- Home

- »

- Organic Chemicals

- »

-

Rubber Process Oil Market Size, Share & Trends Report 2030GVR Report cover

![Rubber Process Oil Market Size, Share & Trends Report]()

Rubber Process Oil Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Aromatic, Paraffinic, Naphthenic), By Application (Tyre, Footwear, Wire & Cable Covering), By Process, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-354-5

- Number of Report Pages: 201

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Rubber Process Oil Market Size & Trends

The global rubber process oil market size was estimated at USD 2.19 billion in 2023 and is projected to grow at a CAGR of 4.3% in terms of revenue from 2024 to 2030. The global product demand is increasing due to its critical role in the manufacturing of various products, including tires, footwear, and industrial goods.

This surge is driven by the growing automotive industry, particularly in emerging markets, where vehicle production and ownership are rising rapidly. In addition, the expanding infrastructure and construction sectors are boosting the need for rubber-based materials. Furthermore, advancements in rubber processing technology and the shift towards environmentally friendly and sustainable products are propelling the demand for high-quality, non-toxic products. These oils enhance the performance, durability, and longevity of products, making them indispensable in both industrial and consumer applications.

Rubber process oils are essential additives used in the production of rubber compounds. These oils are derived from petroleum and are integrated into the manufacturing process to enhance the properties of the final product. They act as plasticizers, making the rubber softer and more pliable, which is crucial during the mixing and molding stages. Depending on their formulation, these products can be categorized into three main types: paraffinic, naphthenic, and aromatic, each offering distinct properties suited for different applications.

The burgeoning automotive industry, particularly in developing economies, fuels the need for tires and other components, consequently boosting the demand for the product. Additionally, the rapid growth of the construction and industrial sectors, which rely heavily on rubber products, further propels market demand.

On the other hand, the market faces some restraining factors. Fluctuations in crude oil prices can impact the cost and availability of these oils. Moreover, the shift towards alternative materials and synthetic products can potentially limit the growth of the global market.

Drivers, Opportunities & Restraints

One of the significant drivers for the growth of the global market is the rising demand for consumer goods such as footwear, sports equipment, and household items. In addition, the increasing use of rubber in medical devices and healthcare products, spurred by advancements in medical technology and the growing healthcare industry, is contributing to market expansion. Furthermore, the trend towards lightweight and high-performance materials in various industries, including aerospace and electronics, is fostering the demand for specialized compounds, thereby boosting the need for these oils.

One of the primary restraints affecting the market is the environmental and health concerns associated with the production and disposal of rubber products. The use of certain types of rubber process oils, particularly aromatic oils, has raised concerns due to their potential toxicity and environmental impact. Regulatory bodies in various regions are imposing stringent regulations on the use of such oils, compelling manufacturers to seek alternative formulations or face compliance challenges.

Despite the challenges, there are numerous opportunities for growth in the market. The ongoing research and development efforts aimed at creating bio-based and sustainable products present a promising avenue. These eco-friendly alternatives can help manufacturers comply with regulatory standards while meeting the growing consumer demand for green products. For example, P.S.P. Specialties Public Company Limited is one of the key companies providing bio-rubber process oil under its portfolio.

Product Insights & Trends

“Paraffinic emerged as the fastest growing product segment with a CAGR of 4.6%”

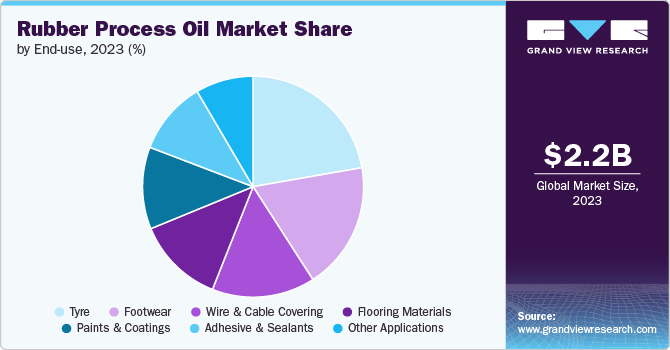

Aromatic dominated the market and accounted for a revenue share of approximately 37.91% in 2023, due to its superior compatibility with a wide range of rubber polymers, particularly in tire manufacturing, where it enhances grip and durability. Aromatic oils possess excellent solvency properties, which improve the dispersion of fillers and other additives, leading to better processing and performance characteristics.

