Saturated Polyester Resin Market Size, Share & Trends Analysis Report By Material (Liquid, Solid), By End-use (Industrial Paints, Powder Coatings), By Region (North America, Europe), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-328-2

- Number of Report Pages: 164

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Saturated Polyester Resin Market Trends

The global saturated polyester resin market size was estimated at USD 5.38 billion in 2023 and is expected to grow at a CAGR of 5.8% from 2024 to 2030. The market growth is being fueled by the growing demand from coating industry and advancements in packaging solutions. The packaging industry benefits from saturated polyester resins due to their excellent adhesion, flexibility, and chemical resistance, leading to increased adoption in food and beverage packaging.

Saturated polyester resin is a type of thermoset polymer that is formed by the reaction of a saturated polycarboxylic acid and a polyhydric alcohol. It is a highly cross-linked material with excellent chemical resistance, mechanical strength, and thermal stability. The proliferation of smart devices such as smartphones, tablets, and laptops has led to the emergence of e-commerce industry which is expected to drive the market over the forecast period. E-commerce heavily relies on flexible as well as rigid packaging to deliver their goods to the consumer in a safe and secure manner.

The market is driven by the growing demand from the coatings industry, particularly in architectural and automotive sectors. In the architectural coatings segment, the rapid growth of the construction industry, especially in emerging economies, has led to increased use of saturated polyester resins due to their durability and attractive finish. Similarly, in the automotive coatings sector, the rise in automobile production coupled with the need for high-quality, aesthetically pleasing finishes has significantly boosted the demand for these resins. Their excellent properties, such as durability and resistance to weathering, make them an ideal choice for both these applications, contributing to the overall growth of the market.

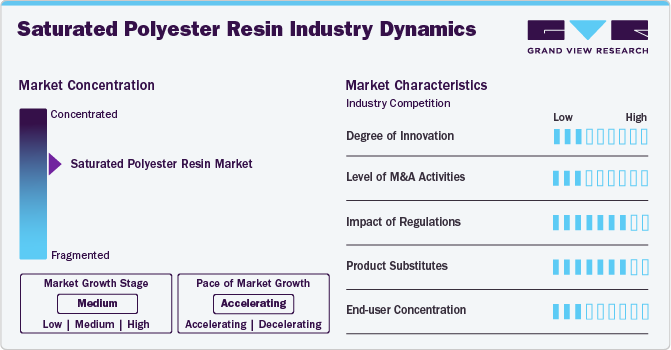

Industry Dynamics

The saturated polyester resin market is consolidated in nature with the presence of key industry players such as DSM, Allnex GmbH, Arkema, IGM Resins, Mitsubishi Chemical Group Corporation, Polynt S.p.A, Hexion, which dominate a significant market share. These companies often engage in aggressive marketing strategies, research and development initiatives, and mergers and acquisitions to strengthen their market position and expand their product offerings.

There are various product substitutes’ available for saturated polyester resins including epoxy resins, polyurethane resins, acrylic resins, and alkyd resins. Epoxy resins offer high chemical and heat resistance, making them suitable for demanding industrial applications but can be more expensive. Polyurethane resins provide excellent flexibility and durability, commonly used in automotive coatings and adhesives. Acrylic resins offer fast drying times and good weather resistance, ideal for architectural coatings and outdoor applications. Alkyd resins, known for their affordability and ease of use, are often used in decorative paints and wood coatings.

Regulations significantly impact the market, especially concerning environmental standards. Stricter regulations on volatile organic compound (VOC) emissions drive manufacturers to develop low-VOC or VOC-free formulations, affecting production processes and costs. Compliance with regulations requires investments in technology and research to develop eco-friendly products, influencing pricing and market competitiveness. Additionally, regulations on hazardous substances and waste disposal impact raw material sourcing and waste management practices, prompting companies to adopt sustainable practices and materials. Adhering to regulations is crucial for market access and customer trust, driving innovation and sustainability in the market.

Material Insights

Based on material, the solid saturated polyester resins segment held the largest share of 60.0% in 2023. This can be attributed to their increasing demand in automotive powder coating owing to the stringent environmental regulations and a shift towards sustainable painting solutions. Solid saturated polyester resins are favored in powder coatings for their low or zero VOC emissions, aligning with stringent environmental regulations and sustainability goals.

