- Home

- »

- Medical Devices

- »

-

Sacroiliac Joint Fusion Injections & RF Ablation Market Report 2030GVR Report cover

![Sacroiliac Joint Fusion Injections And RF Ablation Market Size, Share & Trends Report]()

Sacroiliac Joint Fusion Injections And RF Ablation Market Size, Share & Trends Analysis Report By Indication (Degenerative Sacroiliitis, Sacral Disruption), By Type (Diagnosis), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-319-8

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

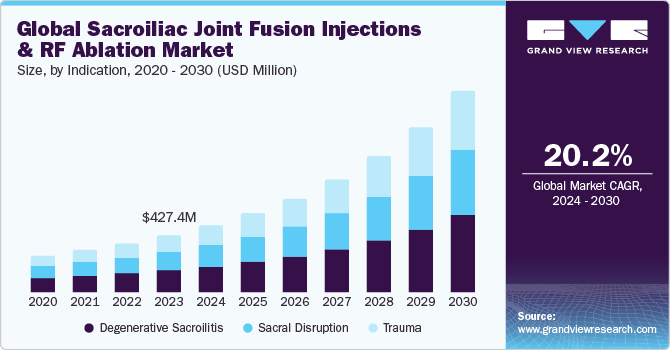

The global sacroiliac joint fusion injections and RF ablation market size was estimated at USD 427.4 million in 2023 and is projected to grow at a CAGR of 20.2% from 2024 to 2030. The increasing prevalence of pain in the lower back, buttocks, groin, & lower extremities, and rising incidence of sacroiliitis or sacroiliac joint dysfunction are key factors fueling market growth. According to a WHO report of June 2023, over 843 million individuals are anticipated to suffer from lower back pain by 2050, attributed to aging and large population expansion. Additionally, lower back pain is the second leading reason for medical consultation, and it is estimated that 80% of the world’s population is subjected to back pain at least once in their lifetime.

The rising incidence of sacroiliitis or sacroiliac joint dysfunction is primarily fueling the market demand worldwide. According to the Physiopedia, sacroiliac joint (SIJ) syndrome is a significant source of pain in 15% to 30% of people with mechanical low back pain. In addition, according to MDPI study published in January 2024, SIJ dysfunction is a significant contributor to chronic low back pain and could be responsible for around 20% of reported cases of low back pain in the general population. As more individuals suffer from these conditions, the demand for minimally invasive treatment options such as sacroiliac joint fusion injections and RF ablation procedures is on the rise.

Furthermore, the market is driven by the growing advancements in RFA technology that have contributed to the rising popularity of this treatment modality for sacroiliac joint (SIJ) pain. The development of new RFA probes with improved tip designs that enable more precise targeting of nerve tissue while minimizing damage to surrounding healthy tissue is fostering market growth. Additionally, advances in imaging technologies such as fluoroscopy and CT guidance have facilitated more accurate needle placement during RFA procedures, further enhancing their safety and efficacy.

The insurance coverage improvements for sacroiliac joint fusion injections and RF ablation are gaining the confidence of people globally. According to the National Center for Biotechnology Information (NCBI) survey conducted in July 2023, the number of SIJ (sacroiliac joint) fusion procedures in the Medicare population has experienced a significant surge since the introduction of the 27279 CPT code in 2015. Among these procedures, minimally invasive surgical (MIS) SIJ fusions have accounted for the majority.

Furthermore, the focus on reducing healthcare costs by opting for RF ablation and sacroiliac joint injections instead of traditional surgeries is also propelling market growth. RF ablation procedures are often performed on an outpatient basis or require shorter hospital stays compared to traditional surgeries. This leads to cost savings by reducing the length of hospitalization, which can be a significant portion of healthcare expenses.

Market Concentration & Characteristics

The industry exhibits a moderate level of concentration. Characteristics include rapid technological advancements, such as integration of artificial intelligence (AI), and remote monitoring. The industry showcases continuous innovation and expansion fueled by rising healthcare expenditure and the growing prevalence of chronic pain and the growing adoption of healthcare solutions.

The market is characterized by a high degree of innovation, with new technologies and methods being developed and introduced at regular intervals. As a minimally invasive procedure that provides lower levels of pain and fatigue, it has become a popular option. As a result, market players are investing in innovative technologies and procedures to meet the demand.

