Sales Training Software Market Size, Share & Trends Analysis Report By Deployment (Cloud, On-premise), By Enterprise Size (Small & Medium Enterprise, Large Enterprise), By End Use (IT & Telecom, BFSI), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-981-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Sales Training Software Market Trends

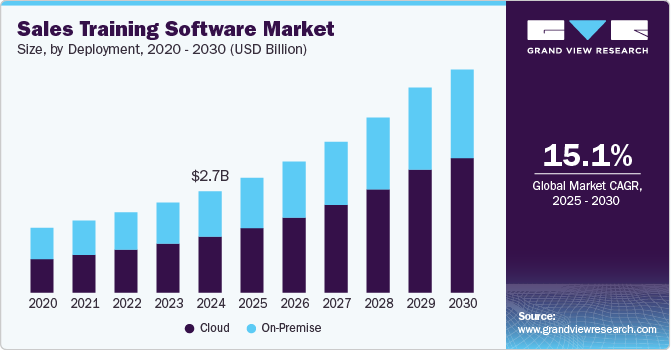

The global sales training software market size was valued at USD 2.68 billion in 2024 and is anticipated to grow at a CAGR of 15.1% from 2025 to 2030. Several key factors, including the rising demand for efficient and scalable training solutions, the need for enhanced sales productivity, and the shift toward digital transformation within sales organizations, are driving the industry growth. As businesses increasingly recognize the value of well-trained sales teams in driving revenue and customer satisfaction, there is a growing investment in platforms that provide structured learning, skills assessment, and performance tracking.

Additionally, the widespread adoption of remote and hybrid work models has accelerated the demand for online training tools that allow companies to deliver consistent and accessible training experiences across geographically dispersed teams. The integration of advanced technologies, such as artificial intelligence and machine learning, further enhances these platforms, enabling personalized learning paths, real-time feedback, and data-driven insights, which ultimately contribute to better training outcomes and higher sales performance. These trends underscore the importance of adaptable, data-backed training solutions in meeting modern sales challenges and maximizing team effectiveness.

The widespread adoption of remote and hybrid work models is significantly propelling the growth of the sales training software industry as organizations seek reliable, scalable solutions to equip and upskill their sales teams regardless of location. Remote work environments necessitate digital tools that can provide consistent, on-demand access to training resources, ensuring that all sales representatives receive uniform, high-quality training even when physically dispersed. Sales training software allows organizations to maintain continuity in learning and professional development with interactive modules, virtual coaching, and real-time feedback that support a seamless, collaborative experience. Additionally, these platforms often feature analytics capabilities that enable managers to monitor progress and performance remotely, fostering an adaptive approach to training that is tailored to individual needs and evolving market demands. The reliance on remote and hybrid models has thus underscored the critical role of digital sales training solutions in developing effective, agile sales teams in a geographically distributed workforce.

A key factor restricting the growth of the sales training software industry is high initial costs. The software development process for sales training software is costly as the provider needs to hire expert software engineers and implement advanced software testing and assessment tools. The market players are adopting various business strategies to reduce the costs of sales training software. These players are focusing on understanding the exact client requirements and accordingly designing the software to control other excess costs incurred for obsolete features. They are also focusing on mergers & acquisitions to improve their service product portfolios and technological expertise, which allow them to reduce software prices.

Deployment Insights

The cloud segment accounted for the largest market share of over 54% in 2024. For cloud-based sales training software, the primary drivers include accessibility, scalability, and cost efficiency. Cloud platforms allow organizations to deliver training seamlessly across locations, providing easy access to learning resources for remote and hybrid sales teams. This flexibility is particularly beneficial for businesses with distributed workforces, as it enables team members to access training anytime, from any device. Cloud solutions also offer scalability, allowing organizations to adjust resources based on changing training needs or company growth without substantial infrastructure investments. Additionally, the subscription-based pricing of most cloud solutions provides a predictable and often lower cost of ownership, making cloud deployment attractive for companies looking to optimize budgets and IT resources.

The on-premise segment is expected to grow at a significant rate during the forecast period, driven by the need for data control, security, and customization. For organizations in regulated industries or those handling sensitive information, on-premise deployment provides greater control over data security and compliance, as data remains within the organization’s infrastructure. This deployment also enables tailored customization, allowing companies to adapt the software to specific organizational processes, integrate with existing in-house systems, and manage updates internally. Organizations with established IT infrastructure and dedicated support teams often prefer on-premise solutions to leverage their in-house resources, ensure data sovereignty, and maintain customized functionality that aligns closely with their unique sales training requirements.

