- Home

- »

- Consumer F&B

- »

-

Sauces, Dressings & Condiments Market Size Report, 2030GVR Report cover

![Sauces, Dressings & Condiments Market Size, Share & Trends Report]()

Sauces, Dressings & Condiments Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Distribution Channel (Hypermarkets & Supermarkets, Convenience Stores, Online), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-614-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sauces, Dressings & Condiments Market Summary

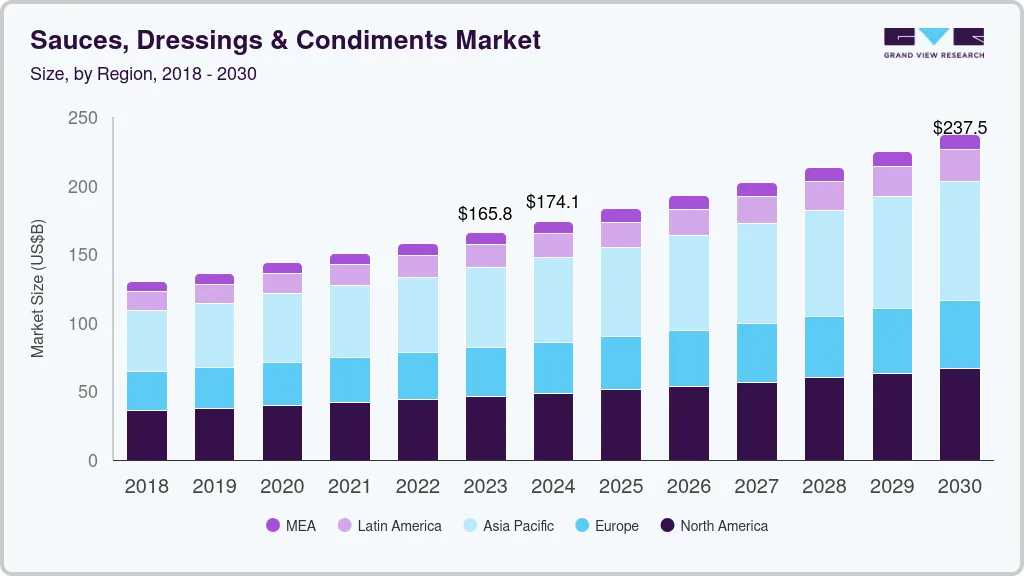

The global sauces, dressings & condiments market size was valued at USD 165.81 billion in 2023 and is projected to reach USD 237.54 billion by 2030, growing at a CAGR of 5.3% from 2024 to 2030. Changing consumer food preferences and consumption patterns to healthier and more nutritious foods is driving growth in the market.

Key Market Trends & Insights

- Asia Pacific sauces, dressings & condiments market accounted for the largest revenue share of 35.2% in 2023.

- Based on product, the cooking sauces segment accounted for the largest market revenue share of 37.9% in 2023.

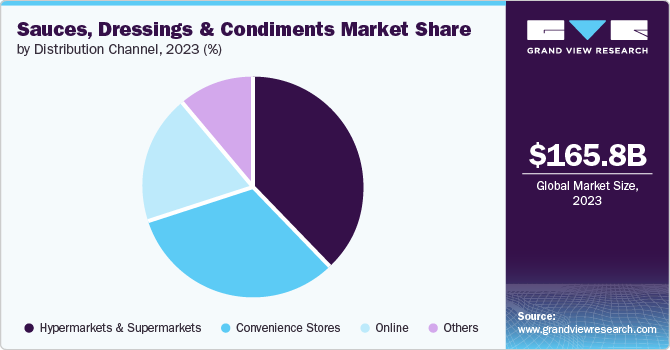

- Based on distribution channel, the hypermarkets & supermarkets distribution segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 165.81 Billion

