Sales Enablement Platform Market Size, Share, & Trends Analysis Report By Component, By Deployment, By Organization Size, By End Use, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-008-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Sales Enablement Platform Market Trends

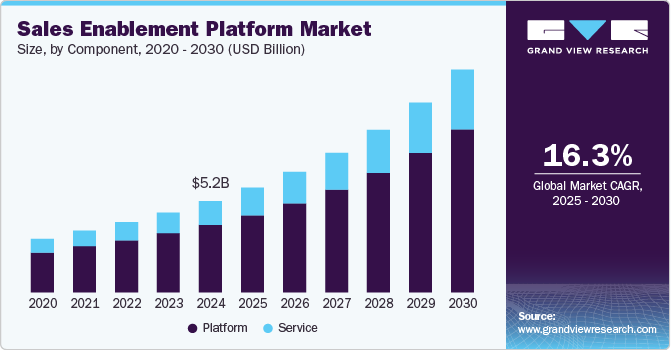

The global sales enablement platform market size was estimated at USD 5.23 billion in 2024 and is anticipated to grow at a CAGR of 16.3% from 2025 to 2030. The market is experiencing robust growth primarily driven by the rising demand for real-time data and analytics, which enhance decision-making and optimize sales strategies. Another significant driver is the growing automation of sales processes to streamline workflows and improve efficiency. In addition, the rise of personalized customer experiences and tailored content is pushing companies to adopt sales enablement solutions that can deliver targeted and relevant interactions, further fueling market expansion.

The growing use of technologies such as Artificial Intelligence (AI) and Machine Learning (ML) is transforming the sales enablement platform market by enhancing sales operations, interactions with customers, and closing deals. AI and ML algorithms can analyze vast amounts of data to uncover patterns and insights that would be impossible for humans to identify quickly. This capability allows sales teams to tailor their approaches based on predictive analytics, forecasting customer behavior, and identifying the best strategies for engaging potential clients. With AI, sales enablement platforms can provide real-time recommendations on content, messaging, and next steps, significantly improving the efficiency and effectiveness of sales processes.

The growing demand for content personalization is one of the leading drivers of market growth. Sales enablement platforms equip sales teams with the tools to create, manage, and deliver tailored content that resonates with individual customer needs and preferences. This personalized approach enhances the customer experience and significantly improves the chances of converting leads into sales. In a May 2024 survey conducted by Exclaimer, a UK-based information technology company, 86% of respondents considered personalized one-on-one marketing crucial for B2B marketing success, with most acknowledging its significance. 58% of the respondents believed that data-driven marketing is the most successful one-on-one marketing method. Personalized marketing strategies are yielding increasingly promising results owing to the growing volumes of customer data accessible to marketers over the past decade, revolutionizing automation efforts.

In addition to the CRM systems, sales enablement platforms are also integrating with a variety of other tools to create a more cohesive sales ecosystem. These include marketing automation software, content management systems, communication tools, and analytics platforms. For instance, integration with marketing automation software allows for better alignment between sales and marketing teams, ensuring that sales teams have access to the latest marketing content and insights. Similarly, integration with communication tools such as Slack or Microsoft Teams facilitates real-time collaboration and information sharing among team members.

In March 2024, TransUnion, a U.S.-based information technology company, introduced OneTru, a solution enablement platform that offers a complete and more persistent picture of a consumer. It manages and delivers data and insights by unifying separate data and analytics assets related to aspects such as credit risk, marketing, and fraud prevention. This integration enhances accuracy, compliance, and contextual insights, addressing the growing challenges of data volume, variety, and regulatory concerns. The market is witnessing the growing demand for such solutions that enable users to integrate with other tools and features that can improve the outcomes of sales practices.

