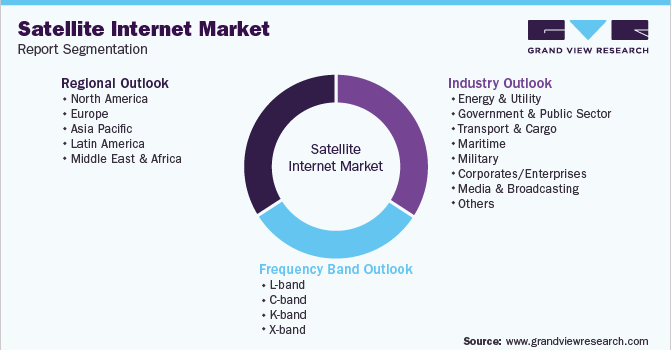

Satellite Internet Market Size, Share & Trends Analysis Report By Frequency Band (L-band, C-band, K-band, and X-band), By Industry, By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-003-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

The global satellite internet market size was valued at USD 8,231.47 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 13.6% from 2023 to 2030. Satellite internet is a wireless network that covers satellite dishes in space and on Earth. It connects people in remote locations worldwide and provides access to up-to-date information. Satellite internet is accessed via high-speed network connectivity provided by satellites circling the Earth. It is faster than standard internet service and distinct from land-based broadband services such as digital subscriber line (DSL) and cable. Satellite communication provides a land-based interface with voice, video, and information that can be accessed anywhere on the planet.

One of the most significant benefits of satellite internet for businesses is the ability to transmit a connection anywhere in the world at many megabits per second over remote locations such as oceans and mountains. On the other hand, a secure and private link can connect numerous remote places separated by considerable distances. Due to the absence of other broadband internet alternatives, demand for the satellite internet market is growing in rural areas. Additionally, satellite internet can provide access to the internet in remote regions like deserts and mountainous areas where it is difficult to access broadband, which increases the demand for satellite internet in these regions. Also, satellite internet technology provides customers with incredible speed and data. As a result, emerging economies such as India, Vietnam, and Malaysia are rapidly adopting these services, which in turn boosts the growth of the market.

The rise in government programs for the uptake of advanced satellite internet services to develop a digitized economy and enhance public safety & security drives the market growth. Furthermore, several governments are significantly funding companies to provide broadband services to rural populations across emerging countries, which is also considered a significant factor in boosting the market growth. For instance, In January 2020, the U.S. Federal Communications Commission (FCC) launched the Rural Digital Opportunity Fund to offer USD 20.4 billion for developing broadband networks in remote areas. The FCC granted USD 886 million in the first deployment phase to SpaceX, a satellite company. Furthermore, satellite broadband usage in smart cities is anticipated to create lucrative market opportunities in the near future. However, satellite internet's high implementation and maintenance costs restrain the market's growth.

COVID-19 Impact Analysis

COVID-19 positively impacted the market due to the increased utilization of satellite internet among government agencies and healthcare organizations for communication during this health emergency and the growing need for a variety of voice, data, and media communications nationally and internationally. During COVID-19, demand for wireless networking services surged, with some companies indicating a 60% rise in internet usage compared to before the crisis. The U.S. Department of Homeland Security (DHS) had identified satellite internet operations as a crucial component of operating critical infrastructure needed for public health, safety, and community well-being during the response to the COVID-19 crisis. Additionally, international space agencies like NASA are utilizing satellite internet to display the global changes resulting from COVID-19.

The adoption of satellite internet technology has increased in several industries during the pandemic. For instance, AT&T launched various initiatives during the pandemic to provide its video subscribers with additional content at no charge. Also, satellite-based telehealth services were widely used during the pandemic as telemedicine offers immediate access to broadband services, especially in rural locations where telecommunications are inadequate or nonexistent, as well as a quick reaction in emergencies. For instance, SES S.A., a satellite telecommunications provider, used its extensive network of satellites to connect hospitals in Bangladesh, Sierra Leone, Mexico, and Italy. Also, During the pandemic, Viasat developed a variety of optimization and web acceleration technologies to minimize broadband traffic by prioritizing access to crucial health applications over non-essential network congestion.

Frequency Band Insights

In terms of frequency band, the market is classified into L-band, C-band, K-band, and X-band. The K-band segment dominated the target market, gaining a share of over 41% in 2022 and witnessing a CAGR of 16.0% during the forecast period. The K-band frequency is increasingly utilized in defense, broadcasting, and security radar systems. K-band monolithic microwave integrated circuit (MMIC) technology is an emerging trend that enables the implementation of K-band power amplifiers and low-noise amplifiers with lower costs, ease of large-scale production, and high durability which is expected to drive the growth of the market in the forecasted period. Additionally, K-band frequency is also used for providing wireless broadband access in remote locations and is used in fixed satellites, local-multipoint distribution systems (LMDS), and digital point-to-point radio services.