Regulations significantly impact the industry by ensuring patient safety, product quality, and efficacy. Companies invest substantial resources in R&D activities and regulatory submissions to obtain regulatory approval for pipeline products. This may result in increasing the cost of developing novel tumor ablation technologies. The American Society of Pain and Neuroscience (ASPN) has created a comprehensive practice guideline to act as a fundamental point of reference for the appropriate management of sacroiliac (SI) joint disorders, utilizing the most reliable evidence available. This guideline aims to be a foundational resource for the treatment of adult patients both in the United States and worldwide.

Mergers and acquisitions in the industry are rising due to the need for research and development, reflecting the industry's dynamic nature. Companies are leveraging M&A activities to innovate and offer advanced solutions that meet the evolving needs of healthcare professionals. For instance, in January 2023, Orthofix Medical, Inc. and SeaSpine Holdings Corporation announced the merger of equals after receiving approval from their respective stockholders. SeaSpine's common shares attained a 99% approval rate, while Orthofix's shares achieved a 98% approval rate for the merger.

The substitute for sacroiliac joint fusion injections and RF ablation is sacroiliac joint fusion surgery. The developments in minimally invasive surgical techniques, insurance coverage improvements, and major companies' proactive efforts are driving the demand for sacroiliac joint fusion surgery. According to AmeriHealth Caritas, as of 2018, Medicaid programs in 44 U.S. states included coverage for minimally invasive sacroiliac joint fusion, and by 2019, 32 Blue Cross Blue Shield plans covered this procedure, encouraging the utilization of minimally invasive sacroiliac joint fusion procedures.

The industry is experiencing robust global expansion. As healthcare systems worldwide strive to improve patient outcomes and reduce healthcare costs, sacroiliac joint fusion injections and RF ablation treatments have gained popularity for their effectiveness in providing long-term pain relief with minimal risks and complications. In a 2022 study titled “Efficacy of Ultrasound-Guided Sacroiliac Joint Injection for Chronic Low Back Pain: A Prospective Observational Study “, researchers investigated the effectiveness of SI joint injections in providing short-term and long-term pain relief for individuals with chronic low back pain. The study consisted of 27 participants, who received injections containing a steroid (triamcinolone) and a local anesthetic (ropivacaine).

Indication Insights

Based on indication, the degenerative sacroilitis segment dominated the market with the largest revenue share of 38.6% in 2023. The key factors contributing to this growth include growing awareness about the condition, improving diagnostic capabilities for sacroiliac joint disorders, and a high prevalence of degenerative sacroiliitis. For instance, in March 2022, according to an article by the American Academy of Family Physicians, sacroiliac joint degeneration prevalence was 25.0% in adult patients. In addition, sacroiliac joint fusion surgery may be recommended in patients with chronic pain who fail to respond to conservative care. The high prevalence of degenerative sacroiliitis and the increasing diagnosis rate is expected to fuel market growth.

The trauma segment is anticipated to witness the fastest CAGR of 20.4% over the forecast period. Injuries to the pelvic ring can result in trauma to the sacroiliac joint. These injuries can be classified as lateral compression, anteroposterior compression, and vertical shear-type injuries. Advancements in minimally invasive techniques, such as fusion injections and RF ablation, are becoming increasingly popular as they offer less invasive alternatives to traditional surgical procedures. These minimally invasive options are appealing to both patients and healthcare providers due to their shorter recovery times, reduced risk of complications, and potential for faster return to activity. Furthermore, the growing awareness of sacroiliac joint pain as a treatable condition is driving demand for these procedures.

End-use Insights

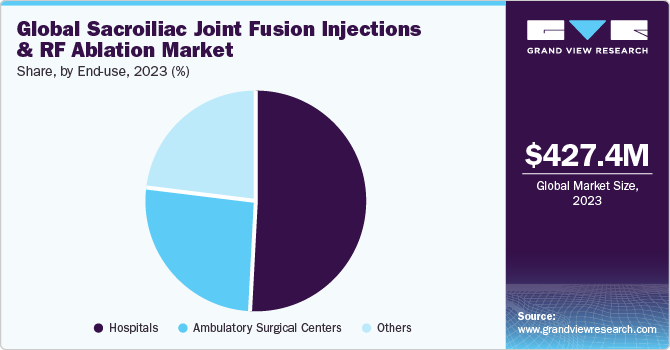

The hospital segment dominated the market with the largest revenue share in 2023. Key factors contributing to the growth of this segment include a higher volume of surgeries performed in hospitals and a growing preference for minimally invasive surgeries. For instance, according to American Hospital Association, there were around 6,129 hospitals in the U.S. in 2023. Furthermore, hospitals provide specialized, long-term care for patients. Moreover, treatments at these facilities are often reimbursed, driving their adoption.

