- Home

- »

- Automotive & Transportation

- »

-

Rolling Stock Market Size & Share, Industry Report, 2033GVR Report cover

![Rolling Stock Market Size, Share & Trends Report]()

Rolling Stock Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Locomotive, Rapid Transit Vehicle), By Type (Diesel, Electric), By Train Type, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-322-5

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2020 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Rolling Stock Market Summary

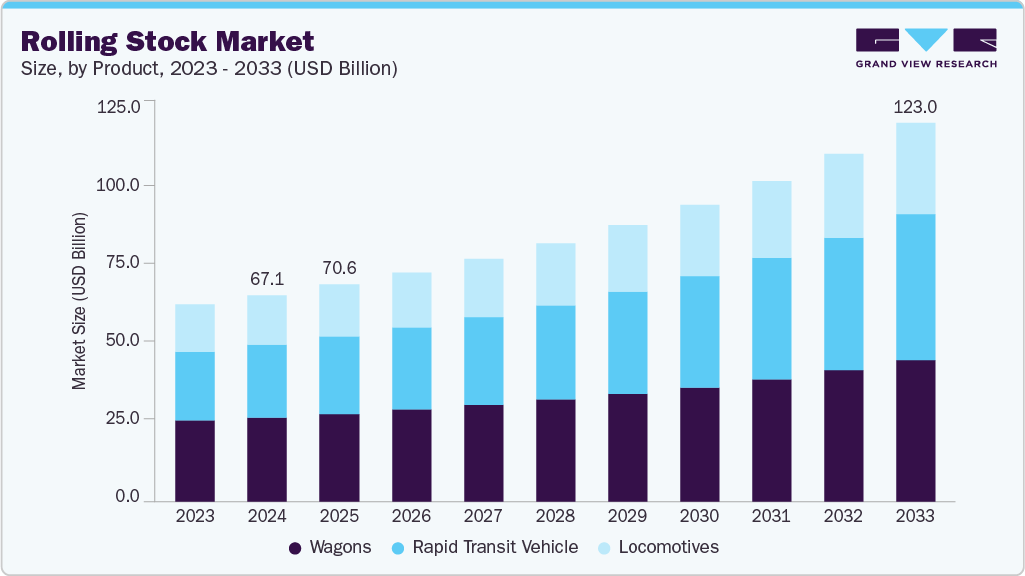

The global rolling stock market size was estimated at USD 67.12 billion in 2024, and is projected to reach USD 123.01 billion by 2033, growing at a CAGR of 7.2% from 2025 to 2033. Increasing investments in railway infrastructure, growing adoption of advanced digital solutions, and rising demand for energy-efficient and sustainable transportation systems are key factors driving the market growth.

Key Market Trends & Insights

- Asia Pacific dominated the rolling stock market with the largest revenue share of 44.0% in 2024.

- By product, the wagons segment led market with the largest revenue share of 40.9% in 2024.

- By type, the diesel segment accounted for the largest market revenue share in 2024.

