By combining KAUST's HyplexTM hyperspectral imaging with amplifAI's expertise, they aim to transform diabetic care, starting with foot complications. This collaboration promises earlier detection, improved treatments, and the potential to save lives globally.

Several industry players are involved in merger and acquisition activities. These M&A endeavors aim to capitalize on emerging opportunities and drive innovation in the industry. Smit. fit, a prominent player in India's digital health sector, and Droobi Health, a key player in digital diabetes management in the Middle East based in Doha, Qatar, have merged to create DroobiSmit, headquartered in Singapore in January 2024. This move and the establishment of a new office in Saudi Arabia represent a significant milestone and underscore the potential for growth in South Asia and the Middle East.

Regulations in the industry have a significant impact, driving players to invest in advanced technologies and quality assurance measures. Compliance with regulatory frameworks ensures patient safety, fosters innovation, and establishes trust among customers.

The potential substitutes include traditional healthcare services and non-digital diabetes management solutions. Traditional healthcare services, such as in-person consultations with healthcare providers and conventional diabetes management methods, may serve as substitutes for digital solutions for some patients. For instance, in November 2023, Dammam Pharma Co., a subsidiary of Saudi Pharmaceutical Industries and Medical Appliances Corp. (SPIMACO), entered into a strategic partnership with Merck Sharp & Dohme International (MSD) to produce type 2 diabetes medications within Saudi Arabia.

The expansion of the digital diabetes industry into new regions involves entering untapped geographical areas to reach a wider population. This expansion strategy aims to increase market penetration, capture new customers, and capitalize on emerging opportunities. It involves adapting to regional preferences, regulatory requirements, and healthcare infrastructure to address local needs effectively.

Product Insights

The continuous glucose monitoring systems segment captured the largest market share of 38.6% in 2023. Continuous glucose monitoring systems (CGMS) are devices offering real-time insights into glucose levels and enhancing diabetes management. These systems consist of wearable sensors that continuously monitor glucose levels in interstitial fluid, providing users with valuable data to make informed decisions about their diabetes management.

In Saudi Arabia, the prevalence of diabetes is high, making CGMS an essential tool for individuals with diabetes to monitor their glucose levels effectively. Nemaura Medical specializes in developing daily, disposable, non-invasive wearable glucose sensors. In addition, it provides digital tools for managing diabetes and recently introduced CGM-guided insulin dose adjustment. The company announced the approval of its sugarBEAT sensor by the Saudi Food and Drug Authority (SFDA) in August 2023. This device has the potential to assist individuals with diabetes and pre-diabetes in effectively managing, reversing, and preventing the progression of this chronic condition. Several factors, including increasing awareness about diabetes management, advancements in sensor technology, and the rising demand for personalized healthcare solutions drive the adoption of CGMS in the country.

Smart Insulin Pens and Smart Glucose Meters are anticipated to grow at the fastest CAGR of 9.8% and 9.7%, respectively, during the forecast period. These innovative devices integrate digital technology to provide real-time monitoring of blood glucose levels and insulin dosing, enhancing precision and convenience for patients. With the rising prevalence of diabetes in Saudi Arabia, the demand for these smart devices is increasing rapidly. They offer personalized insights, seamless data sharing with healthcare providers, and improved treatment.

Type Insights

The wearable devices segment captured the largest market share of 57.0% in 2023 and is expected to grow at the fastest CAGR of 9.0% over the forecast period. These devices encompass a range of technologies, including continuous glucose monitoring (CGM) systems, smart insulin pumps, and fitness trackers with integrated glucose monitoring capabilities and physical activity.

They enable users to make informed decisions about their health, leading to enhanced adherence to treatment regimens and improved outcomes. In general, wearable devices are crucial for enhancing diabetes management results in Saudi Arabia. They encourage continuous monitoring, improve treatment adherence, and empower patients to embrace healthier lifestyles. With the integration of advanced technologies and the growing acceptance of wearable devices, the market is witnessing rapid expansion, promising a future where managing diabetes is more convenient and effective.

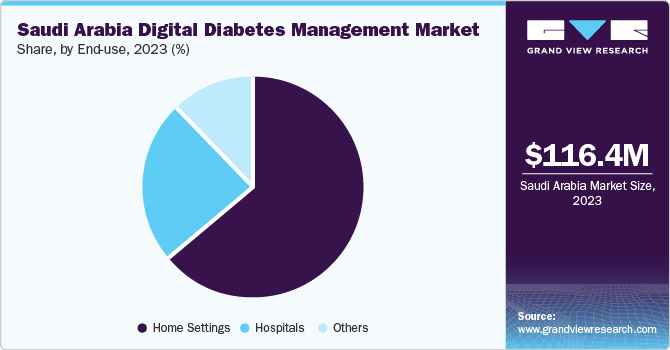

End-use Insights

The home setting segment has captured the largest market share of 64.3% in 2023 and is projected to grow at the fastest CAGR of 6.7% during the forecast period. The home setting segment encompasses a wide range of products and services designed to facilitate diabetes management within the comfort of patient's homes. This segment includes digital health tools such as glucometers, continuous glucose monitoring (CGM) systems, intelligent insulin pens, and mobile applications tailored for diabetes management.

