Ruminant Methane Reduction Market Size, Share & Trends Analysis Report By Product (Feed Additives/ Supplements), By Animal Type (Cattle, Sheep, Goats), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-259-7

- Number of Report Pages: 147

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Ruminant Methane Reduction Market Trends

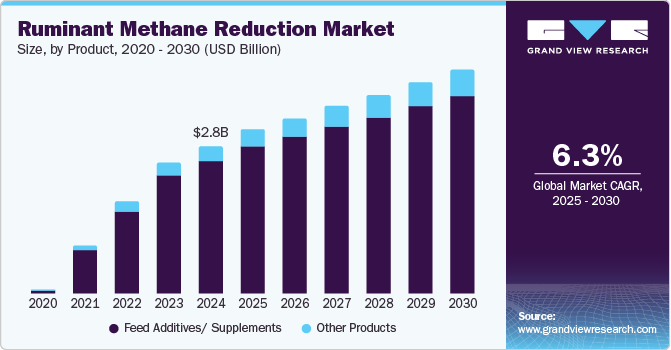

The global ruminant methane reduction market size was estimated at USD 2.79 billion in 2024 and is projected to grow at a CAGR of 6.34% from 2025 to 2030. This can be attributed to the rising investments in R&D, technological advancements, growing awareness about climate change, the need for ruminant methane (CH4) reduction, and the increase in livestock population. According to the Livestock and Poultry: World Markets and Trade report of the U.S. Foreign Agricultural Service, the U.S. had 87.8 million cattle and 74.97 million swine stock as of January 2024.

Moreover, an increase in product approvals and growing product launches is also boosting demand for ruminant methane reduction products. For instance, in May 2024, Elanco Animal Health announced the FDA's completion of its multi-year review of Bovaer, a methane-reducing feed ingredient for dairy cows. Bovaer has been approved for its safety and efficacy, marking a major milestone toward climate-neutral dairy farming. Feeding one tablespoon of Bovaer per cow daily can reduce CH4 emissions by 30%, translating into significant carbon footprint reductions. Elanco expects Bovaer to launch in the U.S. dairy market by Q3 2024, providing farmers with financial incentives through carbon credits. Elanco is also expanding Bovaer’s commercialization across North America, including Canada and Mexico, in partnership with dsm-firmenich.

Increased research and development (R&D) efforts are a significant factor driving the growth of the market. The agricultural sector is collaborating with research projects to reduce CH4 emissions from cattle feedlots. Companies are funding research to create new and efficient solutions that help the environment and enhance productivity and efficiency in the industry. For instance, in May 2023, the Nissui Corporation invested in the Immersion Group, an Australian startup that focuses on cultivating Asparagopsis, a red seaweed known to reduce emissions from ruminants.

The development of innovative technologies, such as feed additives, vaccines, and dietary supplements, has provided effective ways to reduce CH4 emissions from ruminants without compromising their health or productivity. These advancements have fueled the growth of the market. For instance, in December 2023, Mootral, a biotech organization based in the UK, announced the completion of in vitro development and testing phase of its Enterix Advanced technology and is set to begin a series of in vivo trials that will significantly enhance the methane reduction efficacy of the original Enterix.

Growing awareness about climate change and ruminant methane emissions is a significant driver for the adoption of methane reduction strategies in the livestock industry. As public awareness of sustainable practices increases, stakeholders recognize the significance of reducing emissions from livestock to meet climate commitments. Hence, demand for solutions to reduce methane from ruminants is anticipated to grow, fostering development and adoption of innovative technologies and practices within the market.

The increase in livestock population is a major factor propelling the market growth. As the global demand for meat and dairy products continues to rise, there has been a corresponding increase in the number of ruminant animals such as cattle, sheep, and goats. Ruminant animals are known to produce methane as part of their digestive process, primarily through enteric fermentation in their rumen. This increased production contributes to climate change and highlights the urgency of implementing reduction measures. The Ministry of Fisheries, Animal Husbandry & Dairying reports that as per the 20th Livestock Census in India, there are approximately 303.76 million bovines (cattle, Mithun, buffalo, and yak), 9.06 million pigs, 148.88 million goats, 74.26 million sheep, and around 851.81 million poultry.