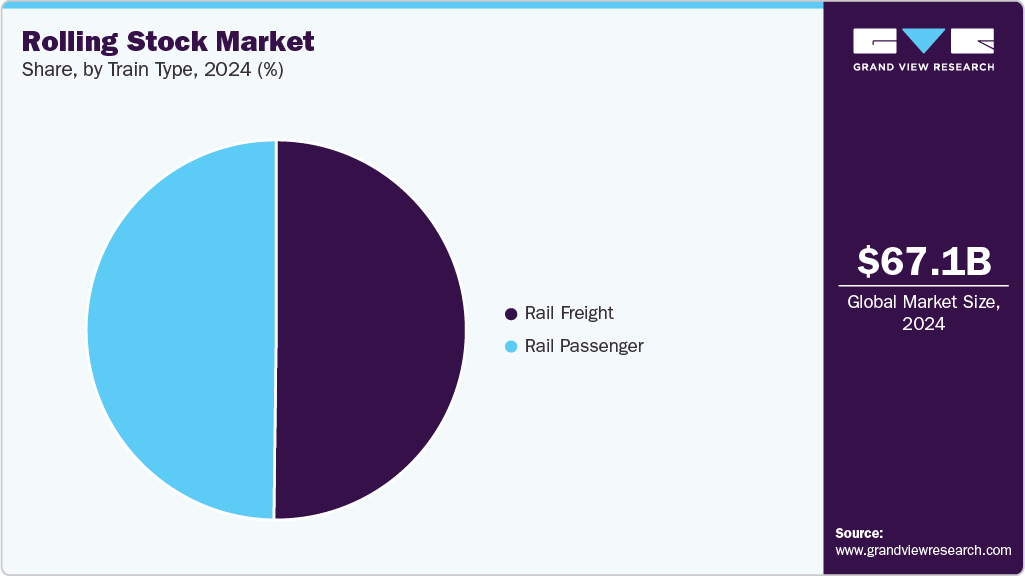

- By train type, the rail freight segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 67.12 Billion

- 2033 Projected Market Size: USD 123.01 Billion

- CAGR (2025-2033): 7.2%

- Asia Pacific: Largest market in 2024

- Europe: Fastest growing market

An emerging opportunity lies in the expansion of high-speed rail networks in developing regions, which could significantly boost rolling stock demand. However, the market faces challenges such as high capital expenditure and long project lead times. A notable trend is the integration of Internet of Things (IoT) and predictive maintenance technologies, enhancing operational efficiency and reducing downtime in railway operations.Several government agencies and private entities are focusing on enhancing their transportation infrastructure while deploying a large number of rolling stock vehicles that can carry considerable loads of freight, ultimately contributing to market growth. For instance, as per Global Railway Review, as of January 2023, the Indian railways contribute approximately 27% of India’s freight transport. Thus, the government of India is aiming to enhance the current share of railway freight transport to almost 40 - 45% in the coming years. As a result, the government is focusing on various strategic initiatives, including collaborations and partnerships with the major players in the rolling stock industry, to be undertaken in order to achieve its target. These initiatives involve high investments in the deployment of advanced rolling stock vehicles and advancements in the associated railway infrastructure.

Increasing investments in railway infrastructure are significantly impacting the rolling stock market growth. With increased investments in railway infrastructure, the focus on modernizing rolling stock is increasing. This involves upgrading locomotives with more powerful engines, installing better braking systems, and improving passenger comfort in coaches. Furthermore, it includes the use of environmentally friendly rolling stock, such as electric trains or trains powered by alternative fuels. Increased investments in railway infrastructure also lead to the expansion of railway networks, which can subsequently drive the demand for rolling stock.

This involves the purchase of new locomotives, coaches, and wagons to meet the needs of an expanded network. Infrastructure upgrades such as improvements to the tracks, which include reducing the number of curves or installing modern signaling systems, are also contributing to the market growth. For instance, in March 2023, Siemens announced an investment of USD 220 million to build advanced manufacturing and rail services facilities in North Carolina, U.S. These new facilities are expected to improve rail technology to aid passenger’s smooth journey within the country

Advances in technology have made it possible to design and produce energy-efficient rolling stock. For instance, modern electric locomotives use regenerative braking, which captures the energy lost during braking and stores it in onboard batteries. This energy can be used later to power the train, which reduces the overall energy consumption and costs. New technologies such as computer vision, and artificial intelligence are also making rail transportation safer. These technologies can be used to detect obstacles on the tracks, monitor train performance, and prevent collisions. For instance, Positive Train Control (PTC) technology uses GPS, wireless communication, and onboard computers to slow down or stop trains and prevent accidents automatically.

The increased preference for railway transportation has resulted in considerable demand for this rolling stock and supporting infrastructure in recent years. However, the high cost of trains, rolling equipment, and accompanying infrastructure are capital-intensive and require considerable financial support from local and central administrations. Therefore, several rolling stock OEMs, rail operators, and third-party suppliers are shifting their focus to condition-based maintenance procedures conducted in real-time while trains are in operation. The near-time analytics programs assist authorities in conducting rail maintenance. By following these procedures, the rolling stock OEMs are observed to reduce their maintenance costs up to USD 2 billion annually.

