- Home

- »

- Next Generation Technologies

- »

-

Satellite Manufacturing Market Size, Industry Report, 2030GVR Report cover

![Satellite Manufacturing Market Size, Share & Trends Report]()

Satellite Manufacturing Market (2025 - 2030) Size, Share & Trends Analysis Report By Category (LEO, MEO, GEO), By Mass (Large Satellites, Medium-sized Satellites, Nano Satellites), By Type of Business (Government, Commercial), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-314-7

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Satellite Manufacturing Market Summary

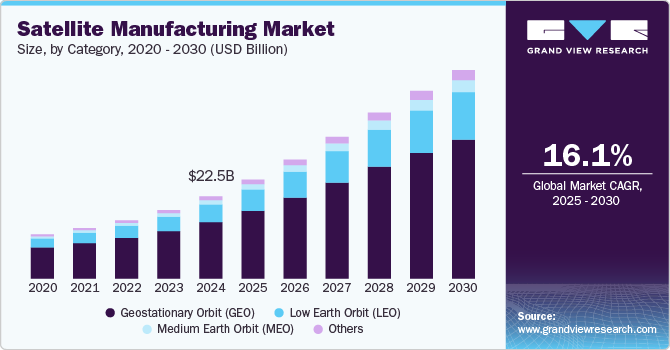

The global satellite manufacturing market size was estimated at USD 22,522.0 million in 2024 and is projected to reach USD 57,181.0 million by 2030, growing at a CAGR of 16.1% from 2025 to 2030. The demand for Earth observation and remote sensing satellites is on the rise, driven by their critical applications in environmental monitoring, agriculture, disaster management, and urban planning.

Key Market Trends & Insights

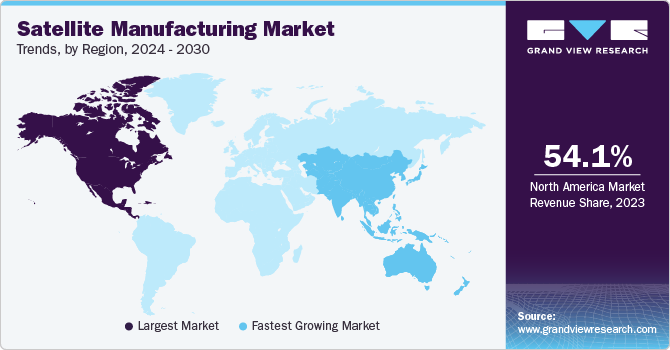

- North America dominated the market with a revenue share of over 53% in 2024.

- The U.S. satellite manufacturing market held a dominant position in 2024 with a share of over 89%.

- By category, the low earth orbit (LEO) segment accounted for the largest market share of over 56% in 2024.

- By, mass, the medium-sized satellites segment accounted for the largest market share in 2024

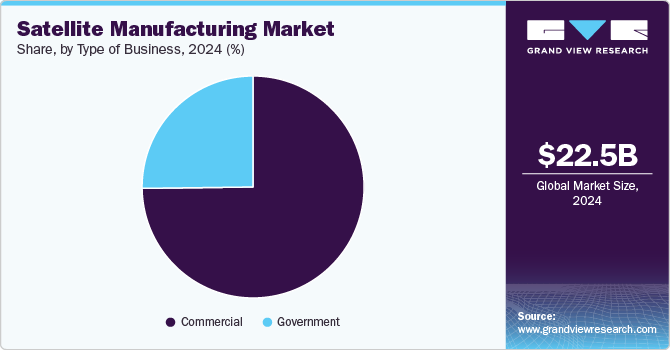

- By type of business, the commercial segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 22,522.0 Million

- 2030 Projected Market Size: USD 57,181.0 Million

- CAGR (2025-2030): 16.1%

- North America: Largest market in 2024

These satellites provide high-resolution imagery and data that support better decision-making and policy formulation across industries and government agencies, fueling their adoption for a wider range of commercial and governmental applications. The satellite manufacturing industry is seeing a substantial increase in the deployment of small satellites and CubeSats due to their cost-effectiveness, faster development cycles, and adaptability for low-Earth orbit (LEO) missions. Small satellites, including CubeSats, are increasingly used for telecommunications, research, and IoT applications, as they are cheaper to manufacture, launch, and maintain compared to traditional large satellites. This trend is particularly popular among new market entrants, private companies, and startups, which seek affordable solutions to access space.

