- Home

- »

- Plastics, Polymers & Resins

- »

-

Rubber Market Size, Share, Growth & Trends Report, 2030GVR Report cover

![Rubber Market Size, Share & Trends Report]()

Rubber Market (2025 - 2030) Size, Share & Trends Analysis Report By Type, By End-Use (Automotive, Construction, Industrial, Healthcare, Consumer goods, Packaging), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-158-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Rubber Market Summary

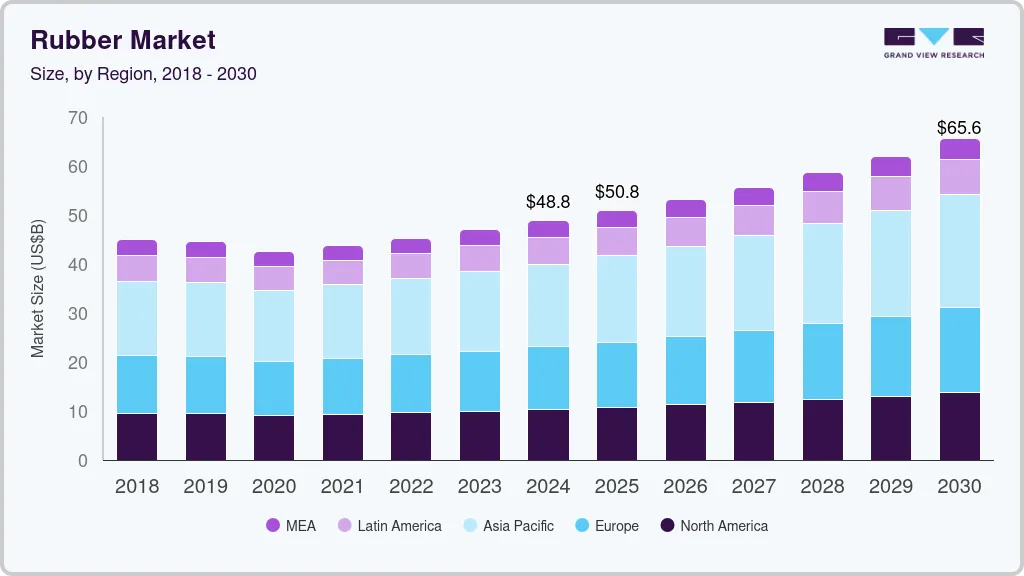

The global rubber market size was estimated at USD 48.77 billion in 2024 and is projected to reach USD 65.65 billion by 2030, growing at a CAGR of 5.1% from 2025 to 2030. The market has been significantly driven by superior properties exhibited by product such as abrasion and heat resistance and its applicability as a valuable raw material in various end-use industries such as industrial, automotive, electrical, and consumer goods.

Key Market Trends & Insights

- Asia Pacific dominated rubber market and accounted for the largest revenue share of over 34% in 2023.

- Europe accounted for a revenue share of more than 26.0% in 2023.

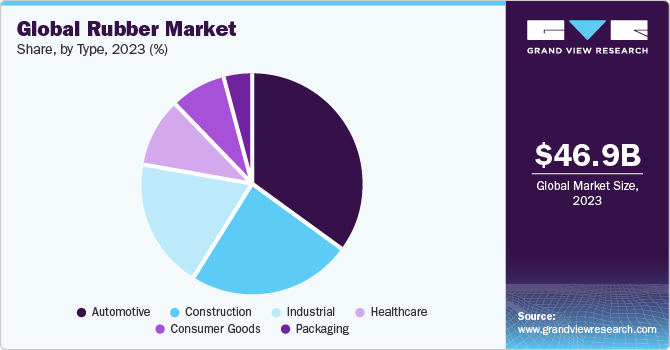

- By end-use, the automotive segment led the market and accounted for largest revenue share of more than 34% in 2023.

