Satellite Propulsion System Market Size, Share & Trends Analysis Report By Platform (Large Satellites, Nano Satellites, CubeSats), By Propulsion (Chemical, Non-chemical), By Component (Thrusters, Rocket Motors), By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-413-7

- Number of Report Pages: 162

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

Satellite Propulsion System Market Trends

The global satellite propulsion system market size was estimated at USD 11.05 billion in 2024 and is projected to grow at a CAGR of 13.6% from 2025 to 2030. The increasing number of space missions for commercial, government, and scientific purposes is primarily driving the demand for satellite propulsion systems, fueling the market growth. Moreover, growing interest in space exploration and the development of satellite constellations is further contributing to market expansion. In addition, rising demand for in-orbit servicing and debris mitigation missions, which necessitate advanced satellite propulsion systems, is positively influencing the market scenario.

Advancements in propulsion technologies, such as electric propulsion, are enabling more efficient and cost-effective satellite operations. For instance, in April 2024, NASA launched an electric propulsion system designed for small spacecraft to support planetary missions and extend the operational life of existing satellites. This solution forms part of the agency's initiative of commercializing technology, allowing it to procure this critical technology from industry partners for future missions. Such developments are expected to create significant growth opportunities for the satellite propulsion system industry.

Technological advancements, including breakthroughs in materials science, electronics, and propulsion physics, are further accelerating the industry growth, facilitating the development of more efficient, reliable, and versatile propulsion systems. Moreover, the advent of 3D printing and additive manufacturing is transforming the production of propulsion components, resulting in lighter, more complex, and cost-effective designs. These developments are expanding the possibilities for satellite missions, stimulating the demand for advanced satellite propulsion systems.

The growth of the satellite propulsion system industry is further driven by the increasing public-private partnerships for space exploration initiatives. For instance, in June 2023, NASA announced to partner with seven U.S. companies to cater to future government and commercial needs, favoring human spaceflight and commercialization of low Earth orbit to support the U.S. economy. This development comes as a part of the second Collaborations for Commercial Space Capabilities-2 (CCSC-2) initiative, aimed at advancing commercial space exploration activities through NASA's technical expertise, assessments, data, and technologies.

Platform Insights

The medium-sized satellites segment accounted for the largest revenue share in 2024, driven by the benefits, such as short production cycles and low cost as compared to conventional satellites. In addition, these satellites require relatively less time for construction and launch, allowing faster implementation of space-related projects. Moreover, they can easily maneuver and alter their positions in orbit, which eases their deployment anywhere in space, offering more flexibility to the mission planners during the examination of a specific area. These factors are driving the demand for efficient satellite propulsion systems, favoring segmental growth.

The nano satellites segment is expected to register the fastest CAGR from 2025 to 2030. Nano satellites are emerging as a powerful tool for scientific research and exploration, which is transforming the space exploration sector by making it more accessible, flexible, and affordable. Besides, these satellites have less production cost and can be simultaneously launched in large numbers. The rising demand for these satellites to conduct scientific research, communications, or observation missions in space is creating lucrative opportunities for the satellite propulsion system industry.

Propulsion Insights

The chemical segment accounted for the largest revenue share of over 83.2% in 2024, owing to greater reference for this propulsion technology on account of its high thrust capabilities, making it suitable for launch vehicles and large satellites. While electric propulsion is gaining traction for specific mission profiles, chemical propulsion remains essential for initial orbit insertion and large orbital maneuvers. The increasing number of satellite launches, driven by growing government space programs and commercialization of space, is driving the demand for high-performance chemical propulsion systems, underlining the dominance of the segment.

The non-chemical segment is expected to witness the fastest CAGR of 16.8% from 2025 to 2030, driven by the increasing focus on sustainability, coupled with the need for longer mission life and reduced operational costs. The non-chemical systems offer higher specific impulse, resulting in lower propellant consumption and extended mission life. Moreover, the growing number of small satellites and satellite constellations has fueled the adoption of non-chemical alternatives, such as electric propulsion systems, due to their efficiency and cost-effectiveness.