- 2030 Projected Market Size: USD 237.54 Billion

- CAGR (2024-2030): 5.3%

- Asia Pacific: Largest market in 2023

In addition, the growing demand for international cuisine and aromatic ethnic dishes is driving the demand for sauces, dressings, and condiments. More people lead busy lives, and the demand for convenient, ready-to-use food products has surged. Sauces, dressings, and condiments offer a quick way to add flavor and variety to meals, catering to the needs of time-constrained consumers. Additionally, there is a growing trend towards experimenting with different cuisines, which has increased the demand for a wide range of sauces and condiments that replicate authentic flavors from around the world. For instance, in April 2024, Heinz unveiled a new pink 'Barbiecue' sauce in partnership with Mattel. This vegan mayonnaise is part of a special limited edition launch to celebrate Barbie's 65th anniversary. This collaboration between Heinz and Mattel aims to bring innovation and fun to consumers. The sauce, Vegan Pink Barbie Cue Mayo, is available on the Heinz website.

Consumers are increasingly seeking products that are perceived as healthier, such as those with natural ingredients, lower sugar and sodium content, and free from artificial additives. This trend has driven manufacturers to innovate and introduce healthier alternatives in their product lines, including organic and gluten-free options, thereby expanding the market. For instance, in January 2024, Kikkoman launched dark soy sauce specially crafted for the Indian market. The sauce is made from a natural brewing process and uses soybeans, wheat, salt, and water. It is made without chemicals, preservatives, or artificial seasonings. The product is available in 440 g and 900 g.

Social media platforms such as Instagram, Facebook, and Twitter are particularly effective for engaging with consumers, sharing recipes and cooking tips, and showcasing product versatility. Influencer partnerships and user-generated content campaigns increase brand visibility and credibility among target demographics. Additionally, collaborations with retailers, restaurants, or other food brands aid in introducing products to new customer bases or support brand values through co-branded initiatives. Promotional strategies such as discounts, coupons, and limited-time offers drive immediate sales and encourage trial among consumers.

Product Insights

The cooking sauces segment accounted for the largest market revenue share of 37.9% in 2023. Cooking sauces offer a quick and easy way to add flavor and variety to meals, making them valuable options for busy households. They reduce the need for extensive preparation and cooking time, allowing consumers to enjoy delicious meals with minimal effort. For instance, in February 2023, Mother's Recipe launched a new category of Exotic Global Sauces under its brand named Recipe. The products are available in green chili, red chili, soya bean, garlic chilli, chilli vinegar, and sriracha sauce. These sauces are used for marinating, dipping, and stir-frying. The bottles are lightweight and have a Twist Nozzle feature, making them easy to use.

The dips segment is expected to register the fastest CAGR during the forecast period. As lifestyles become busier, traditional meal patterns are being replaced by more flexible eating habits, with snacking playing a significant role. Dips, often paired with chips, vegetables, breadsticks, and other snack foods, are suitable for casual and social occasions. Their convenience and versatility make them popular for at-home snacking, parties, and gatherings, driving demand in this segment. Moreover, Pre-packaged dips that require no preparation are highly convenient for consumers looking for quick and easy snack solutions. Single-serve and portable packaging formats such as school lunches, work snacks, and travel are prevalent for on-the-go consumption.

Distribution channel insights

The hypermarkets & supermarkets distribution segment accounted for the largest market revenue share in 2023. Hypermarkets and supermarkets offer an extensive range of products under one roof, making them convenient for consumers pursuing variety. These retail outlets stock various sauces, dressings, and condiments, catering to diverse consumer preferences and dietary needs. The availability of multiple brands and product variants, from basic everyday items to premium and specialty products, ensures that consumers find everything they need in one location. This broad selection enhances customer satisfaction and drives foot traffic to these stores. For instance, in April 2024, Morleys, a cult London fried chicken brand, expanded into retail by launching its collaboration with Heinz, Heinz x Morleys Fried Chicken Sauce. The sauce combines tomatoes, onions, paprika, and a hint of chili to enhance the taste of chicken and other dishes. The product is available in Tesco stores and other supermarkets.

The online distribution segment is expected to register the fastest CAGR during the forecast period. Online shopping allows consumers to browse, compare, and purchase sauces, dressings, and condiments from the comfort of their homes at any time. The ease of access to a wide variety of products without the need to visit physical stores is highly convenient, especially for busy individuals and families. The ability to have products delivered directly to their doorstep further enhances the convenience factor, making online shopping a preferred choice for many. Additionally, online platforms provide detailed product information, including ingredients, nutritional values, and usage suggestions, which aid consumers in making informed purchasing decisions. Customer reviews and ratings offer insight into product quality and performance, influencing buying behavior.

