Rum Market Size, Share & Trends Analysis Report By Product Type (Dark & Golden Rum, White Rum, Flavored & Spiced Rum), By Distribution Channel (Off-Trade, On-Trade), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-924-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

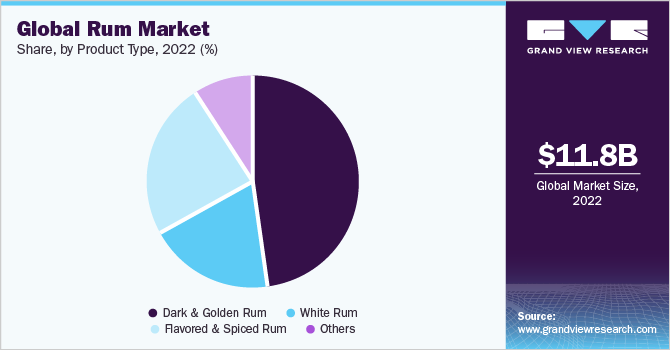

The global rum market size was valued at USD 11.77 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.6% from 2023 to 2030. Factors such as increasing consumer interest and expanding cocktail culture are expected to drive the industry growth globally. Product innovation and diversificationhave attracted new consumers and provided existing consumers with a wider range of options to choose from. Furthermore, there has been a shift in consumer preferences toward spirits with natural and authentic qualities. Rum, as a product with a rich history and often produced from natural ingredients like sugarcane, appeals to consumers seeking authentic and artisanal products.

The growing curiosity and interest among millennial consumers in the authenticity and quality of alcoholic beverages is driving the market. Craft rum, with its smooth flavor, premium quality, and genuine taste, is particularly popular among consumers. It is often produced on a small scale by producers who actively participate in the production process. Artisan producers promote their drinks by emphasizing the country of origin, age, and organic certifications, which attract greater attention from customers. Consumers are increasingly seeking quality drinks with an interesting story, craft credentials, and origin.

Rum is a distilled alcoholic drink made from sugarcane juice or fermented sugarcane molasses which contains natural flavors and oil and contains 40% ABV to 57.7% ABV in minimum overproof rums. The rising popularity of cocktail culture globally has led to an increased sense of adventure among consumers when it comes to their beverage preferences. Rum, being a versatile spirit, has become a sought-after choice in cocktail recipes like mojitos, piña coladas, and daiquiris. As the cocktail culture continues to expand, the demand for rum has witnessed a significant surge.

The presence and engagement of the younger generation in social establishments such as nightclubs, pubs, and bars have created a favorable environment for rum consumption. This demographic demonstrates a higher propensity for exploration and seeks out distinctive and trendy alcoholic beverages, including rum-based cocktails. The growing influence of this demographic within these establishments further contributes to the growth of the rum industry.According to Distilled Spirits Council, millennials constitute just 29% of the drinking-age population; however, they over-index on consumption across all major types of alcohol. In spirits alone, they comprise 32% of consumption by value and this is expected to continue as millennials mature and their buying power increases.

The association of rum with tropical destinations has made it a popular choice among tourists and travelers. With the ongoing growth in tourism, particularly in renowned rum-producing regions like the Caribbean and Latin America, the demand for rum as a souvenir and a way to reminisce about holiday experiences has been on the rise. This increased demand for rum as a memento and a connection to vacation memories has played a significant role in driving the growth of the rum industry.

The shifting trend toward flavored and spiced rums is driving producers to focus on expanding their offerings in the flavored category. This growing demand for variety and innovation is fueled by frequent new product launches. The introduction of new products plays a significant role in attracting new consumers and stimulating the rapid growth of the rum market. For instance, in March 2023, the renowned black spiced rum brand, The Kraken Rum, expanded its portfolio by venturing into the gold spiced rum category with the introduction of a new product called The Kraken Gold Spiced Rum. The new product, called Kraken Gold, is aged for two years in oak barrels and has notes of vanilla, cinnamon, and caramel. It is bottled at 40% ABV.

Distribution Channel Insights

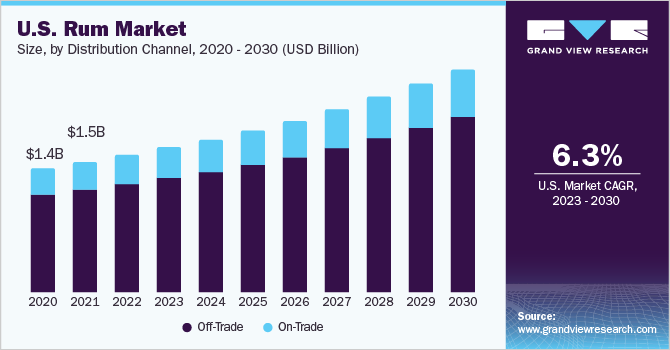

The off-trade segment dominated the market and accounted for the highest revenue share of over 75.8% in 2022 and is expected to grow significantly during the forecast period. The convenience of purchasing spirits from various retail channels such as supermarkets, hypermarkets, liquor stores, and specialty stores contributes to the capture of a substantial market share.

