- Home

- »

- Advanced Interior Materials

- »

-

Saudi Arabia Carbon Nanotubes Market, Industry Report 2030GVR Report cover

![Saudi Arabia Carbon Nanotubes Market Size, Share & Trends Report]()

Saudi Arabia Carbon Nanotubes Market Size, Share & Trends Analysis Report By Product (Single Walled Carbon Nanotube (SWCNT), Multi Walled Carbon Nanotube (MWCNT)), By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-269-2

- Number of Report Pages: 67

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

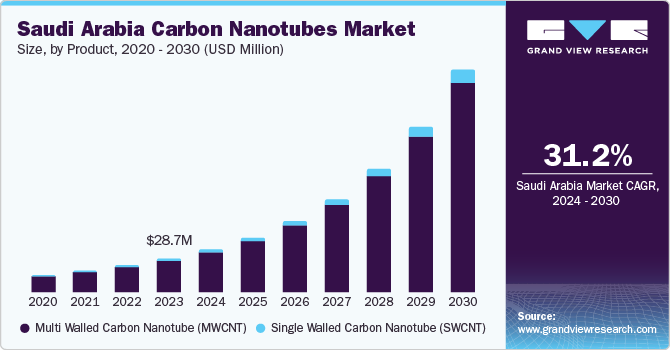

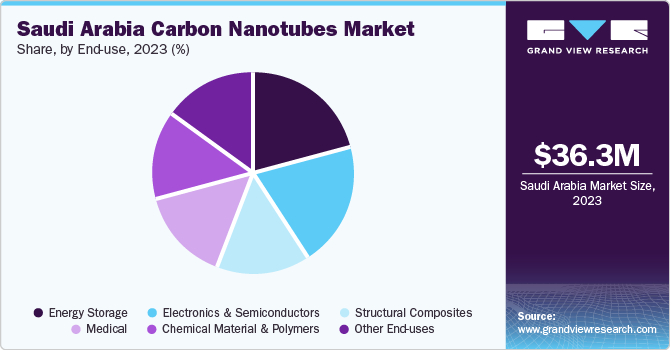

The Saudi Arabia carbon nanotubes market size was estimated at USD 36.3 million in 2023 and is projected to grow at a CAGR of 31.2% from 2024 to 2030. The market growth is attributed to the increasing application of carbon nanotubes in electronics & semiconductors, medical, energy storage, and structural composites owing to their lightweight nature, along with thermal & electrical conductivity and high strength. In addition, the rising investments in the medical and electronics sectors are expected to propel the demand for carbon nanotubes in Saudi Arabia in the coming years.

Carbon nanotubes (CNTs) are incorporated in drug delivery systems to enhance solubility, allowing smooth movement through the human body and reducing the risk of blockage of vital body organ pathways. In addition, carbon nanotubes offer strong optical absorbance of near-infrared light, which allows the selective destruction of disease cells in drug delivery applications.

Carbon nanotube is commercially produced by various companies across the world. These companies cater to the demand from various end-use industries in the global carbon nanotube market. Some of the major global manufacturers of CNT are LG Chem, KUMHO PETROCHEMICAL, CHASM Advanced Materials, Inc., Tokyo Chemical Industry Co., Ltd., NoPo Nanotechnologies, Hyperion Catalysis International, and Cabot Corporation. Many of these manufacturers are in long-term agreements with raw material suppliers in order to ensure a consistent supply of raw materials irrespective of price volatility or geopolitical dynamics.

The high electrical and thermal conductivity, high elasticity, and low-density characteristics of carbon nanotubes (CNT) make it a diverse product. Scientific researchers are constantly modifying the structural arrangement and exploring new products of carbon nanotubes in the fields of electronics, optics, medical, and water treatment. For instance, in October 2023, researchers from King Saud University synthesized non-supported pure and mixed cobalt and iron oxide catalysts made from nitrate precursor materials using water as the sole solvent. Prepared catalytic converters were then used to convert methane into hydrogen and carbon nanotubes.