Besides, several major reforms are underway in the railway sector. New features will be added to trains and the infrastructure on all routes. For instance, in March 2023, the KONCAR - ElektriCna vozila dd, introduced an electric-diesel train at Pula Railway Station. The train can travel at a speed of 120 km/h and has a capacity of 167 passengers. It is a low-floor, three-part train with four double doors on each side. It contains two ramps for wheelchairs, space for bicycles, and video surveillance across the entire passenger area. Passengers receive free Wi-Fi and visual and auditory announcements at stations and stops. This factor is expected to enhance the quality of the transport service, as this type of low-floor train will cover 50% of the lines in this area.

The surge in demand for energy-efficient rolling stock presents a significant growth opportunity for the rolling stock industry. As concerns over environmental sustainability and rising fuel and energy costs intensify, railway operators and governments are increasingly prioritizing trains that consume less energy while maintaining high performance and reliability. Energy-efficient rolling stock, including electric, hybrid, battery-powered, and hydrogen-fueled trains, is gaining traction as countries implement stringent emissions regulations and pursue carbon reduction targets. This global shift toward sustainable mobility is driving investments in advanced train technologies, creating lucrative opportunities for rolling stock manufacturers, component suppliers, and technology providers. For instance, in January 2025, the Canadian National Railway (CN) launched a pilot project to test a medium-horsepower hybrid-electric train developed in collaboration with Knoxville Locomotive Works (KLW).

The high initial investment and maintenance costs associated with rolling stock restrain the market growth. Purchasing new trains, passenger coaches, freight wagons, or metro units requires substantial capital expenditure, which can be a major financial burden for railway operators, particularly in developing regions with limited funding. Advanced rolling stock equipped with modern technologies, such as energy-efficient propulsion systems, automation, real-time monitoring, and predictive maintenance features, comes at a high cost, making large-scale fleet modernization or expansion challenging. For instance, a diesel locomotive typically ranges in price from USD 500,000 to 2 million, whereas an electric locomotive can cost more than USD 6 million. The cost varies based on factors such as whether it uses AC or DC traction, its horsepower, and the type of electronics it includes.

Product Insights

The wagons segment led the market with the largest revenue share of 40.9% in 2024. Factors such as high speed, affordability, and comfortable travel make it the preferred choice of public transport by the increasing urban population. Moreover, increasing investments by key players in automating and digitalizing the components associated with wagons is further expected to drive the market growth. Governments and private players prefer to use wagons for the movement of goods domestically or internationally due to their ability to carry high-volume loads. Wagons are economical and reliable for short and long transit. Governments and private players worldwide are either investing in buying new fleets of wagons or refurbishing their existing fleets.

The rapid transit vehicle segment is expected to grow at the fastest CAGR from 2025 to 2033. The rapid transit vehicle segment is emerging significantly in the rolling stock market as most passengers prefer rapid transit vehicles owing to their high-speed and enhanced comfort features. These vehicles are competing with airlines, long-distance bus services, and other transportation services in terms of speed and improved infrastructure. In addition, the increasing demand for automated trains and magnetic levitation trains among end users for transportation is expected to drive the growth of the segment.

Type Insights

The diesel segment accounted for the largest market revenue share in 2024. The diesel locomotive segment continues to play a significant role in the rolling stock market, primarily due to its operational flexibility and ability to serve regions with limited electrification infrastructure. Factors such as low cost, easy availability, and lower volatility of diesel engines contribute to the growth of the segment. Moreover, the growing need for enhancing freight transport and the low replacement rate of diesel with electric vehicles has allowed this segment to drive the rolling stock market growth. Also, several major manufacturers are developing turbocharged diesel vehicles to cater to the increasing demand for efficient diesel-powered vehicles. Due to their ability to haul freight trains carrying heavy goods. They are widely used for industrial purposes due to higher torque engines. However, as the world becomes more environmentally conscious, diesel train technology is advancing to develop low-emission engines for diesel locomotives.

The electric segment is expected to grow at the fastest CAGR during the forecast period,driven by advancements in battery-electric technology and a global shift towards sustainable transportation. In 2025, Siemens Mobility introduced the Charger B+AC, North America's first battery-electric passenger locomotive, designed to operate at speeds up to 125 mph under catenary power and for up to 100 miles on battery power. This locomotive offers flexible charging options, including catenary, plug-in, and dynamic braking, and is fully compliant with Buy America requirements.