Enterprise Size Insights

The large enterprise segment accounted for the largest market share in 2024, primarily driven by the need for consistent, scalable, and data-driven training solutions that can support extensive and diverse sales teams. Large enterprises often operate across multiple locations and markets, requiring training programs that provide uniform standards and a cohesive learning experience across global teams. Sales training software enables these organizations to deliver standardized content while also offering adaptability to specific regional or market needs, ensuring that training is both comprehensive and relevant. Additionally, large enterprises benefit from the advanced analytics, reporting, and customization capabilities of these platforms, which allow for effective tracking of employee progress and performance, informed decision-making, and an optimized return on investment in training initiatives.

The small & medium enterprise segment is expected to grow at a significant rate during the forecast period. The adoption of sales training software among small and medium-sized enterprises (SMEs) is driven by the need for cost-effective, flexible, and user-friendly solutions that can boost productivity without requiring significant resources. SMEs typically have smaller teams and limited training budgets, making software solutions with scalable pricing and easy implementation attractive. Sales training software provides these businesses with a valuable tool to enhance team skills and productivity through affordable, accessible learning modules that require minimal IT infrastructure. Moreover, the flexibility of these solutions allows SMEs to quickly adapt their training programs to evolving market demands or organizational growth, enabling them to remain competitive with larger counterparts in their industries. The software’s ability to drive meaningful results with low overhead makes it a strategic asset for SMEs aiming to elevate their sales effectiveness while optimizing resources.

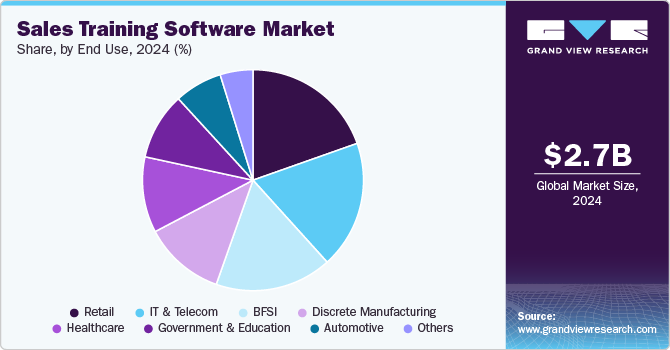

End Use Insights

The retail end use segment accounted for the largest market share of over 19% in 2024. In the retail industry, the primary driver is the need to enhance customer interactions and improve sales conversions in a highly competitive environment. Retail sales teams often work in dynamic, fast-paced settings where product knowledge and customer service skills are essential. Sales training software enables retail organizations to provide ongoing, up-to-date training on product features, promotions, and customer engagement techniques. This ensures that employees can quickly adapt to new offerings and seasonal changes. Furthermore, training software supports the large, often distributed workforce typical in retail, allowing for consistent training delivery across various store locations. This helps to standardize the customer experience and equip sales staff with the skills to build customer loyalty, handle objections, and increase in-store conversions.

The IT & telecom segment is expected to grow at the fastest CAGR during the forecast period. In the IT & telecom industry, the adoption of sales training software is driven by the need to navigate complex products and a constantly evolving technology landscape. Sales representatives in IT and telecom require an in-depth understanding of highly technical offerings, competitive differentiators, and the ability to articulate value propositions in response to sophisticated client needs. Sales training software provides IT and telecom companies with the tools to deliver specialized, continuous learning programs that keep sales teams current on product updates, compliance requirements, and advanced selling techniques. With features like scenario-based learning and interactive simulations, these platforms allow sales professionals to build technical proficiency and improve their consultative sales approach. This is crucial for maintaining credibility, fostering customer trust, and ultimately driving revenue in an industry where expertise and product knowledge are key competitive advantages.

Regional Insights

North America sales training software market held the major share of over 43% of the global industry in 2024. In North America, the market is marked by the adoption of AI-driven personalization and data analytics. Companies increasingly use software to provide tailored training experiences, leveraging insights to enhance individual and team performance and refine sales strategies through data-backed decision-making.

U.S. Sales Training Software Market Trends

The sales training software market in the U.S. is expected to grow significantly from 2025 to 2030. In the U.S., integration with CRM and sales enablement platforms is a key trend. U.S. companies seek solutions that align sales training with real-time sales data, enabling sales teams to link learning with active sales cycles, improve productivity, and streamline performance tracking.

Europe Sales Training Software Market Trends

The sales training software market in Europe is growing significantly at a CAGR of over 14% from 2025 to 2030. In Europe, compliance and data privacy considerations drive software adoption. Organizations prioritize GDPR-compliant solutions that ensure secure data handling while enhancing sales skills, often integrating compliance-focused training with broader sales training efforts to meet regulatory and business needs.

The U.K. sales training software market is expected to grow rapidly in the coming years. In the U.K., the hybrid work model has led to increased demand for flexible training software. Companies seek solutions that deliver consistent training experiences across dispersed teams, emphasizing platforms that support remote learning and interactive modules suitable for a hybrid workforce.