Market Concentration & Characteristics

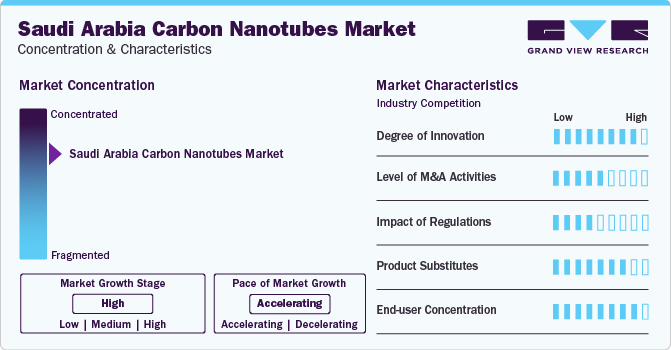

The market growth stage is high, and the pace is accelerating. Furthermore, the market is consolidated as the major companies of carbon nanotubes account for the major share of the market in Saudi Arabia. The top players are continuously engaged in R&D activities and new product development in the market, which prepares them for any changes in the future.

The market is characterized by a high degree of innovation. For instance, Saudi Arabian Oil Co. has partnered with a Rice University-led research initiative called Carbon Hub. The goal is to accelerate the development and deployment of large-scale technologies that produce clean hydrogen fuel and hydrocarbon-based carbon materials. Carbon hub members plan to create Êrbon materials to replace emissions-intensive materials in the textile, manufacturing, food, and transportation sectors.

Prominent players in the market are opting for various strategies such as mergers & acquisitions, joint ventures, and partnerships to gain a competitive advantage in the market. These players have strategic tie-ups with the distributors to cater to other regional markets. For instance, in November 2020, CHASM Advanced Materials, Inc. partnered with Daekyung Hichem Co., Ltd. to help CHASM Advanced Materials, Inc. distribute its products in South Korea.

The market is subject to regulatory scrutiny. For instance, The International Organization for Standardization (ISO) standard TS 11931:2012 provides requirements to describe the basic characteristics of nanoscale calcium carbonate in powder form relevant for applications in nanotechnology. Similarly, the ISO/TS 19808:2020standard specifies the characteristics to be measured of suspensions containing multi-walled carbon nanotubes (CNT suspensions).

Rising demand for substitutes such as metal oxide nanomaterials is expected to pose a credible threat to market growth. However, high market visibility for carbon nanomaterials is anticipated to reduce the threat of substitutes. New product development combined with strategic tie-ups with buyers is expected to negate the threat of substitutes.

Carbon nanotubes are used in several end-use applications such as electronics & semiconductors, energy storage, chemical materials & polymers, and medical and structural composites. The energy storage industry is anticipated to be one of the key forces driving the adoption of carbon nanotubes in the future.

Product Insights

The multi walled carbon nanotubes (MWCNT) segment led the market with the largest revenue share of 93.5% in 2023. MWCNTs are highly conductive and can conduct both thermal and electric energy. The market is also expected to witness at the fastest CAGR over the forecast period, owing to the broad range of applications of MWCNTs in battery cathodes, water filtration, spray-coat-able heater elements, and other heat conduction materials.

The SWCNT segment are suitable for electronic gadgets that tend to heat up, due to high thermal and electric conductivity. Single walled carbon nanotubes have several applications, including cells & batteries, structural materials, sports equipment, conductive adhesive, electric wires, and aviation. SWCNT plays a critical role in air & water filtration, multipurpose coatings, drug delivery, and energy storage.

End-use Insights

Based on end use, the energy storage segment led the market with the largest revenue share of 21% in 2023, and this segment is also anticipated to grow at the fastest CAGR of 32.6% over the forecast period. Rising investments by the government of Saudi Arabia in energy storage materials, such as batteries, super capacitors, solar cells, and fuel cells, are expected to boost market growth over the forecast period.

Carbon nanotubes exhibit higher mechanical, thermal, and electrical properties compared to other nanoparticles, which make them ideal materials for electronic and semiconductor applications such as sensors, photovoltaics, conductors, displays, smart textiles, and energy conversion devices (e.g., fuel cells, harvesters, and batteries). Carbon nanotubes are still a major focus of research in electronics as they are used in the production of transistors and as conductive layers in the fast-growing touchscreen industry.

Carbon nanotubes are highly adopted as polymer nanocomposites owing to their properties such as improved tensile strength, conductivity, and high elastic modulus. They are used as a composite material for a wide range of applications including aerospace and automotive parts, conductive polymers for electronics, and reinforcing agents in structural applications.

Carbon nanotubes are applied to medical & pharmaceutical industry due to their high surface area, which can adsorb or conjugate with a wide variety of therapeutic and diagnostic agents (such as genes, drugs, antibodies, biosensors, and vaccines). CNTs are an effective means of delivering drugs directly into cells without being metabolized by the human body.