Component Insights

The platform segment accounted for the largest market share of over 74% in 2024. The emphasis on streamlining operational tasks and reducing repetitive activities is among the primary drivers driving the demand for sales enablement platforms. In recent years, companies have been investing significantly in enhancing their sales processes. At this juncture, sales enablement platforms offer a unified platform for businesses to connect sellers to relevant content, deliver real-time visibility into customer engagement, and provide flexible methods for presenting content. Additionally, these platforms provide sellers with the right training and guidance, guiding and training them on content management techniques and sales communication skills. As such, sales enablement platforms can ensure that sales teams have access to up-to-date information, effective training programs, and the tools needed to engage with customers effectively, a comprehensive approach that enhances the overall efficiency and productivity of the sales teams and leads to improved sales outcomes and customer satisfaction.

The services segment is expected to grow at a significant CAGR during the forecast period. The growth of the service segment can be attributed to the increasing demand for specialized expertise in deploying and managing sales enablement platforms as organizations strive to maximize their Return on Investment (ROI) from these advanced solutions. The implementation of advanced sales enablement platforms can be a typically complex and sophisticated task requiring expert guidance. Organizations across various industries are looking forward to implementing sales enablement platforms and training programs customized and tailored to their specific needs.

Deployment Insights

The cloud segment accounted for the largest market share of over 53% in 2024. The cloud segment is poised for significant growth, driven by several compelling factors, including the scalability and agility offered by cloud-based deployment. Cloud-based sales enablement platforms can allow organizations to easily scale their usage based on demand, enabling flexibility in resource utilization and cost management. Cloud-based platforms can also offer flexibility in terms of cost, access, and utilization capabilities. Organizations can subscribe to cloud-based platforms on a pay-per-use basis and access those remotely irrespective of the location. Online accessibility enhances collaboration between geographically dispersed teams, supports remote working, saves operational costs, and enhances productivity. Cloud-based deployment can equally ensure that organizations benefit from continuous updates and new features without deploying any significant internal IT resources.

The on-premise segment is expected to grow at a significant CAGR during the forecast period. The relevance of on-premise sales enablement platforms has grown significantly, particularly among organizations operating in highly regulated industries, such as finance and healthcare. These companies prioritize on-premise solutions to maintain control over their customers’ data and comply with industry-specific regulations. These businesses often have robust in-house IT infrastructure conducive to hosting and managing software internally. On-premise sales enablement platforms also offer a higher degree of customization and integration with existing systems, which helps businesses manage and track sales performance more effectively. Thus, as organizations continue to emphasize data sovereignty and security, on-premise deployments are expected to remain a viable choice, presenting a steady opportunity for the growth of the segment.

Organization Size Insights

The large organization segment accounted for the largest market share in 2024. The growing adoption of sales enablement platforms among large organizations can be attributed to the need to manage distributed sales teams and handle complex sales processes efficiently. Large organizations often deal with extensive product portfolios and diverse customer bases, necessitating sophisticated tools to manage sales activities, track performance, and ensure consistency across sales teams. The rising demand for sales enablement platforms and reporting capabilities, the need for seamless integration, and the focus on improving the productivity of the sales teams and their mutual collaboration are among the major factors driving the demand for sales enablement platforms among large organization.

The small & medium organization segment is expected to grow at a significant pace during the forecast period. The need to streamline sales processes and enhance productivity is prompting small and medium-sized organizations to opt for sales enablement platforms. Small and medium-sized often operate with limited resources and smaller sales teams, making it crucial to maximize efficiency and effectiveness. At this juncture, sales enablement platforms can provide Small and Medium Organization with the tools and insights that were previously accessible only to large organization, democratizing advanced sales techniques and technologies. Other key drivers driving the demand for sales enablement platforms among Small and Medium Organization include the increasing adoption of digital tools by Small and Medium Organization, the need for cost-effective solutions that can provide a competitive edge, and the rising awareness of the benefits of data-driven sales strategies.

