Rope Access Services Market Size, Share & Trends Analysis Report By Type (Land, Ocean), By Application (Oil & Gas, Construction, Energy & Power, Infrastructure, Mining, Marine & Offshore, Telecommunications), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-493-4

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Rope Access Services Market Size & Trends

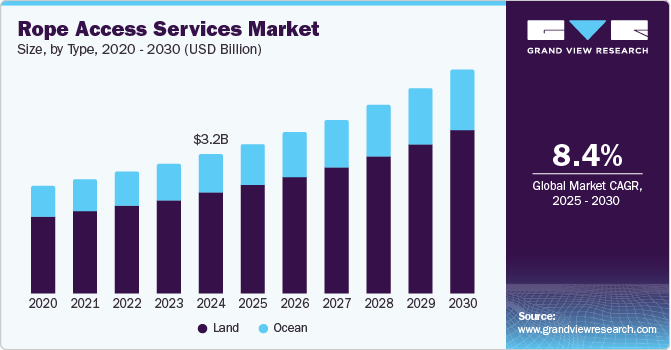

The global rope access services market size was valued at USD 3.24 billion in 2024 and is projected to grow at a CAGR of 8.4% from 2025 to 2030. Growing demand for efficient, safe, and cost-effective solutions for accessing hard-to-reach areas in various industries is a significant factor contributing to the growth of the industry. As infrastructure ages, industries such as oil and gas, construction, telecommunications, and energy are increasingly reliant on regular inspections, maintenance, and repairs. The increasing focus on predictive maintenance and asset optimization is driving growth of the industry.

The investments in renewable energy infrastructure, particularly in wind and solar power, drive industry growth. Countries worldwide are committed to reducing carbon emissions and transitioning toward cleaner energy sources, and significant resources are being directed toward expanding and maintaining renewable energy assets. Wind energy, both onshore and offshore, requires extensive maintenance and inspections at high elevations. Rope access provides an efficient, safe, and cost-effective method for performing these tasks, offering technicians direct access to turbines, blades, and other critical components. This demand is intensified by the distinctive needs of offshore wind farms, where traditional access methods such as scaffolding are impractical and prohibitively expensive.

In offshore wind energy projects, rope access is essential owing to the remote and challenging environments where these assets are located. Offshore turbines are often positioned far from shore, exposed to high winds, and subject to constant wear from saltwater. Regular maintenance and inspections are crucial to ensure operational efficiency and prevent costly breakdowns. Rope access enables technicians to reach these offshore turbines with minimal equipment setup and faster response times compared to traditional access solutions. With increasing investment in offshore wind farms, demand for rope access services is expected to grow, providing a cost-effective and logistically feasible solution in these complex environments.

The cost-effectiveness of rope access services drives the growth of the market. Industries worldwide are seeking affordable and efficient solutions for high-elevation maintenance and repair tasks. Traditional access methods, such as scaffolding or aerial lifts, often involve substantial time and expense due to lengthy setup, large equipment needs, and prolonged project timelines. In contrast, rope access services offer a quicker, more flexible alternative that allows technicians to reach complex or high-up areas with minimal equipment and setup. It leads to considerable cost savings, especially in industries such as construction, oil & gas, and telecommunications, where frequent inspections, repairs, and maintenance are required. This reduction in labor and equipment costs makes rope access an attractive choice for businesses looking to optimize operational efficiency and control expenditures, thereby fueling the growth of the market.

The integration of drones into rope access services presents a growth opportunity for the market by enhancing operational efficiency, safety, and accuracy in high-elevation work environments. Drones can conduct preliminary visual inspections of hard-to-reach areas, capturing high-resolution images and videos that provide a comprehensive assessment before rope access technicians are deployed. This pre-inspection capability allows technicians to focus on targeted areas requiring maintenance or repair, minimizing their time on ropes and reducing the overall project timeline. For industries such as wind energy, telecommunications, and oil and gas, where inspections often occur in difficult-to-access or hazardous locations, drones can streamline operations and make rope access more efficient and less labor-intensive.