Paraffinic oils offer better thermal stability and oxidative resistance, making them ideal for applications requiring enhanced durability and longevity, such as automotive and industrial products. Their lower volatility and reduced tendency to produce hazardous emissions during processing also align with the growing regulatory and consumer demand for eco-friendly and sustainable materials.

Naphthenic oils are favored for their excellent low-temperature flexibility and compatibility with a wide range of elastomers. These oils provide improved solvency and easier processing, which enhances the dispersion of fillers. This results in better mechanical properties and performance of the final product. In addition, naphthenic oils have a balanced viscosity and good color stability, making them suitable for various applications, including high-performance tires, seals, and gaskets.

Application Insights & Trends

“Flooring materials emerged as the fastest growing segment with a CAGR of 4.8%”

Tyre applications dominated the market and accounted for a revenue share of 22.25% in 2023, due to their critical role in enhancing the performance, durability, and safety of tires. They improve the elasticity, grip, and wear resistance, essential for maintaining traction and longevity under diverse driving conditions. The ability of these oils to facilitate better filler dispersion and mixing efficiency also ensures the production of high-quality tires, making them indispensable in the automotive sector.

In the footwear industry, these products are extensively used to improve the flexibility, softness, and resilience of soles and components. These oils help achieve the desired balance between comfort and durability, which is crucial for consumer satisfaction. The use of these oils in footwear manufacturing also allows for better color stability and surface finish, enhancing the aesthetic appeal of the products.

The wire and cable covering industry relies heavily on the product to enhance the insulation and protective properties of rubber coatings. These oils improve the processing characteristics, ensuring uniform coating and better adhesion to the wire or cable core. The resulting products exhibit superior resistance to environmental factors such as moisture, heat, and chemicals, ensuring the longevity and reliability of electrical and telecommunication cables.

Regional Insights & Trends

North America consumes a significant amount of the product driven by its well-established automotive industry and technological advancements. The demand for high-performance and durable products in automotive, aerospace, and healthcare sectors fuels the consumption of the product. In addition, the region's focus on sustainable and environmentally friendly products has led to increased adoption of advanced products that meet stringent regulatory standards.

Asia Pacific Rubber Process Oil Market Trends

Asia Pacific dominated the market and accounted for a 45.10% share in 2023, due to its rapidly growing automotive and industrial sectors. Countries such as China and India have become major manufacturing hubs, driving the demand for tires, industrial products, and consumer goods. The region's robust construction activities and infrastructure development further boost the need for the product, making Asia Pacific a dominant market.

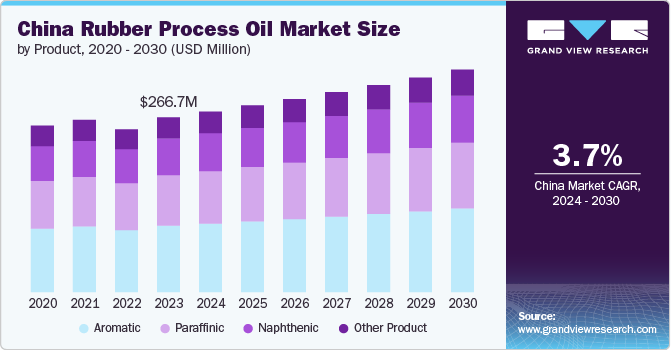

China is a major consumer of the product, owing to its status as the world's largest automotive producer and a significant player in global manufacturing. The country's robust tire manufacturing industry, coupled with extensive industrial and construction activities, creates a high demand for the product. China's focus on technological advancements and innovation enhances the quality and performance of its rubber products, further driving the consumption of process oils. Moreover, the government's emphasis on environmental sustainability and the adoption of green manufacturing practices promotes the use of eco-friendly process oils, aligning with global trends and regulatory requirements.