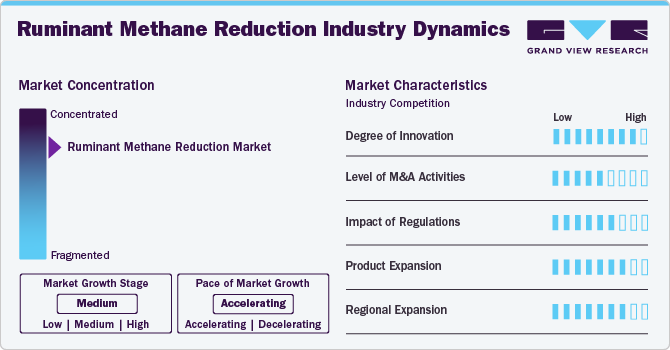

Market Concentration & Characteristics

The market growth stage is medium, and the pace of the market growth is accelerating. The market is characterized by a high degree of innovation owing to the rapid technological advancements, increasing research and developments, collaborations between industry stakeholders, research institutions, and government agencies. For instance, in October 2023, the Department for Environment, Food and Rural Affairs (DEFRA) announced its commitment to collaborating with industry to implement measures by introducing methane-suppressing feed products to reduce livestock emissions

The market is also characterized by a moderate level of merger and acquisition (M&A) activity by the players. This is due to several factors, including the aim to influence synergies, accelerate product development, and expand market reach within the sector. In May 2023, Alltech acquired a majority stake in Agolin, a Swiss company specializing in plant-based nutrition solutions to enhance herd performance and sustainability, using Agolin's certified feed additive for methane reduction in ruminants, contributing to global climate protection initiatives, and supporting farmers in achieving environmental goals.

The ruminant methane reduction market is also subject to increasing regulatory scrutiny as governments across countries aim to tackle climate change by reducing greenhouse gas emissions. Regulatory bodies such as the Environmental Protection Agency (EPA) in the U.S., the European Union, and various national governments have implemented regulations and policies to address this issue. These regulations often include emission reduction targets, incentives for adopting reduction technologies, and monitoring requirements to ensure compliance.

The market has high product expansion. The key players in the ruminant methane reduction market have been actively expanding their product portfolios to offer a wider range of solutions for farmers looking to reduce emissions from their livestock. In April 2023, CH4 Global, Inc. launched Methane Tamer Beef Feedlot, a proprietary methane-reducing feed formulation for cattle containing Asparagopsis seaweed to achieve up to 90% reduction in emissions.

Key players in this market have been expanding their presence regionally to capitalize on the growing demand for sustainable solutions to reduce emissions from ruminant livestock. In January 2024, CH4 Global began construction of the world's first commercial-scale Asparagopsis seaweed facility in South Australia, aiming to reduce CO2- equivalent emissions by a billion metric tons by 2030.

Product Insights

Feed Additives/ Supplements dominated the market and accounted for a share of over 90% in 2024. Ongoing R&D efforts have led to the discovery of novel feed additives and supplements that are more effective at reducing methane emissions without compromising animal health or productivity. These advancements have generated interest and increased adoption among livestock producers. For example, Agolin SA, a Swiss company, has developed a feed additive containing extracts from coriander seed oil, clove, and wild carrot, which has been shown to shift microbial populations in the rumen and increase milk production while reducing emissions by 10% per animal.

Other products segment is anticipated to grow at the fastest CAGR over the forecast period. Other products include wearables devices such as Zelp and ozone in drinking water. As awareness of the harmful effects of methane emissions grows, the demand for innovative reduction solutions is expected to increase, driving further R&D in this field and expanding the market for methane reduction products and services. Furthermore, growing strategic initiatives such as partnerships between key players to advance ruminant methane reduction solutions are expected to boost demand for ruminant reduction solutions. For instance, in July 2024, a U.S. start-up, ArkeaBio, has developed a prototype vaccine that reduces methane emissions from cows by 13% in early trials involving 10 cows. Methane, a potent greenhouse gas, is produced in large quantities as cattle digest grasses and hay in their rumen. Agriculture, particularly cattle farming, is a major source of human-caused pollution. The company plans to commercially launch the vaccine within three years.