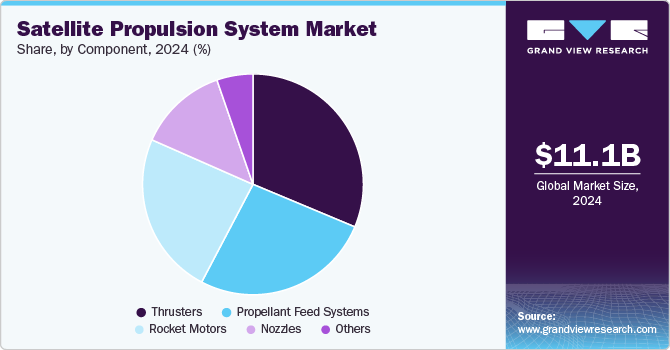

Component Insights

The thrusters segment accounted for the largest revenue share in 2024, owing to the increasing number of satellite launches driven by both commercial and government entities, stimulating the demand for propulsion systems. Thrusters are the core component responsible for generating thrust, making them essential for satellite orbit maintenance, attitude control, and station-keeping. Moreover, the growing preference for smaller satellites has increased the demand for miniaturized and efficient thrusters. The ongoing expansion of the satellite industry is expected to drive the product demand, accelerating the segment growth.

The propellant feed systems segment is expected to register the fastest CAGR from 2025 to 2030, driven by the increasing satellite complexity and the demand for higher-performance missions that require sophisticated propellant management. Besides, the advent of electric propulsion systems, with their specific propellant handling requirements, is driving innovation and demand for advanced propellant feed systems. Moreover, the growing emphasis on in-orbit servicing and refueling missions necessitates reliable and efficient propellant transfer technologies, which is further contributing to the expansion of the propellant feed systems segment within the satellite propulsion system industry.

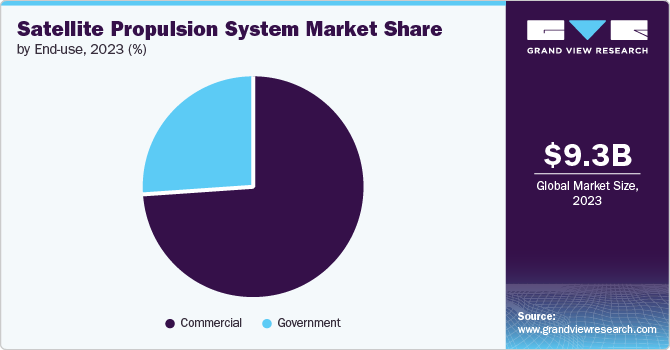

End-use Insights

The commercial segment dominated the market in 2024, owing to the growing demand for propulsion systems amid a significant surge in satellite constellations for communication, internet services, and Earth observation in this sector. In addition, the expanding commercial space economy, including satellite-based services for agriculture, maritime, and disaster management, is also improving the adoption of satellite propulsion system, in turn driving the demand in this segment. Furthermore, the emergence of various new players in this sector, that are engaged in the development and testing of reusable rockets and launching payloads into the orbit, is also playing a pivotal role in segmental growth.

The government segment is expected to register a significant CAGR from 2025 to 2030, driven by the growing focus on national security, space exploration, and telecommunication needs, and increasing adoption of satellite propulsion systems for defense applications such as reconnaissance, missile detection, and secure communications, requiring advanced propulsion for maneuverability and longer missions.

In addition, government space agencies invest in satellite missions for exploration, climate monitoring, and research, making propulsion critical for orbit changes and long-term operations. Furthermore, satellites play a key role in communication infrastructure and earth observation, supporting weather forecasting, environmental monitoring, and disaster management, all of which depend on reliable propulsion systems.

Regional Insights

North America satellite propulsion system market dominated the global market with a revenue share of over 51% in 2024, driven by substantial government funding for space exploration and research and growing innovations in propulsion technologies across the region. The rise of commercial space activities coupled with increasing public-private partnerships is also fueling the demand for advanced satellite technologies.

Significant government and military investments, particularly from organizations such as NASA and the U.S. Department of Defense, are advancing propulsion technologies for defense and surveillance purposes. Technological innovations, such as electric, chemical, and hybrid propulsion systems, are improving satellite efficiency by lowering fuel consumption and extending satellite lifespans, making them more cost-effective for commercial operators across the region, in turn supporting the growth of the regional market.

U.S. Satellite Propulsion System Market Trends

The U.S. satellite propulsion system market held a dominant position in 2024. The market growth is fueled by the growing need for satellite propulsion system and technological innovation in satellite propulsion to strengthen national security. The U.S. government's investment in advanced nuclear-powered spacecraft technologies significantly propels the satellite propulsion system market by enhancing civil and military applications. This initiative supports ambitious space exploration projects, including returning humans to the Moon and facilitating missions to Mars. Nuclear propulsion systems offer advantages such as higher efficiency and longer operational lifespans than conventional chemical propulsion, making them crucial for deep-space missions.

