- Home

- »

- Medical Devices

- »

-

Sacroiliac Joint Fusion Surgery Market Size Report, 2030GVR Report cover

![Sacroiliac Joint Fusion Surgery Market Size, Share & Trends Report]()

Sacroiliac Joint Fusion Surgery Market Size, Share & Trends Analysis Report By Type (MIS, Open), By Indication, By Approach, By Product, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-333-7

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

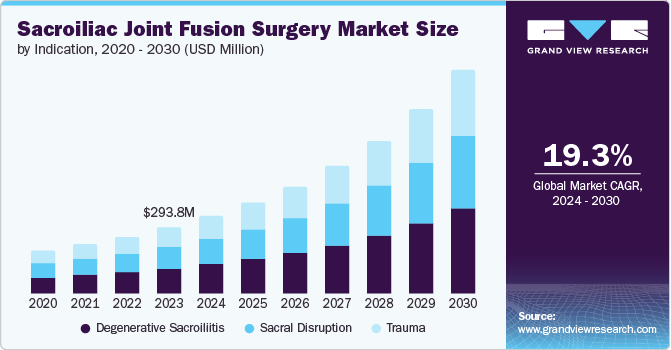

The global sacroiliac joint fusion surgery market size was valued at USD 293.80 million in 2023 and is projected to grow at a CAGR of 19.3% from 2024 to 2030. The growing number of people suffering from chronic low back pain is expected to boost market growth. According to a report from the University of San Francisco published in 2023, chronic lower back pain (CLBP) is a widespread issue globally, affecting around 1.71 billion people, with a significant proportion being women. CLBP contributes to an increasing incidence of sacroiliac (SI) joint dysfunction. For instance, a study published in the American Academy of Family Physicians in 2022 found that approximately 25% of adult patients with chronic low back pain suffer from sacroiliac (SI) joint dysfunction.

Technological advancements are revolutionizing healthcare, and the SI joint fusion market is witnessing several innovations. In recent years, remarkable studies have been made in developing advanced technologies and techniques to address SI joint disorders, a source of chronic pain and discomfort for numerous individuals. These innovations are enhancing the effectiveness of treatment and improving patient outcomes and recovery experiences. Furthermore, the increasing use of innovative materials and technologies to develop improved and safer SI joint fusion systems is driving market growth, including the use of additive manufacturing and 3D-printed titanium implants.

In addition, advancements in minimally invasive surgical methods, enhancements in insurance coverage, and proactive initiatives by leading corporations are propelling the market growth. In July 2021, SI-BONE, Inc. announced that Centene Corporation established a positive coverage policy for minimally invasive sacroiliac joint fusion, including triangular iFuse Implant System. Centene's updated policy considers minimally invasive sacroiliac joint fusion as medically necessary for addressing low back and buttock pain, provided specific criteria are met. This determination stems from a substantial body of published clinical evidence and reviews, which consistently highlight the safety & efficacy of the iFuse Implant System.

Moreover, increasing product approvals and launches are anticipated to fuel market growth. In October 2022, Aurora Spine, a firm that specializes in regenerative technologies and emphasizes minimally invasive methods, revealed that its patented SiLO TFX MIS had obtained 510(k) clearance from the U.S. FDA. The sacroiliac joint fixation system is a minimally invasive option designed for SI joint fusion in situations involving SI joint disruptions and degenerative sacroiliitis. The SiLO TFX system includes a sacrum screw, ilium screw, transfixing cone, and associated instrumentation designed to achieve stability and fixation for bony fusion between the ilium and sacrum.

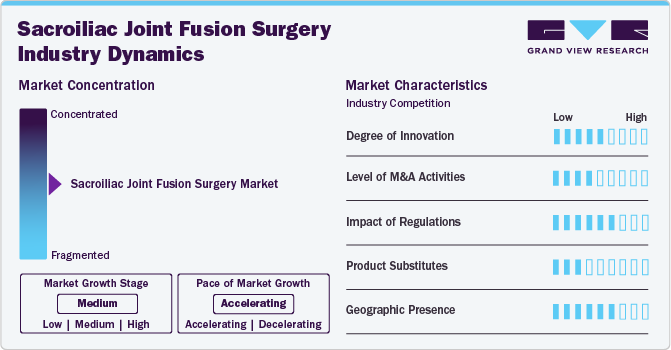

Market Concentration & Characteristics

The market for sacroiliac joint fusion surgery is experiencing remarkable innovation due to advancements in medical technology and surgical techniques. Cutting-edge developments include minimally invasive surgical procedures, which result in reduced recovery times and lower complication rates compared to traditional open surgeries. The use of 3D imaging and navigation systems enhances the precision of implant placement, further improving patient outcomes. In addition, the use of biocompatible materials and novel implant designs is contributing to more effective fusion and long-term durability.

