- Home

- »

- Communications Infrastructure

- »

-

Rugged Servers Market Size & Share, Industry Report, 2033GVR Report cover

![Rugged Servers Market Size, Share & Trends Report]()

Rugged Servers Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Type (Rackmount Servers, Blade Servers, Edge Servers), By Memory Size, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-393-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Rugged Servers Market Summary

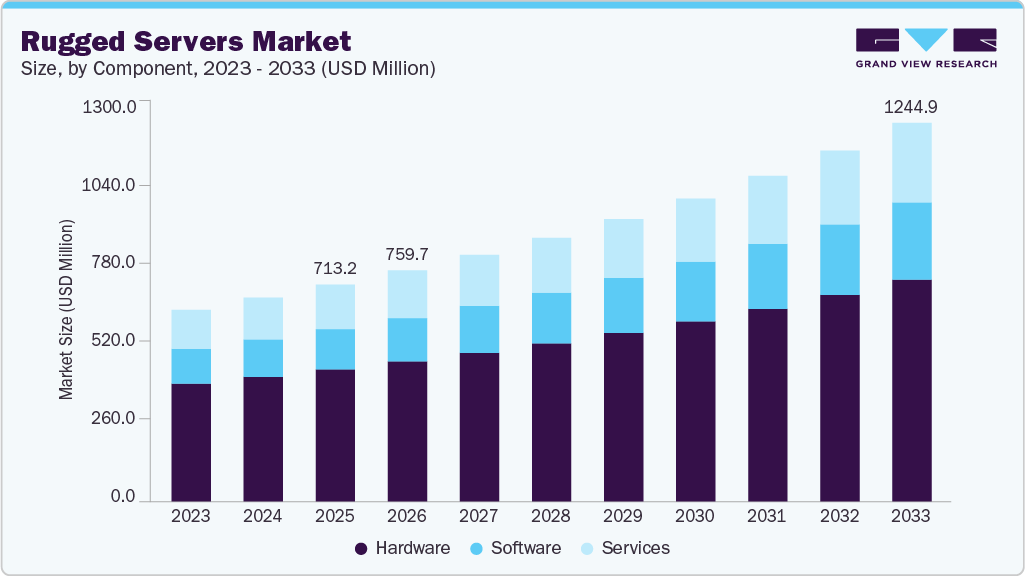

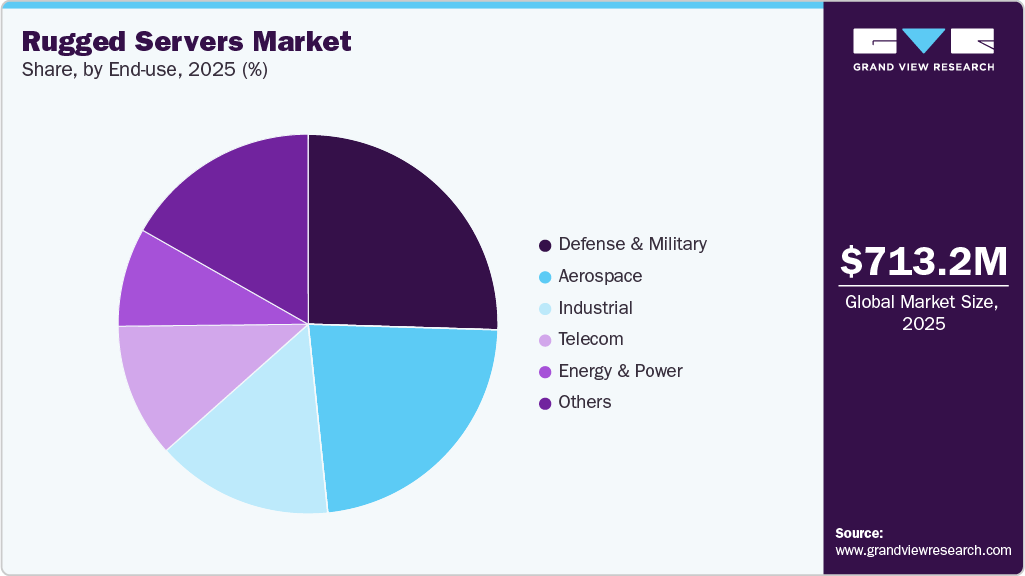

The global rugged servers market size was estimated at USD 713.2 million in 2025 and is projected to reach USD 1,244.9 million by 2033, growing at a CAGR of 7.3% from 2026 to 2033. This growth can be attributed to the increasing demand for high-performance computing in challenging and mission-critical environments, including defense, aerospace, industrial automation, telecommunications, transportation, and energy.