The liquid saturated polyester resins segment is poised to grow at a significant CAGR through the forecast period. The rising demand for consumer goods due to the increasing disposable income of numerous countries is expected to drive the segment. These resins are used in coatings and adhesives that enhance the durability and aesthetics of finished productssuch as appliances and furniture.

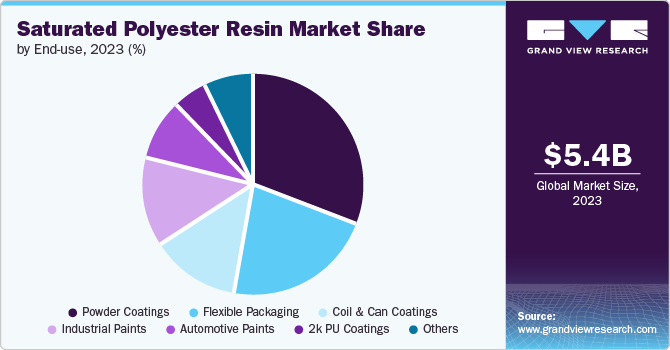

End-use Insights

The powder coatings segment dominated the market in terms of revenue in 2023. The growing demand for automotive vehicles globally is propelling the need of saturated polyester resin in the segment. According to the International Organization of Motor Vehicle Manufacturers, the total vehicle production worldwide rose by 10.0% in 2023 reaching 93,546,599 units. Additionally, the rising adoption of electrical vehicles (EVs) is also driving the demand for powder coating segment.

The industrial paint segment is projected to grow at the fastest rate over the forecast period owing to the rapid industrialization in developing countries such as India, China, South Korea, Taiwan, and others. The saturated polyester resins are eco-friendly in nature with low or no VOC emissions and offer superior performance. Innovations in resin formulations continue to improve properties like hardness, flexibility, and UV resistance, making industrial paints more durable and effective.

Regional Insights

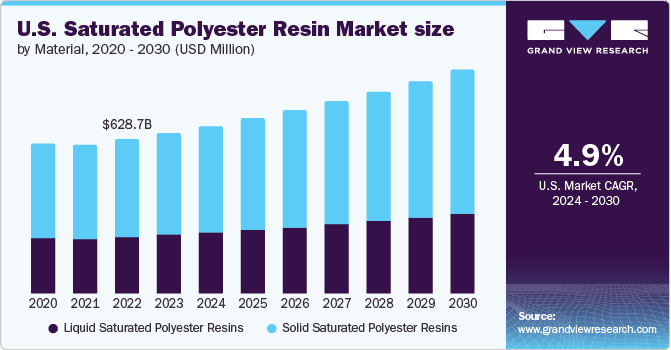

North America is one of the key regional markets and held a revenue share of 14.9% in 2023. In North America, the market is supported by an advanced manufacturing infrastructure and increasing demand for sustainable products. Major players in the region, including the U.S. and Canada, are emphasizing innovation and environmentally friendly practices, driving growth in applications ranging from automotive and construction to electrical & electronics industry.

U.S. Saturated Polyester Resin Market Trends

The U.S. market led the North America region with a revenue share of 81.4%. With a focus on innovation and sustainability, the U.S. continues to make an important contribution to the global market, driving advances in product development and manufacturing processes of saturated polyester resin.

Europe Saturated Polyester Resin Market Trends

The European market is anticipated to grow at a moderate pace of 3.8% during the forecast period. The market in Europe thrives on sustainability initiatives, with Germany, Italy and the United Kingdom leading the region's innovation in eco-friendly textiles and automotive applications.

Saturated polyester resin market in Germany benefits from the strong automotive industry, which drive steady growth and technological advances in sustainable polyester products. Germany was the leading manufacturer of Saturated Polyester Resin in Europe and captured around 27% of the revenue market share in 2023.

Italy saturated polyester resin market is expected to grow at substantial rate over the forecast period. The country is transitioning towards sustainable solutions to fight climate change, leading to an increased adoption of these resins.