The sacroiliac joint fusion surgery market is characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to expand the business to cater to the growing demand for nanorobots. In December 2023, Nevro acquired Vyrsa, an SI Joint fusion firm, for USD 40 million. This acquisition helped Nevro expand its SI joint fusion devices.

Medical devices used in sacroiliac joint fusion must receive approval from relevant health authorities, such as the FDA in the U.S. or the European Medicines Agency in Europe. Manufacturers are also subject to product listing & facility registration, labeling regulations, approval of product modifications, medical device reporting regulations, post-marketing surveillance regulations, regulations pertaining to product recalls, and other regulations.

The market for sacroiliac joint fusion surgery offers various alternatives for managing sacroiliac joint dysfunction without invasive procedures. These alternatives include physical therapy, which aims to strengthen the muscles around the sacroiliac joint to improve stability and reduce pain. Techniques such as corticosteroid injections and radiofrequency ablation provide temporary relief by reducing inflammation and disrupting pain signals. In addition, orthobiologics such as platelet-rich plasma (PRP) and stem cell therapy are emerging as minimally invasive options that promote tissue healing and regeneration.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. Rising research and development activities create more opportunities for market players to enter new regions. In July 2023, PainTEQ secured USD 35 million in non-dilutive growth capital, leveraging its intellectual property portfolio. The funding would support the expansion and commercialization of its LinQ implantable sacroiliac joint stabilization system and help improve R&D efforts for sacroiliac joint pain & dysfunction. LinQ offers a minimally invasive outpatient solution for sacroiliac joint dysfunction, promoting stabilization and alleviating lower back pain without drilling.

Indication Insights

In 2023, the degenerative sacroiliitis segment dominated the market and accounted for the largest revenue share of 38.6%. Degenerative sacroiliitis stands as a primary factor contributing to the occurrence of sacroiliac joint pain and dysfunction. This is because numerous conditions causing inflammation in the sacroiliac joint often lead to significant levels of discomfort. These include infection, degenerative changes due to aging, pregnancy, and osteoarthritis. Treatment options include physical therapy, non-steroidal anti-inflammatory drugs, and muscle relaxants during the acute phase of presentations. However, the efficacy of these solutions is reduced in case of chronic sacroiliac joint pain, which requires anesthetic/steroid injections for diagnostic and therapeutic effects. Radiofrequency ablation may be recommended if the previous treatments do not provide adequate relief. In addition, sacroiliac joint fusion surgery may be recommended in patients with chronic pain who fail to respond to conservative care.

The trauma segment in the market is anticipated to witness the fastest CAGR over the forecast period. Growing cases of traumas across the globe are fostering market growth. According to a report published in 2023 in the U.S. National Library of Medicine, trauma injuries to the sacroiliac joint can have various etiologies. Approximately 88% of trauma cases are attributed to repetitive micro-injuries or acute trauma. Athletes are also known to have a high prevalence of sacroiliac joint injuries. Pregnancy and idiopathic causes can also result in trauma of the sacroiliac joint along with complete sacroiliac dislocations, incomplete sacroiliac dislocations, & sacroiliac fracture-dislocations. Traumatic injuries to the sacroiliac joint may frequently require immediate surgical correction. Thus, the seriousness and high frequency of trauma will foster market growth.