Key Market Trends & Insights

- North America held a 38.9% revenue share of the global rugged servers market in 2025.

- In the U.S., the rugged server market is driven by increasing defense modernization programs, demanding operational requirements across military and industrial sectors.

- By component, the hardware segment held the largest revenue share of 60.9% in 2025.

- By application, the standard segment held the largest revenue share in 2025.

- By type, the rugged rackmount servers segment accounted for the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 713.2 Million

- 2033 Projected Market Size: USD 1,244.9 Million

- CAGR (2026-2033): 7.3%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

This demand is further fueled by the expansion of 5G and edge computing, rising investments in smart infrastructure, and the growing deployment of military and public safety technologies. In addition, the growing adoption of IoT, AI-driven analytics, and autonomous systems across various industries drives the requirement for reliable and durable servers that can operate under extreme temperatures, shock, vibration, and dust conditions, accelerating market growth. Recent advancements in the rugged server industry include the integration of powerful processors, enhanced data storage capabilities, and improved networking features. For instance, in September 2025, Dell launched the PowerEdge XR8720t in the United States, delivering a rugged, single-server solution that enhanced Cloud RAN and edge deployments by improving performance, lowering costs, and strengthening connectivity. Furthermore, innovations such as Non-Volatile Memory Express (NVMe) storage technology enable faster data access and processing, which is crucial for applications requiring real-time data analysis.

In addition, rugged servers are increasingly equipped with advanced security features to protect sensitive data from cyber threats, ensuring critical operations remain secure in hostile environments. Current trends indicate enhanced processing capabilities and integration with emerging technologies, such as 5G, for improved connectivity on the go. However, hurdles remain, including steep upfront expenses and risks to data security at exposed sites. Companies such as Dell Technologies, Siemens, and Mercury Systems lead the way by focusing on innovations that address these ongoing needs.

Component Insights

The hardware segment accounted for the largest revenue share of 60.9% in 2025, as technological advancements and the rising need for reliable performance in harsh environments continue to fuel the growth of advanced hardware solutions. To meet these demands, manufacturers are focusing on enhancing the durability of server components, making them more resistant to physical impacts, extreme temperatures, dust, and moisture. Using cutting-edge materials and design practices enables these systems to perform consistently under challenging conditions. The trend has encouraged vendors to introduce next-generation, military-grade hardware designed to withstand extreme operational demands. For instance, Core Systems released the Rugged Cisco C220 M7 2U Server, offering a military-grade, all-aluminum design engineered for harsh environments. Such advancements strengthen the segment’s leadership by expanding adoption across mission-critical environments and accelerating overall market growth.

The software segment is expected to register the fastest CAGR over the forecast period from 2026 to 2033. The expansion of software solutions for rugged servers is driven by the demand for tailored applications and management tools that support reliable performance and security in demanding conditions. These environments require specialized software for real-time monitoring, predictive maintenance, and remote diagnostics, ensuring smooth and efficient server operations. In addition, heightened cybersecurity concerns in critical sectors are pushing the development of advanced software to defend against cyber threats and maintain data integrity. As rugged servers play an increasingly vital role in mission-critical tasks across various industries, the need for software that enhances their functionality, control, and protection continues to grow.

Type Insights

The rugged rackmount servers segment accounted for the largest revenue share in 2025, driven by the increasing demand for secure, high-performance computing in space-constrained and environmentally harsh settings across defense, industrial, and telecommunications sectors. These servers offer scalability, centralized processing, and enhanced durability, making them ideal for deployment in mobile command centers, field data centers, and edge infrastructure. As industries adopt 5G, AI, and IoT technologies, the demand for reliable, rack-mounted computing solutions that can withstand shock, vibration, temperature extremes, and dust continues to increase, thereby further boosting market expansion. This growing demand has encouraged vendors to introduce advanced, highly customizable rackmount solutions designed for modern mission-critical workloads. For instance, in July 2025, RUGGED SCIENCE launched its NOMAD Rugged Rackmount Server Series, offering customizable 1U–3U systems engineered and assembled in Maryland, U.S. the lineup provided flexible, high-performance, rugged server options tailored to mission-specific needs with enhanced control, reliability, and deployment efficiency.

