- Home

- »

- Medical Devices

- »

-

Saudi Arabia Diabetes Devices Market, Industry Report, 2030GVR Report cover

![Saudi Arabia Diabetes Devices Market Size, Share & Trends Report]()

Saudi Arabia Diabetes Devices Market Size, Share & Trends Analysis Report By Type (BGM Devices, Insulin Delivery Devices), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies), By End-use (Hospitals, Diagnostic Centers), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-261-8

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

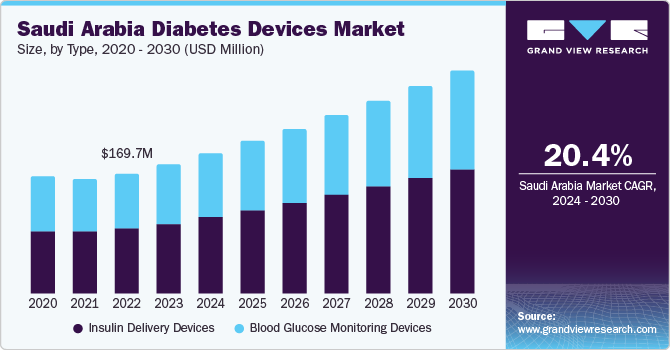

The Saudi Arabia diabetes devices market size was estimated at USD 183.8 million in 2023 and is expected to grow at a CAGR of 8.14% from 2024 to 2030. The growing prevalence of diabetes, technological advancements, and strategic initiatives undertaken by the government are major factors contributing to the market growth. For instance, as part of its Vision 2030 initiative, Saudi Arabia's government aims to enhance the country's healthcare infrastructure, privatize health services and insurance, establish 21 health clusters all over the nation, and broaden the reach of e-health services by investing more than USD 65 billion.

Diabetes is a major health concern in Saudi Arabia. According to the International Diabetes Federation (IDF), approximately 4.27 million people were living with diabetes in 2021, which is expected to increase to 7.53 million by 2045. The total diabetes-related healthcare spending in the country was about USD 7,459.5 million in 2021, which is expected to increase to USD 10,045.2 million by 2045. The modernization and resultant shift in lifestyle to more sedentary activity with higher-fat diets and obesity are the causes of the increased prevalence of diabetes mellitus in the Saudi community.

Government initiatives such as launch of diabetes awareness initiatives and awareness regarding diabetes, which encourages healthcare practitioners to continue screening and early intervention efforts, including lifestyle changes is expected to contribute to the overall market growth. For instance, in July 2022, a Memorandum of Understanding (MOU) was signed between Digital Diagnostics-the manufacturer of IDx-DR, the first FDA-cleared, fully autonomous AI system for the diagnosis of diabetic retinopathy-and the Ministry of Investment of the Kingdom of Saudi Arabia. The parties concurred to investigate prospective partnerships in the areas of healthcare, medical technology, and digital health, with a major financial commitment and the creation of 1,950 employment by 2030.

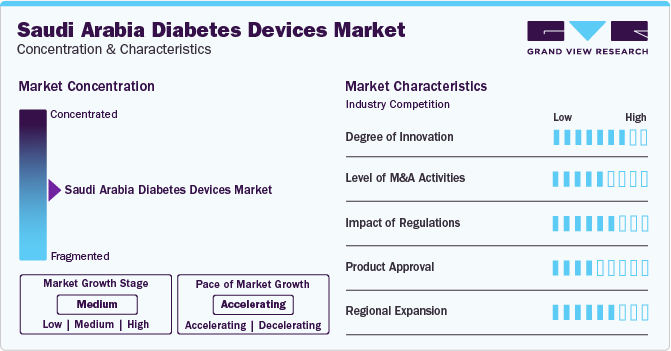

Market Concentration & Characteristics

The global diabetes devices market growth stage is high, and the pace of the industry growth is accelerating. The Saudi Arabia diabetes devices market has witnessed significant innovation, characterized by advancements in technology, growing awareness regarding diabetes care, and efficient results.This transformative shift is evident in the emergence of technologically advanced products like continuous glucose monitoring (CGM) systems, smart insulin pumps, and advanced insulin delivery devices. These innovations not only improve the accuracy and effectiveness of diabetes management but also provide greater convenience and ease of use for patients.

To expand their customer base and gain a larger industry share, major players in the industry are continuously working to improve their product offerings. This involves upgrading their products, exploring acquisitions, obtaining government clearances, and engaging in important cooperation activities. For instance, in April 2022, Medtronic collaborated with GE Healthcare to address the distinct needs and demand for care at ambulatory surgery centers and office-based laboratories. Customers can access a wide range of products, financial solutions, and service excellence through this new alliance.