Type Insights

The land segment accounted for the largest share of 72.39% in 2024. Rope access services on land-based structures provide a versatile and efficient solution for accessing difficult or elevated locations, primarily used in various industries such as construction, infrastructure, mining, telecommunication, and entertainment, among others. Increasing use of rope access services for inspecting and maintaining tall buildings, bridges, towers, and industrial structures is driving the segments’ growth. Technicians can safely access high or complex parts of the structure, such as facades, rooftops, chimneys, communication towers, and more, to perform visual inspections, identify damage, and carry out maintenance tasks.

The ocean segment is anticipated to grow at a significant CAGR during the forecast period. Ocean rope access services refer to the use of rope-based techniques to perform maintenance, inspection, repair, and installation tasks on offshore and marine structures, typically in challenging environments such as at sea, on ships, or offshore platforms. These services are essential for industries such as oil and gas, shipping, renewable energy (particularly offshore wind farms), and marine infrastructure. Thus, increasing demand for rope access services for a wide range of tasks, including inspections, maintenance, and repairs on various marine structures such as oil tankers, offshore platforms, and Floating Production Storage and Offloading units (FPSOs) and the vast presence of companies providing rope access services these marine structures are contributing to the segment growth.

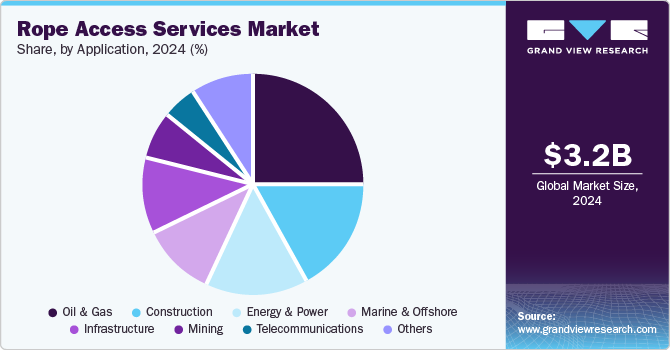

Application Insights

The oil & gas segment dominated the market in 2024. Rope access is a vital service in the oil and gas industry, supporting inspection, repair, and maintenance tasks on offshore platforms, drilling rigs, and refineries. Technicians use rope access techniques to access complex structures, including pipelines, flare stacks, and storage tanks, ensuring the safety and integrity of these critical facilities. Increasing demand for rope access services in the oil and gas industry in applications such as non-destructive testing (NDT) of structures and equipment, routine inspections of offshore platforms and onshore facilities, maintenance of flare stacks, pipelines, and other elevated structures, and for emergency response for urgent repairs can be attributed to the growth of the segment.

The energy & power segment is expected to grow at a significant CAGR over the forecast period. As global energy demand rises, there is a growing need for new energy infrastructure. This expansion drives the demand for maintenance and inspection services, where rope access offers a cost-effective, efficient solution, especially for hard-to-reach or hazardous locations. In the energy and power industry, rope access services have emerged as the preferred solution for inspecting, maintaining, and repairing power stations, refineries, and storage depots. Its versatility enables technicians to efficiently access complex structures and equipment, reducing operational downtime and minimizing the risks associated with ignition that can arise from the use of traditional maintenance methods.

Regional Insights

North America rope access services market dominated the global industry and accounted for the largest share of 30.31% in 2024. Several factors, such as rapid growth of the end-use industries, such as construction, infrastructure, and energy and power, among others, and advancements in rope access equipment technology, including improvements in climbing gear and safety systems, drive the market. In addition, stricter safety regulations and codes, such as those related to high-rise inspections, are driving the adoption of rope access solutions in countries such as the U.S. and Canada. Furthermore, the rising demand for rope access services in emergency response situations, such as the critical removal of hurricane-damaged roofs, is expected to contribute to the market's growth.

U.S. Rope Access Services Market Trends

The rope access services industry in the U.S. held a dominant position in 2024. The increasing demand for cost-effective, safe, and efficient solutions for inspecting and maintaining high-rise buildings and other difficult-to-reach structures is a major driver behind the growth of the market. As urbanization continues, the need for facade inspections, building maintenance, and repair work on tall buildings and complex infrastructure projects has risen, making rope access an attractive alternative to traditional scaffolding and aerial work platforms.