Key Saudi Arabia Carbon Nanotubes Company Insights

Some of the key players operating in the market include LG Chem, KUMHO PETROCHEMICAL, and Cabot Corporation:

-

LG Chem is a leading chemical company involved in the manufacturing of a wide range of high-value-added products. It operates through a diverse business portfolio, including advanced materials, petrochemicals, and life sciences

-

KUMHO PETROCHEMICAL is involved in several business sectors, including fine chemistry, synthetic rubber, synthetic resin, nanocarbon, energy, and construction materials.

AdNano Technologies Pvt Ltd, Ossila Ltd, and Hyperion Catalysis International are some of the emerging participants in the Saudi Arabia market.

-

Hyperion Catalysis International is involved in developing carbon nanotubes under its brand, FIBRIL nanotubes. The company provides FIBRIL nanotubes, which are pre-mixed in various plastics (including polystyrene and high-density polyethylene) to cater to its growing demand in electronics and automotive applications

-

AdNano Technologies Pvt Ltd is a leading manufacturer and supplier of nanomaterials. The company offers a wide range of products, including graphene oxide, single-walled and multi-walled carbon nanotubes, metal oxide nanoparticles, nano dispersions, polymer composites, and conductive inks. It exports products to more than 20 countries, including Saudi Arabia

Key Saudi Arabia Carbon Nanotubes Companies:

- LG Chem

- KUMHO PETROCHEMICAL.

- CHASM Advanced Materials, Inc.

- Tokyo Chemical Industry Co., Ltd.

- NoPo Nanotechnologies

- Hyperion Catalysis International

- Cabot Corporation

- OCSiAl

- Ossila Ltd

- AdNano Technologies Pvt Ltd.

Recent Development

-

In October 2023, KUMHO PETROCHEMICAL and POSCO INTERNATIONAL considered establishing a joint venture to produce carbon nanotubes. With this joint venture, the former aimed to increase its share in the market.

-

In June 2023, CHASM Advanced Materials, Inc. launched NTeC-E conductive carbon nanotube (CNT) additives for lithium-ion batteries used in electric vehicles. CNT additives have longer life cycles, superior rate capability, lower internal resistance, and increased energy storage capacity than traditional conductive carbon additives used in lithium-ion batteries

-

In January 2023, Cabot Corporation announced an investment of approximately USD 200 million for the next five years in the U.S. in the conductive carbon additive production capacity to develop lithium-ion batteries. This strategic expansion is expected to help CABOT increase its market position. Conductive carbon additives (CCA) are essential components of lithium-ion batteries

Saudi Arabia Carbon Nanotubes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 46.2 million

Revenue forecast in 2030

USD 242.0 million

Growth rate

CAGR of 31.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use

Country scope

Saudi Arabia

Key companies profiled

LG Chem; KUMHO PETROCHEMICAL; CHASM Advanced Materials, Inc.; Tokyo Chemical Industry Co., Ltd.; NoPo Nanotechnologies; Hyperion Catalysis International; Cabot Corporation; OCSiAl, Ossila Ltd; AdNano Technologies Pvt Ltd

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Saudi Arabia Carbon Nanotubes Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented Saudi Arabia carbon nanotubes market report based on product, and end-use.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Single Walled Carbon Nanotube (SWCNT)

-

Multi Walled Carbon Nanotube (MWCNT)

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Electronics & Semiconductors

-

Energy Storage

-

Chemical Material & Polymers

-

Medical

-

Structural Composites

-

Other End-uses

-

Frequently Asked Questions About This Report

b. The Saudi Arabia carbon nanotubes market size was estimated at USD 36.3 million in 2023 and is expected to reach USD 46.2 million in 2024.

b. Saudi Arabia carbon nanotubes market is expected to grow at a compound annual growth rate of 31.2% from 2024 to 2030 to reach USD 242.0 million by 2030.

b. Multi walled carbon nanotubes (MWCNT) led the market and accounted for over 93.5% share of the revenue in 2023 owing to the broad range of applications of MWCNTs in battery cathodes, water filtration, spray-coat-able heater elements, and other heat conduction materials

b. Some of the key players operating in the Saudi Arabia carbon nanotubes market include LG Chem, KUMHO PETROCHEMICAL, CHASM Advanced Materials, Inc., and Tokyo Chemical Industry Co., Ltd.

b. The key factors that are driving the Saudi Arabia carbon nanotubes market include rising investments in the medical, energy storage, and electronics sectors in Saudi Arabia in the coming years.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."