Consumers' preference for buying rum from these channels further strengthens their position in the market for the foreseeable future. The segment growth is also expected to be boosted by the introduction of new brands by several market leaders through off-trade channels. For instance, in October 2021, SUNCAMINO PTY LTD, a Cape Town-born liquor brand, was launched in the UK and is exclusively distributed by 31Dover, an independent supplier.

The on-trade is expected to be the fastest-growing distribution channel with a CAGR of 6.0% over the forecast period. Major suppliers focused on e-commerce portals for selling their products in this growing digitalization world where consumers want to buy online and receive the product at their doorstep.

Consumers’ inclination for ordering products from home, the easy availability of products in these channels, and changing buying behavior of customers during the pandemic, are expected to drive the segment’s growth in the near future. According to Campari's UK Rum Report 2022, spiced/flavored rum grabbed a 6.3% share of spirits in the on-trade in 2020, a rise of 1.2% from 2019, with flavor being the main factor influencing consumer interest, along with the availability of flavors at the on-trade channel.

Product Type Insights

The dark and golden rum dominated the market and accounted for a revenue share of 45.7% in 2022 owing to consumer preference and production. Dark and golden rums tend to undergo an extended aging process compared to other varieties. This aging duration contributes to the development of enhanced flavors, intricate profiles, and a velvety texture in the rum, making it more appealing to many consumers.

Old age dark rum has a rising demand from millennial consumers as it is smooth in taste. It is aged in oak barrels and has rich flavors than others when used in cocktails. Bacardi Ltd. has been focusing on the premiumization of rum / dark spirits by continuously investing in Ocho, Cuatro, and Diez. Dark rum has been recognized globally for its value and quality. For instance, in May 2022, Denizen Vatted Dark Rum from Guyana won two gold medals and the "Best Value of the Year" award at the 2022 Bartender Spirits Awards in San Francisco, U.S. Such trends and validations are likely to bode well for the growth of the dark rum market.

Flavored and spiced rum is projected to register a CAGR of 6.2% over the forecast period. This growth can be attributed to the rising customer demand for these varieties, as well as the continuous introduction of innovative products within this category. Flavored and spiced rums are particularly favored in cocktails due to their ability to impart distinct and enjoyable taste profiles. For instance, in May 2023, Bacardi Rum introduced its latest flavored rum offering, Mango Chile, to the U.S. market. This new variant had initially debuted in Mexico before making its way to American shores. Mango Chile is a fusion of natural mango extracts, spicy chili, and Bacardi white rum, creating a unique and captivating flavor profile.

Regional Insights

The Asia Pacific rum market accounted for the largest revenue share of over 45.1% in 2022 and is expected to grow at a substantial CAGR from 2023 to 2030. This is owing to the presence of a huge population, rise in disposable income, easy availability of products, and increasing popularity of rum in the younger generation. India and the Philippines markets for rum play a significant role in the overall regional dynamics and are expected to grow at a significant CAGR, as both countries are major producers and consumers of rum. Australia and China are expected to witness growth at a CAGR of 5.2% and 5.4% from 2023 to 2030, respectively.

The growing expansion of experiential liquor retails in India, Japan, Australia, and other Asian countries will boost sales from the off-trade channels. Local and international brands have launched experiential liquor retail outlets in metros and cities with larger capacities to increase their sales of liquor products like rums and whiskies. For instance, in February 2022, Living Liquidz opened 'Mansionz,' a luxury lifestyle experiential liquor store in Bangalore, India. The first-of-its-kind premium experiential liquor store with a New York-style tasting room provides visitors with an enhanced experience. Such stores will boost the sales of rum and other spirits through the off-trade channel.

North America is estimated to be the fastest-growing market for rum with a CAGR of 6.2% from 2023 to 2030. The presence of a large number of global producers, rising demand for premium rums, and an increase in consumption of flavored and spiced rums in cocktails are propelling the market growth. The U.S. rum market is expected to grow at a CAGR of 6.3% from 2023 to 2030.