The rugged edge servers segment is expected to register the fastest CAGR over the forecast period from 2026 to 2033. The proliferation of AI and IoT technologies generates vast volumes of data at the network edge. Rugged edge servers equipped with AI acceleration, such as GPUs or dedicated AI chips, allow organizations to perform inferencing and advanced analytics on-site, eliminating the need to transmit sensitive or high-volume data to distant data centers. This capability is particularly valuable in autonomous vehicle deployments, predictive maintenance of industrial machinery, and smart city infrastructure, where response time and data sovereignty are vital. In addition, edge servers reduce operational risks by enabling localized computing even in areas with limited or unreliable connectivity, ensuring continuous functionality in mission-critical applications.

Memory Size Insights

The <256 GB segment dominated the market and accounted for the largest revenue share in 2025. Rugged servers with less than 256 GB of memory are experiencing growth due to rising demand for affordable, energy-efficient solutions tailored to applications with moderate memory requirements. Sectors such as manufacturing, logistics, and transportation often rely on durable servers that can effectively manage data processing tasks without requiring high memory capacities. These servers offer a cost-efficient option with lower power consumption, making them well-suited for environments where budget limitations and energy efficiency are key priorities.

The 512 GB-1 TB segment is expected to grow at the fastest CAGR over the forecast period. Rugged servers with 512 GB to 1 TB of memory are gaining traction due to the growing need for high-performance computing in data-heavy and mission-critical environments. Industries such as defense, aerospace, and oil and gas depend on these servers to handle vast datasets, execute complex computations, and support real-time analytics. Their substantial memory capacity enables reliable, scalable performance under demanding conditions, making them essential for applications that require advanced processing power and robust data management capabilities.

Application Insights

The standard segment dominated the market and accounted for the largest revenue share in 2025, due to its adaptability and wide-ranging use across industries that require dependable and durable computing systems. These servers are designed to deliver a balance of durability and general-purpose performance, making them well-suited for applications in various fields, including industrial automation, transportation, and telecommunications. As organizations seek reliable infrastructure capable of operating effectively in challenging environments, the need for standard rugged servers grows. Their ability to perform consistently across varied conditions and support diverse operational needs contributes significantly to their expanding market presence.

The dedicated segment is expected to grow at the fastest CAGR during the forecast period from 2026 to 2033. This segment consists of highly customized, purpose-built systems engineered for mission-critical and specialized operations in extreme environments, where off-the-shelf solutions cannot meet stringent requirements for performance, security, compliance, and reliability. These servers are deployed in defense and military applications for command and control, radar data processing, secure communications, and battlefield intelligence. The market growth is driven by the integration of advanced technologies, including AI acceleration, enhanced cybersecurity protocols, and high-density computing, which enable real-time decision-making with zero tolerance for downtime. For instance, in July 2025, Rugged Science launched the NOMAD rugged rackmount server lineup in 1U, 2U, and 3U configurations in North America, targeting the defense and military dedicated application segment with customizable, high-performance solutions for mission-critical environments.

End-use Insights

The defense & military segment dominated the market and accounted for the largest revenue share in 2025. This segment is growing owing to the sector's constant need for reliable, high-performance computing in extreme and mission-critical environments. Modern defense operations increasingly rely on real-time data processing, secure communications, situational awareness, and AI-enabled decision-making, which demand computing systems that can operate seamlessly under harsh physical conditions. Rugged servers are engineered to withstand shock, vibration, dust, extreme temperatures, and electromagnetic interference, making them indispensable in a range of defense scenarios, including battlefield communications, mobile command centers, unmanned aerial vehicles (UAVs), ground combat systems, and naval platforms. Ongoing technological enhancements by key market participants further reinforce the adoption of ruggedized computing solutions within defense programs. For instance, in February 2025, Crystal Group advanced its rugged server portfolio by integrating next-generation processing technologies, leveraging strategic industry partnerships to deliver high-performance, reliable computing solutions engineered to meet stringent defense & military, government, and industrial requirements in demanding environments.