Regional Insights

North America sauces, dressings & condiments market is expected to witness a significant CAGR over the forecast period. North America's rich cultural diversity significantly influences the market of sauces, dressings, and condiments. The region is home to many ethnic communities with culinary traditions and flavors. This diversity fuels demand for a broad range of sauces and condiments, from classic American barbecue to spicy Mexican salsas, tangy Asian sauces, and aromatic Mediterranean dressings. The desire to explore and incorporate diverse cuisines into everyday meals drives market growth and encourages continuous product innovation.

U.S. Sauces, Dressings & Condiments Market Trends

The U.S. sauces, dressings & condiments market is expected to witness significant growth over the forecast period. Manufacturers constantly develop new flavors, textures, and formulations to meet evolving consumer preferences. This includes the introduction of unique and gourmet flavors, fusion sauces that blend different culinary traditions, and functional products with added health benefits. The ability to offer diverse products helps brands stand out in a competitive market and attract a wider audience. Additionally, different types of tomato sauces serve as a base for barbecue sauces, marinades, dressings, and dips. Its compatibility with numerous foods, including sandwiches, hot dogs, and grilled meats, ensures it remains a kitchen essential. This wide application across different meals and recipes increases its market presence and consumer demand. For instance, in September 2023, Heinz launched a new product, Heinz Tomato Ketchup Pasta Sauce. The limited-edition sauce is prepared from sun-ripened Italian tomatoes, blending tomato sauce with the flavor of Heinz Tomato Ketchup. This launch addresses the ongoing debate in the culinary world about using ketchup with pasta, which has divided opinions on social media.

The Canada sauces, dressings & condiments market is expected to witness significant growth over the forecast period. There is a growing preference for products that match health and wellness trends, such as low-sodium, low-sugar, organic, and natural ingredients. Canadian consumers are increasingly aware of their dietary choices, seeking products that offer nutritional benefits without compromising on taste. Manufacturers are responding by introducing healthier formulations and labeling practices that provide transparency about ingredients and nutritional content, demanding health-conscious consumers.

Europe Sauces, Dressings & Condiments Market Trends

The Europe sauces, dressings & condiments market is expected to witness significant growth over the forecast period. Europe boasts a rich culinary heritage with diverse palates and regional specialties that significantly drive the demand for sauces, dressings, and condiments. Each European country has its traditional recipes and flavors that influence consumer preferences. This diversity promotes a dynamic market where traditional products coexist with innovative offerings, catering to the varied tastes of European consumers. Manufacturers are continuously developing new products to cater to evolving tastes and preferences. This includes the introduction of unique flavor combinations, gourmet and artisanal products, and region-specific specialties.

The UK sauces, dressings & condiments market is expected to witness significant growth over the forecast period. The food service industry, including restaurants, cafes, and takeaways, significantly impacts the UK's demand for sauces, dressings, and condiments. Sauces and condiments are essential in food preparation and service, enhancing the flavor of dishes and offering variety to customers. The recovery and growth of the foodservice sector post-pandemic are driving demand for bulk and specialty products. The trend of consumers seeking restaurant-quality meals at home influences retail sales as consumers look to recreate their favorite dishes with the help of high-quality sauces and condiments. Moreover, online grocery shopping and home delivery services have become increasingly popular, providing consumer’s convenient access to various products. These factors combined are driving the market growth.

Asia Pacific Sauces, Dressings & Condiments Market Trends

Asia Pacific sauces, dressings & condiments market accounted for the largest revenue share of 35.2% in 2023. E-commerce platforms, mobile apps, and online grocery delivery services are gaining popularity, offering consumers convenient access to a wide range of products. The use of technology extends to marketing and consumer engagement, with brands leveraging social media, influencer partnerships, and digital advertising to reach tech-savvy consumers. Digital platforms provide opportunities for personalized shopping experiences, targeted promotions, and direct-to-consumer engagement, driving growth in online sales of sauces and condiments.