The sales training software market in Germany held a substantial market share in 2024. In Germany, customization and modularity are major trends. German companies value platforms that allow customization of training modules and content, catering to sector-specific requirements and regulatory standards, particularly in technical fields where tailored learning is critical.

Asia Pacific Sales Training Software Market Trends

The sales training software market in Asia Pacific is expected to grow at a CAGR of over 17% from 2025 to 2030. In the Asia Pacific region, demand for mobile-compatible and multilingual platforms is on the rise. Companies prioritize flexible solutions that support various languages and are accessible on mobile devices, making training convenient and effective for diverse, widespread teams.

China sales training software industry held a substantial market share in 2024. In China, mobile accessibility and localized content are essential. Companies focus on training platforms that support Mandarin and are mobile-friendly, aligning with a tech-savvy, mobile-first workforce and a fast-paced, consumer-driven market environment.

The sales training software industry in Japan held a substantial market share in 2024. In Japan, consultative sales training and scenario-based learning are prominent. Japanese companies prefer platforms that emphasize skills in client engagement and trust-building, aligning with the market’s focus on relationship-driven, consultative sales strategies through immersive, scenario-based training experiences.

India sales training software industry is growing rapidly owing to a strong demand for scalable, cost-effective cloud-based solutions. With a highly distributed workforce, Indian companies, particularly in IT and telecom, look for affordable training platforms that offer comprehensive remote learning options.

Key Sales Training Software Company Insights

Key players operating in the sales training software industry include Allego, Brainshark, Inc., Mindmatrix Inc., Mindtickle Inc., Qstream, Inc., Salesforce, Inc., SalesHood Inc., SAP SE, Showpad, and Zoho Corporation Pvt. Ltd. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In March 2024, Mindmatrix Inc., a provider of next-generation Partner Relationship Management (PRM), partner marketing, and sales ecosystem enablement solutions, introduced significant enhancements to its PRM platform, Bridge. These upgrades mark a major advancement in enabling businesses to manage their channel partnerships and sales ecosystems efficiently. The latest enhancements include several dynamic features aimed at transforming partner engagement, channel optimization, and the overall partner experience.

-

In October 2023, Qstream, Inc., a microlearning technology company, launched an integration with Zoom's all-in-one intelligent collaboration platform aimed at transforming the microlearning experience for organizations. This integration enables real-time collaboration among distributed field teams. With this new feature, Qstream learners can now record videos to respond to scenario-based challenge questions, while managers can provide feedback on their responses.

Key Sales Training Software Companies:

The following are the leading companies in the sales training software Market. These companies collectively hold the largest market share and dictate industry trends.

- Allego

- Brainshark, Inc.

- Mindmatrix Inc.

- Mindtickle Inc.

- Qstream, Inc.

- Salesforce, Inc.

- SalesHood Inc.

- SAP SE

- Showpad

- Zoho Corporation Pvt. Ltd.

Sales Training Software Market Report Scope

|

Report Attribute |

Details |

|

Market size in 2025 |

USD 3.02 billion |

|

Revenue forecast in 2030 |

USD 6.11 billion |

|

Growth Rate |

CAGR of 15.1% from 2025 to 2030 |

|

Actual data |

2018 - 2023 |

|

Base Year |

2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Deployment, enterprise size, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico U.K., Germany, France, China, India, Japan, Australia, South Korea, Brazil, UAE, Saudi Arabia, and South Africa |

|

Key companies profiled |

Allego; Brainshark, Inc.; Mindmatrix Inc.; Mindtickle Inc.; Qstream, Inc.; Salesforce, Inc.; SalesHood Inc.; SAP SE; Showpad; Zoho Corporation Pvt. Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Sales Training Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sales training software market report based on deployment, enterprise size, end use, and region.

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small & Medium Enterprise

-

Large Enterprise

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

IT & Telecom

-

BFSI

-

Retail

-

Healthcare

-

Automotive

-

Discrete Manufacturing

-

Government & Education

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global sales training software market size was estimated at USD 2.68 billion in 2024 and is expected to reach USD 3.02 billion in 2025.

b. The global sales training software market is expected to grow at a compound annual growth rate of 15.1% from 2025 to 2030 to reach USD 6.11 billion by 2030.

b. North America held the largest share of 43% in 2024 due to the availability of diverse programs offered by Information Technology (IT) companies, coupled with flexible modules. Furthermore, a significant percentage of learners are rapidly shifting toward mobile-based IT learning. This enables them to access information anywhere and anytime on their devices.

b. Some key players operating in the sales training software market include Allego, Brainshark, Inc., Mindmatrix Inc., Mindtickle Inc., Qstream, Inc., Salesforce, Inc., SalesHood Inc., SAP SE, Showpad, and Zoho Corporation Pvt. Ltd.

b. The market growth can be attributed to the growing corporate competition and changing business needs, large companies and Small & Medium Enterprises (SMEs) are regularly investing in the training of their sales and other teams.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."