Saudi Arabia diabetes deviceshave achieved a high degree of innovation, owing to remarkable technological advancements, R&D activities, government initiatives, and growing awareness. For instance, in January 2024, King Abdullah University of Science and Technology (KAUST) and Saudi health tech firm amplifAI health have collaborated to develop an innovative diabetes detection system.

Companies that manufacture diabetes devices are undertaking merger and acquisition activities. This strategic approach seeks to improve technological capabilities, expand industry reach, and maintain competitiveness. For instance, in May 2023, Medtronic plc announced its agreement to acquire EOFlow Co. Ltd., the manufacturer of the EOPatch device-a tubeless, wearable, and fully disposable insulin delivery device. The addition of EOFlow, coupled with Medtronic's Meal Detection Technology algorithm and next-generation continuous glucose monitor (CGM), is anticipated to enhance the company's capacity to meet the needs of a broader range of individuals with diabetes, regardless of their stage in treatment or preference for insulin delivery method.

In Saudi Arabia, regulations overseeing diabetes devices are established and enforced by the Saudi Food and Drug Authority (SFDA). These regulations are formulated to ensure the safety, efficacy, and quality of medical devices used for diabetes management throughout the country. The SFDA mandates that all diabetes devices, such as blood glucose meters, continuous glucose monitoring systems, insulin pumps, and insulin delivery devices, undergo comprehensive assessment and registration before they can be introduced to the market and distributed in Saudi Arabia.

New product launches by manufacturers to stay competitive in the market and the growing demand and adoption of medical imaging devices for orthopedic applications is an important factor driving market growth. For instance, in August 2023, Nemaura Medical received Saudi Food and Drug Authority (SFDA) approval for its sugarBEAT sensor, a non-invasive glucose sensor.

The geographical reach of diabetes devices has been expanding at a moderate to high level. For instance, Saudi Pharmaceutical Industries and Medical Appliances Corp. (SPIMACO)'s subsidiary, Dammam Pharma Co., has formed a strategic alliance agreement with Merck Sharp & Dohme International (MSD) to manufacture type 2 diabetes medications in the Kingdom of Saudi Arabia.

Type Insights

The insulin delivery segment held the largest market share of over 54.2% in 2023 and the segment is further expected to grow at the fastest CAGR over the forecast period. These devices offer several advantages over traditional methods of insulin administration, providing patients with greater flexibility, precision, and convenience in managing diabetes. The insulin delivery devices, such as insulin pens and insulin pumps, simplify the process of administering insulin injections. They eliminate the need for manual drawing and measuring of insulin doses, thereby reducing the risk of dosing errors and enhancing treatment accuracy.

The presence of several market players in the country, along with various strategic initiatives undertaken by them, is anticipated to contribute to the expansion of the market. For instance, in October 2023, the National Unified Procurement Company (Nupco), a unit of the Saudi sovereign wealth fund PIF, has signed an agreement with leading pharmaceutical groups Sudair and Sanofi to commence local production of insulin in the kingdom. Consequently, this is expected to lead to an increase in the production of insulin within the country, thereby also potentially increasing the production of insulin delivery devices.

Distribution Channel Insights

The hospital pharmacies segment held the largest market share of more than 54.1% in 2023. This is attributed to the critical role hospital pharmacies play as primary access points for patients receiving diabetes care within healthcare facilities. Given the complexity of diabetes management and the necessity for specialized medical guidance, hospitals serve as primary settings where patients receive diagnosis, treatment, and ongoing support for their condition. Moreover, hospital pharmacies adhere to regulatory standards and quality control measures to ensure the safety, efficacy, and reliability of the diabetes devices they dispense.

The retail pharmacy segment is expected to grow at the fastest rate from 2024 to 2030, as they serve as convenient and accessible points of purchase for individuals seeking diabetes devices and related supplies. With their widespread presence in local communities and urban areas, retail pharmacies offer patients the convenience of obtaining diabetes devices closer to their homes, reducing travel time and logistical barriers to access. Diabetes care product offered by retail pharmacies to patients includes medication, self-monitoring glucose supplies (meter, testing strips, lancing device), insulin delivery equipment, and OTC products.

End-use Insights

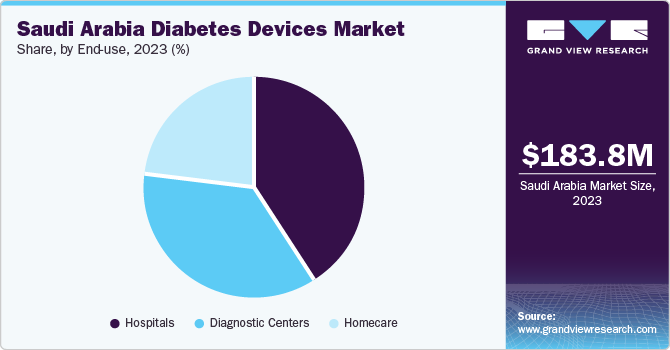

The hospital segment dominated the market with a share of over 40.8% in 2023. The increasing number of hospital admissions of diabetes patients is boosting the demand for the segment. Patients suffering from diabetes have a threefold chance of hospitalization compared with those without diabetes. Diabetes technology has evolved rapidly in the past few years. Most of these technologies aim to improve diabetes care in hospitals and clinics. These advancements in technology have increased the usage of diabetes devices in hospitals and clinics.