The China sauces, dressings & condiments market is expected to witness significant growth over the forecast period Traditional Chinese herbs and ingredients, such as ginger, garlic, and fermented soybeans, are valued for their health-promoting properties and culinary benefits. Consumers are increasingly interested in functional foods that offer nutritional benefits beyond basic sustenance. Manufacturers are incorporating these traditional ingredients into sauces and condiments, highlighting their health benefits and demanding consumers pursue natural remedies for wellness.

The India sauces, dressings & condiments market is expected to witness significant growth over the forecast period. India's rich cultural diversity and regional culinary traditions are crucial in driving the Sauces, Dressings & Condiments market. Each region in India has its distinct flavors, spices, and cooking techniques, influencing the demand for various sauces, dressings, and condiments. From the tangy chutneys of North India to the spicy pickles of South India and the aromatic spices of the Northeast, the diversity of flavors reflects the country's multicultural heritage. This cultural richness fuels innovation and product differentiation as manufacturers cater to local tastes and preferences. For instance, in January 2024, Cremica launched a range of new products in India. The launch included four new products, such as Tombo, a Vegetarian Mayonnaise Squeeze Pack, a trial pack of Dips and Spreads in tandoori, pizza pasta, original, cheese jalapeno, veg mayo, and salsa Mexican flavors.

Key Sauces, Dressings & Condiments Company Insights

Some key companies in the sauces, dressings & condiments market include Del Monte Foods, Inc., Kikkoman Sales USA, Inc., McCormick & Company, Inc, and Nestlé S.A.

-

Kikkoman is a globally renowned soy sauce company that offers a wide range of Asian sauces, seasonings, and condiments. The company emphasizes natural brewing processes and superior taste, making its products famous worldwide in households and professional kitchens.

-

McCormick & Company, Inc. manufactures and markets spices, seasoning mixes, condiments, and other flavors in more than 150 countries. McCormick stands out by offering a wide array of flavors in segments that meet the needs of consumers and the food industry. Their homemade products include Cholula Hot Sauce, Old Bay Seasoning and more.

Key Sauces, Dressings & Condiments Companies:

The following are the leading companies in the sauces, dressings & condiments market. These companies collectively hold the largest market share and dictate industry trends.

- CAMPBELL SOUP COMPANY

- Conagra Brands, Inc.

- Del Monte Foods, Inc.

- General Mills Inc.

- Kikkoman Sales USA, Inc.

- McCormick & Company, Inc.

- PepsiCo

- Nestlé

- The Kraft Heinz Company

- Unilever

Recent Development

-

In June 2024, Heinz collaborated with Iceland to introduce Heinz BBQ Filled Hash Browns. These hash browns are exclusively available online in Iceland stores across the UK. The launch of the BBQ Filled Hash Browns follows the success of Heinz's Beanz and Tomato Ketchup Filled Hash Browns.

-

In April 2024, the KRAFT brand introduced five delicious sauces. Creamy Sauces highlights the innovation line to be released under the new KRAFT Sauces, which facilitates all spreads, sauces, and salad dressings under one family for the first time. These include the Smoky Hickory Bacon Flavored Aioli, Burger Aioli, Garlic Aioli, Chipotle Aioli, and Buffalo Style Mayonnaise Dressing.

Sauces, Dressings & Condiments Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 174.10 billion

Revenue forecast in 2030

USD 237.54 billion

Growth rate

CAGR of 5.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, Australia, South Korea, Brazil, South Africa,

Key companies profiled

The Kraft Heinz Company; McCormick & Company, Inc.; CAMPBELL SOUP COMPANY; Del Monte Foods, Inc.; General Mills Inc.; Unilever; Conagra Brands, Inc.; Kikkoman Sales USA, Inc.; PepsiCo; Nestlé

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sauces, Dressings & Condiments Market Report Segmentation

This report forecasts revenue growth on a global, regional and country level and analyzes the latest trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global sauces, dressings & condiments market report by product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Table Sauces

-

Cooking Sauces

-

Pickled Products

-

Purees & Pastes

-

Dips

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Convenience stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

Saudi Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.