Europe Rubber Process Oil Market Trends

“Europe emerged as the fastest growing market with a CAGR of 4.8% from 2024-2030”

Europe's product consumption is propelled by its strong automotive industry and the presence of leading tire manufacturers. The region's emphasis on quality and innovation, along with stringent environmental regulations, drives the demand for high-quality products. Moreover, Europe's focus on green and sustainable manufacturing practices encourages the use of eco-friendly products, aligning with the region's environmental goals and consumer preferences.

Central & South America Rubber Process Oil Market Trends

In Central & South America, the market is driven by the growing automotive and construction industries. Countries such as Brazil and Argentina are witnessing increased vehicle production and infrastructure development, boosting the demand for tires. In addition, the expanding industrial sector further contributes to the region's consumption of the product. The availability of raw materials and improving economic conditions are also playing a role in the market's growth.

Middle East & Africa Rubber Process Oil Market Trends

The Middle East & Africa market is influenced by the burgeoning automotive sector and ongoing infrastructure projects. Countries such as South Africa, Saudi Arabia, and the UAE are experiencing growth in vehicle ownership and construction activities, which drives the demand for the product. The region's focus on diversifying its economy beyond oil and gas also supports the growth of the manufacturing sector, increasing the need for the product.

Key Rubber Process Oil Company Insights

Some of the key players operating in the global rubber process oil market include Shell Plc, Chevron USA Inc., H&R GROUP, and Sunoco Lubricants, among others.

-

Shell Plc, a global leader in energy and petrochemicals, has a robust portfolio of rubber process oils designed to meet the diverse needs of the end-use industry. Their product line includes high-quality paraffinic, naphthenic, and aromatic oils, known for their excellent solvency, stability, and performance characteristics. Shell's rubber process oils are engineered to enhance the processing efficiency, elasticity, and durability, making them suitable for a wide range of applications including tires, industrial goods, and consumer products. The company's commitment to sustainability and innovation drives the development of eco-friendly formulations that comply with stringent environmental regulations, ensuring that their products meet the evolving demands of the global market.

-

Chevron is a prominent player in the global oil and gas industry, offering a comprehensive range of rubber process oils tailored for various manufacturing processes. Chevron's product portfolio includes premium paraffinic and naphthenic oils that are highly valued for their superior performance in enhancing flexibility, durability, and processing efficiency. These oils are widely used in the production of tires, footwear, and industrial products. Chevron's focus on research and development ensures that their products not only meet industry standards but also address the growing demand for environmentally friendly and sustainable solutions, reinforcing their position as a trusted supplier in the overall industry.

-

H&R GROUP is a leading specialty chemical company with a strong presence in the rubber process oil market. The company offers a diverse range of high-quality aromatic, naphthenic, and paraffinic products designed to improve the performance, processability, and longevity of rubber products. H&R's oils are utilized in various applications including tire manufacturing, wire and cable coverings, and automotive components. The company's dedication to innovation and sustainability is reflected in its development of eco-friendly and low-aromatic content oils that meet global environmental standards. H&R GROUP's extensive expertise and commitment to quality make it a preferred supplier for manufacturers seeking reliable and efficient process oil solutions.

Adinath Chemicals, Shreeya International FZE, Panorama Global Trade Sdn Bhd, and Horman Process Oils Malaysia Plant Sdn Bhd, are some of the emerging market participants in the global market.

-

Shreeya International FZE, based in the UAE, is a notable manufacturer and supplier of rubber process oils with a strong presence in the Middle East and international markets. Their product portfolio includes high-quality paraffinic, naphthenic, and aromatic oils that cater to various manufacturing needs. Shreeya International is recognized for its commitment to providing consistent and reliable products that enhance the performance, flexibility, and processing efficiency of compounds. Their oils are widely used in the production of tires, footwear, and industrial goods. The company’s focus on quality assurance and customer satisfaction has established it as a trusted partner for manufacturers seeking dependable process oil solutions.