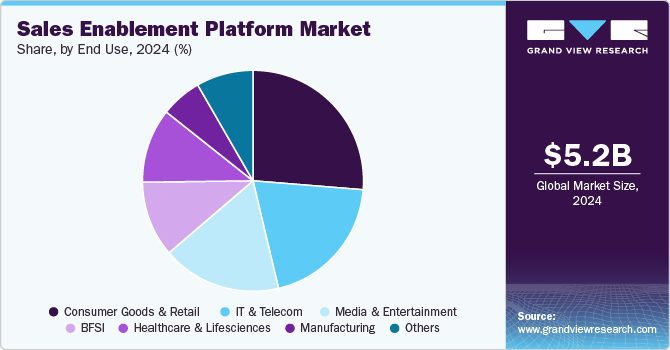

End Use Insights

The consumer goods & retail end use segment accounted for the largest market share in 2024. The rising demand for personalized customer offerings, sales channels, and sales scripts are among the key factors driving the demand for sales enablement platforms among consumer goods and retail organizations. Sales enablement platforms boasting sales enablement platform and AI capabilities can enable sales teams to deliver personalized experiences and facilitate tailored interactions and recommendations preferred by most modern consumers. The increasing adoption of e-commerce and omnichannel strategies is also pushing retailers to adopt sophisticated sales enablement tools that can seamlessly integrate online and offline sales activities, ensuring a cohesive customer journey. As retailers gather large volumes of customer data, there is a significant opportunity to implement sales enablement platforms to analyze this data and generate actionable insights to optimize inventory management, predict consumer trends, and enhance promotional strategies.

The IT & telecom segment is expected to grow at a significant rate during the forecast period. The growing adoption of sales enablement platforms by the incumbents of the IT & telecommunications industry can be attributed to the rapid pace of advances in technology and the subsequent need for sales teams to stay updated with the latest products and services. These platforms offer comprehensive resources, such as product information, sales collaterals, and training materials, which enable sales teams to effectively understand the value propositions of complex IT and telecom solutions. On the other hand, the integration capabilities of sales enablement platforms with CRM systems and other enterprise applications can enhance the efficiency and productivity of sales teams, allowing them to focus on building strong customer relationships and closing deals effectively.

Regional Insights

North America held the major share of over 35% of the sales enablement platform market in 2024. The North America market is witnessing robust growth, primarily driven by the presence of several large organization and the rapid adoption of advanced technologies by these organization. A highly competitive business environment in the U.S. is prompting organization to opt for innovative tools to enhance their sales processes. The emphasis organization are putting on pursuing customer-centric strategies and personalized sales approaches is pushing market players to introduce comprehensive sales enablement solutions.

U.S. Sales Enablement Platform Market Trends

The sales enablement platform market in the U.S. is expected to grow significantly from 2025 to 2030. The U.S. market is driven by the presence of several large organization known for the adoption of innovative solutions based on the latest, emerging technologies. Leading organization in the U.S. are aggressively investing in advanced sales enablement tools based on AI and ML to gain actionable insights and streamline sales processes. For instance, in September 2022, Seismic, a provider of sales enablement solutions announced a strategic collaboration with Microsoft Corporation. The collaboration envisaged integrating Seismic's content production, automation, and engagement intelligence with Microsoft Corporation’s Viva Sales as part of the efforts to transform the future of sales operations by streamlining everyday workflows for modern sales representatives.

Europe Sales Enablement Platform Market Trends

The sales enablement platform market in Europe is growing significantly at a CAGR of over 16% from 2025 to 2030. The pursuit of personalized selling techniques, growing demand for customized sales management tools catering to diverse customer expectations, and rising emphasis on leveraging AI and analytics to gain actionable insights into sales performance are some of the key factors driving the growth of the Europe market. A noticeable demand for user-friendly, multi-language, and secure sales enablement platforms can be considered the highlight of the European market. Key market players in Europe are introducing innovative solutions to cater to this demand.

Asia Pacific Sales Enablement Platform Market Trends

The sales enablement platform market in the Asia Pacific is growing significantly at a CAGR of over 18% from 2025 to 2030. The Asia Pacific market is experiencing robust growth driven by the rapid digital transformation and increasing adoption of advanced technologies. Companies across the region are investing heavily in sales enablement tools to enhance their sales processes and improve productivity. The support various governments are extending toward digitization, the presence of a large customer base, and the rapid use of digital platforms for buying and selling goods across the region are driving the adoption of innovative solutions that support personalized sales operations and data-driven decision-making.