The ambulatory surgical centers (ASCs) segment is anticipated to grow at the fastest rate during the forecast period, owing to the rising number of ASCs. For instance, Centers for Medicare & Medicaid Services (CMS), in December 2022, there were around 458 Medicare-certified ASCs in Texas state, 183 in Washington, 468 in Florida, 848 in California, and 386 in Georgia. These numbers are anticipated to increase over the forecast period, supporting segment growth. In addition, these centers facilitate a large volume of surgeries in short periods, thus further driving the segment.

Type Insights

Based on type, the diagnosis segment dominated the market with the largest revenue share in 2023. The growth is attributed to the accurate diagnosis and determining the appropriate treatment for sacroiliac joint pain. As such, healthcare providers rely heavily on diagnostic procedures such as imaging tests, physical examinations, and diagnostic injections to pinpoint the exact source of the pain before proceeding with interventions like fusion injections or radiofrequency ablation.

Additionally, advancements in diagnostic technologies have enhanced the precision and reliability of identifying sacroiliac joint dysfunction, leading to a higher demand for diagnostic services in this market segment. For instance, NYU Langone is leading the way in applying artificial intelligence (AI) to biomedical imaging, with research spanning the entire radiology process from data acquisition to image interpretation. Their efforts aim to enhance MRI scans by increasing speed and expanding access. Neural networks are trained at NYU Langone to optimize radiofrequency pulse sequences, reconstruct images from raw data, and identify disease signatures within MR signal patterns.

The treatment segment is anticipated to witness the fastest CAGR over the forecast period. The growing advancements in medical technology have led to the development of more effective and minimally invasive treatment options for sacroiliac joint pain. Procedures such as RF ablation offer patients a less invasive alternative to traditional surgical interventions, leading to increased patient acceptance and demand for these treatments. Radiofrequency ablation (RFA) is a minimally invasive procedure that uses heat to disrupt nerve signals responsible for pain. A newer variation called “cooled RFA” (C-RFA) is an outpatient procedure that provides more precise pain relief without involving an incision.

Regional Insights

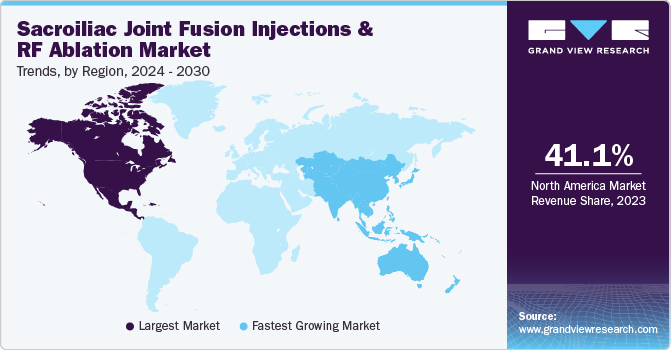

North America sacroiliac joint fusion injections and RF ablation market dominated the global market and accounted for the 41.1% revenue share in 2023. Factors such as advanced healthcare infrastructure, the presence of key companies, and growing reimbursement coverage are driving regional growth. Key market players are involved in implementing strategic initiatives, such as conducting clinical tests of their products, regional expansion, patent applications, product launches, and partnerships & collaborations to increase their market share. These patents signify a significant advancement in medical device technology, providing renewed optimism for the many individuals enduring severe lower back pain.

U.S. Sacroiliac Joint Fusion Injections and RF Ablation Market Trends

The sacroiliac joint fusion injections and RF ablation market in the U.S. held a significant share of the North America region in 2023. Growing technological developments, initiatives by key companies, and reimbursement coverage are key factors expected to propel market growth. Moreover, the increasing adoption of advanced technologies like image-guided injections and minimally invasive ablation techniques further enhances the market’s potential.