Europe is expected to witness a steady CAGR of 5.7% over the forecast period owing to favorable trade agreements and tariff reductions. In 2021, the rum category was saved from taxes after the European Union and the U.S. agreed to a five-year exemption of tariffs on goods including Cognac and vodka. The suspension of the EU's 25% tax on rum, vodka, and brandy from the U.S. due to the Boeing-Airbus trade dispute is likely to positively impact the growth of the Europe market. It opens up opportunities for U.S. rum producers, enhances availability and diversity, and promotes competitive pricing, thus driving market growth in the region.The Germany rum market emerged as a dominant market in Europe region with a revenue share of 24.9% in 2022. The UK market for rum is expected to grow at a CAGR of 6.4% from 2023 to 2030.

Key Companies & Market Share Insights

The market includes both international and domestic participants. Brand market share analysis indicates that key market players are focusing on strategies such as new product launches, partnerships, mergers & acquisitions, global expansion, and others. Some of the initiatives include:

-

In January 2023, Brown‑Forman Corporation completed the acquisition of the Diplomático Rum brand and related assets from Distillers United Group S.L. (Spain). In October 2022, the company announced its agreement to purchase the brand. This acquisition marked Brown‑Forman’s entry into the growing super-premium+ rum category.

-

In March 2022, the UK division of Proximo Spirits introduced a coffee-flavored version of its flagship The Kraken Black Spiced Rum in the UK The Kraken Roast Coffee is the first flavored rum from Cuervo‘s Proximo Spirits unit and was made available through both on- and off-trade channels.

-

In July 2021, Takamaka Rum introduced a new series called the Seychelles Series, which comprises five distinct rums: Rum Blanc, Zannannan (Pineapple), Dark Spiced, Overproof, and Koko (Coconut). These rums undergo the process of distillation from molasses using a continuous column still and are then diluted with natural spring water sourced from Takamaka's water source in the Seychelles National Park. The intention behind the Seychelles Series is to encapsulate the unique identity of Takamaka Rum and its origin in the Indian Ocean. To reflect the introduction of this new series and appeal to both the on-trade and consumers, Takamaka has undergone a comprehensive redesign of its visual identity, including the bottles and brand assets.

Some prominent players in the global rum market include:

-

Bacardi Limited

-

Davide Campari-Milano Spa

-

Demerara Distillers Ltd.

-

Diageo Plc

-

LT Group Inc.

-

Nova Scotia Spirit Co.

-

Pernod Ricard SA

-

Suntory Holdings Ltd.

-

William Grant & Sons Ltd.

-

Mohan Meakin Limited

Rum Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 12.32 billion |

|

Revenue forecast in 2030 |

USD 18.15 billion |

|

Growth rate |

CAGR of 5.6% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2017 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Report updated |

August 2023 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product type, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Germany; U.K.; France; Russia; Italy; China; Philippines; India; Japan; Australia; Brazil; Argentina; South Africa |

|

Key companies profiled |

Bacardi Limited; Davide Campari-Milano Spa; Demerara Distillers Ltd.; Diageo Plc; LT Group Inc.; Nova Scotia Spirit Co.; Pernod Ricard SA; Suntory Holdings Ltd.; William Grant & Sons Ltd.; Mohan Meakin Limited |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Rum Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global rum market report based on product type, distribution channel, and region:

-

Product Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Dark and Golden Rum

-

White Rum

-

Flavored and Spiced Rum

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

Off-Trade

-

On-Trade

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

- Europe

-

Germany

-

U.K.

-

France

-

Russia

-

Italy

-

-

Asia Pacific

-

China

-

Philippines

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global rum market size was estimated at USD 11.77 billion in 2022 and is expected to reach USD 12.32 billion in 2023.

b. The rum market is expected to grow at a compound annual growth rate of 5.6% from 2023 to 2030 to reach USD 18.15 billion by 2030

b. The dark and golden rum dominated the market with a share of 45.7% in 2022 owing to consumer preference and production. Dark and golden rums tend to undergo an extended aging process compared to other rum varieties. This aging duration contributes to the development of enhanced flavors, intricate profiles, and a velvety texture in the rum, making it more appealing to many consumers

b. Some of the key market players in the rum market are Bacardi Limited; Davide Campari-Milano Spa; Demerara Distillers Ltd.; Diageo Plc; LT Group Inc.; Nova Scotia Spirit Co.; Pernod Ricard SA; Suntory Holdings Ltd.; William Grant & Sons Ltd.; Mohan Meakin Limited

b. Factors such as increasing consumer interest and expanding cocktail culture are expected to drive the industry growth globally. Product innovation and diversification have attracted new consumers and provided existing consumers with a wider range of options to choose from. Furthermore, there has been a shift in consumer preferences toward spirits with natural and authentic qualities. Rum, as a product with a rich history and often produced from natural ingredients like sugarcane, appeals to consumers seeking authentic and artisanal products.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."