The diagnostic centers segment is expected to grow at a significant rate during the forecast period from 2024 to 2030. Diabetes devices are being increasingly used in various healthcare settings, such as diagnostic centers. Patients suffering from diabetes prefer examining glucose levels in diagnostic centers due to their effectiveness in providing instant results without long waiting times. SMBG devices are widely used in these diagnostic centers. Thus, increasing demand for diabetes devices is expected to propel segment growth.

Key Saudi Arabia Diabetes Devices Company Insights

The key players operating in Saudi Arabia market are working to improve their product offerings by upgrading their products, leveraging important cooperative drives, as well as considering acquisitions and government approvals to increase their client base and get a larger part of the market share. Some of the major market players operating in the market are Medtronic plc., Abbott Laboratories, F. Hoffmann-La Roche Ltd.

Key Saudi Arabia Diabetes Devices Companies:

- Medtronic plc

- Abbott Laboratories

- F. Hoffmann-La Roche Ltd

- Bayer AG

- Lifescan, Inc.

- B Braun Melsungen AG

- Dexcom Inc.

- Insulet Corporation

- Sanofi

- Novo Nordisk A/S

- BD

Recent Developments

-

In February 2023, Insulet Corporation acquired the assets of a California-based company, Automated Glucose Control LLC (AGC), specializing in automated insulin delivery technology

-

In February 2023, Insulet Corporation acquired the patents for insulin pumps from Bigfoot Biomedical (Bigfoot), a company specializing in insulin delivery technologies

-

In August 2022, Abbott entered a strategic agreement with WW International, Inc. (WeightWatchers). With the help of this partnership, both companies will combine WeightWatchers weight management program for people with diabetes with Abbott's line of FreeStyle Libre products to produce a seamless mobile experience, offering knowledge & insights to improve their diet, lower their blood sugar levels, and, ultimately, take back control of their health

-

In August 2022, Insulet Corporation received FDA clearance for its Omnipod 5 Automated Insulin Delivery System (Omnipod 5) for individuals aged 2 and above with type 1 diabetes

Saudi Arabia Diabetes Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 199.6 million

Revenue forecast in 2030

USD 319.3 million

Growth rate

CAGR of 8.14% from 2024 to 2030

Actual period

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, end use

Key companies profiled

Medtronic plc; Abbott Laboratories; F. Hoffmann-La Roche Ltd; Bayer AG; Lifescan, Inc.; B Braun Melsungen AG; Dexcom Inc.; Insulet Corporation;

Sanofi; Novo Nordisk A/S; BD

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Saudi Arabia Diabetes Devices Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Saudi Arabia diabetes devices market report based on type, distribution channel, and end-use:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood Glucose Monitoring Devices

-

Self-monitoring Devices

-

Blood Glucose Meters

-

Testing Strips

-

Lancets

-

-

Continuous Glucose Monitoring Devices

-

Sensors

-

Transmitters

-

Receiver

-

-

-

Insulin Delivery Devices

-

Insulin Pumps

-

Insulin Pens

-

Insulin Syringes

-

Insulin Jet Injectors

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Diabetes Clinics/Centers

-

Online Pharmacies

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Homecare

-

Diagnostic Centers

-

Frequently Asked Questions About This Report

b. The Saudi Arabia diabetes devices market size was estimated at USD 183.8 million in 2023 and is expected to reach USD 199.6 million in 2024.

b. The Saudi Arabia diabetes devices market is expected to grow at a compound annual growth rate of 8.14% from 2024 to 2030 to reach USD 319.3 million by 2030.

b. Insulin delivery devices dominated the Saudi Arabia diabetes devices market type segment with a share of over 54.2% in 2023.

b. Some key players operating in the Saudi Arabia diabetes devices market include Medtronic plc; Abbott Laboratories; F. Hoffmann-La Roche Ltd; Bayer AG; Lifescan, Inc.; B Braun Melsungen AG; Dexcom Inc.; Insulet Corporation;Sanofi; Novo Nordisk A/S; BD

b. Key factors that are driving the market growth include growing prevalence of diabetes, technological advancements and strategic initiatives undertaken by the government.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."