Asia Pacific Saturated Polyester Resin Market Trends

Asia Pacific region led the market in terms of revenue in 2023. The market in Asia Pacific, particularly China and India, is experiencing significant growth due to rapid industrialization, urbanization, and a growing middle class, resulting in increased consumption of saturated polyester resin-based packaged products.

Saturated polyester resin market in China dominates the Asia Pacific market and is expected to keep its dominance over the forecast period, as, it is one of the largest manufacturer of consumer electronics.Saturated polyester resins are used as protective coatings for various electronic components such as circuit boards, capacitors, and resistors. These coatings provide excellent insulation, protecting components from moisture, dust, and other environmental factors.

India saturated polyester resin market is growing steadily, supported by a growing population, increasing disposable income and rapid industrialization in the country. The Indian government is increasingly focusing on manufacturing various products in the country to aid protectionism and increase its exports. It also launched the Make in India initiative to further develop the industrial infrastructure for the same, which is anticipated to drive the market.

Central & South America Saturated Polyester Resin Market Trends

The Central & South America market is growing significantly. Government investments in infrastructure projects, such as roads, bridges, and public buildings, drives the need for high-performance coatings and materials that utilize saturated polyester resins for protection and longevity.

Middle East & Africa Saturated Polyester Resin Market Trends

The market in the Middle East and Africa is witnessing steady growth driven by infrastructure development, and increasing disposable income. Large-scale infrastructure projects, such as Saudi Arabia’s NEOM city and the UAE’s Expo 2020 developments, increase the demand for high-performance coatings and materials that use saturated polyester resins for long-lasting protection.

Key Saturated Polyester Resin Company Insights

Key companies are adopting several organic and inorganic expansion strategies, such as mergers & acquisitions, new product launches, capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

- In April 2021, Covestro AG announced the completion of its acquisition of the Resins & Functional Materials (RFM) business including saturated polyester resin production from DSM at a valuation of. The acquisition is expected increase Covestro AG’s revenue by USD 1.07 billion.

Key Saturated Polyester Resin Companies:

The following are the leading companies in the saturated polyester resin market. These companies collectively hold the largest market share and dictate industry trends.

- DSM

- Allnex GmbH

- Arkema

- IGM Resins

- Mitsubishi Chemical Group Corporation

- Polynt S.p.A

- Hexion

- Evonik Industries AG

- BASF SE

- Ashland Global Holdings Inc.

- Sika AG

- Sika AG

Saturated Polyester Resin Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 5.65 billion |

|

Revenue forecast in 2030 |

USD 7.91 billion |

|

Growth rate |

CAGR of 5.8% from 2024 to 2030 |

|

Base Year |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative Units |

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Material, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; France; UK; Italy; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa |

|

Key companies profiled |

DSM; Allnex GmbH; Arkema; IGM Resins; Mitsubishi Chemical Group Corporation; Polynt S.p.A; Hexion; Evonik Industries AG; BASF SE; Ashland Global Holdings Inc.; Sika AG |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Saturated Polyester Resin Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global saturated polyester resin market report based on material, end-use, and region:

-

Material Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Liquid Saturated Polyester Resins

-

Solid Saturated Polyester Resins

-

-

End-use Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Industrial Paints

-

Powder coatings

-

Coil & Can Coatings

-

Automotive Paints

-

Flexible Packaging

-

2k PU Coatings

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Italy

-

France

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global saturated polyester resin market size was estimated at USD 5.38 billion in 2023 and is expected to reach USD 5.65 billion in 2024.

b. The global saturated polyester resin market is expected to grow at a compound annual growth rate of 5.8% from 2024 to 2030 to reach USD 7.91 billion by 2030.

b. Powder coatings dominated the saturated polyester resin end-use segment, with a share of 31.6% in 2023. The growing demand for automotive vehicles globally is propelling the need for saturated polyester resin in this segment.

b. Some key players operating in the saturated polyester resin market include DSM; Allnex GmbH; Arkema; IGM Resins; Mitsubishi Chemical Group Corporation; Polynt S.p.A; Hexion; and Evonik Industries AG.

b. Key factors that are driving the market growth include growing demand from the coating industry and advancements in packaging solutions. The packaging industry benefits from saturated polyester resins due to their excellent adhesion, flexibility, and chemical resistance, leading to increased adoption in food and beverage packaging.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."