Role-based Access Control Market Size, Share & Trends Analysis Report By Component (Solution, Services), By Model Type (Core RBAC, Hierarchical RBAC), By Enterprise Size, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-166-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

RBAC Market Size & Trends

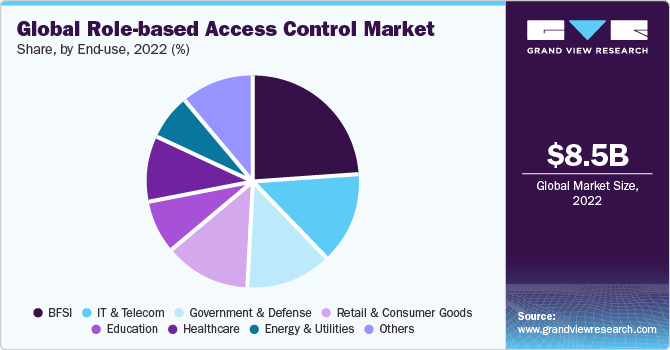

The global role-based access control market size was estimated at USD 8.5 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 12.4% from 2023 to 2030. There is an increasing inclination towards adopting role-based access control (RBAC) solutions designed explicitly for DevOps settings. These RBAC systems are customized to meet the ever-changing requirements of DevOps teams by offering detailed access controls that match the continuous integration/continuous deployment (CI/CD) pipeline. The goal of RBAC for DevOps is to simplify access administration for developers, guaranteeing they possess the required authorizations for projects while upholding robust security measures.

The rising acceptance of Bring-your-own-device (BYOD) practices within workplaces is propelling market expansion. As employees increasingly utilize personal devices to reach corporate assets, RBAC has emerged as a vital tool for regulating access to these resources. RBAC systems empower organizations to govern user access according to their job roles and duties, irrespective of the device they employ. This guarantees that employees are granted access solely to the necessary resources for their roles, thereby reducing the potential for data breaches resulting from unauthorized access. Consequently, RBAC has become an indispensable element of numerous companies' security strategies tailored for BYOD implementations.

One of the key trends within the role-based access control industry pertains to adjusting access control solutions to suit the changing dynamics of hybrid work environments. As remote work and hybrid work models, combining both remote and office work, become more prevalent, RBAC systems are being optimized to oversee access permissions across varied environments. This trend is concentrated on guaranteeing that employees, regardless of their work location (be it home or office), maintain regulated access to organizational resources according to their designated roles. This approach ensures that security measures are upheld while fostering smooth teamwork and efficiency in hybrid work arrangements.

End-use Insights

The BFSI segment dominated the market with a revenue share of 24.4% in 2022. The increasing emphasis on bolstering cybersecurity measures within the BFSI sector is the trend that has emerged. This trend entails the integration of RBAC systems with advanced threat detection technologies to fortify security protocols. RBAC solutions are being combined with sophisticated threat intelligence and analytical tools to identify potential security breaches proactively. This strategic integration emphasizes the utilization of RBAC not only for access control but also for continuous monitoring and rapid response to emerging threats, vital in safeguarding sensitive financial data.

There is a growing inclination among governments to prioritize the implementation of interoperable RBAC frameworks and standardized access control regulations across different departments and agencies. This shift aims to create consistent access control standards, enabling smooth sharing of information, collaboration, and preservation of data integrity among government bodies. The goal of standardization is to ensure uniformity and harmony in access control measures, thereby improving efficiency and security in collaborative governmental operations. Emphasizing interoperability aligns to foster secure data exchange while upholding strong access limitations, resulting in a more unified and secure infrastructure within government entities.