K-band MMICs are innovative for K-band frequency applications such as broadcasting, terrestrial microwave communications, and speed detectors. For instance, in March 2018, The Federal Communications Commission (FCC) of the U. S. granted SpaceX's proposal to use satellite technology to deliver broadband services both nationally and internationally. SpaceX has been given conditional permission to use frequency in the K (20/30 GHz) and K (11/14 GHz) bands to provide worldwide internet access. Under several requirements, including safeguarding other operations in the requested frequency bands, the company launched 4,425 satellites.

The X-band segment is anticipated to witness a significant CAGR of 10.8% throughout the forecast period. The X-band has been explicitly allocated for marine, military, and government missions. The demand for X-band is increasing owing to the growing adoption in marine rescue operations due to the capability to explore and track a specific target. Furthermore, it offers communication antenna systems that support rescue efforts by providing broadband service and email access for operation and personnel usage, boosting the market in this category. The International Telecommunications Union and the United Nations body in command of the wireless spectrum have allocated X-band SATCOM for use by military missions. The X-band frequency band has become increasingly popular as more governments seek X-band SATCOM for their military mission; this was especially noticeable during combat operations in Iraq and Afghanistan.

Industry Insights

Based on industry, the market is classified into energy & utility, government and public sector, transport & cargo, maritime, military, corporates/enterprises, media & broadcasting, and others. Among these, the government and public segment is dominated the target market in 2022, gaining a share of over 19%. Governments across the globe have been investing in satellite broadband technology to provide broadband services in every region of their nations and rely only on cutting-edge technology to connect rural areas to the broadband network. For instance, In September 2022, Hughes Communications India announced the commercial release of the HTS internet service. The service combines ground-based Hughes Jupiter Platform technology with the K-band satellite frequency on GSAT-29 and GSAT-11, operated by the Indian Space Research Organization (ISRO), to provide countrywide high-speed internet connectivity. This includes the most distant regions in the northeastern and the densely forested regions, such as Jharkhand, Odisha, Chhattisgarh, Maharashtra, and others.

Governments all over the world are implementing satellite internet to operate smart cities. Smart cities are brimming with devices that automatically alert concerned authorities and constantly monitor the water and electricity supply and the level of air quality in specific areas. There must be a broadband connection for these sensors to communicate with one another and a centralized computer that turns sensor readings data into valuable insights. Although optical fibers reach urban areas, satellite internet can be used in an emergency.

The media and broadcasting segment is anticipated to witness the fastest growth of 16.4% throughout the forecast period. The development of the media and broadcasting sector is due to an increase in demand for TV and radio applications. Additionally, the growing popularity of over-the-top (OTT) services is fueling market growth. Internet services have grown in popularity over the last few decades as network coverage has expanded and societal lives have changed. This increased demand for content distribution via the internet among broadcasting service providers, fueling the media and broadcasting segment. For instance, The AIBROINFRA project is a crucial step towards a worldwide mobile solution for optimizing high-quality audio/video connectivity even from remote areas where there is no terrestrial network. The key objective of this project is to address the growing demand in the broadcast business for more program development of high quality while simultaneously lowering operating expenses.

Regional Insights

North America led the overall market in 2022, with highest market share of over 32%. It is expected to grow at a CAGR of 13.1% throughout the forecast period. The market is consolidated and is anticipated to witness increased competition due to several players' presence. This is because of the region's growing utilization of cutting-edge technologies, including cloud-based, IoT, and AI technology, as well as increasing government initiatives to deploy satellite technology in various parts of North America. The population of developed countries such as the U.S. and Canada is highly digital-savvy and dependent upon digital sites. This elevates the demand for high-speed internet, which should foster regional market growth.

Additionally, the market expansion is supported by various companies such as SpaceX, and Hughes Network launching innovative products. For instance, In September 2022, Hughes Network Systems, LLC, an EchoStar Corporation subsidiary, announced HughesNet Fusion's launch in selected U.S. markets. HughesNet Fusion is a satellite internet service with reduced latency. Furthermore, several companies are also partnering with U.S. wireless network operators to provide broadband coverage across the U.S. For instance, In August 2022, SpaceX Starlink announced a partnership with T-Mobile to launch Coverage Above and Beyond: a new plan to bring cell phone connectivity everywhere. The companies built a new network to deliver this service that will use T-countrywide Mobile's mid-band bandwidth while being broadcasted from Starlink satellites.