Europe Rope Access Services Market Trends

The rope access services industry in Europe is rising due to the increasing demand for cost-effective, safe, and efficient solutions for inspecting and maintaining high-rise buildings and other difficult-to-reach structures. As urbanization continues, the need for facade inspections, building maintenance, and repair work on tall buildings and complex infrastructure projects has risen, making rope access an attractive alternative to traditional scaffolding and aerial work platforms.

The U.K. rope access services market is experiencing robust growth, driven by several key factors. The country’s ongoing investment in infrastructure, including construction, oil and gas, and renewable energy sectors, is a significant driver of demand for rope access services. For instance, in the U.K., the government’s commitment to driving economic growth is reflected in the planned GBP 164 billion (USD 211 billion) investment in major infrastructure and construction projects for the 2023/24 to 2024/25 period.

The rope access services market in Germany held a substantial market share in 2024 as major players in Germany are experiencing steady growth, driven by the country's growing industrial sector, stringent safety regulations, and the increasing demand for efficient, cost-effective maintenance solutions.

Asia Pacific Rope Access Services Market Trends

The rope access services market in Asia Pacific is anticipated to register significant growth over the forecast period. The increasing demand for efficient and cost-effective maintenance solutions across industries such as construction, oil and gas, energy, and telecommunications. The region’s rapid urbanization and industrialization have spurred the construction of high-rise buildings and large-scale infrastructure projects, requiring advanced access solutions for inspections, cleaning, and repairs. Additionally, stringent safety regulations and the rising focus on minimizing downtime and operational costs have amplified the adoption of rope access techniques over traditional methods like scaffolding and aerial lifts.

Japan rope access services market is expected to grow rapidly in the coming years. As Japan continues to modernize its aging infrastructure, rope access services have emerged as a critical solution for inspecting and maintaining bridges, buildings, and industrial facilities, particularly in hard-to-reach areas. The technique’s ability to minimize disruption and reduce operational downtime aligns with the nation’s focus on optimizing productivity.

The rope access services market in India is experiencing rapid growth. Factors such as rapid industrialization and urbanization, rising demand for energy, and increasing infrastructure development projects across the country can be attributed to the growth of the India rope access services market. India’s rapid population growth and economic development demand significant improvements in transportation infrastructure, encompassing roads, railways, shipping, aviation, and inland waterways. The infrastructure sector plays a pivotal role in driving India’s economic growth, with a strong focus from the government on implementing policies that ensure the timely development of world-class infrastructure.

Key Rope Access Services Company Insights

Some of the key companies in the rope access services market include Applus+, ALTRAD, MISTRAS Group, and others. Collaboration with end-user industries and investments in safety compliance and workforce training are key strategies driving market positioning. Additionally, technological integration, such as drones and remote monitoring systems complementing rope access techniques, further differentiates key players, enabling them to secure higher market shares.

-

Applus+ is one of the prominent companies in the rope access services market, recognized for its wide-ranging service offerings across industries such as oil and gas, construction, and telecommunications. The company has built a strong reputation for its commitment to safety, quality, and technical expertise. Applus+ combines rope access techniques with advanced inspection, testing, and certification services, positioning itself as a trusted partner for large-scale projects requiring efficient and cost-effective solutions.

-

ALTRAD has a better robust infrastructure, global service capabilities, and a focus on safety standards. The company provides comprehensive rope access solutions to a wide range of industries, including energy, petrochemicals, and construction. ALTRAD’s innovative approach, combined with its diverse service portfolio, enables it to offer tailored solutions for challenging maintenance and inspection tasks.

Key Rope Access Services Companies:

The following are the leading companies in the rope access services market. These companies collectively hold the largest market share and dictate industry trends.

- Rope Access Inspection (RAI)

- Altius Technical Services

- SIS Group Ltd.

- Access Techniques

- CAN

- K2 Access

- Stork

- GECKO ROPE ACCESS

- MISTRAS Group

- IRISNDT

- PALACIOS MARINE & INDUSTRIAL

- Rope Partner Inc.

- X-Cel Construction Services Pty Ltd.

- Brand Industrial Services, Inc.