Animal Insights

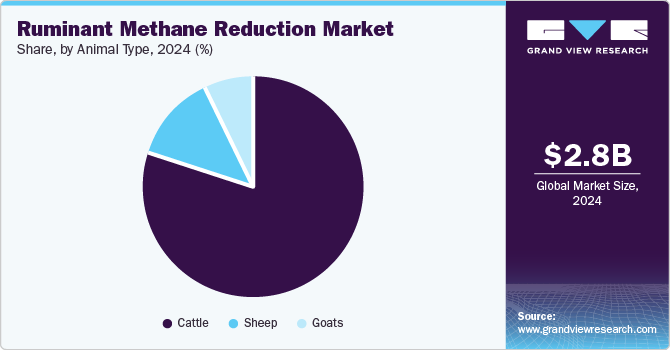

Cattle accounted for the largest market revenue share of 80.08% in 2024. This is attributable to the increasing awareness of the environmental impact of methane emissions from cattle and the rising focus of government and regulatory bodies on reducing greenhouse gas emissions, including methane, from agricultural sources. For instance, In December 2023, Canada introduced economic incentives for beef cattle farms to reduce emissions through the Reducing Enteric Methane Emissions from Beef Cattle (REME protocol), encouraging changes in diets and management practices to cut enteric methane emissions and earn offset credits.

The goats segment is expected to register the fastest CAGR during the forecast period, owing to the increasing awareness of the environmental impact of methane emissions. Furthermore, developing new technologies and innovations specifically targeted at reducing methane emissions from goats is also driving demand for reduction solutions in the goat farming sector. These advancements may include dietary supplements, feed additives, or management practices that minimize production.

Regional Insights

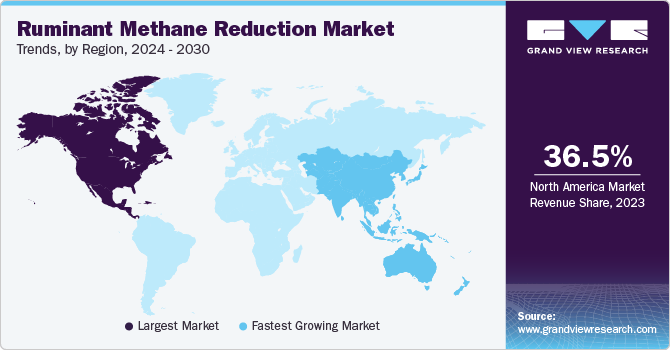

North America ruminant methane reduction market dominated the global market with a share of more than 36% in 2024. The investments in ruminant methane reduction initiatives and the availability of financial incentives and support mechanisms for reduction projects are contributing to the expansion and sustainability of the ruminant methane reduction market in North America. For instance, in December 2023, the U.S. Department of Agriculture’s (USDA) National Institute of Food and Agriculture (NIFA) announced a USD 10 million investment in two groundbreaking & interdisciplinary initiatives to advance the understanding and mitigation of emissions, a potent Greenhouse Gas (GHG) naturally produced by ruminant animals.

U.S. Ruminant Methane Reduction Market Trends

The ruminant methane reduction market in the U.S. dominated the market with a share of over 90% in 2024. This can be attributed to government initiatives in the US aimed at incentivizing and supporting livestock producers in adopting reduction technologies and practices. For instance, the U.S. Methane Emissions Reduction Action Plan, part of the Inflation Reduction Act, aims to diminish methane output across sectors, including ruminant agriculture.

