- Home

- »

- Next Generation Technologies

- »

-

Satellite Bus Market Size, Share And Growth Report, 2030GVR Report cover

![Satellite Bus Market Size, Share & Trends Report]()

Satellite Bus Market (2024 - 2030) Size, Share & Trends Analysis Report By Size (Large, Medium, Small, Nano), By Subsystem (Electrical Power System, Attitude Control System), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-398-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Satellite Bus Market Summary

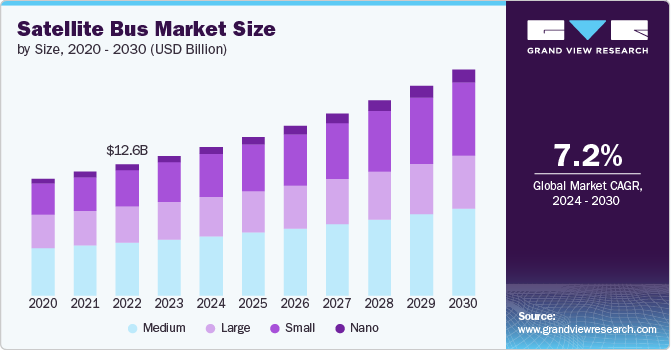

The global satellite bus market size was estimated at USD 13.44 billion in 2023 and is projected to reach USD 21.77 billion by 2030, growing at a CAGR of 7.24% from 2024 to 2030. The increasing demand for satellite-based services across communication, earth observation, navigation, and scientific research is driving the demand for efficient satellite buses.

Key Market Trends & Insights

- North America dominated the satellite bus market with the largest revenue share of 49.16% in 2023.

- The satellite bus market in U.S. is projected to grow at the fastest CAGR of 5.12% from 2024 to 2030.

- Based on size, the medium segment led the market with the largest revenue share of 40.23% in 2023.

- Based on subsystem, the structure and mechanical system segment led the market with the largest revenue share of 25.09% in 2023.

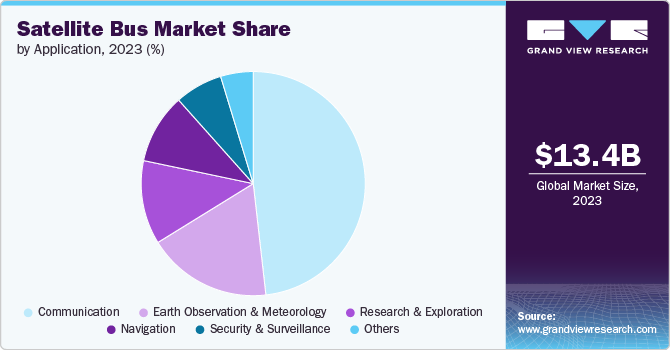

- Based on application, the communication segment led the market with the largest revenue share of 48.17% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 13.44 Billion

- 2030 Projected Market Size: USD 21.77 Billion

- CAGR (2024-2030): 7.24%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Furthermore, the demand for reliable and efficient satellite buses has surged with increasing investments by governments and private entities in space exploration and satellite technology. This demand is further fueled by advancements in technology, which is expected to further fuel market growth in the coming years.Smaller satellites, such as nanosatellites and microsatellites, are becoming increasingly popular due to their lower launch costs and versatility in applications. This push towards smaller satellites has led to innovations in satellite bus design, allowing for reduced weight and size without compromising functionality.This trend reduces launch costs and allows for the quick deployment of satellite constellations, enabling global coverage for various applications. As a result, manufacturers are increasingly focusing on developing compact satellite buses that can accommodate diverse payloads while maintaining operational efficiency. This trend of miniaturization of satellite technology is expected to further fuel the market expansion in the coming years.