- Tacten Industrial Inc.

- Danos

- Gulf Island Fabrication, Inc.

- OMNI Environmental Solutions

- Grand Isle Shipyard

- Megarme

- Aslan Energy

- Turner Industries Group, LLC

- Applus+

- Acuren

- Bilfinger Height Specialists B.V.

- ALTRAD

- EM&I

- Allriggroup

- SGS Société Générale de Surveillance SA

- PALFINGER AG

- Rope Access Group BV

- Dangle

- GEV GROUP

- TASC

Recent Developments

-

In October 2024, Apave Group, a France-based leader in risk management services, announced the acquisition of IRISNDT. The strategic acquisition expands Apave Group's capabilities and presence in the global market, enhancing its service offerings in key industries, such as petrochemical, power, renewables, and mining, across the U.S., Canada, the U.K., and Australia.

-

In April 2024, Acuren Group Inc. acquired Advance Coating Solutions Inc., a provider of coatings and blasting services in Western Canada. This acquisition aimed to strengthen Acuren’s Rope Access Technician Solutions by offering comprehensive corrosion prevention and remediation services to clients in diverse industries. Operating under the Acuren brand, the new service line will retain the Advance Coating Solutions Inc. name. This strategic move further expanded Acuren’s extensive rope access solutions portfolio.

Rope Access Services Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 3.47 billion |

|

Revenue forecast in 2030 |

USD 5.19 billion |

|

Growth rate |

CAGR of 8.4% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, U.K., Germany, France, China, India, Japan, South Korea, Australia, Brazil, KSA, UAE, and South Africa |

|

Key companies profiled |

Rope Access Inspection (RAI); Altius Technical Services; SIS Group Ltd.; Access Techniques; CAN; K2 Access; Stork ; GECKO ROPE ACCESS; MISTRAS Group; IRISNDT; PALACIOS MARINE & INDUSTRIAL; Rope Partner Inc.; X-Cel Construction Services Pty Ltd.; Brand Industrial Services, Inc.; Tacten Industrial Inc.; Danos; Gulf Island Fabrication, Inc.; OMNI Environmental Solutions; Grand Isle Shipyard; Megarme; Aslan Energy; Turner Industries Group, LLC; Applus+; Acuren; Bilfinger Height Specialists B.V.; ALTRAD; EM&I; Allriggroup; SGS Société Générale de Surveillance SA; PALFINGER AG; Rope Access Group BV; Dangle; GEV GROUP; TASC |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Rope Access Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global rope access services market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Land

-

Ocean

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Construction

-

Energy & Power

-

Infrastructure

-

Mining

-

Marine & Offshore

-

Telecommunications

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global rope access services market size was estimated at USD 3.24 billion in 2024 and is expected to reach USD 3.47 billion in 2025.

b. The global rope access services market is expected to grow at a compound annual growth rate of 8.4% from 2025 to 2030 to reach USD 5.19 billion by 2030.

b. North America dominated the largest market, with a share of 30.3% in 2024. Factors, such as rapid growth of the end-use industries, such as construction, infrastructure, and energy and power, among others drive the growth of the market.

b. Some key players operating in the rope access services market include Rope Access Inspection (RAI), Altius Technical Services, SIS Group Ltd., Access Techniques, CAN, K2 Access, Stork , GECKO ROPE ACCESS, MISTRAS Group, IRISNDT, PALACIOS MARINE & INDUSTRIAL , Rope Partner Inc., X-Cel Construction Services Pty Ltd., Brand Industrial Services, Inc., Tacten Industrial Inc., Danos, Gulf Island Fabrication, Inc.,OMNI Environmental Solutions, Grand Isle Shipyard, Megarme, Aslan Energy, Turner Industries Group, LLC, Applus+, Acuren, Bilfinger Height Specialists B.V., ALTRAD, EM&I, Allriggroup, SGS Société Générale de Surveillance SA, PALFINGER AG ,Rope Access Group BV, Dangle, GEV GROUP, TASC.

b. Key factors driving the rope access services market include increasing adoption in emerging markets, rising demand for safe and efficient access solutions in high-risk environments, and growing utilization in maintenance and inspection activities across industries.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."