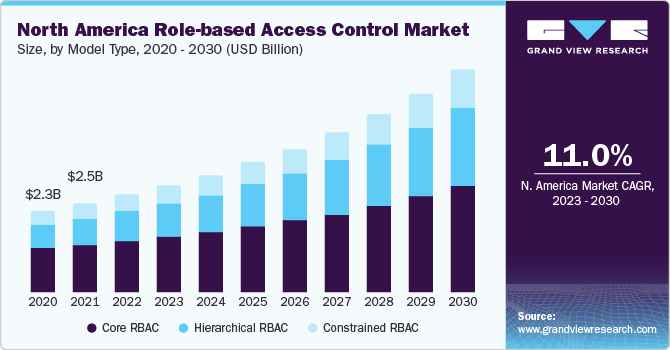

Regional Insights

The North America region dominated the market with a revenue share of 33.0% in 2022. One of the key trends observed in North America is the uptake of cloud-native RBAC solutions tailored to meet organizations' escalating requirements for scalability, adaptability, and remote accessibility. These solutions, specifically designed for cloud setups, address the region's rising need for scalable access management tools. Cloud-native RBAC allows smooth integration with diverse cloud services, catering to the dynamic infrastructure needs of enterprises in North America and enabling secure remote access for dispersed work teams.

The Asia Pacific region stands as the fastest-growing sector within the global market, encompassing burgeoning economies like India, Japan, China, and Australia, all hosting a multitude of SMEs. Amid escalating cybersecurity threats, expanded online service utilization, and mounting expectations from citizens and workforces, it is imperative for governments and agencies across this region to urgently modernize digital identities to ensure superior digital experiences. The surge in digitization endeavors, notably in online banking and UPI payments, is revolutionizing the financial services sector throughout the Asia Pacific and globally. However, this transformation also opens pathways for cyber threats like ransomware and risks associated with third-party involvement. Consequently, the financial services sector in Asia Pacific faces a pressing need to reassess its cybersecurity framework to adapt to the evolving technological landscape, seize business opportunities, and mitigate associated risks.

Components Insights

The solution segment dominated the market in 2022 with a revenue share of over 61.94%. A prominent trend observed in RBAC solutions involves the fusion of Identity Governance and Administration (IGA) platforms. This integration aims to deliver all-encompassing access control by combining RBAC's role-focused methodology with IGA's functionalities in managing identities, access requests, certifications, and policy enforcement. This unified solution streamlines governance, risk management, and compliance (GRC) endeavors, ensuring stronger access controls and improved insight into user entitlements across the entire organization.

The service segment is anticipated to grow at the fastest CAGR from 2023 to 2030. Another trend involved is a growing need for consulting and advisory services specializing in RBAC strategy development. Organizations sought expert guidance to craft comprehensive access control strategies that align with their business goals and security requirements. These services encompassed evaluating existing access control mechanisms, identifying gaps, and devising tailored RBAC frameworks to strengthen security posture and compliance adherence.

Model Type Insights

The Core RBAC segment dominated the market with a revenue share of 52.2% in 2022. A significant trend involves the increased adoption of intricate and detailed access control policies within Core RBAC systems. Organizations are progressing from conventional broad access control models to implementing more exact and sophisticated permission structures. This transition allows for highly specific and customized access privileges, providing users with precise permissions required without unnecessary access rights, thus strengthening security measures while preserving operational efficiency.

The hierarchical RBAC segment is expected to grow with the fastest CAGR from 2023 to 2030. With the widespread use of Internet of Things (IoT) devices and edge computing, a developing trend revolves around applying hierarchical RBAC principles to these decentralized environments. Companies are exploring hierarchical access models specifically designed for IoT ecosystems, enabling structured access control for devices, sensors, and gateways. Hierarchical RBAC facilitates secure communication among interconnected devices, ensuring appropriate authorization and management within intricate IoT networks.

Enterprise size Insights

The large enterprises segment dominated the market with a revenue share of 61.0% in 2022. One noteworthy trend is the integration of RBAC solutions customized for large enterprises operating in multi-cloud environments. With these organizations increasingly embracing a variety of cloud services and platforms, RBAC systems are being developed to offer centralized access management across multiple clouds. This trend aims to ensure consistent enforcement of policies, govern access, and facilitate user provisioning, thereby ensuring secure and streamlined operations within intricate multi-cloud infrastructures.

