- Home

- »

- Plastics, Polymers & Resins

- »

-

Sachet Packaging Market Size, Share, Industry Report, 2030GVR Report cover

![Sachet Packaging Market Size, Share & Trends Report]()

Sachet Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Plastic, Paper, Aluminum Foil), By End-use (Food & Beverages, Pharmaceuticals, Personal Care & Cosmetics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-521-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sachet Packaging Market Summary

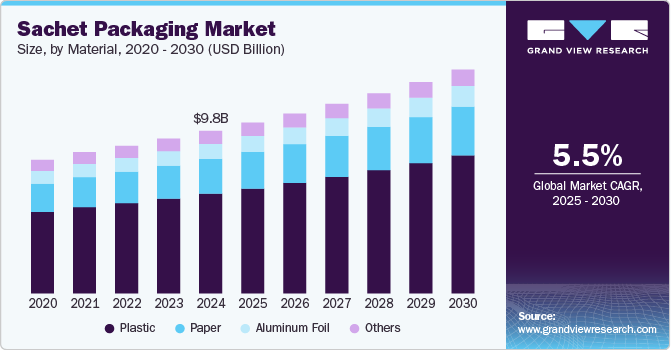

The global sachet packaging market size was estimated at USD 9.82 billion in 2024 and is projected to reach USD 13.52 billion by 2030, growing at a CAGR of 5.5% from 2025 to 2030. The growth of the sachet packaging market is driven by the rising demand for affordable and convenient packaging solutions, the expansion of the fast-moving consumer goods (FMCG) sector, and continuous advancements in packaging technology.

Key Market Trends & Insights

- Asia Pacific dominated the global market and accounted for the largest revenue share of over 38.0% in 2024 and is anticipated to grow at the fastest CAGR of 6.0% over the forecast period.

- The U.S. Sachet Packaging market growth can be attributed to its robust consumer packaged goods (CPG) industry and evolving consumer preferences.

- Based on material, the plastic material segment recorded the largest revenue share of over 61.0% in 2024.

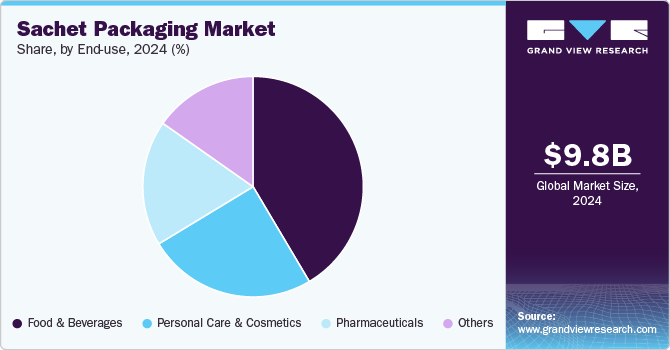

- Based on end-use, the food & beverage segment recorded the largest revenue share of over 41.0% in 2024 and is projected to grow at the fastest CAGR of 6.0% during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 9.82 Billion

- 2030 Projected Market Size: USD 13.52 Billion

- CAGR (2025-2030): 5.5%

- Asia Pacific: Largest market in 2024

Sachets are widely used across industries such as food & beverages, personal care, pharmaceuticals, and household products due to their affordability, portability, and ability to maintain product freshness. The growing consumer preference for single-use and small-sized packaging formats, particularly in developing economies, further fuels market expansion.

The sachet packaging market is driven by the growing demand for affordable packaging in emerging markets. In regions such as Asia-Pacific, Latin America, and Africa, where consumers have lower purchasing power, sachets offer an economical way to buy essential products in small quantities. For instance, in countries such as India and Indonesia, sachets of shampoo, detergent, and sauces are popular among middle- and lower-income groups. This affordability factor has led major FMCG companies such as Unilever and P&G to introduce sachet variants of their products, allowing them to penetrate deep into rural and semi-urban markets.

Another significant factor driving the market is the rise in on-the-go consumption trends. Busy lifestyles and urbanization have increased the demand for convenient, portable packaging solutions. Sachets are easy to carry, store, and dispose of, making them ideal for single-serving products such as condiments, coffee, and health supplements. The food & beverage sector has particularly benefited from this trend, with companies offering sauces, ketchup, and instant coffee in sachet formats to cater to consumer needs. Moreover, the growth of e-commerce and food delivery services has further boosted the demand for sachet packaging, as it enables portion control and minimizes packaging waste.

Technological advancements in flexible packaging materials and printing techniques have also contributed to market growth. Manufacturers are developing high-barrier films that enhance the shelf life of sachet-packed products while maintaining their freshness. Innovations in sustainable packaging, such as biodegradable and recyclable sachets, are gaining traction due to growing environmental concerns.