The telecom segment is expected to register the fastest growth during the forecast period in the global market for rugged servers. The rapid growth of edge computing is changing the telecom industry by decentralizing data processing and moving computational power closer to the source of data generation. Unlike traditional cloud computing, where data is sent to centralized data centers, edge computing relies on distributed edge data centers-often located in harsh or remote environments process information in real time. Telecom providers increasingly deploy rugged servers in these edge locations to ensure reliability, low latency, and continuous operation under extreme conditions.

Regional Insights

The North America rugged servers market accounted for the largest market share of 38.9% in 2025 in the global industry. North America’s stringent regulations regarding data security and system resilience, especially in federal and critical infrastructure sectors, create a strong incentive to adopt rugged servers with enhanced physical and cybersecurity features. Rugged servers often support secure boot, TPM (Trusted Platform Module), and hardware-based encryption, making them well-suited for environments requiring secure and stable operations. Growing enterprise demand for secure, high-performance on-premise computing further accelerates the adoption of ruggedized server solutions across the region. For instance, in August 2024, Nextria provider of secure, on-premise generative AI platforms from Canada, partnered with PureLogic IT to enhance the deployment of its CastleGuard AI platform and Sentinel Server solution, providing integrated hardware, specialized implementation services, and secure on-premise AI capabilities for enterprise customers seeking controlled, high-performance technology environments.

U.S. Rugged Servers Market Trends

The rugged servers industry in the U.S. is expected to grow significantly at a CAGR of 5.9% from 2026 to 2033. This strong growth is due to rising demand in avionics, rail systems, and autonomous vehicles. In aviation, rugged servers are critical for flight control systems, in-flight entertainment, and real-time data processing in military and commercial aircraft. The expansion of unmanned aerial vehicles (UAVs) and next-gen fighter jets further drives adoption.

Europe Rugged Servers Market Trends

The rugged servers industry in Europe is anticipated to register significant growth from 2026 to 2033. The expansion of Industry 4.0 across Europe, particularly in manufacturing powerhouses such as Germany and Italy, drives the demand for rugged servers in smart factory environments. Rugged servers enable edge processing on the shop floor, where dust, temperature fluctuations, and vibrations are common. Moreover, sectors such as aerospace and telecommunications depend heavily on these servers to support real-time data processing in aircraft and 5G edge networks, while industrial automation in manufacturing and renewable energy projects in offshore wind farms demand their durability to ensure uninterrupted operations in harsh coastal or high-altitude settings.

In addition, the growing defense and military applications in Europe are further boosting the demand for ruggedized IT solutions. For instance, in October 2025, MilDef Group AB received a USD 5.5 million contract with L3Harris Technologies to supply rugged IT systems, including customized servers, Cisco-based routers, and fiber switches for armored vehicles. This deal support MilDef’s European defense market presence and is expected to drive increased adoption of durable, high-performance IT solutions across the region.

The UK rugged servers industry is projected to experience growth from 2026 to 2033. The UK defense sector is undergoing significant modernization, driven by programs such as the Future Combat Air System (FCAS) and naval fleet upgrades, which are accelerating the adoption of rugged servers. These high-performance computing systems are essential for military applications where reliability, durability, and security are paramount.

The rugged servers industry in Germany accounted for the largest share in 2025. The proliferation of Industry 4.0 initiatives across German manufacturing facilities creates substantial demand for ruggedized server solutions. Smart factories, particularly in the automotive and chemical sectors, require industrial-grade computing infrastructure capable of real-time data processing in environments characterized by extreme temperatures, particulate contamination, and electromagnetic interference.

Asia Pacific Rugged Servers Market Trends

The rugged servers industry in the Asia Pacific is expected to register the fastest CAGR from 2026 to 2033. Several countries, including China, India, Japan, and South Korea, are significantly increasing their defense budgets to modernize their armed forces and enhance border security. This includes investment in command-control systems, battlefield communications, and unmanned surveillance vehicles. The growing demand for ruggedized, high-performance computing solutions is further driven by regional initiatives focused on strengthening real-time mission capabilities. For instance, in May 2025, 7STARLAKE expanded its partnership with Dell Technologies in the Asia Pacific region by introducing rugged military servers engineered for mission-critical unmanned systems, delivering enhanced reliability, secure data processing, and high performance for next-generation ground control station operations.