Europe Ruminant Methane Reduction Market Trends

Europe ruminant methane reduction market was identified as a lucrative region in this industry due to the stringent environmental regulations, such as those set by the European Union directives and national policies. These regulations create a legal framework that compels agricultural stakeholders to reduce emissions from ruminants. These regulations often include targets & standards for emissions reduction, incentivizing the adoption of technologies and practices aimed at mitigating methane.

The UK ruminant methane reduction market is expected to grow rapidly in the coming years due to rising government initiatives. Through policies and programs aimed at mitigating climate change & promoting sustainable agriculture, the government fosters innovation and adoption of technologies & practices to reduce emissions from ruminants. Initiatives such as the Agriculture Bill, the Clean Air Strategy, and the Environmental Improvement Plan provide regulatory frameworks, incentives, and support for farmers to implement reduction measures

Asia Pacific Ruminant Methane Reduction Market Trends

Asia Pacific ruminant methane reduction market is anticipated to witness the fastest CAGR during the forecast period. The escalating emissions in the Asia Pacific are catalyzing growth in the ruminant methane reduction market. With a significant portion of global emissions originating from ruminant livestock in this region, there is a pressing need for effective mitigation strategies. This rise in emissions is spurring increased demand for reduction solutions. According to the Food and Agriculture Organization of the United Nations, the livestock sector in the Asia Pacific is confronting unprecedented challenges due to population expansion and the effects of climate change

Ruminant methane reduction market in Japan is expected to grow rapidly in the coming years due to R&D efforts to develop effective feed additives and technological innovations. In December 2023, KAJIMA CORPORATION developed a groundbreaking technology using seaweed to drastically reduce emissions from cow burps. Methane is a potent GHG, and the seaweed, Asparagopsis taxiformis, has proven effective in suppressing these emissions when added to cattle feed. Collaborating with dairy farmers, Kajima aims to commercialize this innovation.

China ruminant methane reduction market held a substantial market share in 2024 owing to collaborations between government agencies, research institutions, industry stakeholders. By pooling resources, expertise, and efforts, these collaborative initiatives enable the development and adoption of innovative reduction solutions tailored to the specific needs and challenges of the Chinese agricultural sector. In November 2023, China introduced the "Methane Emission Control Action Plan," which plans to significantly decrease methane emissions in China's various sectors, including agriculture.

Latin America Ruminant Methane Reduction Market Trends

The increasing global cattle population has led to a surge in emissions, primarily from their digestive process, prompting the growth of the Latin America ruminant methane reduction market. This market addresses the urgent need to mitigate methane, a potent GHG, by offering feed additives and dietary modifications to curb emissions from ruminant livestock, thereby contributing to environmental sustainability efforts worldwide.

Brazil ruminant methane reduction market initiatives to reduce carbon emissions. With increasing awareness of the environmental impact of emissions from livestock, efforts to curb these emissions have become a focal point of sustainability initiatives. These efforts include developing and implementing technologies such as feed additives and dietary modifications to mitigate production in ruminant animals.

MEA Ruminant Methane Reduction Market Trends

In the Middle East and Africa, collaboration among government agencies, nonprofits, private companies, and international partners is crucial for addressing challenges and fostering a sustainable market for ruminant methane reduction. Stakeholders overcome obstacles such as limited awareness and high technology costs by offering grants, driving awareness campaigns, and advocating for supportive policies. Through pilot projects, knowledge sharing, capacity building, and international partnerships, these efforts accelerate the adoption of reduction practices, ultimately paving the way for a greener, more resilient agricultural sector in the region.

South Africa's ruminant methane reduction market is growing due to rising awareness of methane's link to climate change, driven by government initiatives, research, and consumer demand for sustainable farming. The government, through the Department of Agriculture and Department of Environment, regulates agricultural methane reduction efforts. Farmers are adopting solutions such as feed additives and improved grazing management to reduce emissions. A research project by the Red Meat Industry highlighted dairy cattle's 11% contribution to livestock CH4 emissions, with South Africa aiming for a 20%-30% emissions reduction by 2030.