- By type, the synthetic rubber type segment led the market and accounted for revenue share of over 57% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 48.77 Billion

- 2030 Projected Market Size: USD 65.65 Billion

- CAGR (2025-2030): 5.1%

- Asia Pacific: Largest Market in 2023

- Europe: Fastest growing market

Rubber is a major raw material used for production of car tires, personal protective equipment such as masks and gloves, and others. Rubber market in the U.S. is predicted to witness significant growth in recent years, with several factors driving this expansion. U.S. is one of the prominent importer of rubber tires and one of the major importers of rubber owing to high demand for product from automotive, construction, and electrical industries. The U.S. automotive industry is influenced by growing popularity of electric vehicles and establishment of manufacturing bases by automobile manufacturers in the country, which is expected to drive market growth for rubber tires and thus influence growth of the market

Rising consumer awareness of physical fitness is likely to propel demand for rubber flooring mats, driving the market growth. Moreover, growing aviation sector is expected to result in increased flights and more consumption of rubber tires. These factors are likely to positively impact demand for rubber for its use in aircraft tires.

Market Dynamics

Growing consumer awareness toward environmental conservation and rubber manufacturers’ approach toward sustainability have created high demand for reclaimed rubber in various end-use sectors such as footwear, automotive, flooring, and others.

Rubber is mainly used as a raw material in a variety of end-use industries due to properties such as heat and abrasion resistance. It is primarily utilized in production of tires, crap tubes, adhesives, hoses, gaskets, and roll coatings. Owing to its robust qualities, including tear resistance and durability, it is mostly employed in manufacture of tires.

Furthermore, rising demand for natural rubber goods, combined with a developing global automobile and construction industry, is expected to boost the market. Due to its high tensile strength, vibration-dampening characteristics, and tear resistance, natural rubber is preferred over synthetic rubber.

End-Use Insights

The automotive segment led the market and accounted for largest revenue share of more than 34% in 2023. Rubber demand is increasing due to its distinctive characteristics, such as high tensile strength, vibration dampening, and tear and abrasion resistance, which makes it suitable for manufacture of seals, tires, and others in automotive industry.

Rubber finds application in construction industry owing to its properties such as durability, weather resistance, and energy efficiency. Various rubber-based materials are required for construction of roads, bridges, and infrastructure projects. In infrastructure, rubber is used in applications such as expansion joints, waterproofing membranes, and sealants. Rising construction activities across the globe is expected to boost the demand for rubber over the forecast period.

Industrial end-use industry is expected to grow at a significant rate over the forecast period. Rise of automation and smart manufacturing is predicted to drive up demand for rubber components in industrial machines and equipment. Rubber components are in high demand in a variety of industries, including manufacturing, mining, and energy.

Type Insights

The synthetic rubber type segment led the market and accounted for revenue share of over 57% in 2023. Synthetic rubber is being more widely used in a variety of industries, including construction, automotive, textiles, medicines, and defense, due to its low cost and lightweight properties.

Synthetic rubber in automotive end-use industry to produce a wide range of goods, including adhesives, gaskets, hoses, roll covers, pipes, tires, and waste tubes. The rapidly increasing population and increasing rates of urbanization drive construction industry. In order to lower the cost and increase quality of materials, major players in these industries also invest in research and development.

Furthermore, natural rubber is expected to grow at a significant rate. Demand growth is ascribed to causes such as increased vehicle manufacturing, increased construction activity, high demand for footwear, and increased airplane production. Furthermore, natural rubber is a key raw material utilized in production of a wide range of end-use items, including medical equipment, industrial components, surgical gloves, vehicle tires, clothes, pacifiers, toys, mattresses, and others.

Regional Insights

Asia Pacific dominated rubber market and accounted for the largest revenue share of over 34% in 2023. Asian countries such as China, Vietnam, Indonesia, India, and Thailand, Japan are expected to emerge as primary markets for rubber due to extensive rubber tire production in these countries. In recent years, China and India have witnessed a rise in automotive production accounting to technology transfer to sector from Western markets which is expected to drive demand for rubber tires and influence the market.