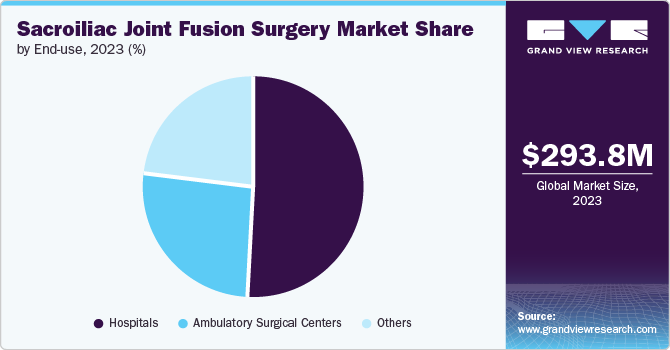

End Use Insights

The hospitals segment held the largest revenue share in 2023 as hospitals see the highest patient footfalls, and most surgeries are performed in hospitals compared to other settings. This growth can be attributed to well-established healthcare infrastructure in developed markets, developing healthcare services in emerging economies, and adopting sacroiliac joint pain diagnostic & treatment services to expand offerings. Furthermore, hospitals provide specialized, long-term care to patients and treatment at these facilities, which is often reimbursed, thereby boosting their adoption. Moreover, the growing number of hospitals is fostering segmental growth. As per the American Hospital Association, there were around 6,120 hospitals in the U.S. in 2024. In addition, post-sacroiliac joint fusion surgery patients might need longer stays to recover along with rehabilitation, which further contributes to segment growth.

The ambulatory surgical centers segment is anticipated to register the fastest CAGR of 19.4% over the forecast period as these centers provide simpler treatment options with shorter duration of patient stays. The cost of treatment at ambulatory surgery centers is more economical, which may further drive their adoption. The increasing number of ambulatory surgery centers and their associated affordability are key factors fueling segment growth. According to the Olympus report, in 2023, there were about 6,223 ambulatory surgery centers in the U.S., which is expected to increase over time.

Type Insights

The minimally invasive surgery (MIS) segment held the largest revenue share in 2023 and is anticipated to register the fastest CAGR of 19.5% over the forecast period. Sacroiliac joint fusion may be recommended to patients when nonsurgical approaches fail. According to research published in the SICOT-J in October 2022, it was demonstrated that minimally invasive (MI) SIJ fusion results in reduced hospital stay, reduced operative blood loss, less surgical time, and improved pain relief when compared to open SIJ fusion. In another study published in 2020 in the International Journal of Spine Surgery, minimally invasive surgery techniques notably improved pain scores and disability in most patients undergoing sacroiliac joint fusion. Increasing preference for minimally invasive surgeries, growing product advancements by players, and raising awareness initiatives deployed by industry stakeholders are expected to fuel segment growth in the coming years.

The open segment in the market is anticipated to register significant growth over the forecast period. As per the Population Reference Bureau report, the population of Americans aged 65 and above will grow from 58 million in 2022 to 82 million by 2050, reflecting a 47% increase. In addition, the share of the total population represented by the 65-and-older age group is expected to increase from 17% to 23%. This indicates that a notable American population is susceptible to orthopedic and spinal disorders such as degenerative sacroiliitis & sacral disruption. This is estimated to increase the number of patients needing sacroiliac joint fusion surgery in the future. Open sacroiliac joint fusion surgery involves:

-

Accessing the sacroiliac joint via surgical incision.

-

Removing cartilaginous material.

-

Using screws & bone grafts to help fuse the sacroiliac joint.

Approach Insights

The lateral segment held the largest revenue share in 2023. The transiliac approach is used in lateral minimally invasive sacroiliac joint fusion and implants to transfix the sacroiliac joint. The lateral or posterolateral approach is used to fuse the ilium and the upper part of the sacrum by inserting the implant(s) through the sacroiliac joint in the direction of the sacrum. This segment is expected to grow notably over the forecast period owing to increasing R&D activities, product launches, and availability of clinical evidence. The U.S. FDA has approved over 20 devices for this procedure, and these devices are indicated for patients with chronic sacroiliac joint pain and degenerative or traumatic disruption. The lateral approach also offers certain benefits over the dorsal approach, such as a minimal complication rate, low revision rate, and a more stable fusion. Some sacroiliac joint fusion solutions approved for lateral approach include iFuse (SI-BONE) and TriCor (Zimmer Biomet).