Mexico sacroiliac joint fusion injections and RF ablation market is experiencing significant growth attributed to various factors. The use of sacroiliac joint fusion injections and RF (radiofrequency) ablation is governed by regulatory frameworks that prioritize patient safety and quality standards. Healthcare facilities offering these procedures must adhere to strict regulations set forth by health authorities, such as the Federal Commission for the Protection against Health Risks (COFEPRIS) in Mexico. These regulations ensure that medical interventions are performed by qualified personnel using approved equipment and techniques.

Europe Sacroiliac Joint Fusion Injections and RF Ablation Market Trends

The sacroiliac joint fusion injections and RF ablation market in Europe is witnessing growth fueled by the increasing cases of SI joint dysfunction, back pain, and treatment approvals in the region. The aging population in Europe is another significant driver. As people age, they are more likely to experience SIJD and other musculoskeletal conditions.

The UK sacroiliac joint fusion injections and RF ablation market is one of the major markets in the region. The growth is attributed to the growing clinical trials for lower back in the country. As per NHS, approximately 10 million individuals register back pain disorders. Moreover, Guy’s and St Thomas’ NHS Foundation Trust has launched the Modulate-LBP study, which seeks to investigate the efficacy of spinal cord stimulation as a treatment for chronic back pain. This groundbreaking trial has the potential to revolutionize the way chronic back pain is managed.

The sacroiliac joint fusion injections and RF ablation market in Germany is projected to expand during the forecast period owing to the presence of well-established healthcare system with substantial public and private funding [(OECD, 2021)]. The government’s mandatory health insurance program covers most medical procedures, including SI joint fusion injections and RF ablation. These favorable reimbursement policies encourage patients to undergo these procedures, supporting market growth. However, there is still room for expansion as new technologies emerge and gain regulatory approval.

Asia Pacific Sacroiliac Joint Fusion Injections and RF Ablation Market Trends

The sacroiliac joint fusion injections and RF ablation market in the Asia Pacific is expected to grow at the fastest CAGR from 2024 to 2030. This growth can be attributed to a large patient pool, developing healthcare facilities, and investments by key regional companies. According to International Citizens Insurance, the Japanese healthcare system is consistently ranked as one of the best in the world. While the public system is modern and accessible, it doesn't fully cover healthcare costs. Depending on their income level, patients are required to pay around 30% of their medical fees. Because of this, most people tend to have private insurance plans.

China sacroiliac joint fusion injections and RF ablation market is expected to grow at the fastest CAGR during the forecast period. As China has the largest population in the world, with 1.4 billion as of June 2021, it is expected to have the highest number of people at risk of chronic lower back pain associated with sacroiliac joints. The country's availability and adoption of treatment options are estimated to increase over time. Minimally invasive SI joint surgery, for instance, is increasingly preferred over open SI joint fusion due to its complexity and prolonged recovery. It is an increasingly adopted surgical method for SI joint dysfunction.

The sacroiliac joint fusion injections and RF ablation market in India holds a significant share of the Asia Pacific regional market revenue. The increasing cases of lower back pain in the country is primarily driving the sacroiliac joint fusion injections and RF ablation market. For instance, as per article published in The Indian Express in June 2023, around 87.5 million individuals suffer from low back pain in India.

Latin America Sacroiliac Joint Fusion Injections and RF Ablation Market Trends

The sacroiliac joint fusion injections and RF ablation market in Latin America is experiencing significant growth attributed to the growing interest in minimally invasive procedures including sacroiliac joint fusion injections and RF ablation for managing sacroiliac joint-related pain. These procedures are gaining popularity due to their effectiveness in providing relief to patients with chronic lower back pain originating from the sacroiliac joint. The advancements in technology and techniques have made these procedures safer, more precise, and with reduced recovery times, making them attractive options for patients seeking alternatives to traditional surgery.

MEA Sacroiliac Joint Fusion Injections and RF Ablation Market Trends

The sacroiliac joint fusion injections and RF ablation market in MEA is experiencing significant growth. This is driven by healthcare infrastructure development in the MEA region which is playing a crucial role in fueling the demand for advanced pain management solutions such as sacroiliac joint fusion injections and RF ablation. With improving access to healthcare services, more patients are seeking treatment for chronic pain conditions, contributing to the expansion of this market. Additionally, rising awareness among both patients and healthcare providers about the benefits of these procedures is further propelling market growth.