Train Type Insights

The rail freight segment accounted for the largest market revenue share in 2024.The rail freight segment is experiencing strong growth, driven by increasing demand for cost-effective and efficient transportation of goods over long distances. As global trade and industrial production expand, rail freight is emerging as a preferred mode for bulk and heavy cargo due to its reliability, lower fuel consumption, and reduced environmental impact compared to road transport. Investments in modern freight locomotives, automated cargo handling systems, and dedicated freight corridors are further enhancing operational efficiency and transit speed, supporting the segment’s robust revenue growth.

The digitalization of freight offers rail operators significant opportunities in terms of operating safety and productivity, improving their professional attractiveness and working conditions. For instance, in February 2023, the members of the French Rail Freight of the Future (4F) coalition launched the MONITOR project. The project involved equipping rail cars with sensors that detect derailments and incorrect brake applications, reducing time spent preparing trains.

The passenger rail segment is expected to register at the fastest CAGR from 2025 to 2033, owing to the urbanization, rising commuter demand, and government initiatives to reduce road congestion. The growth of the passenger rail segment is attributed to the increasing demand for public rail transportation. Passengers are preferring this type of transportation owing to several benefits, such as reliability, comfort, and reduced traffic compared to road transportation. Various companies are manufacturing passenger rail vehicles with the latest technologies to improve the passenger experience and enhance security.

Regional Insights

The rolling stock market in North America was identified as a lucrative region in 2024. The region is home to several rolling stock companies that are rapidly pursuing the development and implementation of trams and high-speed trains. Strategic partnerships and technology collaborations are enabling advanced freight solutions, which support growing demand for reliable and modern rolling stock. For instance, in February 2025, Texmaco Rail & Engineering Ltd signed a global supply and services agreement with the U.S.-based Trinity Rail Group to co-develop advanced rolling stock for Indian and international freight operations. The partnership also includes a Global Capability Centre in Faridabad to enhance rail technology innovation. This collaboration is aimed at improving freight efficiency, thereby addressing the increasing need for high-performing rolling stock.

U.S. Rolling Stock Market Trends

The rolling stock market in the U.S. accounted for the largest market revenue share in North America in 2024. The rolling stock industry in the U.S. is witnessing a significant transformation, driven by government initiatives promoting sustainable transportation and investments in rail infrastructure. Policies aimed at reducing CO2 emissions across trams, metro systems, buses, and commuter trains are creating strong demand for modern, energy-efficient rolling stock. For instance, in November 2021, the U.S. government announced a USD 1.2 trillion infrastructure investment plan, funded by the Federal Transportation Administration (FTA) over five years. This includes USD 8 billion for public transportation projects with high passenger capacity, USD 1.5 billion for replacing over 500 outdated trams, commuter train vehicles, and subterranean carriages, and USD 39 billion in state-level funding. High-speed rail and other railway development projects are supported with an additional USD 66 billion, collectively driving demand for modern and sustainable rolling stock.These initiatives are accelerating the modernization of the U.S. rail fleet, promoting the adoption of energy-efficient and technologically advanced rolling stock. The combined focus on sustainability, infrastructure expansion, and high-capacity passenger transport is expected to sustain strong market growth and position the U.S. as a key leader in advanced rail solutions over the coming decade.

Asia Pacific Rolling Stock Market Trends

Asia Pacific dominated the global rolling stock market with the largest revenue share of 44.0% in 2024, driven by investments from emerging economies such as China, India, and Japan to modernize transportation services. Governments are increasingly adopting trams, electric locomotives, and large-scale infrastructure upgrades to meet rising demand and optimize existing railway networks. Strategic joint ventures and local partnerships are further fueling market demand by combining technological expertise with manufacturing and operational capabilities. In September 2025, RVNL and Texmaco Rail formed a USD 22.6 million joint venture, with RVNL holding 51%, to produce and maintain locomotives, freight cars, passenger coaches, and metro trains while offering depot management services. This initiative strengthens regional manufacturing capacity and directly supports the deployment of high-performance rolling stock.