The growing trend of satellite constellations, which enhance communication and data collection capabilities, is boosting demand for satellite buses that can support complex systems. Satellite constellations, particularly those in low Earth orbit (LEO), consist of numerous small satellites working to provide global coverage and high-speed connectivity. This architecture allows for improved bandwidth and reduced latency, making it ideal for applications such as broadband internet, remote sensing, global navigation, and other missions.Satellite buses must accommodate the specific payloads and functionalities required for each satellite's mission, thus driving innovation and investment in satellite bus technology to meet the evolving demands of the market.

The increasing utilization of electric propulsion systems is transforming the dynamics of the global market. Electric propulsion offers enhanced maneuverability, fuel efficiency, and longer mission lifetimes compared to traditional chemical propulsion systems. This shift towards electric propulsion aligns with growing environmental concerns and regulatory pressures to reduce space debris and improve sustainability in space operations. Consequently, satellite bus manufacturers are investing in research and development to integrate electric propulsion technologies into their offerings.

Moreover, there is a rising emphasis on on-orbit servicing capabilities, which allows satellites to be refueled or repaired while in space. This trend necessitates versatile satellite bus designs that can support such operations, thereby extending the lifespan of satellites and maximizing return on investment for operators. The ability to perform maintenance tasks in orbit represents a significant advancement in satellite technology and opens new avenues for service providers looking to enhance their operational capabilities.

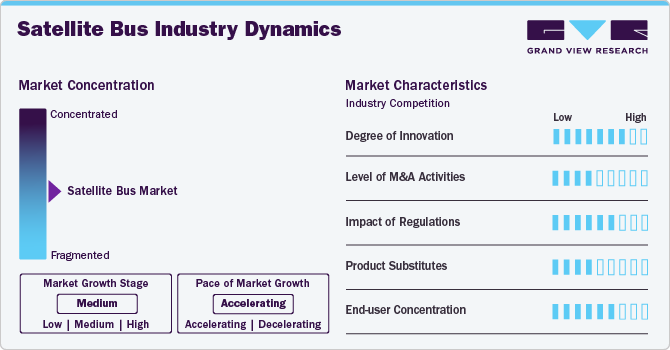

Market Concentration & Characteristics

The market is characterized by a moderate to high degree of innovation, driven by advancements in technology and the increasing demand for more efficient, reliable, and versatile satellite systems. Innovations in materials science, miniaturization, and propulsion technologies have led to the development of lighter and more cost-effective satellite buses. Furthermore, the integration of artificial intelligence (AI) and machine learning into satellite operations has enhanced capabilities such as autonomous navigation and data processing. The push towards small satellites or CubeSats has also enhanced innovation as companies strive to create modular designs that can be easily adapted for various missions.

The level of mergers & acquisition activities in the market is expected to be moderate. Companies operating in this market are acquiring advanced technologies and expertise from innovative firms allows these companies to enhance their product offerings and stay competitive.

The impact of regulations on the market is expected to be moderate to high. Regulations play a significant role in shaping the global market. National governments and international bodies impose regulations concerning frequency allocation, orbital slots, environmental impact assessments, and space debris mitigation strategies. Compliance with these regulations can significantly affect operational costs and timelines for satellite deployment. Moreover, regulatory bodies such as the Federal Communications Commission (FCC) in the United States or the European Space Agency (ESA) influence market entry conditions for new players while ensuring that existing operators adhere to safety standards.

The competition from product substitutes in the market is expected to be low to moderate. Traditional communication methods such as fiber optics or terrestrial wireless networks pose some competition; however, they lack the global coverage provided by satellites. In addition, advancements in drone technology have introduced new possibilities for certain applications traditionally served by satellites—such as remote sensing or telecommunications—potentially diverting some demand away from satellite services. Nevertheless, satellites remain indispensable for specific functions such as weather monitoring, GPS navigation, and global communications due to their unique advantages over terrestrial alternatives.

The end-user concentration in the market is moderate to high, varying significantly across different sectors including government agencies, commercial enterprises, telecommunications providers, and research institutions. While government contracts often dominate due to national security interests and scientific missions funded by public budgets, commercial users are increasingly becoming prominent players as demand for broadband services expands globally.