The dorsal & anterior segment is anticipated to register the fastest CAGR of 19.8% over the forecast period. Dorsal sacroiliac joint fusion is performed through a dorsal paramedian or midline incision and involves dissection of the ligamentous recess between the ilium & sacrum. The sacroiliac joint’s soft tissues are debrided to place one or more implants and bone graft material. For example, SIGNUS Medizintechnik GmbH’s DIANA method facilitates the fusion of the sacroiliac joint via posterior or dorsal access distally in the iliac bone. A study published in 2018 in the Journal of Neurosurgery found that anterior sacroiliac joint arthrodesis was effective in most patients suffering from severe sacroiliac joint pain resistant to conservative management. The advantages associated with this approach were identified to be direct curettage and bone grafting into the sacroiliac joint area, resulting in good bone union. Thus, the growing prevalence of sacroiliac joint pain is expected to fuel segment growth over the forecast period.

Product Insights

The implants segment held the largest revenue share in 2023 and is anticipated to register the fastest CAGR of 19.4% over the forecast period. This can be attributed to rising advancements in technology & materials and growing demand for safe & effective sacroiliac joint fusion systems. 3D printing technology, for instance, is growing in popularity in various minimally invasive surgery applications, including bio-modeling to optimize preoperative planning and manufacturing of implants, guides, & hardware templates. In January 2023, Croom Medical, a company specializing in creating orthopedic joint replacements through advanced additive manufacturing methods, unveiled a personalized SI Joint Fixation device that is 3D printed. This precision-engineered product was created using the latest nTopology software and manufactured using Renishaw’s metal laser PBF technology. It incorporates high-performance materials like tantalum, cobalt chrome, and titanium.

The accessories segment is anticipated to register a significant growth over the forecast period. Sacroiliac joint fusion systems come with custom instrumentation sets or accessories to facilitate smooth implantation of the device. Zimmer Biomet’s TriCor System, for instance, comes with an instrumentation suite that enables preparation and direct exposure of the sacroiliac joint surface, direct visualization-based placement of bone graft into the sacroiliac joint space, and placement of bone graft directly within the TriCor implant itself. Silex Sacroiliac Joint Fusion System by X-spine Systems, Inc. also includes instruments best suited for the placement of implants as well as to support optimum patient outcomes. Increasing demand for sacroiliac joint fusion implants and the rising prevalence of sacroiliac joint pain is expected to drive segment growth in the coming years.

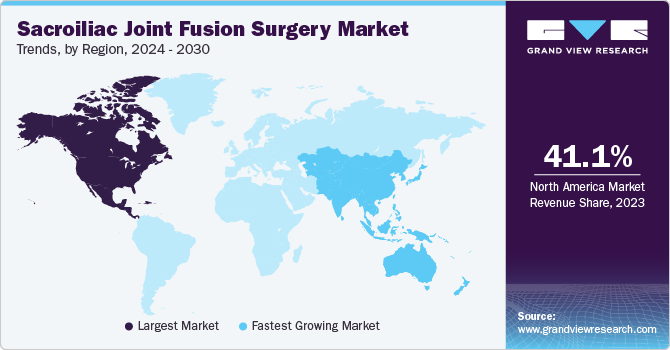

Regional Insights

North America sacroiliac joint fusion surgery market dominated in 2023 with the largest global revenue share of 41.1%. The dominance can be attributed to advanced healthcare infrastructure, the presence of key companies, and growing reimbursement coverage. Key market players are involved in implementing strategic initiatives, such as conducting clinical tests of their products, regional expansion, patent applications, product launches, and partnerships & collaborations to increase their market share.

U.S. Sacroiliac Joint Fusion Surgery Market Trends

The sacroiliac joint fusion surgery market in the U.S. held the largest share, 88.6%, in 2023. Growing technological developments, initiatives by key companies, and reimbursement coverage are key factors expected to propel market growth. In June 2024, Spinal Simplicity received clearance from the U.S. Food and Drug Administration (FDA) for its Patriot-SI posterior implant system, which is designed to be used with the Liberty-SI lateral transfixing system as part of a hybrid SI joint fusion.

The Canada sacroiliac joint fusion surgery market is anticipated to register the fastest growth during the forecast period. Growing awareness about SI joint pathology as a notable contributor to lower back pain, increase in diagnosis rate, and adoption of SI joint treatment solutions by end users are expected to contribute to the market growth in Canada.

