- Home

- »

- Electronic & Electrical

- »

-

Rotary Hammer Drill Market Size And Share Report, 2030GVR Report cover

![Rotary Hammer Drill Market Size, Share & Trends Report]()

Rotary Hammer Drill Market (2025 - 2030 ) Size, Share & Trends Analysis Report By Product (Wired, Non-Wired), By Application (Construction, Professional Services), By End-use (Commercial, Residential), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-636-3

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Rotary Hammer Drill Market Size & Share

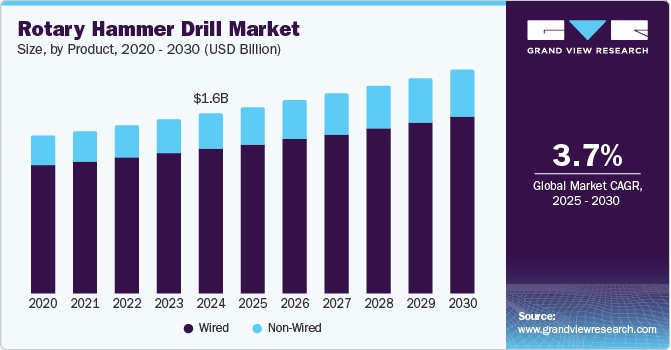

The global rotary hammer drill market size was valued at USD 1.56 billion in 2024 and is projected to grow at a CAGR of 3.7% from 2025 to 2030. The market growth can be attributed to the rapid expansion of the construction industry, particularly in emerging economies such as China, India, and Brazil. These countries have experienced significant urbanization and infrastructure development, which increases the demand for efficient and powerful tools, including rotary hammer drills. Government initiatives and investments in infrastructure projects, such as roads, bridges, and residential buildings, have further propelled the market.

In addition, technological advancements have driven the market of rotary hammer drills. Manufacturers have continuously innovated and enhanced these tools' performance, durability, and user-friendliness. For instance, introducing cordless rotary hammer drills, which offer greater mobility and convenience, has been a significant advancement. Improvements in battery technology have led to longer operational times and faster charging, making cordless options more appealing to professional contractors and DIY enthusiasts.

Furthermore, the rising trend of home renovation and DIY projects has significantly contributed to the market growth. With more people spending time at home, the market experienced an increased interest in home improvement activities. Rotary hammer drills are essential for drilling concrete, masonry, and other hard materials.

Moreover, supply chain improvements and the growth of e-commerce have played a significant role in the market’s expansion. The ease of purchasing tools online, coupled with the availability of detailed product information and customer reviews, has made it easier for consumers to make informed decisions. Additionally, efficient supply chain management ensures timely delivery and availability of products, which is crucial for maintaining customer satisfaction.

Product Insights

Wired products led the market with the dominant share of 81.0% in 2024 owing to the consistent power supply that wired drills offer, which is crucial for heavy-duty applications in the construction and industrial sectors. Unlike cordless hammer drills, wired drills can operate continuously without recharging, making them ideal for prolonged use in demanding environments. In addition, wired drills have a lower upfront cost than cordless models. This affordability and robust performance ensure that wired drills remain a popular choice in various markets. Modern wired drills equipped with features including variable speed settings, improved ergonomics, and enhanced safety mechanisms have significantly catered to the evolving needs of users.

Non-wired products are expected to emerge during the forecast period due to the increasing demand for mobility and convenience. Cordless rotary hammer drills offer the flexibility to work in locations without easy access to power outlets, which is ideal for outdoor and remote job sites. This portability is particularly beneficial for construction and renovation projects. Moreover, modern lithium-ion batteries provide longer run times, faster charging, and greater power output, which allows these tools to perform on par with their wired counterparts. The development of brushless motors has contributed to improved efficiency and durability, further boosting the appeal of cordless models.