Europe Satellite Propulsion System Market Trends

The Europe satellite propulsion system market is expected to grow at a considerable CAGR of 13.5% from 2025 to 2030, driven by growing demand for satellite applications in telecommunications, Earth observation, and scientific research, technological advancements in propulsion systems which enhance efficiency and performance, and substantial government investments from European nations and space agencies support satellite initiatives. There is also a strong focus on sustainability, leading to the development of eco-friendly propulsion systems to minimize environmental impact. The European space propulsion system is achieving significant market success with backing from ESA's Advanced Research in Telecommunications Systems (ARTES) Core Competitiveness program.

The satellite propulsion system market in the UK is expected to grow rapidly in the coming years. The satellite propulsion system’s demand is rising due to the establishment of international partnerships that bolster research and development in advanced electric propulsion technologies. Collaborations between government agencies, academia, and private companies foster innovation and accelerate the deployment of cutting-edge systems, such as Hall Effect thrusters. These partnerships enhance technical expertise and promote sharing of resources and knowledge, ultimately advancing the UK’s position in the global space industry.

Germany satellite propulsion system market held a substantial revenue share in 2024, driven by increasing investment in innovative, green propulsion technologies, growing focus on innovations in the satellite propulsion system. As environmental concerns grow and regulatory pressures mount, the aerospace sector pivots towards sustainable solutions that minimize carbon footprints and enhance energy efficiency. Investments are being channeled into research and development of alternative propulsion systems, such as electric and hybrid technologies, which reduce emissions and improve performance and cost-effectiveness. This shift aligns with global sustainability goals and positions Germany as a leader in developing cutting-edge propulsion systems, fostering innovation, and attracting further investment in the space industry.

Asia Pacific Satellite Propulsion System Market Trends

The satellite propulsion system market in the Asia Pacific is anticipated to grow at a CAGR of 15.4% during the forecast period. This growth is attributed to growing demand for communication, earth observation, and military satellites, fueled by government space programs in India, China, and Japan. The rise of private space ventures, technological advancements in electric propulsion, and the need for national security and better internet connectivity is also contributing to regional growth. In addition, increasing focus on space debris mitigation and cost-efficient satellite propulsion solutions for small and nanosatellites are shaping the satellite propulsion system industry’s growth.

Japan satellite propulsion system market is expected to grow rapidly in the coming years due to growing emphasis on sustainable and cost-effective in-space mobility solutions. This is fueled by collaborations to develop mass-production technologies for next-generation propulsion systems that utilize environmentally friendly propellants, such as water. These advancements in green propulsion technologies are helping Japan enhance its capabilities in satellite propulsion while addressing environmental concerns, positioning the country as a leader in space innovation. Further, the robust space program with substantial government investment, fostering the development of advanced satellite technologies across the country, in turn supporting the growth of this market.

The satellite propulsion system market in China held a substantial revenue share in 2024. The growth is attributed to aggressive expansion of satellite mega constellations, which require enhanced launch capabilities and innovative propulsion technologies for large-scale deployments. As China aims to strengthen its position in the global space industry, developing advanced propulsion systems becomes crucial to support the growing number of satellites being launched. This expansion addresses the demand for improved communication and data services. It enhances China's ability to deploy and manage extensive satellite networks, driving technological advancements and investment in the propulsion sector.

Key Satellite Propulsion System Company Insights

Some key players operating in the market include Airbus SE, and Northrop Grumman among others.

-

Airbus SE provides services in aeronautics, defense, and space. The company manufactures a variety of aircraft, including commercial and corporate jets, helicopters, and unmanned aerial systems. Its space division develops and supports systems for earth observation, telecommunications, navigation, and orbital applications. In addition, Airbus offers special mission aircraft, satellites, military transport, and training services.

-

Northrop Grumman specializes in developing and providing solutions for reconnaissance (C4ISR), intelligence, surveillance, computers, control, command, cybersecurity, autonomous systems, aircraft, unmanned systems, and communications. The company manufactures wireless communications infrastructure, acoustic sensors for spacecraft systems, mission-critical computer systems, aircraft carriers, and submarines. Its product offerings include cybersecurity, electronic warfare solutions, satellites, radar and sensors, ground systems, logistics, and modernization services. Northrop Grumman’s solutions are utilized across the defense, electronics, information systems, and aerospace sectors, serving foreign, state, and local governments, as well as commercial clients, including the government agencies, Air Force, U.S. Navy, and international customers throughout North America, Europe, and the Asia Pacific.

Busek, Co. Inc. and Blue Origin LLC are some emerging participants in the industry.