Size Insights

Based on size, the medium segment led the market with the largest revenue share of 40.23% in 2023.This growth can be attributed to its versatility and suitability for a wide range of applications, including communication, earth observation, and scientific research. Medium satellite buses offer an optimal balance between payload capacity and cost-efficiency, making them highly attractive for commercial and governmental missions. The growing demand for high-throughput satellites (HTS) and geostationary satellites, which often utilize medium-sized buses, is expected to further contribute to the segmental growth.

The nano segment is expected to witness at the fastest CAGR of 11.03% from 2024 to 2030, driven by the rising interest in small satellite constellations and the increasing adoption of CubeSats for various low-cost and rapid deployment missions. The advancements in miniaturization and standardized designs have made nano satellites highly cost-effective and accessible for academic, research, and commercial purposes. The growing trend of using nanosatellites for applications such as earth observation, space research, and technology demonstration has also contributed to this segmental growth.

Subsystem Insights

Based on subsystem, the structure and mechanical system segment led the market with the largest revenue share of 25.09% in 2023. This growth can be attributed to the essential role these systems play in providing the necessary support and stability for all satellite components. The increasing complexity and size of modern satellites, driven by the need for enhanced capabilities and longer operational lifespans, have led to higher investments in robust and reliable structural designs. In addition, advancements in materials science, including the use of lightweight and high-strength composites, have contributed to the higher costs and revenue associated with this segment. The growing demand for satellites across various applications such as communication, earth observation, and defense has further amplified the need for advanced structural and mechanical systems, securing their dominant market position.

The propulsion system segment is expected to grow at the fastest CAGR from 2024 to 2030, owing to the increasing emphasis on satellite maneuverability, extended mission durations, and the ability to reach more distant orbits. Innovations in electric propulsion technologies, which offer higher efficiency and lower fuel consumption compared to traditional chemical propulsion, are driving this growth.

Application Insights

Based on application, the communication segment led the market with the largest revenue share of 48.17% in 2023, owing to the increasing demand for satellite communication services driven by the expansion of global telecommunication networks, increasing internet penetration, and the proliferation of mobile devices. The rise in demand for broadband services, direct-to-home (DTH) television, and the growing reliance on satellite-based communication for remote and underserved areas is further accelerating the segmental growth. In addition, advancements in satellite technology, such as low Earth orbit (LEO) constellations and the development of high-throughput satellites (HTS) and have enhanced the capacity and efficiency of communication satellites, making them more attractive for commercial and governmental applications.

The research and exploration segment is anticipated to grow at the fastest CAGR from 2024 to 2030, driven by increasing investments in space exploration, scientific research, and planetary missions. The advancements in satellite bus technology, including miniaturization and enhanced propulsion systems, enable more cost-effective and sophisticated missions. In addition, the growing interest in earth observation for climate monitoring, natural resource management, and disaster response contributes to the increased demand for research and exploration satellites.

Regional Insights

North America dominated the satellite bus market with the largest revenue share of 49.16% in 2023, driven by substantial investments in space exploration, communication, and defense projects. The presence of key industry players such as Lockheed Martin, Northrop Grumman, and Boeing, coupled with significant government funding from NASA and the Department of Defense, is bolstering the market growth in region.

U.S. Satellite Bus Market Trends

The satellite bus market in U.S. is projected to grow at the fastest CAGR of 5.12% from 2024 to 2030. The increasing demand for advanced satellite systems for weather forecasting, navigation, and surveillance is fueling the market growth in U.S.

Europe Satellite Bus Market Trends

The satellite bus market in Europe is anticipated to grow at the fastest CAGR of 8.64% from 2024 to 2030. This growth is driven by the strong collaboration between government agencies, such as the European Space Agency (ESA), and private sector companies in Europe. The region's focus on space sustainability, earth observation, and telecommunications is driving the demand for innovative satellite bus systems.