Key Sales Enablement Platform Company Insights

Key players operating in the market are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In February 2024, Sydney FC announced a strategic partnership with Bigtincan, an AI-powered sales enablement platform, to enhance organizational performance through innovative technology. This collaboration aims to leverage Bigtincan's advanced AI capabilities, including personalized skill development apps for players and AI-driven virtual showrooms for fan engagement.

-

In May 2023, Mindtickle announced the acquisition of Enable Us, a provider of digital sales rooms and buyer enablement solutions. The move aims to integrate buyer and sales enablement into a single platform. The acquisition enhances Mindtickle's existing portfolio of revenue productivity tools by allowing sales teams to collaborate more effectively with buyers through personalized content experiences.

-

In May 2023, Rallyware, Inc. announced the acquisition of Myagi, enhancing its capabilities in performance enablement and sales force operations. Myagi's platform, which focuses on retail sales training and communication, will complement Rallyware’s AI-driven performance enablement solutions. This acquisition aims to provide a more comprehensive toolset for improving workforce productivity and sales effectiveness, benefiting both companies’ clients through integrated and advanced training and operational support.

Key Sales Enablement Platform Companies:

The following are the leading companies in the sales enablement platform market. These companies collectively hold the largest market share and dictate industry trends.

- Accent Technologies, Inc.

- Bigtincan Holdings Limited

- Bloomfire

- Brainshark, Inc.

- ClearSlide, Inc.

- Highspot

- Mediafly

- Mindtickle Inc.

- PITCHER AG

- QorusDocs Ltd.

- Qstream, Inc.

- Rallyware, Inc.

- SAP SE

- Seismic

Sales Enablement Platform Market Report Scope

|

Report Attribute |

Details |

|

Market size in 2025 |

USD 6.01 billion |

|

Revenue forecast in 2030 |

USD 12.78 billion |

|

Growth rate |

CAGR of 16.3% from 2025 to 2030 |

|

Actual data |

2018 - 2023 |

|

Base Year |

2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, organization size, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Accent Technologies, Inc.; Bigtincan Holdings Limited; Bloomfire; Brainshark, Inc.; ClearSlide, Inc.; Highspot; Mediafly; Mindtickle Inc.; PITCHER AG; QorusDocs Ltd.; Qstream, Inc.; Rallyware, Inc.; SAP SE; Seismic |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Sales Enablement Platform Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the sales enablement platform market report based on component, organization size, deployment, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Platform

-

Service

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Organization

-

Small and Medium Organization

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Consumer Goods & Retail

-

Healthcare & Lifesciences

-

Consumer Goods & Retail

-

IT & Telecom

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global sales enablement platform market size was estimated at USD 5.23 billion in 2024 and is expected to reach USD 6.01 billion in 2025

b. The global sales enablement platform market is expected to grow at a compound annual growth rate of 16.3% from 2025 to 2030 to reach USD 12.78 billion by 2030

b. North America dominated the sales enablement platform market with a market share of over 35% in 2024. The North America sales enablement platform market is witnessing robust growth, primarily driven by the presence of several large organization and the rapid adoption of advanced technologies by these organizations. A highly competitive business environment in the U.S. is prompting organizations to opt for innovative tools to enhance their sales processes. The emphasis organizations are putting on pursuing customer-centric strategies, and personalized sales approaches is pushing market players to introduce comprehensive sales enablement solutions

b. SSome key players operating in the sales enablement platform market include Accent Technologies, Inc., Bigtincan Holdings Limited, Bloomfire, Brainshark, Inc., ClearSlide, Inc., Highspot, Mediafly, Mindtickle Inc., PITCHER AG, QorusDocs Ltd., Qstream, Inc., Rallyware, Inc., SAP SE, and Seismic.

b. The sales enablement platform market is experiencing robust growth driven primarily by the increasing demand for real-time data and analytics, which enhance decision-making and optimize sales strategies. Another significant driver is the growing automation of sales processes to streamline workflows and improve efficiency.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."