Application Insights

Construction dominated the market with a 30.2% share in 2024 owing to rapid urbanization and infrastructure development. Emerging countries such as China, India, and Brazil have heavily invested in large-scale construction projects, including commercial buildings, residential complexes, and public infrastructure, including roads and bridges. This surge in construction activities necessitates the use of powerful and efficient rotary hammer drills to drill into hard materials, including concrete and masonry.

Professional services are projected to emerge at the fastest CAGR over the forecast period due to the increasing demand for specialized construction and renovation projects. Professional services, including contractors, electricians, and plumbers, require high-performance tools to handle rigorous tasks efficiently. Moreover, the growing emphasis on quality and precision in professional services has been a crucial market driver. Professionals need reliable tools that deliver consistent performance and high precision to meet the stringent standards of their projects. Rotary hammer drills, known for their power and accuracy, are well-suited to meet these demands

End Use Insights

The commercial sector held the dominant market share in 2024 due to the increasing commercial renovation and refurbishment projects trend. As businesses strive to modernize their facilities and improve operational efficiency, the demand for high-performance tools that can handle heavy-duty tasks has significantly surged.

The residential segment is expected to grow at a CAGR of 4.0% during the forecast period. The market growth can be attributed to the growing trend of DIY home improvement projects. With more people spending time at home, there is a growing interest in undertaking renovation and repair tasks. Rotary hammer drills are essential tools for these projects, as they can handle tough materials. Furthermore, economic growth and rising disposable incomes in various regions have enabled more consumers to invest in high-quality power tools. This trend is particularly evident in developed regions, including North America and Europe, with a strong culture of DIY and home improvement.

Distribution Channel Insights

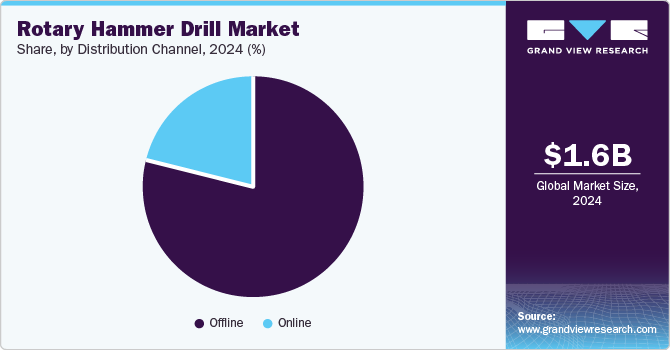

Offline channels dominated the market with 79.0% of the share in 2024, owing to the continuous preference for in-person purchasing experiences. Consumers and professionals favor buying rotary hammer drills from physical stores where they can physically inspect the product, test its features, and receive immediate assistance from knowledgeable staff. This hands-on experience is particularly important for high-investment tools, including rotary hammer drills for assurance. Moreover, physical stores often offer comprehensive after-sales services, including maintenance, repairs, and warranty claims, which are crucial for heavy usage tools.

Online distribution channels are expected to boost over the forecast period with the rising penetration of e-commerce platforms. As the trend of online shopping continues to grow, consumers have greater access to various rotary hammer drills from different brands and at competitive prices. E-commerce platforms offer the convenience of browsing, comparing, and purchasing products, which is particularly appealing in today’s fast-paced world. Additionally, the availability of detailed product information and customer reviews on e-commerce sites helps consumers make informed decisions. Moreover, online platforms often feature comprehensive product descriptions, specifications, and user reviews, which provide valuable insights into the performance and reliability of rotary hammer drills.

Regional Insights

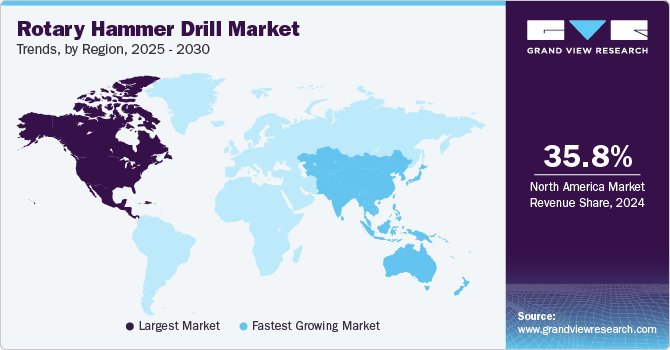

The North America rotary hammer drills market dominated the global revenue with a 35.8% share in 2024. A major market driver is the ongoing expansion of commercial, residential, and industrial construction projects across the region. Moreover, manufacturers have introduced features including vibration control, ergonomic designs, and multi-functionality, making them more appealing to contractors, which drives the market growth.