Europe Sacroiliac Joint Fusion Surgery Market Trends

The sacroiliac joint fusion surgery market in Europe is anticipated to register lucrative growth during the forecast period owing to several factors, such as advanced healthcare infrastructure, high adoption of diagnostic and treatment options for chronic lower back pain, growing research initiatives, and the presence of various key companies. For instance, in June 2022, the preliminary findings from PainTEQ, a medical innovation company, indicated that utilizing the LinQ implant for SI joint fusion through a posterior approach improved pain scores over three to six months. Early data from 69 patients after six months indicated only one significant adverse event, suggesting that LinQ is a safer option than the competitor's lateral approach, which exhibited a 15.1% SAE incidence.

The Germany sacroiliac joint fusion surgery market is anticipated to register a considerable growth rate during the forecast period owing to the growing prevalence of chronic lower back pain, awareness about the role of SI joints in several back pain cases, and initiatives by local companies. SIGNUS Medizintechnik GmbH, for instance, is a German company specializing in products for cervical spine and sacroiliac joints. The company offers the DIANA method comprising implants, an instrument set, and the procedure for the sacroiliac joint fusion. The DIANA system facilitates the distraction-interference-arthrodesis of the sacroiliac joint while sparing neurovascular structures, enabling extra-articular bone attachment. The instrument set is used to perform distraction and ligamentotaxis, while the conical design of the implant helps optimize stability.

The sacroiliac joint fusion surgery market in the UK is expected to record a significant growth rate during the forecast period. A study published in NIH updated in 2023 revealed that the one-month prevalence of lower back pain (LBP) in Europe stood at 44.6%, with significant variations observed among countries ranging from 33.4% to 67.7%. In addition, as per the Ipsos report, chronic pain affected a quarter (26%) of UK adults in 2022. The prevalence was also found to increase with age group and was more common in females than males. Such increasing cases of patients suffering from chronic pain are propelling market growth.

Asia Pacific Sacroiliac Joint Fusion Surgery Market Trends

The Asia Pacific sacroiliac joint fusion surgery market is anticipated to register the fastest CAGR during the forecast period. This is due to lower back pain's growing prevalence, the large patient pool, developing healthcare infrastructure, and rising disposable income. According to research by The Institute for Health Metrics and Evaluation, by the year 2050, it is estimated that there will be a 36.4% surge, affecting a total of 843 million individuals suffering from low back pain, with the most significant increase expected in the continents of Asia & Africa.

The sacroiliac joint fusion surgery market in China held the largest share in 2023. The country's availability and adoption of treatment options are estimated to increase over time. Minimally invasive SI joint surgery, for instance, is increasingly preferred over open SI joint fusion due to its complexity and prolonged recovery. It is an increasingly adopted surgical method for SI joint dysfunction. The growing availability of multiple devices and approaches is projected to fuel market growth.

The India sacroiliac joint fusion surgery market is anticipated to register considerable growth during the forecast period. Strategic initiatives such as investment, R&D expenditure, acquisitions, mergers, and partnerships by key companies are estimated to propel the market growth in the country.

Latin America Sacroiliac Joint Fusion Surgery Market Trends

The sacroiliac joint fusion surgery market in Latin America houses a progressively aging population, and rising awareness of minimally invasive treatment options has increased the demand for sacroiliac joint fusion procedures. Moreover, increasing investments by market players in the region and free-trade agreements with major countries, such as the U.S., Canada, Japan, and several European countries, are anticipated to boost Latin America’s market during the forecast period.

Brazil sacroiliac joint fusion surgery market is anticipated to grow at a healthy rate over the forecast period. A diagnosis with several medical conditions results in pain in the sacroiliac joint. These include adjacent segment disease, degenerative sacroiliitis, degenerative osteoarthritis, SI joint infection, SI joint inflammation, SI joint disruption, trauma, and tumors. The high prevalence of associated sacroiliac joint pain conditions and the growing availability of various treatment options are estimated to drive market growth in the country.