The UK satellite bus market is anticipated to grow at a significant CAGR from 2024 to 2030. The increasing deployment of small satellites and the development of reusable satellite buses are enhancing the market growth in the UK.

The satellite bus market in Germany is expected to grow at the fastest CAGR from 2024 to 2030. The increasing demand for communication services and a strong focus on space exploration are enhancing the market growth in Germany. The country's strong emphasis on space research and development, supported by government initiatives and partnerships with organizations such as the German Aerospace Center and the European Space Agency.

The France satellite bus market is projected to grow at a substantial CAGR from 2024 to 2030. France’s focus on sustainability and climate change initiatives has propelled the need for advanced satellite systems that can provide real-time data on environmental conditions. This trend is driving the development of specialized satellite buses designed to support earth observation missions.

Asia-Pacific Satellite Bus Market Trends

The satellite bus market in the Asia Pacific is expected to grow at the fastest CAGR of 9.34% from 2024 to 2030. Significant investments in satellite technology for communication, navigation, and earth observation purposes are major drivers in this region. The region's emphasis on national security and disaster management is further boosting the demand for advanced satellite bus systems.

The China satellite bus market is projected to grow at the fastest CAGR from 2024 to 2030.The Chinese government has prioritized the development of its space capabilities, leading to a surge in satellite launches for various applications, including telecommunications, earth observation, and scientific research. In addition, the rise of private space companies in China is contributing to innovation within the satellite bus sector, fostering competition and driving down costs.

The satellite bus market in Japan is expected to grow at a significant CAGR from 2024 to 2030. The Japanese government has significantly increased its investment in space exploration and satellite technology. This includes funding for the Japan Aerospace Exploration Agency (JAXA) to enhance its capabilities in satellite development, which is directly boosting the demand for advanced satellite buses.

The India satellite bus market is expected to grow at the fastest CAGR from 2024 to 2030. Indian manufacturers are increasingly developing multi-purpose satellites that can serve various applications such as communication, navigation, and earth observation simultaneously, requiring versatile satellite bus designs.

Middle East and Africa Satellite Bus Market Trends

The satellite bus market in the Middle East and Africa is expected to grow at the fastest CAGR of 8.0% from 2024 to 2030, driven by increasing investments in satellite technology for communication, broadcasting, and surveillance.The MEA region is at the forefront, with ambitious space programs and collaborations with international space agencies, further fueling the market growth. In addition, the growing focus on environmental monitoring, supported by advancements in satellite bus technologies, is enhancing the market growth in the MEA region.

The Saudi Arabia satellite bus market is anticipated to grow at a significant CAGR from 2024 to 2030. The demand for satellite-based earth observation is increasing in sectors such as urban development, agriculture, climate services, energy, and infrastructure, which in expected to further drive the need for more satellite buses in the country.

Key Satellite Bus Company Insights

Some of the key players operating in the global market include Lockheed Martin Corporation, Northrop Grumman Corporation among others.

-

Lockheed Martin Corporation is a global security and aerospace company that specializes in advanced technology systems and services for government and commercial customers, primarily focusing on defense, space exploration, and aeronautics. The company specializes in designing and manufacturing advanced satellite buses that support various applications, including communication, Earth observation, and military reconnaissance

-

Northrop Grumman Corporation is a leading global aerospace and Defense Technology Company that specializes in the development and production of advanced autonomous systems. The company has a strong focus on developing satellite buses that cater to both civilian and military applications, contributing to its significant presence in the market. Northrop Grumman has also been awarded contracts for the SDA's Transport Layer, working alongside Lockheed Martin to deliver advanced satellite systems

Airbus, Honeywell International Inc. are some of the emerging market participants in the global market.