U.S. Rotary Hammer Drill Market Trends

The U.S. rotary hammer drills market is expected to be driven by infrastructure modernization initiatives over the forecast period. Federal and state government investments in large-scale infrastructure projects, including highways, bridges, and energy facilities, are projected to primarily drive the market. For instance, the Infrastructure Investments and Jobs Act has considerably boosted the demand for rotary hammer drills.

Europe Rotary Hammer Drill Market Trends

The European rotary hammer drills market held 30.0% of the share in 2024 owing to significant investments in public infrastructure projects, particularly transportation networks. Countries including Germany, the UK, and France have led the way in infrastructure development. Moreover, Europe’s aging building stock requires extensive renovation and retrofitting to meet modern standards, particularly regarding energy efficiency and safety.

Asia Pacific Rotary Hammer Drill Market Trends

The rotary hammer drills market in the Asia Pacific (APAC) region held 26.0% of the global revenue share in 2024 and is expected to grow during the forecast period. The region has experienced continuous urbanization at a rapid pace, particularly in countries including China, India, and Southeast Asian nations. This is accompanied by extensive infrastructure development projects, including roads, bridges, airports, and railways, leading to increased usage of rotary hammers. In addition, several APAC countries have invested in housing schemes and smart city initiatives to accommodate the growing urban population. For instance, India’s Smart Cities Mission and China’s urban development policies have created significant opportunities for key equipment and tools, including rotary hammer drills.

Key Rotary Hammer Drill Company Insights

The global rotary hammer drills market is intensely competitive and is characterized by several key players such as Robert Bosch Tool Corporation; Makita U.S.A. Inc.; Hilti Group, DEWALT, and others. Companies have increasingly strived to differentiate their products through innovative features, superior performance, and robust after-sales services. Strategic partnerships, mergers, and acquisitions are common strategies these players adopt to expand their market presence and enhance their product offerings.

- Makita U.S.A., Inc. is a prominent player in the power tool industry, known for its extensive range of cordless and corded power tools, power equipment, and accessories. The company is renowned for its innovation and quality, driven by robust research and development capabilities. Their products are designed to meet the demands of professional users, offering durability, performance, and ergonomic design.

Key Rotary Hammer Drill Companies:

The following are the leading companies in the rotary hammer drill market. These companies collectively hold the largest market share and dictate industry trends.

- Robert Bosch Tool Corporation

- Makita U.S.A. Inc.

- Hilti Group

- DEWALT

- Milwaukee Tool

- Metabo Corporation

- Hikoki

- RIDGID

- Festool Group

- Würth Group

Recent Developments

- In October 2023, Makita U.S.A., Inc. introduced the new 40V XGT 13/16" SDS-PLUS Rotary Hammer. It is a cordless tool ideal for heavy-load concrete applications.

Rotary Hammer Drill Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.62 billion

Revenue forecast in 2030

USD 1.94 billion

Growth rate

CAGR of 3.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, distribution channel, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Spain, Italy, China, Japan, India, Australia & New Zealand, Brazil, South Africa

Key companies profiled

Robert Bosch Tool Corporation; Makita U.S.A. Inc.; Hilti Group; DEWALT; Milwaukee Tool; Metabo Corporation; Hikoki; RIDGID; Festool Group; Würth Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Rotary Hammer Drill Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global rotary hammer drill market report based on product, application, end use, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Wired

-

Non-Wired

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Construction

-

Decoration

-

Metal Working

-

Professional Services

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Residential

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.