Technological advancements in satellite miniaturization are making it possible to design satellites with enhanced capabilities while reducing their size and weight. This trend not only supports the deployment of more satellites in constellations but also enables the integration of advanced technologies, such as AI, quantum communication, and laser-based data transmission. Miniaturization is helping reduce the overall cost and energy consumption of satellite operations, further accelerating the growth of satellite manufacturing industry by making satellite-based solutions more accessible.

Satellites play a key role in facilitating secure and reliable communication between military units, command centers, and allied forces, even in remote or hostile environments. Satellite communication systems provide the backbone for voice, data, and video transmissions, allowing for seamless operational coordination. As militaries seek to maintain connectivity across dispersed forces, the demand for robust satellite communication systems continues to grow, driving investment in satellite manufacturing.

The satellite manufacturing industry is witnessing rapid growth, driven by increasing demand for small satellites, advancements in AI and automation, and expanding commercial applications. Governments, defense agencies, and private companies are investing heavily in satellite technology for communications, Earth observation, navigation, and scientific research. The shift toward miniaturization is a key trend, with small satellite constellations in low Earth orbit (LEO) gaining traction for broadband internet. Additionally, AI-powered satellite operations, edge computing, and quantum communication are enhancing satellite efficiency and security. The push for sustainability has also led to innovations in reusable satellite components and debris mitigation strategies, shaping the future of satellite manufacturing industry.

Another major trend in the satellite manufacturing industry is the push for sustainability and reusability in satellite manufacturing. Companies are developing modular and reusable satellite components to reduce space debris and mission costs. The use of advanced propulsion technologies, such as electric and ion propulsion, is improving fuel efficiency and extending satellite lifespans. Quantum communication is also emerging as a game-changer, enhancing data security for military and commercial applications. Meanwhile, mega-constellations, such as SpaceX’s Starlink and Amazon’s Project Kuiper, are driving advancements in mass production and satellite networking. With increasing collaborations between private companies and government agencies, innovations in AI, IoT, and energy-efficient materials are expected to further shape the future of satellite manufacturing, improving performance, reliability, and cost-effectiveness.

Category Insights

The low earth orbit (LEO) segment accounted for the largest market share of over 56% in 2024, driven by factors such as the increasing demand for earth observation and satellite-based services. This demand stems from various sectors, including agriculture, environmental monitoring, and telecommunications, where real-time data is essential for decision-making.

The geostationary orbit (GEO) segment is expected to register the fastest CAGR of over 17% from 2025 to 2030. The growth of this segment is driven by the need for high-capacity communication systems. GEO satellites provide continuous coverage over specific areas, making them ideal for broadcasting and telecommunications services. The rising demand for direct-to-home (DTH) services and high-definition content has spurred investments in GEO satellite technology.

Mass Insights

The medium-sized satellites segment accounted for the largest market share in 2024, owing to the growing demand for versatile communication and monitoring services. These satellites are increasingly utilized for applications such as Earth observation, telecommunications, and scientific research. The rise in global internet connectivity and the need for real-time data transmission have spurred investments in medium-sized satellite technology.

The nano satellites segment is expected to witness a notable CAGR from 2025 to 2030, driven by the growing demand for nano satellites due to their cost-effectiveness and versatility in various applications. These small satellites are particularly favored for Earth observation, technology demonstration, and educational purposes. The increasing interest from startups and academic institutions in deploying nano satellites for research and commercial purposes is driving the expansion of satellite manufacturing industry.

Type of Business Insights

The commercial segment accounted for the largest market share in 2024, owing to the increasing demand for satellite-based services across various sectors, including telecommunications, Earth observation, and internet connectivity. The rise of digital technologies and the need for high-speed internet access, especially in remote and underserved regions, are significant factors propelling the demand for commercial satellites.

The government segment is expected to register the notable CAGR from 2025 to 2030, driven by the increasing reliance on satellite technologies for national security, surveillance, and communication. Governments worldwide are investing heavily in satellite systems to enhance their capabilities in areas such as reconnaissance, disaster management, and environmental monitoring. The need for secure and reliable communication channels, particularly in defense applications, has led to a surge in demand for government-operated satellites.

Regional Insights

North America dominated the market with a revenue share of over 53% in 2024, driven by increasing demand for speed communications, national security needs, and advancements in earth observation technologies. Additionally, government support through NASA, the Department of Defense, and private-public partnerships drives innovation in satellite technology. The growing use of satellites for environmental monitoring, weather forecasting, and emergency response is also contributing to the satellite manufacturing industry growth, as satellite data becomes critical for various sectors.