-

Airbus is a European multinational aerospace corporation known for designing, manufacturing, and selling commercial aircraft, helicopters, military transports, satellites, and launch vehicles. The company's Defense and Space division focuses on developing satellite systems, including satellite buses, which serve as the platform for various payloads. With a strong emphasis on innovation and technology, Airbus is at the forefront of providing advanced solutions in the global market, leveraging its extensive experience and robust capabilities in aerospace engineering

-

Honeywell International Inc. is a globally recognized conglomerate and operates across various industries, including aerospace, building technologies, performance materials, and safety solutions. The company's aerospace division is a leading supplier of avionics, engines, systems, and services for aircraft manufacturers and operators. The company focuses on integrating advanced technologies to enhance the capabilities of satellite buses, ensuring robust performance and mission success in the increasingly competitive and technologically demanding space industry

Key Satellite Bus Companies:

The following are the leading companies in the satellite bus market. These companies collectively hold the largest market share and dictate industry trends.

- Airbus

- Honeywell International Inc.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Thales Group

- Ball Corporation

- Israel Aerospace Industries Ltd. (IAI)

- ISRO

- Sierra Space Corporation

- The Boeing Company

Recent Developments

-

In April 2024, Sierra Space Corporation introduced its new eclipse satellite bus line, comprising three models: Eclipse Velocity, Eclipse Horizon, and Eclipse Titan. This launch aims to meet the evolving demands of the space industry by providing scalable solutions for various missions, including Earth observation, logistics, and communications

-

In October 2023, Northrop Grumman and Airbus have signed a Memorandum of Understanding (MOU) to jointly address the United Kingdom Ministry of Defence's (MOD) military satellite communication system requirements for the SKYNET Enduring Capability (SKEC) program. Both the companies will leverage their strong relationship, with Airbus recently awarded to provide 42 satellite buses for the Tranche 1 Transport Layer (T1TL) constellation that Northrop Grumman is developing for the U.S. Space Development Agency

-

In August 2023, ISRO transferred the IMS-1 Satellite Bus Technology to Alpha Design Technologies Pvt. Ltd. (ADTL), marking a significant advancement in private sector involvement in India's space industry. This transfer was facilitated by NewSpace India Limited (NSIL) through an agreement

Satellite Bus Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 14.31 billion

Revenue forecast in 2030

USD 21.77 billion

Growth rate

CAGR of 7.24% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report deployment

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Size, subsystem, application, regional

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

Airbus; Honeywell International Inc.; Lockheed Martin Corporation; Northrop Grumman Corporation; Thales Group; Ball Corporation; Israel Aerospace Industries Ltd. (IAI); ISRO; Sierra Space Corporation; The Boeing Company.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Satellite Bus Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global satellite bus market report based on size, subsystem, application, and region:

-

Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large

-

Medium

-

Small

-

Nano

-

-

Subsystem Outlook (Revenue, USD Billion, 2018 - 2030)

-

Electrical Power System

-

Attitude Control System

-

Structure and Mechanical System

-

Communication and Data Handling Subsystem

-

Propulsion System

-

Thermal Control

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Communication

-

Earth Observation and Meteorology

-

Navigation

-

Research and Exploration

-

Security & Surveillance

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Australia

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global satellite bus market size was estimated at USD 13.44 billion in 2023 and is expected to reach USD 14.31 billion in 2024.

b. The global satellite bus market is expected to grow at a compound annual growth rate of 7.2% from 2024 to 2030 to reach USD 21.77 billion by 2030.

b. The satellite bus market in North America accounted for a significant revenue share of over 49% in 2023, driven by substantial investments in space exploration, communication, and defense projects.

b. Some key players operating in the satellite bus market include Airbus, Honeywell International Inc., Lockheed Martin Corporation, Northrop Grumman Corporation, Thales Group, Ball Corporation, Israel Aerospace Industries Ltd. (IAI), ISRO, Sierra Space Corporation, The Boeing Company

b. Key factors that are driving satellite bus market growth include the increasing demand for satellite-based services, the demand for reliable and efficient satellite buses and the growing trend of satellite constellations, which enhance communication and data collection capabilities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.