For instance, in April 2022, Mondi and Thimonnier, a French machine supplier, have collaborated to create recyclable packaging for liquid soap refills. The new packaging is a berlingot sachet made from a recyclable mono-material, coextruded polyethylene (PE). It reduces plastic usage by more than 75% compared to rigid plastic bottles and can replace the current industry standard of multilayer PVC refill containers, which are effectively not recyclable.

Material Insights

The plastic material segment recorded the largest revenue share of over 61.0% in 2024. Plastic is the most widely used material for sachet packaging due to its flexibility, durability, and cost-effectiveness. Plastic sachets are extensively used in food, personal care, and pharmaceutical products due to their lightweight nature and ability to be heat-sealed for longer shelf life.

The paper material segment is projected to grow at the fastest CAGR of 5.9% during the forecast period. The shift toward sustainable and biodegradable packaging solutions is a major driver for paper-based sachets. Growing regulatory restrictions on plastic waste and consumer preference for environmentally friendly packaging solutions are boosting demand. It is primarily used in dry product applications, such as sugar, salt, tea, coffee, and powdered beverages.

End-use Insights

The food & beverage segment recorded the largest revenue share of over 41.0% in 2024 and is projected to grow at the fastest CAGR of 6.0% during the forecast period. Sachet is commonly used for packaging products such as condiments (ketchup, mayonnaise), instant coffee, powdered beverages, sauces, and seasonings. The growth of sachet packaging in the food and beverage industry is primarily driven by the increasing demand for convenience food, the expanding fast-food sector, and the rising preference for single-serve packaging formats.

In the pharmaceutical industry, sachets are commonly used to package powders, granules, gels, and liquid medications, such as oral rehydration salts (ORS), vitamin supplements, and pain relief gels. The increasing demand for unit-dose packaging in the pharmaceutical sector, driven by regulatory requirements for accurate dosing and patient convenience, is a significant growth factor. Additionally, the rise in self-medication trends and the expansion of pharmaceutical distribution networks in emerging markets have boosted the demand for sachet packaging.

The personal care and cosmetics industry extensively uses sachet packaging for products such as shampoos, conditioners, hair oils, facial masks, lotions, and serums. This packaging format allows consumers to sample products before committing to larger quantities, making it a preferred choice for promotional campaigns and travel-friendly packaging. Sachets are also beneficial for maintaining product integrity and ensuring precise, single-use application.

Regional Insights

The sachet packaging market in the Asia Pacific dominated the global market and accounted for the largest revenue share of over 38.0% in 2024 and is anticipated to grow at the fastest CAGR of 6.0% over the forecast period. The prevalence of price-sensitive consumers and lower disposable incomes in many Asia Pacific countries has made sachets an essential packaging format.

India Sachet Packaging Market Trends

In markets such as India, Indonesia, and the Philippines, sachets allow consumers to purchase premium products in smaller, more affordable quantities. For example, brands such as Unilever and P&G have successfully penetrated rural markets by offering shampoos, detergents, and personal care products in sachets priced as low as 1-2 rupees or pesos. This sachetization strategy has been particularly effective in reaching the bottom-of-pyramid consumers who cannot afford full-sized products but still desire quality brands.

China's sachet packaging market growth can be attributed to several interconnected factors. The country's massive population of 1.4 billion people, combined with rapid urbanization and a growing middle class, has created significant demand for single-serve and on-the-go products. This trend is particularly evident in personal care items, food condiments, and household products. Additionally, the country’s robust manufacturing infrastructure and advanced packaging technology capabilities have contributed to its market growth. The country has invested heavily in flexible packaging production facilities, particularly in regions such as Guangdong and Zhejiang provinces.

North America Sachet Packaging Market Trends

The pharmaceutical industry in North America, particularly in the U.S., has been a major driver of sachet packaging adoption. The strict regulatory environment, coupled with the need for precise dosing and product protection, has led to increased usage of sachets for medications, vitamins, and dietary supplements. Companies such as Abbott Laboratories and Johnson & Johnson are using sachet packaging technology to ensure product stability and extend shelf life while meeting FDA requirements.

The U.S. Sachet Packaging market growth can be attributed to its robust consumer packaged goods (CPG) industry and evolving consumer preferences. The country’s consumers increasingly favor single-serve portions and on-the-go packaging solutions, which has led to the widespread adoption of sachets across various product categories. For example, companies such as Starbucks and Nestlé have successfully introduced premium coffee and beverage mixes in sachet format, catering to busy professionals and households seeking convenience without compromising quality.