U.S. Satellite Manufacturing Market Trends

The U.S. satellite manufacturing market held a dominant position in 2024 with a share of over 89%. The market growth is fueled by strong government funding, private sector innovation, and a rapidly growing demand for commercial satellites. NASA, the U.S. Department of Defense, and agencies like the National Reconnaissance Office (NRO) play a critical role in advancing satellite capabilities for defense, Earth observation, and deep space exploration. Additionally, government initiatives such as the U.S. Space Force and increased commercial-military partnerships are shaping the future of satellite manufacturing, solidifying the U.S. as a dominant force in the global space industry.

Asia Pacific Satellite Manufacturing Market Trends

The Asia Pacific satellite manufacturing market is anticipated to grow at a CAGR of around 18% from 2025 to 2030. This growth is attributed to the increasing government investments, rising commercial space ventures, and advancements in satellite technology. Countries such as China, Japan, India, and South Korea are leading the region, with strong support from space agencies such as CNSA, JAXA, ISRO, and KARI. Private space startups are also emerging, particularly in China and India, fostering innovation and cost-effective satellite production. Additionally, advancements in AI, quantum communication, and reusable satellite technologies are shaping market trends.

Japan Satellite Manufacturing Market Trends

The Japan satellite manufacturing market is expected to grow rapidly in the coming years due to a focus on high-tech, high-performance satellites for a range of applications, including Earth observation, communication, and scientific research, advancements in miniaturization, precision, and innovative payload technologies, and growing focus on enhancing satellite communication infrastructure, with developments in both low Earth orbit (LEO) and geostationary orbit (GEO) satellite constellations.

China Satellite Manufacturing Market Trends

The China satellite manufacturing market held a substantial market share in 2024. The growth is attributed to strong government support, military-space advancements, and a growing commercial space sector, and growing adoption of small satellite constellations for broadband internet and leveraging AI and quantum communication technologies to enhance satellite capabilities.

Europe Satellite Manufacturing Market Trends

Europe satellite manufacturing market is expected to grow at a considerable CAGR of over 17% from 2025 to 2030, driven by the rising demand for small satellites, government investments, and technological advancements. The European Space Agency (ESA) plays a key role in fostering innovation, and supporting projects in Earth observation, telecommunications, and defense. The shift toward miniaturization, AI-powered satellite operations, and reusable technologies is shaping market trends. Additionally, growing commercial investments and international collaborations are enhancing Europe's competitiveness in the global satellite industry.

UK Satellite Manufacturing Market Trends

The UK satellite manufacturing market is expected to grow rapidly in the coming years. In the UK satellite manufacturing demand is rising due to the government support, private investments, and a strong focus on small satellite technology, and increasing collaborations with international space agencies and private players.

Germany Satellite Manufacturing Market Trends

The Germany satellite manufacturing market held a substantial market share in 2024, driven by increasing demand for small satellites, advancements in space technology, and government initiatives supporting space exploration and defense. The market is seeing strong adoption of satellite miniaturization, AI-powered satellite operations, and reusable satellite components to enhance cost efficiency and sustainability.

Key Satellite Manufacturing Company Insights

Some of the key players operating in the market include Thales Group, Lockheed Martin Corporation among others.

-

Thales Group is a global technology company, specializing in defense, security, aerospace, and digital identity, among other fields. The company focuses on advancing digital and "deep tech" innovations, including AI, cybersecurity, and quantum technology, to create reliable solutions that support the vital missions of governments and organizations. The company designs and manufactures advanced satellite systems for communication and Earth observation, leveraging its expertise to enhance connectivity and data transmission capabilities essential for modern applications.

-

Lockheed Martin Corporation is an aerospace & defense company that focuses on delivering innovative solutions to complex global challenges. The company specializes in advanced technology systems across various fields, including aeronautics, space, missile defense, and cybersecurity. The company is recognized for its commitment to enhancing national security and advancing technological capabilities by leveraging AI and connected protection systems.

Dhruva Space Private Limited and Maxar Technologies Inc. are some of the emerging participants in the virtual tour market.

-

Dhruva Space Private Limited is an aerospace manufacturing company specializing in developing small satellites. The company provides full-stack space engineering solutions that encompass the design, launch, and operation of satellites. The company has been involved in various space missions, including the Thybolt Mission, which marked the deployment of India's first private satellites. The company provides integrated launch services, ensuring rapid deployment of satellites across various platform sizes and launch vehicle providers. Dhruva Space develops scalable and modular satellite platforms ranging from less than 1 kg to 300 kg, catering to commercial, defense, and scientific missions in Low Earth Orbit (LEO) and beyond.