The rolling stock market in China held a substantial market share in 2024, supported by robust rail infrastructure expansion and the government’s strong focus on sustainable mobility. The market is experiencing rapid growth, driven by rising industrial output, increasing freight volumes, and the ongoing shift toward energy-efficient, high-capacity rail transport. Significant investments in advanced electric and hybrid locomotives are helping operators enhance network efficiency, reduce emissions, and meet the country’s carbon neutrality goals.

The Japan rolling stock market is anticipated to grow at a significant CAGR during the forecast period. In Japan, the rolling stock industry is influenced by the steady high passenger density, a strong reliance on rail transport, and government initiatives to modernize and expand the network. Japan is a country highly dependent on its railroad system, and the government is actively supporting railway companies to enhance transportation services, expand the existing network, and attract more passengers to rail travel. These initiatives directly contribute to the growth of the APAC market by creating demand for high-speed, energy-efficient, and technologically advanced trains.

Europe Rolling Stock Market Trends

The rolling stock market in Europe was identified as a lucrative region in 2024. Cities and national operators in the region are increasingly investing in higher-capacity, energy-efficient, and technologically advanced trains to meet growing transportation demands while reducing environmental impact. Urban metro networks are at the forefront of this transformation. In October 2025, Škoda Group introduced a four-car metro train for Sofia under a ~USD 77.1 million (EUR 66 million) contract with Metropoliten EAD. Designed for a 580-passenger capacity, with regenerative braking and air conditioning, these trains help manage increasing ridership while lowering energy consumption.

The Germany rolling stock market is advancing steadily, driven by fleet modernization, sustainable transport initiatives, and high-speed rail expansion. Investments are increasingly focused on energy-efficient rolling stock, improved passenger capacity, and infrastructure that supports faster, more reliable rail connections. Recent developments in fleet financing are supporting modernization and decarbonization. In January 2024, Infracapital entered the German rolling stock industry through a joint venture with Rock Rail to finance 18 four-car Siemens Mireo EMUs for DB Regio’s Mitteldeutschen S-Bahn 2025 plus services. This initiative addresses the need for updated, energy-efficient trains and increases passenger capacity. It also supports Germany’s rail expansion and sustainability goals, demonstrating how strategic investments are driving rolling stock demand.

The rolling stock market in UK is witnessing steady growth, driven by the modernization of rail fleets, government investment in sustainable transport, and increasing demand for technologically advanced trains. Operators in the country are increasingly adopting digital solutions, automation, and energy-efficient technologies to improve operational efficiency, enhance passenger experience, and reduce environmental impact. Innovation in rolling stock design, testing, and maintenance is a key growth driver. In April 2023, Hitachi Rail partnered with the Global Centre of Rail Excellence (GCRE) in Wales to test British-built trains, battery technologies, and advanced digital rail solutions. This collaboration facilitates energy-efficient operations, predictive maintenance, and next-generation signaling systems. By ensuring that new trains comply with stringent operational and environmental standards, the initiative encourages fleet modernization and stimulates demand for sustainable, technologically advanced rolling stock.

Key Rolling Stock Company Insights

Some of the key players operating in the market include Alstom Transport, CRRC Corporation Limited, GE Transportation, Hitachi Rail System, and Hyundai Rotem.

-

Founded in 1928 and headquartered in Saint-Ouen-sur-Seine, France, Alstom Transport operates across multiple transport sectors, offering integrated rail mobility systems. In the rolling stock domain, it designs and manufactures passenger trains, including high-speed, regional, metro, and tram systems. The company develops complete train solutions under product lines such as Coradia and Avelia, integrating traction, control systems, and digital signaling into its rolling stock portfolio. Alstom also undertakes train refurbishment, maintenance, and energy-efficient technology projects across various rail networks.

-

Founded in 1905 and headquartered in Beijing, China, CRRC Corporation Limited manufactures a full range of railway vehicles for passenger and freight transport. Its rolling stock production covers high-speed EMUs, locomotives, metro cars, trams, and freight wagons. The company operates large-scale production bases and research centers that support advancements in lightweight materials, high-efficiency traction, and intelligent rail systems. CRRC supplies rolling stock for both domestic and international markets, contributing to high-speed and urban rail infrastructure development in multiple regions.