Europe accounted for a revenue share of more than 26.0% in 2023 and is expected to grow at a significant rate. Automobile manufacturers in Europe are using high-performance rubber for several applications including tires for trucks and passenger cars. European automakers to switch from diesel engines to electrified motors. Germany is one of the prominent producers of passenger cars in the European Union. The growing automobile production expected to drive the growth of market for rubber in the region.

Key Companies & Market Share Insights

The global players face intense competition from each other as well as from the regional players who have strong distribution networks and good knowledge about suppliers and regulations. Major players, in particular, compete on the basis of application development capability and new technologies used for product formulation. In May 2023, KUMHO Petrochemical Co., Ltd., Idemitsu Kosan Co., Ltd., and Sumitomo Corporation have signed a Memorandum of Understanding (MOU) to form a long-term collaboration for development and expansion of Asian market for sustainable polymers and chemicals. Idemitsu, will produce bio-SM using mass balance method, and KUMHO Petrochemical Co., Ltd., will produce bio-SSBR (Solution Styrene Butadiene Rubber). Sumitomo Corporation will coordinate the collaboration and help to build biomaterials market.

Key Rubber Companies:

- Sinopec

- DuPont

- The Dow Chemical Company

- Exxon Mobil Corporation

- Kumho Petrochemical Company Ltd.

- The Goodyear Tire and Rubber Company

- JSR Corporation

- Denka Company Ltd.

- Vietnam Rubber Group

- Southland Holding Lonza

- Asahi Kasei Corporation

Rubber Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 50.82 billion

Revenue forecast in 2030

USD 65.65 billion

Growth Rate

CAGR of 5.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 – 2022

Forecast period

2024 – 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional Scope

North America, Europe, Asia Pacific, Central and South America, and Middle East and Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain, The Netherlands; China; India; Japan; South Korea, Australia, Malaysia, Singapore, Thailand, Vietnam, Brazil, Argentina, Saudi Arabia, UAE, South Africa

Key companies profiled

Sinopec, DuPont, The Dow Chemical Company, Exxon Mobil Corporation, Kumho Petrochemical Company Ltd., The Goodyear Tire and Rubber Company, JSR Corporation, Denka Company Ltd., Vietnam Rubber Group, Southland Holding Lonza, Asahi Kasei Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Rubber Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Rubber Market report on the basis of type, end-use, region:

-

Rubber Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Natural

-

Ribbed Smoked Sheet Type

-

Solid Block Rubber Type

-

Concentrated Latex Type

-

Others

-

-

Synthetic

-

Styrene Butadiene Rubber

-

Nitrile Rubber

-

Polybutadiene Rubber

-

Butyl Rubber

-

Others

-

-

-

Rubber End-Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Construction

-

Industrial

-

Healthcare

-

Consumer goods

-

Packaging

-

-

Rubber Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

The Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Malaysia

-

Singapore

-

Thailand

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global rubber market size was estimated at USD 46.95 billion in 2023 and is expected to reach USD 48.78 billion in 2024.

b. The global rubber market is expected to grow at a compound annual growth rate of 5.08% from 2024 to 2030 to reach USD 65.65 billion by 2030.

b. The synthetic segment dominated the rubber market with a share of 57.97% in 2023. Synthetic rubber is being more widely used in a variety of industries, including construction, automotive, textiles, medicines, and defense, due to its low cost and lightweight properties.

b. Some key players operating in the rubber market include Sinopec, DuPont, The Dow Chemical Company, Exxon Mobil Corporation, Kumho Petrochemical Company Ltd., The Goodyear Tire and Rubber Company, JSR Corporation, and Denka Company Ltd.

b. Key factors that are driving the rubber market growth include the superior properties exhibited by product such as abrasion and heat resistance and its applicability as a valuable raw material in various end-use industries such as industrial, automotive, electrical, and consumer goods.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.