-

Busek Co. Inc. is a player in space propulsion technologies, specializing in electric propulsion systems such as hall-effect thrusters, ion thrusters, and electrospray thrusters. They also develop chemical propulsion systems and environmentally friendly green propellants while advancing in-space manufacturing technologies for long-duration missions. Busek’s innovations support satellites, spacecraft, and space exploration. Busek operates over 33,000 square feet of engineering, laboratory, product assembly, and testing facilities. Their two locations are specifically designed and fully equipped for the testing, development, and assembly of advanced space subsystems and hardware.

-

Blue Origin LLC is a U.S.-based aerospace company focused on advancing private space travel through reusable rocket technology. Known for its New Shepard suborbital rocket, which offers space tourism and research flights, and the upcoming New Glenn orbital-class rocket for heavy-lift missions, Blue Origin aims to reduce space exploration costs. The company also develops its engines, such as the BE-4 for ULA’s Vulcan rocket.

Key Satellite Propulsion System Companies:

The following are the leading companies in the satellite propulsion system market. These companies collectively hold the largest market share and dictate industry trends.

- Airbus SE

- OHB SE

- ArianeGroup

- Busek Co. Inc.

- Blue Origin LLC

- Thales Group

- ENPULSION GmbH

- Moog Inc.

- Sierra Nevada Corporation

- Northrop Grumman

- Orbion Space Technology

- L3Harris Technologies, Inc.

- Safran Group

- Lockheed Martin Corporation

- VACCO Industries Inc.

Recent Developments

-

In August 2024, SAFRAN expanded its U.S. manufacturing capabilities for small satellite propulsion systems to address the growing commercial and defense demand.

-

In August 2024, Space logistics industry player D-Orbit and Magdrive, a space startup specializing in innovative electrical propulsion systems, announced their collaboration for Magdrive’s inaugural in-orbit demonstration mission of the Magdrive Rogue propulsion thruster, which was scheduled for launch in June 2025.

-

In July 2024, L3Harris Technologies, Inc. boosted its investment in the propulsion sector by 40% after a year of acquiring Aerojet Rocketdyne. This move is modernizing manufacturing and improving production. This led to faster deliveries and met the rising demand for missile systems vital for national security.

Satellite Propulsion System Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 12.28 billion |

|

Revenue forecast in 2030 |

USD 23.24 billion |

|

Growth rate |

CAGR of 13.6% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Platform, propulsion, component, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Rest of Europe; China; Australia; Japan; India; South Korea; Rest of Asia Pacific; Brazil; Rest of Latin America; South Africa; Saudi Arabia; UAE;Rest of MEA |

|

Key companies profiled |

Airbus; OHB SE; ArianeGroup; Busek Co. Inc.; Blue Origin LLC; Thales Group; ENPULSION GmbH; Moog Inc.; Sierra Nevada Corporation; Northrop Grumman; Orbion Space Technology; L3Harris Technologies, Inc.; Safran Group; Lockheed Martin Corporation; VACCO Industries Inc. |

|

Customization scope |

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Satellite Propulsion System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global satellite propulsion system market report based on platform, propulsion, component, end-use, and region:

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Satellites

-

Medium-Sized Satellites

-

Nano Satellites

-

CubeSats

-

-

Propulsion Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemical

-

Non-Chemical

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Thrusters

-

Propellant Feed Systems

-

Nozzles

-

Rocket Motors

-

Others

-

-

End User Outlook (Revenue, USD Million, 2018 - 2030)

-

Government

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Rest of Latin America

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global satellite propulsion system market size was estimated at USD 11.05 billion in 2024 and is expected to reach USD 12.28 billion in 2025.

b. The global satellite propulsion system market is expected to grow at a compound annual growth rate of 13.6% from 2025 to 2030 to reach USD 23.24 billion by 2030.

b. The North America region dominated the industry with a revenue share of over 51% in 2024. This can be attributed to rising demand for advanced satellite technologies driven by increasing government funding for space exploration coupled with the proliferation of commercial space activities in the region.

b. Some key players operating in satellite propulsion system market include Airbus, OHB SE, ArianeGroup, Busek, Co. Inc., Blue Origin LLC, Cobham Limited, ENPULSION GmbH, Moog Inc., Sierra Nevada Corporation, Northrop Grumman, Orbion Space Technology, L3Harris Technologies, Inc., Safran Group, Lockheed Martin Corporation, Thales Group, and VACCO Industries Inc.

b. Key factors that are driving satellite propulsion system market growth include increasing number of space missions for commercial, government, and scientific purposes as well as technological advancements in propulsion technologies.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."