Key Rolling Stock Companies:

The following are the leading companies in the rolling stock market. These companies collectively hold the largest market share and dictate industry trends.

- Alstom Transport

- CRRC Corporation Limited

- Hitachi, Ltd.

- GE Transportation

- Hyundai Rotem

- Kawasaki Heavy Industries, Ltd.

- Siemens Mobility

- Stadler Rail AG

- The Greenbrier Co.

- Trinity Rail

- CAF, Construction and Railway Auxiliary, SA

Recent Developments

-

In June 2025, Alstom inaugurated its new Plant-4 manufacturing facility in Hornell, New York, expanding its North American production footprint. The 135,000-square-foot unit is designed to fabricate stainless-steel car body shells for next-generation passenger railcars. This strategic expansion aims to strengthen Alstom’s local supply chain, create new jobs, and reinforce its commitment to U.S. manufacturing.

-

In August 2024, Hitachi’s intercity battery train started trials on the UK network in collaboration with TransPennine Express and Angel Trains, a clear project partnership to demonstrate battery traction and route trials.

-

In February 2023, Stadler Rail AG partnered with ASPIRE Engineering Research Centre and the Utah State University for the construction of a passenger train powered by batteries centered on the FLIRT Akku idea. The development, construction, and testing of an FLIRT Akku battery-operated two-car multi-unit are all included in the project's scope. During subsequent test runs, the trio will focus on delivering insights for American passenger transit decarbonization using battery-powered trains.

-

In January 2023, Siemens Mobility partnered with the Indian Railways, wherein it received a purchase order for 1,200 locomotives with 9,000 HP, making it the single largest locomotive order in the history of Siemens Mobility and Siemens India. The trains will be designed, developed, assembled, and put through testing by Siemens Mobility. The contract covers 35 years of full-service maintenance, and the deliveries are scheduled over 11 years. The trains will be assembled at the Indian Railways facility in Gujarat, India.

Rolling Stock Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 70.62 billion

Revenue Forecast in 2033

USD 123.01 billion

Growth rate

CAGR of 7.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2020 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Product, type, train type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

Alstom Transport; CRRC Corporation Limited; GE Transportation; Hitachi Rail System; Hyundai Rotem; Kawasaki Heavy Industries, Ltd.; Siemens Mobility; Stadler Rail AG; The Greenbrier Co.; Trinity Rail; CAF, Construction and Railway Auxiliary, SA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Rolling Stock Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global rolling stock market report based on product, type, train type, and region.

-

Product Outlook (Revenue, USD Million, 2021- 2033)

-

Locomotive

-

Rapid Transit Vehicle

-

Wagon

-

-

Type Outlook (Revenue, USD Million, 2021- 2033)

-

Diesel

-

Electric

-

-

Train Type Outlook (Revenue, USD Million, 2021- 2033)

-

Rail Freight

-

Passenger Rail

-

-

Regional Outlook (Revenue, USD Million, 2021- 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global rolling stock market size was estimated at USD 67.12 billion in 2024 and is expected to reach USD 70.62 billion in 2025.

b. The global rolling stock market is expected to witness a compound annual growth rate of 7.2% from 2025 to 2033 to reach USD 123.01 billion by 2033.

b. Asia Pacific region held the largest share of 44.0% in 2024 owing to the large-scale adoption of rail vehicles for transporting passengers and goods. Moreover, the growth of the regional market can also be attributed to the increase in investments in metro and electric trains in countries such as China, India, Taiwan, and others.

b. Some key players operating in the rolling stock market include Alstom Transport, CRRC Corporation Limited, GE Transportation, Hitachi Rail System, Hyundai Rotem, Kawasaki Heavy Industries, Ltd., Siemens Mobility, Stadler Rail AG, The Greenbrier Co., and Trinity Rail.

b. The key factors driving the growth of the rolling stock market include the growing concertation of the population in urban areas and the increasing demand for rail vehicles such as trams, local trains, passenger rails, and so on. Moreover, the rising preference for high-speed trains over conventional trains owing to faster transportation and comfortability is likely to further boost the market growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.