Saudi Arabia sacroiliac joint fusion injections and RF ablation market is anticipated to expand in the forecast period due to technological innovation. The advancements in medical technology and techniques, coupled with a rising geriatric population in Saudi Arabia, are propelling the adoption of sacroiliac joint fusion injections and RF ablation procedures. Furthermore, favorable government initiatives aimed at improving healthcare infrastructure and accessibility to advanced pain management solutions are also playing a significant role in driving the growth of this market.

The sacroiliac joint fusion injections and RF ablation market in Kuwait is expected to grow over the forecast period. The growth is attributed to the increasing prevalence of sacroiliac joint dysfunction (SIJD) and degenerative diseases including osteoarthritis (OA). According to a study published in the Journal of Pain Research, the prevalence of SIJD is estimated to be around 15-30% in the general population, with a higher incidence in women and older adults. Moreover, as per Centers for Disease Control and Prevention, OA affects approximately 27 million Americans and an estimated 10% of the world population. With a significant expat population and an aging demographic, Kuwait is no exception to this trend.

Key Sacroiliac Joint Fusion Injections and RF Ablation Company Insights

The global market is highly competitive. Key companies deploy strategic initiatives, such as product development, launches, and sales & marketing strategies to increase product awareness and regional expansions and partnerships to strengthen their market share. Market players are also involved in conducting clinical testing of their products, patent applications, and increasing product penetration.

Key Sacroiliac Joint Fusion Injections and RF Ablation Companies:

The following are the leading companies in the sacroiliac joint fusion injections and RF ablation market. These companies collectively hold the largest market share and dictate industry trends.

- SI-BONE, Inc.

- PainTEQ

- CornerLoc

- SIGNUS Medizintechnik GmbH

- Globus Medical

- Orthofix Medical, Inc.

- Life Spine, Inc.

- Camber Spine Technologies, LLC

- CoreLink Surgical

- Xtant Medical

- Surgalign Spine Technologies, Inc.

- Medtronic

Recent Developments

- In December 2023, Nevro announced the acquisition of Vyrsa Technologies. Nevro paid USD 40 million upfront and an additional USD 35 million in milestone payments for a total deal value of USD 75 million. This valuation places the SI joint market, where Nevro’s product is targeted, at over USD 2 billion. The company anticipates that this market may experience significant growth, with double-digit percentage increases predicted for the coming years.

Sacroiliac Joint Fusion Injections and RF Ablation Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 501.1 million

Revenue forecast in 2030

USD 1.51 billion

Growth rate

CAGR of 20.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast Data

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Indication, type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Singapore; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

SI-BONE, Inc.; PainTEQ; CornerLoc; SIGNUS Medizintechnik GmbH; Globus Medical; Orthofix Medical, Inc.; Life Spine, Inc.; Camber Spine Technologies, LLC; CoreLink Surgical; Xtant Medical; Surgalign Spine Technologies, Inc.; Medtronic

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sacroiliac Joint Fusion Injections and RF Ablation Market Report Segmentation

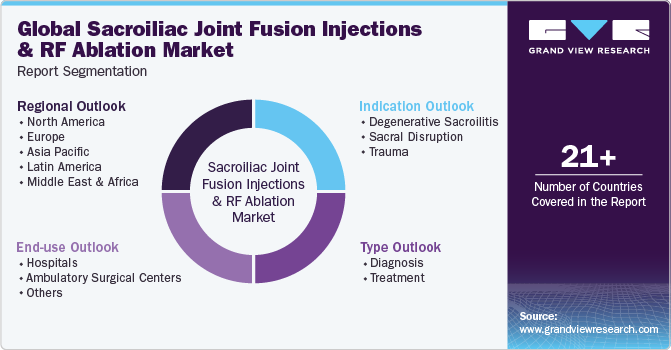

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sacroiliac joint fusion injections and RF ablation market report based on indication, type, end-use, and region:

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Degenerative Sacroilitis

-

Sacral Disruption

-

Trauma

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnosis

-

Treatment

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."