Key Ruminant Methane Reduction Company Insights

The market is competitive as companies, research institutions, and governmental organizations vie to develop & commercialize innovative solutions to mitigate emissions from livestock. Some of the key companies operating in the ruminant methane reduction market include DSM, Alltech., Fonterra Cooperative Group Limited, and Cargill Incorporated.

Key Ruminant Methane Reduction Companies:

The following are the leading companies in the ruminant methane reduction market. These companies collectively hold the largest market share and dictate industry trends.

- DSM

- Blue Ocean Barns

- Alltech.

- CH4 GLOBAL, INC.

- Mootral Private

- Symbrosia Inc.

- Fonterra Co-operative Group Limited

- Elanco Animal Health Inc.

- Rumin8 Ltd

- Zelp Ltd

- Cargill, Incorporated

- FutureFeed

Recent Developments

-

In October 2024, Rumin8, an Australian climate tech company, has received feed ingredient approval from Brazil’s Ministry of Agriculture for its methane-reducing supplement for livestock. This marks a significant step towards commercialization, especially in Brazil, which has the world’s largest cattle herd. Rumin8’s technology, using the compound Tribromomethane (TBM), has shown methane reductions of up to 86% and improved cattle weight gain in trials.

-

In February 2024, dsm-firmenich and Donau Soja partnered to highlight the environmental impact of feed ingredients using Sustell, aiding businesses in measuring & improving sustainability in the animal protein value chain. Their collaboration aimed to reduce greenhouse gas emissions from food production and enhance transparency in the feed & food industry.

-

In January 2024, Rumin8 has successfully opened its manufacturing demonstration plant in Perth, Western Australia, to refine production processes for its methane-reducing feed and water supplements for livestock.

-

In November 2023, Athian.ai introduced the first voluntary livestock carbon in setting marketplace, collaborating with Elanco Animal Health to reduce enteric methane emissions and enhance feed utilization in the dairy industry.

Ruminant Methane Reduction Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 3.11 billion |

|

Revenue forecast in 2030 |

USD 4.22 billion |

|

Growth rate |

CAGR of 6.34% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical Data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

October 2024 |

|

Quantitative units |

Revenue in USD billion/million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, animal type, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Norway; Sweden; Denmark; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

DSM; Blue Ocean Barns; Alltech.; CH4 GLOBAL, INC.; Mootral Private; Symbrosia Inc.; Fonterra Co-operative Group Limited; Elanco Animal Health Inc; Rumin8 Ltd; Zelp Ltd; Cargill, Incorporated; FutureFeed |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Ruminant Methane Reduction Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ruminant methane reduction market report based on product, animal type and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Feed Additives/ Supplements

-

Plant-based

-

Chemical-based

-

Microbial-based

-

-

Other Products

-

-

Animal Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cattle

-

Sheep

-

Goats

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global ruminant methane reduction market size was estimated at USD 2.79 billion in 2024 and is expected to reach USD 3.11 billion in 2025.

b. The global ruminant methane reduction market is expected to grow at a compound annual growth rate of 6.34% from 2025 to 2030 to reach USD 4.22 billion by 2030.

b. North America ruminant methane reduction market dominated the market in 2024. The investments in ruminant methane reduction initiatives and the availability of financial incentives and support mechanisms for methane reduction projects contribute to the expansion and sustainability of the ruminant methane reduction market in North America.

b. Some key players operating in the ruminant methane reduction market include DSM ; Blue Ocean Barns ; Alltech. ; CH4 GLOBAL, INC. ; Mootral Private ; Symbrosia Inc.; Fonterra Co-operative Group Limited ; Elanco Animal Health Inc; Rumin8 Ltd ; Zelp Ltd Cargill, Incorporated; FutureFeed

b. Key factors that are driving the market growth include rising investments in R&D, technological advancements, growing awareness about climate change and need for ruminant methane reduction and increasing in livestock population. According to the Livestock and Poultry: World Markets and Trade report of the U.S. Foreign Agricultural Service, the U.S. had 87.8 million cattle and 74.97 million swine stock as of January 2024.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."