MEA Sacroiliac Joint Fusion Surgery Market Trends

The MEA sacroiliac joint fusion surgery market is anticipated to grow lucratively during the forecast period. This is due to developing healthcare infrastructure, the growing prevalence of chronic lower back pain, and key companies' regional expansion.

South Africa sacroiliac joint fusion surgery market is witnessing, growing awareness about the benefits of SI joint fusion in patients who have not responded to conservative care. Developing healthcare infrastructure & services is estimated to fuel the market growth in South Africa over the forecast period.

Key Sacroiliac Joint Fusion Surgery Company Insights

Key participants in the market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Sacroiliac Joint Fusion Surgery Companies:

The following are the leading companies in the sacroiliac joint fusion surgery market. These companies collectively hold the largest market share and dictate industry trends.

- SI-BONE, Inc.

- CornerLoc

- Globus Medical

- Orthofix Medical, Inc.

- Camber Spine Technologies, LLC

- Life Spine, Inc.

- CoreLink Surgical

- PainTEQ

- SIGNUS Medizintechnik GmbH

- Medtronic

Recent Developments

-

In May 2024, PainTEQ was granted two additional patents for the LinQ procedure, furthering advancements in the treatment of SI joint dysfunction. These patents serve to further establish the company's position as a pioneer in the treatment of sacroiliac (SI) joint dysfunction.

-

In June 2023, Genesys Spine launched the SIros O Oblique SI Fusion system. Genesys Spine's third sacroiliac joint fusion system offers physicians additional surgical choices for treating SI Joint pain.

-

In December 2022, SI-BONE secured FDA approval for its iFuse Bedrock Granite implant system. This system offers the utilization of the implant system alongside a broad range of pedicle screw system rods.

-

In June 2022, SI-BONE, Inc. obtained FDA clearance for its iFuse-TORQ system designed for pelvic fracture fixation. This system can be used to treat many fractures, including acute, nonacute, and nontraumatic types, such as pelvic fragility & pelvic insufficiency fractures.

Sacroiliac Joint Fusion Surgery Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 341.9 million

Revenue Forecast in 2030

USD 984.9 million

Growth Rate

CAGR of 19.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, indication, approach, product, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S., Canada, Mexico, Germany, UK, Spain, Italy, France, Norway, Denmark, Sweden, Japan, China, India, Australia, Thailand, South Korea, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

SI-BONE, Inc., CornerLoc, Globus Medical, Orthofix Medical, Inc., Camber Spine Technologies, LLC, Life Spine, Inc., CoreLink Surgical, PainTEQ, SIGNUS Medizintechnik GmbH, Medtronic

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sacroiliac Joint Fusion Surgery Market Report Segmentation

This report forecasts revenue growth at global, regional, and country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global sacroiliac joint fusion surgery market report based on type, indication, approach, product, end use, and region:

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Degenerative Sacroiliitis

-

Sacral Disruption

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

MIS

-

Open

-

-

Approach Outlook (Revenue, USD Million, 2018 - 2030)

-

Dorsal & Anterior

-

Lateral

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Implants

-

Accessories

-

-

End use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

NorthAmerica

-

U.S.

-

Canada

-

Mexico

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Latin America

-

Brazil

-

Argentina

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Frequently Asked Questions About This Report

b. The global sacroiliac joint fusion surgery market size was estimated at USD 293.8 million in 2023 and is expected to reach USD 341.9 million in 2024.

b. The global sacroiliac joint fusion surgery market is expected to grow at a compound annual growth rate of 19.3% from 2024 to 2030 to reach USD 984.9 million by 2030.

b. North America dominated the sacroiliac joint fusion surgery market in 2023 and accounted for the largest revenue share of 41.1%. The dominance can be attributed to advanced healthcare infrastructure, the presence of key companies, and growing reimbursement coverage.

b. Some key players operating in the market include SI-BONE, Inc., CornerLoc, Globus Medical, Orthofix Medical, Inc., Camber Spine Technologies, LLC, Life Spine, Inc., CoreLink Surgical, PainTEQ, SIGNUS Medizintechnik GmbH, Medtronic

b. The growing number of people suffering from chronic low back pain is expected to boost market growth. According to a report from the University of San Francisco published in 2023, chronic lower back pain (CLBP) is a widespread issue globally, affecting around 1.71 billion people

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."