Patients in Saudi Arabia are increasingly adopting digital solutions to monitor their blood glucose levels, track insulin dosages, and manage their diet and exercise routines from the convenience of their homes. These digital tools empower patients to take charge of their health and make informed decisions about their diabetes care.

Healthcare providers are capitalizing on telemedicine and remote monitoring technologies to deliver virtual consultations and support to patients in their homes. This allows for regularly monitoring patients' health status and timely intervention when needed, improving overall diabetes management outcomes. For instance, in May 2022, Tamer, a prominent healthcare distribution company in the Middle East, inked a 5-year agreement to introduce Huma's modern technology platform, enabling "hospitals at home" equipped with remote patient monitoring, benefiting the 34 million residents of the Kingdom of Saudi Arabia. The initiative will initially focus on supporting patients with diabetes and cardiovascular conditions.

Key Saudi Arabia Digital Diabetes Management Company Insights

The major market players operating in the Saudi Arabia digital diabetes management industry include Medtronic, Philipps Healthcare., Johnson & Johnson and others. These players are focusing on enhancing their product offerings through product upgrades, strategic collaborations, and merger & acquisition activities. In addition, the emerging players operating in the market include Dexcom, Ascensia Diabetes Care, Aljeel Medical (SA), and others.

Key Saudi Arabia Digital Diabetes Management Companies:

- Salehiya Medical W/H (SA)

- Aljeel Medical (SA)

- Alhammad Medical (SA)

- Johnson & Johnson

- Medtronic

- Philipps Healthcare

- Dexcom

- Ascensia Diabetes Care

Recent Developments

-

In February 2023, Digital Diagnostics, creator of LumineticsCore (previously named IDx-DR), the initial FDA-approved autonomous AI system for diagnosing diabetic retinopathy, partnered with Tamer Healthcare, an integrated healthcare firm in Saudi Arabia, to boost healthcare and innovation in the kingdom.

-

In June 2023, Integrative Health, a health technology company headquartered in Saudi Arabia, announced its acquisition of Nala, another health technology platform based in the kingdom

Saudi Arabia Digital Diabetes Management Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 124.9 million

Revenue forecast in 2030

USD 208.3 million

Growth Rate

CAGR of 8.9% from 2024 to 2030

Historic data

2018 - 2022

Base year for estimation

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, end-use

Key companies profiled

Medtronic; Philipps Healthcare; Johnson & Johnson; Dexcom; Ascensia Diabetes Care; Aljeel Medical (SA); Salehiya Medical W/H (SA); Alhammad Medical (SA)

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Saudi Arabia Digital Diabetes Management Market Report Segmentation

This report forecasts the revenue growth of Saudi Arabia as well as provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Saudi Arabia Digital Diabetes Management market report based on product, type, and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Smart Glucose Meters

-

Continuous Glucose Monitoring Systems

-

Smart Insulin Pens

-

Smart Insulin Pumps/Closed Loop Systems

-

Apps

-

Digital Diabetes Management Apps

-

Weight & Diet Management Apps

-

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Wearable Devices

-

Hand-held Devices

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Home Settings

-

Others

-

Frequently Asked Questions About This Report

b. The Saudi Arabia digital diabetes management market size was estimated at USD 116.4 million in 2023 and is expected to reach USD 124.90 million in 2024.

b. The Saudi Arabia digital diabetes management market is expected to grow at a compound annual growth rate of 8.90% from 2024 to 2030 to reach USD 208.3 million by 2030.

b. The continuous blood glucose monitoring system segment held the largest revenue share of over 38.58% in 2023, owing to its advanced features such as compatibility with smart devices that serve as display devices.

b. Some key players operating in the Saudi Arabia digital diabetes management market include Abbott; Medtronic; F. Hoffmann-La Roche Ltd.; Bayer AG; LifeScan, Inc.; Dexcom, Inc.; Sanofi; Insulet Corporation; Ascensia Diabetes Care Holdings AG; B. Braun Melsungen AG

b. Key factors that are driving the market growth include growing prevalence of diabetes, coupled with technological advancements and innovations.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."