-

Maxar Technologies Inc. is a space technology company that specializes in advanced satellite imaging and geospatial services. The company provides a diverse range of products, including Synthetic Aperture Radar (SAR) and various data suites, alongside services that cater to sectors such as telecommunications, climate research, and defense. The company designs and builds high-powered satellites for various applications, including communications, Earth observation, exploration, and on-orbit servicing. Their spacecraft platforms, such as the Maxar 1300 series, are renowned for reliability and versatility, serving a broad range of telecommunications, civil, defense, and intelligence missions.

Key Satellite Manufacturing Companies:

The following are the leading companies in the satellite manufacturing market. These companies collectively hold the largest market share and dictate industry trends.

- Airbus SE

- ArianeGroup

- Azista BST Aerospace

- The Boeing Company

- Dhruva Space Private Limited

- Gilmour Space Technologies

- INVAP

- Lockheed Martin Corporation

- Maxar Technologies Inc

- Mitsubishi Electric Corporation

- Northrop Grumman

- RTX Corporation

- Sierra Nevada Corporation

- SpaceX

- Thales Group

Recent Developments

-

In October 2024, SpaceX launched 20 satellites for Eutelsat Group as part of their first mission following the merger with OneWeb. This launch marks a significant step for Eutelsat in expanding its Low Earth Orbit (LEO) satellite communications network, which serves various telecommunications and broadcasting clients.

-

In September 2024, Airbus SE announced that the EUTELSAT 36D telecommunications satellite built by the company was launched via a Falcon 9 rocket from the Kennedy Space Center in Florida, U.S. The satellite, part of the Eurostar Neo family, aimed to provide TV broadcasting and government services across Africa, Europe, and Eastern countries, with a planned operational lifetime exceeding 15 years.

-

In August 2024, Northrop Grumman launched the Arctic Satellite Broadband Mission (ASBM) constellation, developed for Space Norway, aboard a SpaceX Falcon 9 rocket from Vandenberg Space Force Base in California. This mission marks a historic collaboration between Space Norway and the U.S. Space Force, as it is the first operational U.S. military payload hosted on an international commercial space mission.

Satellite Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 27,136.3 million

Revenue forecast in 2030

USD 57,181.0 million

Growth rate

CAGR of 16.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million/Billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Category, mass, type of business, application, regional

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Russia; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

Airbus SE; ArianeGroup; Azista BST Aerospace; The Boeing Company; Dhruva Space Private Limited; Gilmour Space Technologies; INVAP; Lockheed Martin Corporation; Maxar Technologies Inc; Mitsubishi Electric Corporation; Northrop Grumman; RTX Corporation; Sierra Nevada Corporation; SpaceX; Thales Group

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Satellite Manufacturing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global satellite manufacturing market report based on category, mass, type of business, application and region:

-

Category Outlook (Revenue, USD Million; 2018 - 2030)

-

Low Earth Orbit (LEO)

-

Medium Earth Orbit (MEO)

-

Geostationary orbit (GEO)

-

Others

-

-

Mass Outlook (Revenue, USD Million; 2018 - 2030)

-

Large Satellites

-

Medium-Sized Satellites

-

Nano Satellites

-

Others

-

-

Type of Business Outlook (Revenue, USD Million; 2018 - 2030)

-

Government

-

Commercial

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Communication

-

Earth Observation and Remote Sensing

-

Navigation

-

Research and Development

-

Military Surveillance

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global satellite manufacturing market size was estimated at USD 22.52 billion in 2024 and is expected to reach USD 27.14 billion in 2025.

b. The global satellite manufacturing market is expected to grow at a compound annual growth rate of 16.1% from 2025 to 2030 to reach USD 57,181.0 million by 2030.

b. The North America region dominated the industry with the highest revenue share in 2023. This can be attributed to the rising growing space industry, the presence of prominent industry players, and the ongoing expansion of various private aerospace companies.

b. The key players in the satellite manufacturing market include ArianeGroup, Beijing Spacecraft Manufacturing Co., Ltd. (BSC), Boeing, Dhruva Space Private Limited, Gilmour Space Technologies, INVAP, Lockheed Martin Corporation, Maxar Technologies Inc., Mitsubishi Electric Corporation, Northrop Grumman, RTX Corporation, Sierra Nevada Corporation, and SpaceX.

b. Key factors that are driving the market growth include the owing to increasing demand for satellites for research & development activities and various applications across industries. Several industries, including mining, construction, oil & gas, energy & utilities, agriculture, transportation, etc., are adopting satellite communication solutions to monitor on-site operations and conduct research activities remotely.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.