The China rugged servers industry held a dominant share in 2025. China’s significant investment in military modernization and self-sufficiency in defense technology has led to rising demand for rugged computing infrastructure. Rugged servers are vital to military command centers, mobile units, and unmanned systems such as drones and autonomous ground vehicles.

The rugged servers industry Japan is expected to grow rapidly in the coming years. Japan’s highly advanced transportation network, including bullet trains, automated metros, and intelligent traffic systems, relies on rugged IT equipment for control systems, surveillance, and in-transit data processing. Rugged servers are used in vehicles and outdoor environments where temperature, motion, and humidity require specialized computing hardware.

Key Rugged Servers Company Insights

Key players operating in the industry are Mercury Systems, Inc., ADLINK Technology Inc., Advantech Co., Ltd., Core Systems, and Trenton Systems, Inc., among others. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In May 2025, Kontron announced the release of the µDARC, an ultra-rugged, compact microserver designed for mission-critical mobile applications in challenging defense environments. Powered by a high-performance NXP Arm i.MX8X quad-core processor, the µDARC offers a lightweight, energy-efficient solution with extensive I/O capabilities, making it ideal for tactical edge computing. Tailored for real-time data collection and transmission, it supports a wide range of defense use cases, including wearable tech, UGVs with LiDAR and GPS, UAVs for object recognition and telemetry, and cybersecurity gateways and health monitoring systems.

-

In April 2025, ADLINK Technology Inc. and Elma Electronic announced a partnership to deliver rugged computing solutions for the railway and mission-critical applications. The collaboration combined ADLINK’s CPCI, CPCI Serial and VPX platforms with Elma’s chassis and integration capabilities to provide reliable, scalable systems designed for harsh, mission-critical environments and field deployments.

Key Rugged Servers Companies:

The following are the leading companies in the rugged servers market. These companies collectively hold the largest market share and dictate industry trends.

- ADLINK Technology Inc.

- Advantech Co., Ltd.

- Core Systems

- General Micro Systems, Inc.

- GETAC

- Kontron

- Mercury Systems, Inc.

- One Stop Systems, Inc.

- Trenton Systems, Inc.

- Westek Technology

Rugged Servers Market Report Scope

Report Attribute

Details

Market size in 2026

USD 759.7 million

Revenue forecast in 2033

USD 1,244.9 million

Growth rate

CAGR of 7.3% from 2026 to 2033

Actual data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report Coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, type, memory size, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

ADLINK Technology Inc.; Advantech Co., Ltd.; Core Systems; General Micro Systems, Inc.; GETAC; Kontron; Mercury Systems, Inc.; One Stop Systems, Inc.; Trenton Systems, Inc.; Westek Technology

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Application and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Rugged Servers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global rugged servers market report based on component, type, memory size, application, end-use, and region.

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Software

-

Services

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Rugged Rackmount Servers

-

Rugged Blade Servers

-

Rugged Edge Servers

-

-

Memory Size Outlook (Revenue, USD Million, 2021 - 2033)

-

<256 GB

-

256GB-512GB

-

512GB-1TB

-

>1TB

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Standard

-

Dedicated

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Defense & Military

-

Aerospace

-

Industrial

-

Telecom

-

Energy & Power

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global rugged servers market size was estimated at USD 713.2 million in 2025 and is expected to reach USD 759.7 million in 2026.

b. The global rugged servers market is expected to grow at a compound annual growth rate of 7.3% from 2026 to 2033 to reach USD 1,244.9 million by 2033.

b. The hardware segment dominated the rugged servers market in 2025 due to the high demand for durable, shock-resistant, and reliable physical components capable of operating in extreme environmental conditions, ensuring consistent performance and longevity for critical industrial and military applications.

b. Some key players operating in the market include ADLINK Technology Inc., Advantech Co., Ltd., Core Systems, General Micro Systems, Inc., GETAC, Kontron, Mercury Systems, Inc., One Stop Systems, Inc., Trenton Systems, Inc., Westek Technology and others.

b. Factors such as the increasing deployment of industrial automation, harsh environmental operations, and mission-critical applications requiring durable, reliable, and high-performance computing play a key role in accelerating the rugged servers market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.