The small and medium-sized enterprises (SMEs) segment is expected to grow at the fastest CAGR from 2023 to 2030. The increasing need for streamlined access control solutions in SMEs has sparked a trend. This trend involves the emergence of simplified RBAC solutions specially designed to facilitate easier implementation and management within SME environments. These solutions feature user-friendly interfaces, pre-configured templates, and intuitive setups tailored to address the limited resources and expertise commonly found in SME settings. As a result, this trend enables SMEs to adopt RBAC without necessitating extensive technical knowledge, effectively streamlining access control processes for smoother operations.

Key Companies & Market Share Insights

The industry is characterized by fierce competition, dominated by a few major global players who possess significant market influence. The focus revolves around developing inventive offerings and encouraging cooperation among the primary participants in the field. For instance, In January 2023, Microsoft Corporation collaborated with Cloudflare, Inc., a company specializing in IT service management, aimed at enhancing zero-trust security measures. This partnership entails merging Cloudflare One functionality with Microsoft Azure Active Directory. As a result, Microsoft aims to offer enterprises an efficient zero-trust security solution that requires no modifications to existing code during deployment.

In another instance, In February 2022, IBM acquired Neudesic, a consulting firm specializing in cloud-based services, as part of its strategy to bolster its hybrid multi-cloud offerings. With this acquisition, Neudesic's proficiency in delivering cloud services will contribute to IBM's expansion of hybrid multi-cloud solutions and the progression of its hybrid cloud and AI services.

Key Role-based Access Control Companies:

- Amazon Web Services, Inc.

- Broadcom Inc.

- CyberArk Software Ltd.

- Dell EMC

- IBM Corporation

- JumpCloud Inc.

- Micro Focus International plc

- Microsoft Corporation

- Okta, Inc.

- Oracle Corporation

- RSA Security LLC

- SolarWinds

- Thales Group

Role-based Access Control Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 9.4 billion |

|

Revenue forecast in 2030 |

USD 21.3 billion |

|

Growth rate |

CAGR of 12.4% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2017 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Component, model type, enterprise size, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; U.K.; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; KSA; UAE; South Africa. |

|

Key companies profiled |

Amazon Web Services, Inc.; Broadcom Inc.; CyberArk Software Ltd.; Dell EMC; IBM Corporation; JumpCloud Inc.; Micro Focus International plc; Microsoft Corporation; Okta, Inc.; Oracle Corporation; RSA Security LLC; SolarWinds; Thales Group |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Role-based Access Control Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global role-based access control market report based on component, model type, enterprise size, end-use, and region:

-

Components Outlook (Revenue, USD Million, 2017 - 2030)

-

Solution

-

Services

-

-

Model Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Core RBAC

-

Hierarchical RBAC

-

Constrained RBAC

-

-

Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Enterprises

-

Small & Medium-sized Enterprises (SMEs)

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

IT & Telecom

-

Government & Defense

-

Retail & Consumer Goods

-

Education

-

Healthcare

-

Energy & Utilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global role-based access control market size was estimated at USD 8.50 billion in 2022 and is expected to reach USD 9.44 billion in 2023

b. The global role-based access control market is expected to grow at a compound annual growth rate of 12.14% from 2023 to 2030 to reach USD 21.3 billion by 2030.

b. North America dominated the role-based access control market with a share of 33.0% in 2022. It is witnessing a rising demand that is driven by increased emphasis on data security and compliance.

b. Some key players operating in the role-based access control market include Amazon Web Services, Inc., Broadcom Inc., CyberArk Software Ltd., Dell EMC, IBM Corporation, JumpCloud Inc., Micro Focus International plc, Microsoft Corporation, Okta, Inc., Oracle Corporation, RSA Security LLC, SolarWinds, Thales Group.

b. Key factors that are driving the market growth include the Need to improve compliance requirements in organizations and the Need to enhance operational efficiency.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."