Europe Sachet Packaging Market Trends

The sachet packaging market in Europe is driven by the region's strong focus on sustainability and environmental regulations, which has pushed manufacturers to innovate in eco-friendly sachet materials and designs. Companies such as Amcor plc and Huhtamaki have invested heavily in developing biodegradable and recyclable sachet solutions to meet the EU's stringent packaging waste directives, setting new industry standards.

Additionally, the region's highly developed personal care and cosmetics industry is a major driver for the market. European consumers show a strong preference for premium sample-sized products and travel-friendly packaging formats. Luxury brands like L'Oréal and Beiersdorf extensively use sachets for product sampling and travel-sized offerings, particularly in their high-end skincare lines.

Germany sachet packaging market is primarily driven by its robust personal care and cosmetics industry. The country's strong focus on sustainable packaging solutions has also positioned it as prominent in developing eco-friendly sachet materials, with companies such as Constantia Flexibles investing heavily in recyclable and biodegradable sachet technologies.

Key Sachet Packaging Company Insights

The global sachet packaging industry is highly competitive, driven by a mix of established packaging giants and regional players focusing on innovation, sustainability, and cost efficiency. Key players such as Amcor plc, Mondi, Huhtamaki, Constantia Flexibles, and Graphic Packaging International, LLC, dominate the market with extensive product portfolios.

Companies differentiate through material innovation, such as recyclable and biodegradable films, as sustainability concerns drive regulatory and consumer preferences. Emerging players and local manufacturers compete on pricing and customization, particularly in cost-sensitive regions such as Asia Pacific and Africa. Strategic partnerships, acquisitions, and R&D investments are key strategies for maintaining a competitive edge in this dynamic market.

Key Sachet Packaging Companies:

The following are the leading companies in the sachet packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- Huhtamaki

- Constantia Flexibles

- Mondi

- Graphic Packaging International, LLC

- RATTPACK

- Amber Packaging

- ePac Holdings, LLC

- Glenroy, Inc.

- Sachet Solutions

- Greendot Biopak Pvt. Ltd.

- The Sachet Company

- Budelpack

- Polysack Flexible Packaging Ltd.

Recent Developments

-

In January 2025, Arcade Beauty launched the 80.0% Paper Packette, a recycle-ready, mono-dose sample sachet designed as an alternative to plastic or foil sachets. The new paper packette is made with 80% paper material and is designed for skincare, haircare, and color cosmetics sampling.

-

In June 2023, Amcor plc expanded its AmFiber Performance Paper packaging range in Europe to include heat seal sachets for dry culinary and beverage applications such as instant coffee, drink powders, spices, seasonings, and dried soups.

Sachet Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.32 billion

Revenue forecast in 2030

USD 13.52 billion

Growth rate

CAGR of 5.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, end-use, region

States scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Key companies profiled

Amcor plc; Huhtamaki; Constantia Flexibles; Mondi; Graphic Packaging International, LLC; RATTPACK; Amber Packaging; ePac Holdings, LLC; Glenroy, Inc.; Sachet Solutions; Greendot Biopak Pvt. Ltd.; The Sachet Company; Budelpack; Polysack Flexible Packaging Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sachet Packaging Market Report Segmentation

This report forecasts revenue growth at global level, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sachet packaging market report based on material, end-use, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Paper

-

Plastic

-

Aluminum Foil

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Pharmaceuticals

-

Personal Care & Cosmetics

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global sachet packaging market was estimated at around USD 9.82 billion in the year 2024 and is expected to reach around USD 10.32 billion in 2025.

b. The global sachet packaging market is expected to grow at a compound annual growth rate of 5.5% from 2025 to 2030 to reach around USD 13.52 billion by 2030.

b. Food & beverages emerged as the dominating end-use segment within the sachet packaging market, with a value share of around 41.0% in 2024, owing to the increasing demand for convenient, single-use, and portion-controlled packaging solutions.

b. The key players in the sachet packaging market include Amcor plc; Huhtamaki; Constantia Flexibles; Mondi; Graphic Packaging International, LLC; RATTPACK; Amber Packaging; ePac Holdings, LLC; Glenroy, Inc.; Sachet Solutions; Greendot Biopak Pvt. Ltd.; The Sachet Company; Budelpack; and Polysack Flexible Packaging Ltd.

b. The growth of the sachet packaging market is driven by the rising demand for affordable and convenient packaging solutions, the expansion of the fast-moving consumer goods (FMCG) sector, and continuous advancements in packaging technology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.