The Asia-Pacific is expected to develop substantially by the projection period and grow at a fastest CAGR of 14.9%. The target market is significantly growing in the Asia Pacific region owing to the rise of satellite internet in the broadcasting, healthcare, and government and military sectors. China, Japan, India, and South Korea have the highest demand in the region for the satellite internet market. Satellite connectivity will supplement terrestrial access in distant places and other areas untapped by domestic broadband or fixed wireless access. The advent of Medium Earth Orbit (MEO) and Low Earth Orbit (LEO) constellations across the Asia Pacific will propel the market. For instance, In January 2022, Chongqing Satellite Network System Research Institute Co., Ltd and China Satellite Network Application Co., Ltd. signed an agreement to jointly build an internet system in Chongqing, China. This is another step towards China's national objective to develop an LEO satellite internet constellation. The project aims to overcome communications gaps and deliver services to rural communities. Companies across the globe are launching their satellite broadband service in Asia-Pacific region. For instance, In October 2022, SpaceX announced the launch of an internet service in Japan, making the country the first in Asia to deploy a satellite-based broadband service., KDDI Corporation will operate as an authorized Starlink integrator for subscribers in rural and remote areas. Since 2021, the company has been providing a technical demonstration of Starlink in Japan. Starlink will provide internet service in remote islands such as Tohoku, Kanto, and Chubu regions that do not have broadband connectivity. With over 16,000 mountains in Japan, Starlink's industry-leading satellite network is particularly well suited to provide Japanese companies with stable, long-term wireless broadband access.

Key Companies & Market Share Insights

Major players operating in the market include Singtel Group, Freedomsat, EchoStar Corporation, Thuraya Telecommunications Company, Eutelsat Communications SA, OneWeb.net, SpaceX, Viasat, Inc., Axess, and DSL Telecom, among others. To broaden their product offering, several companies are adopting development strategies, such as partnerships, regular mergers, and acquisitions. For instance, In October 2022, Axess announced a partnership with Viasat. Viasat's maritime operations will be able to reach a wider global audience owing to its strategic relationship with AXESS Maritime, which will provide a variety of solutions and services. AXESS Maritime offers regional and international networks and provides the complete rotation from network infrastructure, deployment, implementation, ship monitoring, and round-the-clock global NOC support. Some of the prominent players in the global satellite internet market include:

-

Singtel Group

-

Freedomsat

-

EchoStar Corporation

-

Thuraya Telecommunications Company

-

Eutelsat Communications SA

-

OneWeb.net

-

SpaceX

-

Viasat, Inc.

-

Axess

-

DSL Telecom

Recent Developments

-

In May 2022, Singtel launched iSHIP, an all-in-one platform providing satellite-enabled digital services and connectivity for the maritime industry. This service of iSHIP gave ship owners and ship managers substantial visibility and flexibility of their operations and resources

-

In July 2022, Eutelsat Communications collaborated with OneWeb to combine Eutelsat’s 36 GEO satellites with OneWeb’s constellation of 648 low Earth orbit satellites. This enabled both the entities to capture the satellite connectivity market, and take on SpaceX's satellite internet dominance

Satellite Internet Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 9.22 billion |

|

Revenue forecast in 2030 |

USD 22,571.58 million |

|

Growth Rate |

CAGR of 13.6% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2017 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2023 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Frequency band, industry, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; U.K.; Germany; France; Italy; China; India; Japan; South Korea; Brazil; Mexico |

|

Key companies profiled |

Singtel Group; Freedomsat; EchoStar Corporation; Thuraya Telecommunications Company; Eutelsat Communications SA; OneWeb.net; SpaceX; Viasat, Inc.; Axess; DSL Telecom |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Satellite Internet Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global satellite internet market based on frequency band, industry, and region:

-

Frequency Band Outlook (Revenue, USD Million, 2017 - 2030)

-

L-band

-

C-band

-

K-band

-

X-band

-

-

Industry Outlook (Revenue, USD Million, 2017 - 2030)

-

Energy & Utility

-

Government & Public Sector

-

Transport & Cargo

-

Maritime

-

Military

-

Corporates/Enterprises

-

Media & Broadcasting

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

-

Asia-Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global satellite internet market size was estimated at USD 8,231.47 million in 2022 and is expected to reach USD 9.22 billion in 2023.

b. The global satellite internet market is expected to grow at a compound annual growth rate of 13.6% from 2023 to 2030 to reach USD 22,571.58 million by 2030.

b. North America dominated the satellite internet market with a share of 32% in 2022. This is attributable to the growing utilization of cutting-edge technologies, including cloud-based, IoT, and AI technology, as well as increasing government initiatives to deploy satellite technology in various parts of North America.

b. Some key players operating in the satellite internet market include CSingtel Group, Freedomsat, EchoStar Corporation, Thuraya Telecommunications Company, Eutelsat Communications SA, OneWeb.net, SpaceX, Viasat, Inc., Axess, and DSL Telecom, among others

b. Key factors that are driving the growth of the satellite internet market are the rise in government programs for the uptake of advanced satellite internet services to develop a digitized economy and enhance public safety & security.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."