-

Panorama Global Trade Sdn Bhd, headquartered in Malaysia, specializes in the manufacturing and distribution of the product that meet the diverse requirements of the rubber industry. Their extensive product range includes paraffinic, naphthenic, and aromatic oils, known for their superior quality and performance. These oils are integral in enhancing the durability, elasticity, and processing characteristics of products such as tires, hoses, and seals. Panorama Global Trade’s dedication to maintaining high standards of quality and their ability to provide customized solutions tailored to client needs have made them a reputable supplier in the regional and international markets.

- Horman Process Oils Malaysia Plant Sdn Bhd is a prominent manufacturer and supplier in Malaysia, offering a wide array of products including paraffinic, naphthenic, and aromatic oils. Their oils are designed to optimize the processing and performance of rubber compounds, making them suitable for applications in the tire industry, wire and cable coverings, and various industrial products. Horman Process Oils is committed to innovation and sustainability, focusing on producing environmentally friendly and high-performance oils that comply with global standards. The company's state-of-the-art manufacturing facilities and rigorous quality control processes ensure the consistent delivery of top-tier products, positioning them as a key player in the market.

Key Rubber Process Oil Companies:

The following are the leading companies in the rubber process oil market. These companies collectively hold the largest market share and dictate industry trends.

- Adinath Chemicals

- Shell Plc

- Chevron USA .Inc

- Sunoco Lubricants

- Shreeya International FZE

- H&R GROUP

- Panorama global trade Sdn Bhd

- Norman Process Oils Malaysia Plant Sdn Bhd

Recent Developments

-

In February 2024, Nordmann announced expansion of its distribution agreement with Ergon International, the world’s largest manufacturer of naphthenic process and base oils.

-

In January 2022, Safic-Alcan, a global speciality chemicals distributor, announced partnership agreement with Repsol. This agreement pertains to the Rubber industries in Belgium, Germany, Greece, Italy, Luxembourg, the Netherlands, Poland, Romania, Russia, South Africa, Sweden, Denmark, Norway, and Finland.

-

In March 2019, Nynas AB introduced its newest biobased rubber process oil.

Rubber Process Oil Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.28 billion

Revenue forecast in 2030

USD 2.93 billion

Growth rate

CAGR of 4.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2024 to 2030

Report coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Italy; UK; France; Spain; China; India; Japan; South Korea; Malaysia; Thailand; Indonesia; Vietnam; Saudi Arabia; South Africa; Brazil; Argentina

Key companies profiled

Adinath Chemicals; Shell Plc; Chevron USA .Inc; Sunoco Lubricants; Shreeya International FZE; H&R GROUP; Panorama global trade Sdn Bhd; Norman Process Oils Malaysia Plant Sdn Bhd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Rubber Process Oil Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global rubber process oil market report based on material product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Aromatic

-

Paraffinic

-

Naphthenic

-

Other Products (If Any)

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Tyre

-

Footwear

-

Wire & Cable Covering

-

Flooring Materials

-

Paints & Coatings

-

Adhesive & Sealants

-

Other Applications (If Any)

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Malaysia

-

Indonesia

-

Vietnam

-

Indonesia

-

Thailand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

Frequently Asked Questions About This Report

b. The global rubber process oil market was estimated at USD 2.19 billion in 2023 and is expected to reach USD 2.28 billion in 2024.

b. The global rubber process oil market is anticipated to grow at a CAGR of 4.3% from 2024 to reach USD 2.93 billion by 2030.

b. Asia Pacific dominated the market and accounted for a 45.10% share in 2023, due to its rapidly growing automotive and industrial sectors. Countries like China and India have become major manufacturing hubs, driving the demand for tires, industrial products, and consumer goods. The region's robust construction activities and infrastructure development further boost the need for the product, making Asia Pacific a dominant market.

b. Some of the key players operating in the global rubber process oil market include Shell Plc, Chevron USA Inc., H&R GROUP, and Sunoco Lubricants, among others.

b. The demand for rubber process oil is increasing due to its critical role in the manufacturing of various products, including tires, footwear, and industrial goods. This surge is driven by the growing automotive industry, particularly in emerging markets, where vehicle production and ownership are rising rapidly.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.